How to check if life insurance company is legitimate – Life insurance is a serious business, and you want to make sure you’re putting your trust in a company that’s on the up-and-up. “How to check if a life insurance company is legitimate” is a question that should be on everyone’s mind before signing on the dotted line. You wouldn’t buy a car without checking out the dealer, right? The same goes for life insurance – you need to do your homework to ensure you’re getting a good deal and a trustworthy partner in protecting your family’s future.

This guide will walk you through the essential steps to verify a life insurance company’s legitimacy. We’ll cover everything from checking their credentials and financial stability to understanding their reputation and comparing policies. By the end, you’ll be equipped to make an informed decision and choose a life insurance company that’s both reliable and right for your needs.

Understanding Legitimate Life Insurance Companies

You’re looking to secure your loved ones’ future, but you need to make sure you’re working with a real deal. No one wants to find out they’ve been scammed after a tragedy. So, let’s break down how to tell the good guys from the bad guys in the life insurance world.

Key Characteristics of Legitimate Life Insurance Companies

Legitimate life insurance companies are like the Avengers of financial protection, operating with transparency, integrity, and a commitment to their customers. They’re not just out to make a quick buck; they’re here to provide a safety net for your family when you’re gone.

- Licensed and Regulated: Just like you need a license to drive, life insurance companies need a license to operate. This means they’ve been vetted by the state and are subject to regulations that protect you. You can check a company’s licensing status on your state’s insurance department website.

- Financial Stability: You want a company that’s financially strong and able to pay out claims when the time comes. Look for companies with a good financial rating from agencies like AM Best, Standard & Poor’s, or Moody’s. These ratings are like report cards for insurance companies, showing their financial health and ability to meet their obligations.

- Transparency and Clear Communication: A legit company will be upfront about their policies, fees, and how they handle claims. They’ll have clear and concise documents, and they’ll be responsive to your questions. If you’re ever left feeling confused or unsure, that’s a red flag.

The Role of State Regulation

Think of state insurance departments as the guardians of your financial well-being. They’re like the “life insurance police” making sure companies play by the rules. They enforce laws, investigate complaints, and take action against companies that engage in shady practices. So, you can rest assured knowing that your state is looking out for you.

Red Flags That Indicate a Fraudulent or Illegitimate Company

Be on the lookout for these red flags, because they can signal a company that’s not worth your time or money.

- High-Pressure Sales Tactics: If a salesperson is pressuring you to buy immediately or threatening to raise rates, it’s a big red flag. A legitimate company will give you time to understand the policy and make an informed decision.

- Promises That Sound Too Good to Be True: If a company is offering rates that are significantly lower than other companies, or if they’re promising guaranteed returns, it’s likely a scam. Remember, there’s no such thing as a free lunch in the insurance world.

- Unlicensed or Unregistered Companies: Always check if a company is licensed and regulated by your state. You can find this information on your state’s insurance department website. If a company is not licensed, it’s probably not legit.

- Unprofessional Conduct: A legitimate company will have a professional website, a physical address, and a toll-free number. If you’re dealing with a company that seems shady or unprofessional, it’s best to walk away.

Verifying Company Credentials

You’ve got your eye on a life insurance company, but before you sign on the dotted line, you gotta make sure they’re legit. Think of it like this: you wouldn’t buy a car without checking if it’s been inspected, right? Same goes for life insurance. Here’s how to check if a company is on the up and up:

Checking License and Registration Status

It’s crucial to make sure your life insurance company is authorized to operate in your state. It’s like a company’s driver’s license – it proves they’re allowed to do business. You can usually find this information on your state’s insurance department website. Here’s how:

- Visit your state’s insurance department website. Every state has an insurance department responsible for regulating insurance companies. You can usually find their website by searching for “Insurance Department” followed by your state’s name. For example, “Insurance Department California.”

- Look for a “Search for Licenses” or “Company Information” section. These sections usually allow you to search for companies by name or license number.

- Enter the company’s name and search. The results should display the company’s license status, including whether it’s active, inactive, or suspended.

Financial Stability Ratings

You wouldn’t want to invest in a company that’s about to go belly up, right? Same goes for life insurance. You want to make sure the company is financially sound and can pay out claims when you need them. To check this, you can look at financial stability ratings from reputable agencies like A.M. Best, Standard & Poor’s, and Moody’s. These agencies assess a company’s financial strength and assign ratings based on their findings.

- Check the company’s ratings on these agencies’ websites. A.M. Best, Standard & Poor’s, and Moody’s all have websites where you can search for companies and see their financial stability ratings.

- Understand the rating system. Each agency uses a different rating system, but generally, higher ratings indicate a stronger financial position.

- Look for ratings that are at least “A” or “Stable.” While higher ratings are always better, companies with “A” or “Stable” ratings are generally considered financially sound.

Verifying Industry Association Membership

Just like any other industry, life insurance has its own associations. These associations promote ethical business practices and help ensure that their members meet certain standards. Checking if a company is a member of a reputable industry association can give you a good idea of its commitment to professionalism and integrity.

- Look for membership information on the company’s website. Many companies will list their memberships on their “About Us” or “Company Information” pages.

- Check the websites of major industry associations. You can search for the association’s website and see if the company is listed as a member.

- Consider reputable associations like the National Association of Insurance Commissioners (NAIC) and the American Council of Life Insurers (ACLI). These associations set high standards for their members and provide valuable resources for consumers.

Assessing Company Reputation and Transparency

Before diving into the nitty-gritty of life insurance policies, it’s crucial to get a feel for the company itself. Think of it like checking out a restaurant before ordering: You wouldn’t want to walk into a place with a bad reputation, would you? Assessing a life insurance company’s reputation and transparency is like looking at the menu and reviews – it gives you a good idea of what you’re getting into.

Company Reviews and Complaints

To get the lowdown on a company’s reputation, you need to hear from the people who have actually dealt with them. Think of it like reading online reviews for a new gadget: You want to know what other folks are saying, right? Here’s how to dig into the real-world experience with life insurance companies:

- Check out online review platforms: Sites like Trustpilot, ConsumerAffairs, and the Better Business Bureau (BBB) are gold mines for customer feedback. Look for patterns in the reviews – are people generally happy, or are there a lot of complaints?

- Search for company-specific forums: There are online communities dedicated to discussing life insurance companies. Forums like Reddit’s r/personalfinance or r/insurance can provide valuable insights.

- Look for regulatory actions: State insurance departments often have public records of complaints and disciplinary actions against insurance companies. This information can help you spot any red flags.

Company Financial Reports and Disclosures, How to check if life insurance company is legitimate

Just like you wouldn’t trust a restaurant that’s constantly running out of food, you want to make sure a life insurance company is financially stable. These companies handle a lot of money, and you want to be sure they’re not going to go belly up and leave you hanging. Here’s how to check their financial health:

- Request a copy of the company’s Annual Statement: This document provides a comprehensive overview of the company’s financial position, including assets, liabilities, and profits. You can usually find this information on the company’s website or by contacting the state insurance department.

- Check the company’s credit rating: Credit rating agencies like AM Best, Moody’s, and Standard & Poor’s assess the financial strength of insurance companies. Look for companies with strong ratings (A or higher), as this indicates they are financially stable.

- Review the company’s disclosures: Pay attention to any warnings or disclosures about the company’s financial condition. If there are any red flags, it’s a good idea to steer clear.

Company Website Transparency

A company’s website is like its online storefront. If it’s cluttered, confusing, or lacking important information, it’s a bad sign. You want a website that’s easy to navigate and provides clear, concise information about the company’s products, services, and policies.

- Look for a dedicated “About Us” page: This section should provide details about the company’s history, mission, and values.

- Check for clear and concise policy information: The company’s website should provide easy-to-understand explanations of its policies, including terms, conditions, and exclusions.

- Look for contact information: The website should provide multiple ways to contact the company, including phone numbers, email addresses, and physical addresses.

- Check for customer support resources: A reputable company will provide resources to help customers find answers to their questions. This might include FAQs, online chat, or a customer support portal.

Comparing Insurance Policies and Coverage

Alright, so you’ve got your list of legit life insurance companies, but now it’s time to dive into the nitty-gritty: comparing those policies. You know, like choosing the right flavor of ice cream – you gotta find the one that fits your needs and budget, right?

It’s all about finding the sweet spot between coverage, premiums, and benefits. It’s like finding the perfect balance in your life, but with insurance.

Comparing Different Types of Life Insurance

You’ve got a couple of main players in the life insurance game: term life and whole life. Let’s break it down:

| Policy Type | Coverage | Premiums | Benefits |

|---|---|---|---|

| Term Life | Temporary coverage for a set period, like 10, 20, or 30 years. | Generally lower than whole life premiums. | Death benefit paid only if you die within the term. |

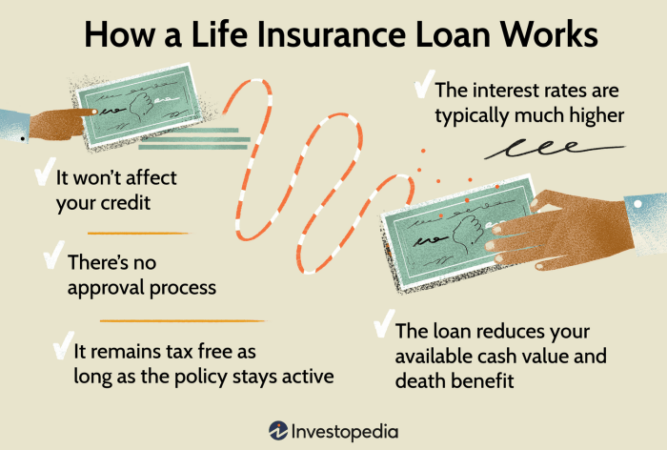

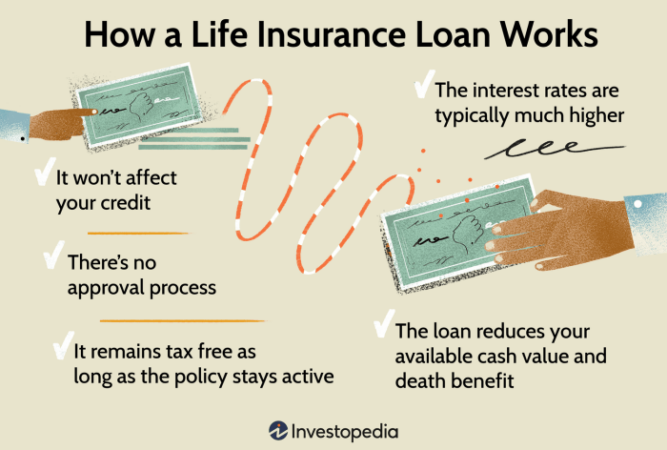

| Whole Life | Permanent coverage for your entire life, as long as you pay premiums. | Higher than term life premiums, but can build cash value over time. | Death benefit paid whenever you die, plus cash value can be borrowed against or withdrawn. |

Understanding Policy Terms and Conditions

You wouldn’t sign up for a concert without knowing the lineup, right? Same goes for life insurance. Before you sign on the dotted line, take a good look at the fine print:

- Death Benefit: The amount your beneficiaries will receive if you pass away.

- Premium: The monthly or annual payment you make for coverage.

- Term: The duration of your coverage, if it’s a term life policy.

- Exclusions: Certain situations or causes of death that may not be covered by the policy.

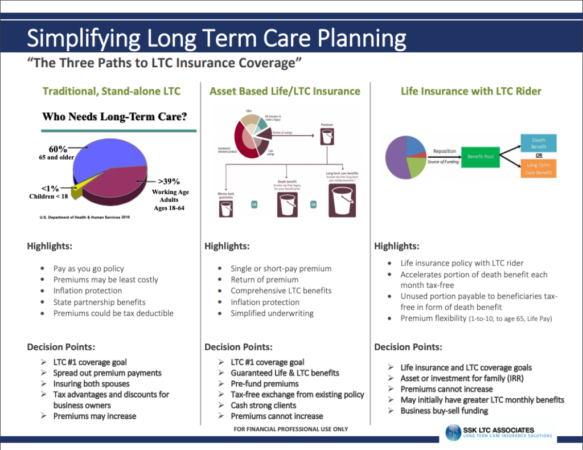

- Riders: Additional features you can add to your policy, like accidental death benefits or long-term care coverage.

Comparing Benefits and Drawbacks

Here’s the thing: no insurance policy is perfect. They all come with their own pros and cons. Like choosing a pizza topping, it’s all about what you’re looking for.

- Term Life:

- Pros: Affordable, good for temporary coverage needs (like when you have young kids).

- Cons: No cash value, coverage ends after the term expires.

- Whole Life:

- Pros: Permanent coverage, cash value builds up over time, can be used as a savings tool.

- Cons: Higher premiums, may not be the most affordable option for everyone.

Consulting with Financial Professionals

You’ve done your homework, researched, and compared, but you’re still feeling a little lost in the life insurance jungle. That’s where a financial professional can be your trusty guide. They’re like the Indiana Jones of the insurance world, helping you navigate the treacherous terrain and uncover the right policy for your needs.

Role of a Financial Advisor

A financial advisor, like a personal trainer for your finances, can help you choose a legitimate life insurance company that aligns with your individual goals and budget. They can provide valuable insights into the different types of life insurance, the pros and cons of each, and help you understand the fine print that can make or break your policy. Think of them as your insurance whisperer, translating the jargon and revealing the hidden gems.

Benefits of Independent Agents and Brokers

Independent insurance agents and brokers are like the ultimate insurance matchmakers. They work for you, not the insurance company, and their goal is to find the best policy for your unique situation. They have access to a wide range of life insurance companies and can compare quotes from multiple providers, saving you time and effort. They can also provide personalized advice based on your specific circumstances and goals. Think of them as your insurance superheroes, fighting for the best deal and protecting your interests.

Finding Qualified Financial Professionals

Finding a qualified and reputable financial professional is crucial. You wouldn’t trust just anyone to manage your money, and the same goes for your life insurance. Here are some tips for finding the right financial guru:

- Ask for referrals: Talk to friends, family, or colleagues who have worked with financial advisors in the past. They can provide valuable insights and recommendations.

- Check credentials: Look for financial professionals who are licensed and certified, such as Certified Financial Planners (CFPs) or Chartered Financial Consultants (CHFCs). These certifications demonstrate expertise and commitment to ethical standards.

- Consider experience: Choose a financial professional with experience in life insurance and a proven track record of success. They’ll be able to guide you through the complexities of the industry with confidence.

- Research online: Check online reviews and ratings from websites like the Better Business Bureau (BBB) or Yelp. This can give you a glimpse into the experiences of other clients and help you identify reputable professionals.

Final Wrap-Up

Choosing a life insurance company is a big decision, but with a little research and due diligence, you can feel confident that you’re working with a legitimate and trustworthy company. Remember, it’s all about peace of mind. By taking the time to thoroughly vet your options, you can ensure that your family is protected and your financial future is secure. So, get out there, do your research, and choose wisely!

Questions Often Asked: How To Check If Life Insurance Company Is Legitimate

What are some red flags that might indicate a fraudulent life insurance company?

Red flags include high-pressure sales tactics, promises of unrealistic returns, or companies that are not licensed in your state. If something feels off, it probably is.

How do I find out if a life insurance company is licensed in my state?

You can usually find this information on the website of your state’s insurance department.

What is the role of a financial advisor in choosing a life insurance company?

A financial advisor can provide unbiased advice and help you compare different policies and companies. They can also help you determine how much life insurance you need and what type of policy is right for you.

Is it worth it to get a life insurance policy from a company that’s not well-known?

It’s important to do your research and ensure that any company you choose is financially sound and has a good reputation. Just because a company is not well-known doesn’t mean it’s not legitimate. But, it’s always a good idea to stick with a company that has a proven track record.