What insurance companies cover cochlear implants? It’s a question that pops up for many people facing hearing loss, and it’s a big one. Think about it – getting a cochlear implant is a life-changing decision, not just for you, but for your whole family. It’s about regaining independence, rediscovering the joy of sound, and opening up a whole new world of possibilities. But, let’s be real, getting a cochlear implant can be a serious investment, and that’s where insurance comes into play.

This guide breaks down the ins and outs of insurance coverage for cochlear implants, covering everything from the different types of plans that might cover it to the factors that can affect your chances of getting approved. We’ll also dive into the costs associated with cochlear implants, including the device itself, surgery, and post-operative care. We’ll even give you some tips on navigating the insurance approval process and explore alternative financing options if you need them. So, buckle up, and let’s get into it!

Understanding Cochlear Implants: What Insurance Companies Cover Cochlear Implants

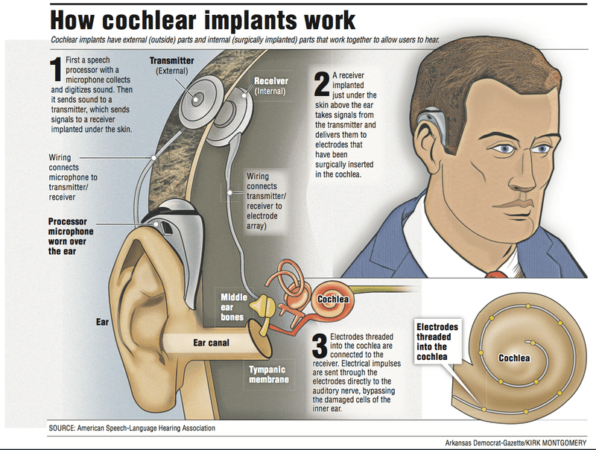

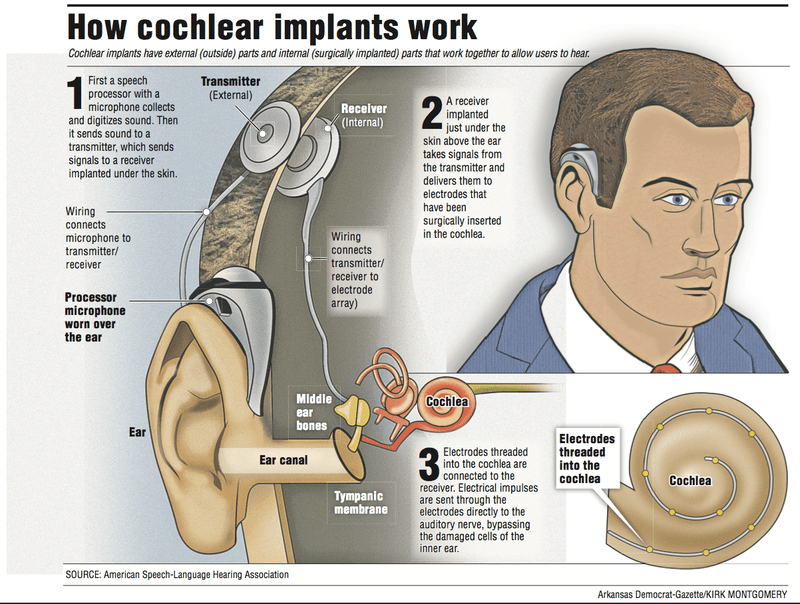

Cochlear implants are electronic devices that can help people with severe to profound hearing loss hear again. They work by directly stimulating the auditory nerve, bypassing the damaged parts of the inner ear. Cochlear implants are not hearing aids, which amplify sound, but rather they provide a different way of hearing.

Types of Cochlear Implants

There are different types of cochlear implants available, each with its own unique features and benefits.

- Single-channel implants: These implants have one electrode that stimulates the auditory nerve. They are typically used for people with profound hearing loss in both ears.

- Multi-channel implants: These implants have multiple electrodes that stimulate different parts of the auditory nerve. They are typically used for people with severe to profound hearing loss in one or both ears. They provide more detailed sound information than single-channel implants.

- Hybrid implants: These implants combine features of both single-channel and multi-channel implants. They are typically used for people with moderate to profound hearing loss who still have some residual hearing.

Benefits of Cochlear Implants, What insurance companies cover cochlear implants

Cochlear implants can provide a wide range of benefits for people with hearing loss. These benefits can include:

- Improved hearing ability: Cochlear implants can help people with hearing loss hear sounds that they were previously unable to hear. This can include sounds like speech, music, and environmental noises.

- Improved speech understanding: Cochlear implants can help people with hearing loss understand speech more clearly. This can improve their ability to communicate with others and participate in conversations.

- Increased social interaction: Cochlear implants can help people with hearing loss feel more confident and comfortable in social situations. This can lead to increased social interaction and a better quality of life.

- Improved cognitive function: Studies have shown that cochlear implants can improve cognitive function in people with hearing loss. This includes improvements in memory, attention, and language skills.

- Increased independence: Cochlear implants can help people with hearing loss become more independent. This can include being able to participate in activities such as work, school, and social events.

Insurance Coverage for Cochlear Implants

Getting a cochlear implant can be a life-changing experience, but it’s also a significant financial investment. Many people rely on insurance to help cover the costs. This section will provide information on how insurance companies typically handle coverage for cochlear implants.

Common Insurance Plans Covering Cochlear Implants

Insurance coverage for cochlear implants can vary depending on the plan and the individual’s specific circumstances. However, some common insurance plans typically cover cochlear implants, either fully or partially. Here’s a breakdown of the most common plans:

- Private Health Insurance: Many private health insurance plans, especially those with comprehensive coverage, will cover at least a portion of the costs associated with cochlear implants. However, it’s important to review your plan’s specific benefits and limitations to understand what’s covered and what’s not.

- Medicare: Medicare, the federal health insurance program for people aged 65 and older and those with certain disabilities, covers cochlear implants under certain conditions. Medicare generally covers the surgical procedure, the implant device, and some related services, such as audiology evaluations and speech therapy.

- Medicaid: Medicaid, the federal-state health insurance program for low-income individuals and families, also covers cochlear implants in many states. However, Medicaid coverage may vary depending on the specific state and the individual’s eligibility.

- Employer-Sponsored Plans: Many employer-sponsored health insurance plans also cover cochlear implants. It’s essential to check with your employer or benefits administrator to determine the specific coverage details.

Coverage Limitations and Exclusions

While insurance plans often cover cochlear implants, there are typically some limitations and exclusions to be aware of. These can include:

- Pre-existing Conditions: Some insurance plans may have limitations or exclusions for pre-existing conditions. For example, a plan might not cover cochlear implants if the hearing loss is due to a pre-existing condition that was not disclosed during the enrollment process.

- Age Restrictions: Some insurance plans may have age restrictions for cochlear implant coverage. For example, a plan might not cover implants for children under a certain age or adults over a certain age.

- Prior Authorization: Many insurance plans require prior authorization for cochlear implants, meaning you’ll need to get approval from your insurance company before the procedure can be performed. This can involve providing medical documentation and undergoing a review process.

- Out-of-Pocket Costs: Even with insurance coverage, you’ll likely have some out-of-pocket costs associated with cochlear implants. These costs can include deductibles, copayments, coinsurance, and the cost of certain services not covered by your plan.

Factors Influencing Coverage Decisions

Several factors can influence an insurance company’s decision to cover cochlear implants. These include:

- Severity of Hearing Loss: Insurance companies often consider the severity of hearing loss when making coverage decisions. They are more likely to approve coverage for individuals with profound hearing loss, as cochlear implants are more likely to provide significant benefit in these cases.

- Age and Health: The age and overall health of the individual may also play a role in coverage decisions. Insurance companies may be more likely to cover cochlear implants for younger, healthier individuals, as they are more likely to benefit from the implant for a longer period.

- Medical Necessity: Insurance companies typically require that cochlear implants be considered medically necessary to be covered. This means that the implant must be deemed essential for improving the individual’s hearing and overall quality of life.

- Cost-Effectiveness: Insurance companies may also consider the cost-effectiveness of cochlear implants when making coverage decisions. They may be more likely to approve coverage for implants that are considered cost-effective, meaning they provide a significant benefit at a reasonable cost.

Factors Affecting Insurance Coverage

Getting a cochlear implant is a big decision, and insurance coverage can be a major factor in making that choice. Unfortunately, insurance coverage for cochlear implants isn’t always a straightforward process. Several factors can influence whether your insurance plan will cover the implant and related expenses.

Pre-Existing Conditions

Pre-existing conditions can impact insurance coverage for cochlear implants. Insurance companies may be more likely to approve coverage for implants if the hearing loss is a result of a new condition, rather than a pre-existing one. For example, if you develop hearing loss due to an accident, your insurance may be more likely to cover the implant than if you have hearing loss due to a condition you’ve had for many years. However, this doesn’t mean that individuals with pre-existing conditions are automatically denied coverage. Each insurance plan has its own set of rules and guidelines, and you should always consult with your insurance provider to determine your specific coverage.

Obtaining Coverage for Cochlear Implants

Getting a cochlear implant is a big decision, and it’s important to understand how insurance works to help you navigate this process. Insurance companies play a crucial role in making these life-changing devices accessible.

Insurance Approval Process

The insurance approval process for cochlear implants can seem like a maze, but it’s a necessary step to ensure you’re covered. Here’s a breakdown of the steps involved:

- Getting a Referral: The journey starts with your doctor. Your audiologist or ENT will evaluate your hearing loss and determine if a cochlear implant is the right option for you. If so, they’ll refer you to a cochlear implant center for further evaluation and potential surgery.

- Pre-Authorization: Once you’re deemed a candidate for a cochlear implant, your doctor will submit a pre-authorization request to your insurance company. This is basically a formal request for coverage, outlining the medical necessity and rationale for the implant. Think of it like a pitch for why your insurance company should foot the bill.

- Review and Decision: The insurance company’s medical review team will assess the request, considering your medical history, hearing loss severity, and other factors. They’ll make a decision based on their coverage guidelines. This can take a few weeks, so be patient.

- Appeal Process: If your pre-authorization is denied, don’t give up! You have the right to appeal the decision. This typically involves providing additional medical documentation or explaining why the implant is essential for your quality of life. You’ll have a set timeframe to submit your appeal, so make sure to get it in on time.

Required Documents and Information

It’s like prepping for a big presentation – you need to have all the necessary information ready to make your case. Here’s a checklist of documents and information you’ll likely need for your insurance claim:

- Doctor’s Referrals: These are your golden tickets! They establish the medical necessity of the cochlear implant and show that you’re a qualified candidate.

- Medical Records: Your complete medical history, including any previous hearing tests, audiograms, and documentation of your hearing loss.

- Insurance Information: Make sure you have your policy number, coverage details, and any relevant plan documents.

- Financial Information: This might include income verification, any co-pays or deductibles you’ve already paid, and any other relevant financial details.

- Cochlear Implant Center Information: Details about the cochlear implant center, including their qualifications and experience with cochlear implants.

- Support Letters: Letters from family, friends, or even your employer, explaining the impact of your hearing loss and how a cochlear implant could improve your quality of life.

Contact Information for Major Insurance Providers

It’s important to have direct access to your insurance company to ask questions, get updates, or even address any concerns. Here’s a table with contact information for major insurance providers:

| Insurance Provider | Phone Number | Website |

|---|---|---|

| UnitedHealthcare | 1-800-444-5423 | https://www.uhc.com/ |

| Anthem | 1-800-444-5423 | https://www.anthem.com/ |

| Blue Cross Blue Shield | 1-800-444-5423 | https://www.bcbs.com/ |

| Cigna | 1-800-444-5423 | https://www.cigna.com/ |

| Aetna | 1-800-444-5423 | https://www.aetna.com/ |

Additional Considerations for Cochlear Implants

While the decision to get a cochlear implant is a significant one, it’s crucial to understand that it’s just the beginning of a journey. There are several additional factors to consider beyond insurance coverage, and they play a vital role in your overall success with the implant.

The Role of Healthcare Professionals

Cochlear implants involve a team of healthcare professionals who work together to ensure the best possible outcome for the patient. Here’s a breakdown of their roles:

- Audiologists: They are the primary professionals involved in evaluating your hearing loss, determining your candidacy for a cochlear implant, and providing pre- and post-operative counseling and therapy. They also play a crucial role in programming and adjusting the implant to optimize your hearing.

- Otolaryngologists (ENTs): These specialists are responsible for the surgical implantation of the cochlear device. They also monitor your overall health and address any potential complications related to the surgery.

- Speech-Language Pathologists (SLPs): SLPs work closely with you to help you learn to understand and use spoken language after receiving the implant. They provide therapy and strategies for improving speech perception, comprehension, and communication skills.

- Other Healthcare Professionals: Depending on your individual needs, you might also work with other specialists, such as psychologists, social workers, and educators, to address the social and emotional aspects of living with hearing loss and receiving a cochlear implant.

Post-Operative Rehabilitation and Therapy

The journey with a cochlear implant doesn’t end with surgery. Post-operative rehabilitation and therapy are essential for maximizing the benefits of the implant. Here’s what to expect:

- Sound Familiarization: After the implant is activated, you’ll begin a process of getting used to the new sounds you hear. This involves adjusting to the sounds of speech, music, and everyday noises, which may sound different than what you remember.

- Speech Therapy: Speech-language pathologists will work with you to develop listening and speaking skills. This includes learning to understand speech, improve your ability to speak clearly, and develop strategies for communication in various situations.

- Auditory Training: This involves regular exercises and activities designed to improve your ability to discriminate between sounds, understand speech in different environments, and learn to recognize different voices.

- Ongoing Support: You’ll continue to receive regular follow-up appointments with your audiologist to adjust the implant settings, monitor your progress, and address any concerns you may have.

Potential Risks and Complications

Like any medical procedure, cochlear implants carry potential risks and complications. It’s important to discuss these with your doctor and weigh them against the potential benefits. Here are some of the potential risks and complications:

- Infection: Like any surgery, there is a risk of infection at the surgical site. This can be treated with antibiotics, but in some cases, it may require additional surgery.

- Hearing Loss: While cochlear implants aim to improve hearing, there is a small risk of further hearing loss in the implanted ear. This can occur due to complications during surgery or other factors.

- Facial Nerve Damage: The facial nerve is located near the inner ear, and there is a small risk of damage during surgery. This can lead to facial paralysis or weakness.

- Device Malfunction: While cochlear implants are generally reliable, there is a chance that the device may malfunction. This can be due to technical issues, battery problems, or damage to the implant.

- Tinnitus: Some people may experience tinnitus (ringing in the ears) after receiving a cochlear implant. This is often temporary but can be persistent in some cases.

- Speech Discrimination Issues: Despite the implant, some people may still have difficulty understanding speech, particularly in noisy environments. This is because cochlear implants don’t restore hearing to normal levels and may not pick up all sounds.

Conclusion

Navigating the world of insurance and cochlear implants can feel like a maze, but with the right information, you can feel empowered to make the best decisions for yourself or your loved one. Remember, it’s not just about the device; it’s about the journey to regaining hearing and the impact it can have on your life. Whether you’re starting your research or already in the process, know that you’re not alone. Keep asking questions, explore your options, and never stop believing in the power of sound.

General Inquiries

What are the most common insurance plans that cover cochlear implants?

Many major health insurance plans, including Medicare, Medicaid, and private insurance, typically offer coverage for cochlear implants. However, coverage details and limitations vary depending on the specific plan and state.

What are some factors that can influence insurance coverage for cochlear implants?

Several factors can influence coverage decisions, including your age, pre-existing conditions, the severity of your hearing loss, and whether your doctor deems the implant medically necessary.

How long does it take to get insurance approval for a cochlear implant?

The approval process can vary depending on your insurance company and the specific details of your case. It can take several weeks to several months to get approved.

What happens if my insurance doesn’t cover a cochlear implant?

If your insurance doesn’t cover the full cost, you may be able to explore alternative financing options like medical loans, grants, or fundraising campaigns.