Can you sue an insurance company for dropping you – So, your insurance company just dropped you, and you’re wondering if you can take them to court. It’s a rough situation, and you’re not alone. Insurance companies have the right to terminate policies under certain circumstances, but that doesn’t mean they can do it willy-nilly. There are rules, and you might have a case.

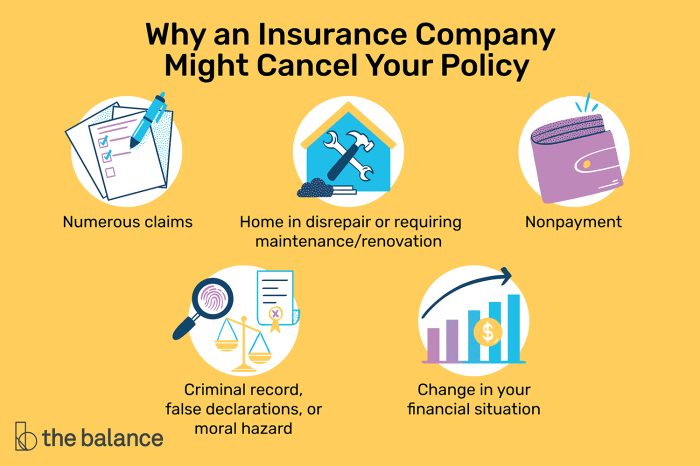

First, you need to understand the reasons why an insurance company might drop you. Maybe your premiums haven’t been paid, or you’ve filed too many claims. Or, maybe they’re just not offering your type of coverage anymore. It’s crucial to review your policy to see if the termination was justified. If you think it wasn’t, you might have grounds to sue.

Understanding Insurance Company Practices

Insurance companies are businesses, and like any business, they need to be profitable. They do this by carefully evaluating the risks they take on and setting premiums accordingly. However, there are times when insurance companies might decide to drop a client, which can be frustrating for the policyholder.

Reasons for Policy Termination

Insurance companies may terminate a policy for various reasons, most of which are Artikeld in the policy’s terms and conditions. These reasons can be categorized into two main groups: non-payment of premiums and policy violations.

- Non-payment of premiums: This is the most common reason for policy termination. If you fail to pay your premiums on time, the insurance company may cancel your policy. They typically provide a grace period, but after that, your policy will be canceled.

- Policy violations: These violations can include:

- Misrepresentation: Providing false or misleading information during the application process. This can be anything from your driving record to your medical history.

- Fraud: Filing a fraudulent claim or engaging in any activity that is intended to deceive the insurance company.

- Increased Risk: Changes in your circumstances that significantly increase the risk associated with your policy, such as moving to a high-crime area or starting a dangerous hobby.

- Changes in Coverage: The insurance company may decide to no longer offer the type of coverage you have. This is especially common with niche policies or those that have become unprofitable for the insurer.

Examples of Policy Termination

Here are some real-life examples of situations where an insurance company might terminate a policy:

- Non-Payment: A homeowner fails to pay their monthly premium for their homeowners insurance for three consecutive months. The insurance company sends several notices, but the homeowner continues to neglect the payments. Eventually, the insurance company cancels the policy.

- Misrepresentation: A car insurance applicant hides a prior DUI conviction from their application. When the insurance company discovers the omission, they cancel the policy.

- Fraud: A homeowner files a claim for a fire that was intentionally set. The insurance company investigates the claim and discovers the fraud, leading to the termination of the policy.

- Increased Risk: A homeowner converts their garage into a workshop for woodworking, which significantly increases the risk of fire. The insurance company may cancel the policy because the risk associated with the property has changed.

Legal Framework for Policy Termination, Can you sue an insurance company for dropping you

Each state has its own laws governing insurance policies and their termination. Generally, insurance companies must follow specific procedures when terminating a policy, such as providing proper notice and an opportunity to rectify the situation. The specific requirements vary depending on the state and the type of policy. It’s important to review your policy’s terms and conditions and familiarize yourself with your state’s insurance laws.

Examining Your Policy Terms

You’ve been dropped by your insurance company, and you’re wondering if you can sue them. But before you go all “Legally Blonde” on them, it’s crucial to understand the terms of your policy. This is your roadmap to figuring out if you have a case.

The fine print in your policy can be a real snoozefest, but it’s essential to dig in and find the clauses related to termination. These clauses are the rules of the game when it comes to ending your insurance coverage.

Policy Termination Clauses

These clauses are the “do not pass go” rules for your insurance company. They lay out the conditions under which they can kick you to the curb. Here’s what you need to know:

- Non-Payment of Premiums: This is the most common reason for termination. If you’re late on your payments, your insurance company can cancel your policy. They’ll usually give you a grace period (like 30 days), but after that, they’re free to say “sayonara.”

- Material Misrepresentation: If you lied on your application (like saying you’re a safe driver when you actually have a lead foot), your insurance company can cancel your policy. This applies even if you’re not aware of the misrepresentation.

- Increased Risk: If something changes that makes you a higher risk (like you start driving a race car), your insurance company can terminate your policy. They may offer you a new policy with higher premiums, but they don’t have to.

- Fraud: If you commit insurance fraud, your policy will be terminated, and you could face legal consequences.

Comparing Termination Conditions

You need to compare the termination conditions in your policy to the standard industry practices. While your policy might be a little different, most insurance companies follow similar guidelines.

Here’s where you can find this info:

- State Insurance Department: Your state’s insurance department website usually has information about standard insurance practices and consumer rights. They’re like the “insurance police” of your state.

- Insurance Industry Associations: Organizations like the National Association of Insurance Commissioners (NAIC) and the American Insurance Association (AIA) provide resources and information on insurance practices.

- Independent Consumer Groups: Groups like Consumer Reports and the National Consumer Law Center offer guidance and advice on insurance issues.

Potential Grounds for Challenging Termination

Sometimes, insurance companies might try to pull a fast one. They might terminate your policy for a reason that’s not valid or justified. Here are some potential grounds for challenging their decision:

- Breach of Contract: If the insurance company terminates your policy without following the terms of your contract, you might have a claim for breach of contract.

- Bad Faith: If the insurance company acts unfairly or unreasonably, they might be guilty of “bad faith.” This could involve denying your claim without a valid reason or trying to pressure you into settling for less than you deserve.

- Discrimination: If the insurance company discriminates against you based on your race, religion, gender, or other protected characteristics, you might have a claim for discrimination.

Remember: It’s crucial to understand your policy terms, compare them to industry practices, and identify any potential grounds for challenging the insurance company’s decision. This will help you navigate this tricky situation and fight for your rights.

Understanding the Risks and Rewards

Suing an insurance company can be a risky endeavor, even if you believe you have a strong case. Before taking this step, it’s crucial to weigh the potential benefits against the potential drawbacks.

Financial Implications

The financial implications of suing an insurance company can be significant. You’ll likely need to hire an attorney, which can be expensive, especially if the case goes to trial. You’ll also need to consider the costs associated with court fees, expert witness fees, and other litigation expenses.

Legal Implications

The legal implications of suing an insurance company are complex and depend on the specific circumstances of your case. You’ll need to prove that the insurance company acted in bad faith or breached the terms of your policy. If you fail to prove your case, you could be ordered to pay the insurance company’s legal fees.

Benefits of Suing

The potential benefits of suing an insurance company include:

- Financial compensation: You may be able to recover damages for your losses, such as medical expenses, lost wages, and pain and suffering.

- Justice: Suing an insurance company can be a way to hold them accountable for their actions and ensure that they don’t engage in similar behavior in the future.

- Setting a precedent: A successful lawsuit can set a precedent for other policyholders who may have been wronged by the same insurance company.

Drawbacks of Suing

The potential drawbacks of suing an insurance company include:

- Cost: Litigation can be expensive, and you may have to pay for legal fees, court costs, and expert witness fees.

- Time: Lawsuits can take a long time to resolve, and you may have to wait years to see any results.

- Stress: Suing an insurance company can be stressful, especially if you’re dealing with a complex legal issue.

- Uncertainty: There’s no guarantee that you’ll win your case, and you could end up losing money and time.

Outcomes of Suing vs. Seeking Alternative Resolutions

| Outcome | Suing | Seeking Alternative Resolutions |

|---|---|---|

| Financial Compensation | Potential for full compensation, but also risk of no compensation or even having to pay the insurance company’s legal fees. | Potential for partial compensation, but also risk of receiving no compensation. |

| Time | Can take years to resolve. | Can be resolved much faster, sometimes within a few months. |

| Stress | Can be very stressful. | Generally less stressful than litigation. |

| Cost | Can be very expensive. | Generally less expensive than litigation. |

| Control | Less control over the outcome. | More control over the outcome. |

Conclusive Thoughts

Remember, the legal landscape is complex. If you’re considering suing your insurance company, it’s always a good idea to consult with a lawyer. They can help you assess your options, understand your rights, and navigate the legal process. It’s not always a slam dunk, but knowing your rights and options can make a big difference in the outcome.

Quick FAQs: Can You Sue An Insurance Company For Dropping You

What are some common reasons insurance companies drop clients?

Common reasons include non-payment of premiums, filing too many claims, changes in coverage, and policy violations.

Can I sue for emotional distress if my insurance company dropped me?

It depends on the circumstances and your state’s laws. In some cases, you might be able to sue for emotional distress if the insurance company acted in bad faith or intentionally caused you harm.

What happens if I win a lawsuit against my insurance company?

If you win, you could receive compensation for damages, including lost coverage, financial losses, and even punitive damages.