What is captive insurance company – What is a captive insurance company? Think of it like a private insurance company, but instead of selling policies to the public, it’s set up by a specific business or group to cover their own risks. It’s like having your own personal insurance superhero, ready to protect you from unexpected financial blows.

Imagine you’re a tech startup on the rise, but you’re worried about the potential risks of cyberattacks or product liability lawsuits. A captive insurance company can help you manage these risks by creating a customized insurance plan tailored to your specific needs. It’s like having a financial safety net, specifically designed for your unique challenges.

Definition of a Captive Insurance Company

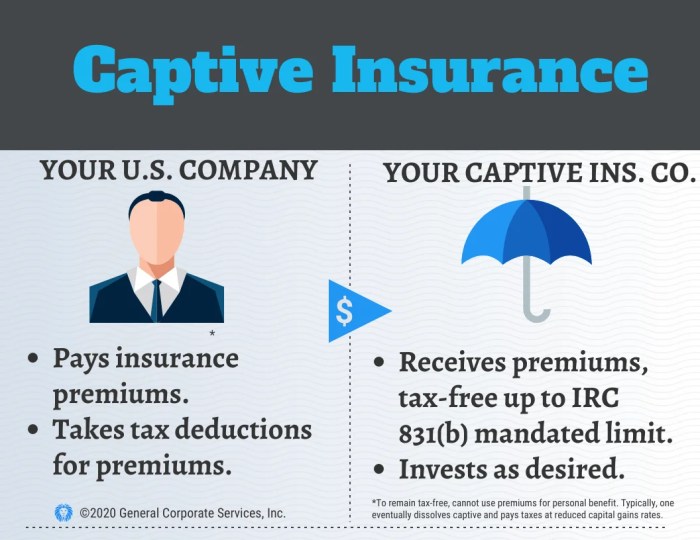

Think of a captive insurance company as your own personal insurance company. It’s a subsidiary of a larger company, set up to cover the parent company’s risks. This way, the parent company has more control over their insurance and can potentially save money.

Types of Captive Insurance Companies

Captive insurance companies can be structured in various ways, each with its own benefits and drawbacks.

- Single-Parent Captive: This is the most common type, where a single parent company owns and controls the captive. It’s like having a dedicated insurance company just for your business.

- Group Captive: A group of companies, often with similar risks, join forces to form a captive. This allows them to pool their risks and potentially lower their insurance costs.

- Pure Captive: This type of captive only insures the risks of its parent company. It’s like having a custom-made insurance plan for your specific needs.

- Rent-a-Captive: Here, a company rents space within an existing captive, allowing them to benefit from the captive’s structure and expertise without setting up their own.

Comparison with Traditional Insurance Companies

Captive insurance companies differ from traditional insurance companies in several ways.

| Characteristic | Captive Insurance Company | Traditional Insurance Company |

|---|---|---|

| Ownership | Owned by the parent company | Owned by shareholders or investors |

| Focus | Insuring the parent company’s risks | Insuring a wider range of risks for various clients |

| Risk Management | More control over risk management strategies | Limited control over risk management for individual clients |

| Pricing | Potential for lower premiums due to control over risks | Premiums based on industry averages and risk assessments |

Formation and Structure of a Captive

Think of forming a captive insurance company as building your own personal insurance empire! It’s a journey with steps, legal hurdles, and a structure that’s crucial to your success. Let’s break down the key elements to make your captive insurance dream a reality.

Steps Involved in Forming a Captive

Forming a captive insurance company is like setting up any other business. It involves several steps, each crucial to its successful launch.

- Identify Your Risk Management Needs: It’s like figuring out what you need to protect before buying a security system. You need to know your risks and the potential impact they could have on your business. This helps determine the type of captive that’s right for you.

- Develop a Business Plan: A business plan is like a roadmap. It Artikels your goals, strategies, and financial projections. This helps secure funding, gain regulatory approval, and demonstrate your commitment to success.

- Choose a Jurisdiction: This is like picking the right location for your business. Different jurisdictions have varying regulations and tax benefits. Factors like cost of formation, regulatory environment, and tax advantages need to be considered.

- Secure Funding: Money talks, and you’ll need to secure capital to get your captive off the ground. This could be through equity investment, debt financing, or a combination of both.

- Obtain Regulatory Approvals: Just like getting a business license, you’ll need to meet regulatory requirements to operate a captive. This involves submitting applications, meeting specific criteria, and securing approval from the relevant authorities.

- Establish the Captive: This involves incorporating the captive as a legal entity, drafting bylaws, and appointing a board of directors. It’s like getting your business officially recognized and structured.

- Develop an Underwriting and Claims Management Plan: This is like setting up your insurance policies and procedures. You need to establish how you’ll assess risks, determine premiums, and handle claims. It’s all about managing risk and ensuring your captive can fulfill its purpose.

Legal and Regulatory Considerations

Navigating the legal and regulatory landscape is like walking through a minefield. You need to be aware of the rules and regulations that govern captive insurance companies.

- Domestic vs. Offshore Captives: Deciding whether to set up your captive in your home country or offshore is a major decision. Domestic captives offer familiarity with the legal system, while offshore captives may provide tax advantages. You need to weigh the pros and cons of each option.

- Insurance Regulation: Each jurisdiction has its own set of insurance regulations. These regulations cover aspects like licensing, capital requirements, and solvency standards. You need to understand and comply with these regulations to operate legally.

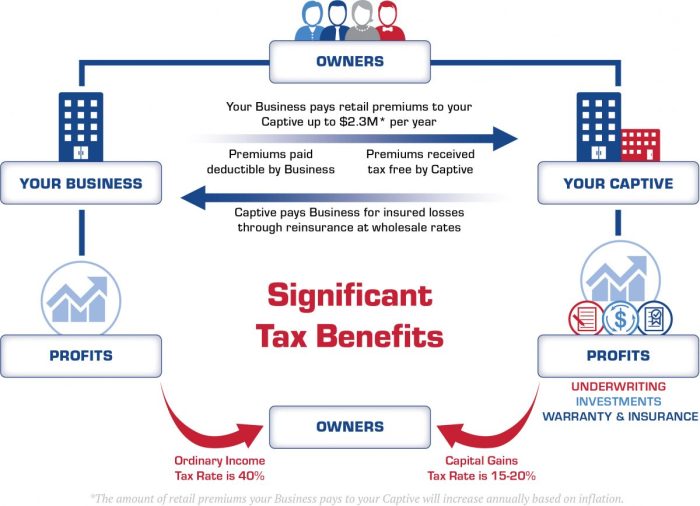

- Taxation: Captives can offer tax benefits, but it’s crucial to understand the tax implications. You need to determine how your captive will be taxed, both in its jurisdiction of formation and in your home country.

- Contractual Agreements: You’ll need to carefully draft contracts with reinsurers, brokers, and other service providers. These contracts need to clearly define responsibilities, liabilities, and payment terms. It’s all about protecting your captive’s interests.

Organizational Structure

A well-defined structure is like the backbone of your captive. It helps ensure efficient operation, accountability, and effective risk management.

- Board of Directors: The board is like the governing body of your captive. They oversee the overall management, strategic direction, and financial health of the captive. They’re responsible for setting policies, approving budgets, and ensuring compliance with regulations.

- Management Team: This team is like the day-to-day operations crew. They handle the underwriting, claims management, and administrative tasks. They need to have expertise in insurance, risk management, and financial operations.

- Service Providers: Just like any business, you’ll need external help. Service providers like actuaries, lawyers, and accountants play vital roles in ensuring your captive’s success. They provide specialized expertise and support to ensure your captive runs smoothly.

Benefits of Captive Insurance

Captive insurance companies offer a unique and often advantageous approach to risk management. They can provide numerous benefits, including enhanced control over risk management, potential cost savings, and improved access to insurance coverage. Let’s delve into the key advantages that captives bring to the table.

Risk Management Advantages

Captive insurance companies empower businesses to take a more proactive approach to risk management. Instead of simply paying premiums to an external insurer, captives allow companies to actively participate in the risk management process.

“Captive insurance companies are not simply an alternative to traditional insurance; they are a strategic tool for managing risk.”

Here are some of the specific risk management advantages of captive insurance:

- Increased Control: Captives provide businesses with greater control over their risk management strategy. Companies can tailor their insurance programs to meet their specific needs, rather than being bound by standardized policies offered by traditional insurers. This allows them to address unique risks that may not be covered by traditional insurance.

- Improved Risk Assessment: By establishing a captive, companies are encouraged to conduct more thorough risk assessments. This process helps identify potential risks, evaluate their severity, and develop strategies for mitigation. This proactive approach can lead to more informed decision-making and ultimately better risk management.

- Enhanced Loss Prevention: Captives often incentivize businesses to invest in loss prevention measures. Knowing that they are directly responsible for covering losses, companies may be more motivated to implement safety programs, adopt best practices, and invest in risk mitigation strategies.

Risks and Challenges of Captives

It’s not all sunshine and rainbows when it comes to captive insurance companies. While they offer numerous benefits, there are also some potential risks and challenges you need to be aware of. Think of it like choosing the right team in a game of Risk – you want to be prepared for any unexpected turns!

Let’s dive into the potential pitfalls and how to navigate them:

Regulatory and Legal Complexities

Navigating the world of captive insurance can feel like navigating a labyrinth, with a complex web of regulations and legal hurdles. The regulatory landscape for captive insurance is a bit like a puzzle, with different pieces fitting together depending on where your captive is domiciled.

Here’s a breakdown of the challenges:

- State and Federal Regulations: Captives must comply with both state and federal regulations, which can vary widely. This can be like trying to juggle multiple balls at once!

- Taxation: The tax treatment of captives can be complicated, and you need to be sure you’re following the rules to avoid any nasty surprises. It’s like making sure you’re paying the right amount of taxes, but with a more intricate system.

- Solvency Requirements: Like any insurance company, captives must maintain a certain level of financial stability. This means meeting specific solvency requirements to ensure they can pay out claims. It’s like having enough money in the bank to cover your bills, but with more stringent rules.

It’s crucial to have a good understanding of these complexities and work with experienced professionals who can guide you through the process. Think of it like having a trusted advisor in your corner who can help you make the right moves.

Comparison with Traditional Insurance, What is captive insurance company

Captive insurance may seem like a great alternative to traditional insurance, but it’s important to weigh the risks and benefits before making a decision. It’s like comparing apples and oranges – both have their own unique flavors and benefits.

Here’s a comparison:

| Risk | Captive Insurance | Traditional Insurance |

|---|---|---|

| Regulatory Compliance | Higher complexity and potential for stricter scrutiny | Generally simpler and less stringent regulations |

| Financial Stability | Requires careful management and financial resources to maintain solvency | Larger and more established companies with greater financial resources |

| Expertise and Resources | May require greater internal expertise or external support for risk management and claims handling | Access to a wider pool of expertise and resources for risk management and claims handling |

Ultimately, the decision to go with captive insurance depends on your specific needs and risk tolerance. It’s like choosing the right tool for the job – you need to pick the one that best fits your situation.

Applications of Captive Insurance

Captive insurance companies are incredibly versatile, offering a wide range of applications across various industries. They can be customized to address specific risks and financial goals, making them a valuable tool for risk management and financial planning.

Industries Where Captive Insurance is Commonly Used

Captive insurance is a popular risk management strategy across many industries. Here are some examples:

- Healthcare: Hospitals and healthcare providers face significant risks related to medical malpractice, cyberattacks, and data breaches. Captives can help them manage these risks by providing coverage for these events. For example, a group of hospitals could form a captive to pool their risks and provide affordable coverage for medical malpractice claims.

- Manufacturing: Manufacturers face risks from product liability, environmental damage, and workplace accidents. Captives can provide a cost-effective way to insure against these risks. For example, a manufacturer of heavy machinery could establish a captive to provide coverage for product liability claims.

- Construction: Construction companies are exposed to risks related to accidents, injuries, and property damage. Captives can help them manage these risks by providing coverage for these events. For example, a construction company could establish a captive to provide coverage for workers’ compensation claims.

- Technology: Technology companies face risks related to cyberattacks, data breaches, and intellectual property theft. Captives can provide coverage for these risks and help companies protect their valuable assets. For example, a software development company could establish a captive to provide coverage for cyberattacks and data breaches.

- Energy: Energy companies face risks related to environmental damage, accidents, and natural disasters. Captives can help them manage these risks by providing coverage for these events. For example, an oil and gas company could establish a captive to provide coverage for environmental damage claims.

Tailoring Captives to Address Specific Industry Risks

Captive insurance companies can be tailored to address specific industry risks. This flexibility is one of the key advantages of captives.

- Custom Coverage: Captives can be designed to provide coverage for specific risks that are not readily available in the traditional insurance market. This can be particularly valuable for companies with unique or complex risks.

- Risk Management Tools: Captives can be used to implement a variety of risk management tools, such as loss prevention programs, risk retention, and risk transfer. These tools can help companies reduce their overall risk exposure and improve their financial performance.

- Financial Planning: Captives can be used to achieve specific financial goals, such as reducing insurance premiums, improving cash flow, and increasing profitability. For example, a company could use a captive to self-insure for certain risks, which could help them reduce their insurance premiums.

Applications of Captive Insurance Across Various Sectors

| Industry | Risk | Captive Application |

|---|---|---|

| Healthcare | Medical Malpractice | A group of hospitals forms a captive to pool their risks and provide affordable coverage for medical malpractice claims. |

| Manufacturing | Product Liability | A manufacturer of heavy machinery establishes a captive to provide coverage for product liability claims. |

| Construction | Workers’ Compensation | A construction company establishes a captive to provide coverage for workers’ compensation claims. |

| Technology | Cyberattacks | A software development company establishes a captive to provide coverage for cyberattacks and data breaches. |

| Energy | Environmental Damage | An oil and gas company establishes a captive to provide coverage for environmental damage claims. |

Future Trends in Captive Insurance

The captive insurance market is constantly evolving, driven by factors such as regulatory changes, technological advancements, and the growing need for risk management solutions. Captive insurance companies are becoming increasingly sophisticated, offering a wider range of risk transfer options and leveraging technology to enhance their operations.

Emerging Trends in the Captive Insurance Market

Here are some key trends shaping the future of captive insurance:

- Increased Focus on Cyber Risk: The growing prevalence of cyberattacks has made cyber risk a top concern for businesses worldwide. Captives are increasingly being used to manage this risk, providing a dedicated pool of capital to cover potential losses.

- Expansion of Captive Solutions: Captives are no longer limited to traditional risk transfer mechanisms. They are now being used to provide innovative solutions, such as risk financing, alternative risk transfer, and reinsurance.

- Adoption of Technology: Technology is playing a key role in transforming the captive insurance industry. From data analytics to artificial intelligence, captives are using technology to improve their efficiency, underwriting, and risk management capabilities.

- Global Growth of Captive Insurance: The captive insurance market is experiencing rapid growth worldwide, driven by the increasing demand for customized risk management solutions.

Potential Growth Areas for Captive Insurance

Several areas hold significant potential for captive insurance growth:

- Emerging Markets: Captive insurance is gaining traction in emerging markets as businesses seek to manage their risks and access capital more effectively.

- Specialty Lines: Captives are increasingly being used to cover specialty lines of insurance, such as environmental liability, professional liability, and directors and officers liability.

- Healthcare: The rising costs of healthcare are driving the adoption of captives in the healthcare industry. Captives can provide a cost-effective way to manage healthcare risks and provide access to capital for healthcare investments.

- Technology: The technology sector is a prime candidate for captive insurance. Tech companies face unique risks, such as cybersecurity threats, data breaches, and intellectual property infringement. Captives can provide a tailored approach to managing these risks.

Key Drivers of Future Captive Insurance Development

The following table highlights the key drivers of future captive insurance development:

| Driver | Description |

|---|---|

| Regulatory Environment | Favorable regulatory environments, such as tax incentives and flexible licensing requirements, encourage captive formation. |

| Economic Conditions | Periods of economic uncertainty and volatility often lead to increased demand for risk management solutions, such as captive insurance. |

| Technological Advancements | Technology is enabling captives to become more efficient, sophisticated, and data-driven, driving further growth and innovation. |

| Risk Management Needs | The increasing complexity of risks faced by businesses is driving the demand for customized risk management solutions, which captives can provide. |

| Market Trends | Trends such as the growth of emerging markets, the rise of specialty lines, and the increasing focus on cyber risk are creating new opportunities for captive insurance. |

Ultimate Conclusion: What Is Captive Insurance Company

So, whether you’re a big corporation or a small business, understanding captive insurance companies can be a game-changer. It’s like having a secret weapon in your arsenal, allowing you to manage risk, control costs, and potentially gain access to insurance coverage that might otherwise be difficult to obtain. Think of it as a smart move for your business, a way to stay ahead of the curve and secure your financial future.

Quick FAQs

What are the main advantages of using a captive insurance company?

Captive insurance companies offer several benefits, including:

– Cost Savings: Captives can potentially lower insurance premiums and help you control costs.

– Risk Management: They allow you to manage your own risks and tailor coverage to your specific needs.

– Enhanced Coverage: Captives can provide access to insurance coverage that might be difficult to obtain through traditional insurers.

– Tax Benefits: In some cases, captive insurance programs can offer tax advantages.

What are some common examples of industries that use captive insurance?

Captive insurance is commonly used in a variety of industries, including:

– Manufacturing: To manage product liability risks.

– Healthcare: To cover medical malpractice claims.

– Technology: To protect against cyberattacks and data breaches.

– Construction: To cover workers’ compensation and property damage risks.

– Energy: To manage environmental and operational risks.

How do I know if a captive insurance company is right for my business?

It’s best to consult with an experienced insurance advisor or broker who can help you determine if a captive insurance company is a suitable solution for your specific needs and risk profile. They can guide you through the process and help you make an informed decision.