Is Root Insurance a good insurance company? That’s a question on a lot of people’s minds, especially those looking for a more personalized and potentially cheaper insurance option. Root Insurance is shaking things up in the insurance world with its unique approach, using telematics to assess driving behavior and tailor rates accordingly. But is it all hype, or does Root really deliver on its promises?

This article dives deep into the world of Root Insurance, exploring its history, pricing model, customer experiences, coverage options, claims process, technology, financial stability, and reputation. We’ll break down the pros and cons to help you decide if Root Insurance is the right fit for your needs.

Root Insurance Overview

Root Insurance is a relatively new kid on the block in the insurance world, but they’re already making waves with their unique approach to car insurance. Founded in 2015, Root is shaking up the traditional insurance industry with its innovative, data-driven approach.

Company Mission and Values

Root Insurance is on a mission to make car insurance fairer and more affordable. They believe that drivers should pay for the risks they actually take, not just for their zip code or driving history. They’re committed to using technology to create a more transparent and personalized insurance experience for their customers.

Key Features and Services

Root Insurance offers a variety of features and services that set them apart from the competition. Here’s a breakdown of some of their key offerings:

- Personalized Pricing: Root uses a smartphone app to track your driving habits, such as acceleration, braking, and time of day you drive. This data is used to create a personalized insurance quote based on your individual driving behavior. This means that safe drivers can potentially save money on their premiums.

- Telematics-Based Insurance: Root’s pricing model is based on telematics, which means that your driving behavior is a major factor in determining your insurance premium. This approach is becoming increasingly popular in the industry, as it allows insurance companies to offer more accurate and personalized rates.

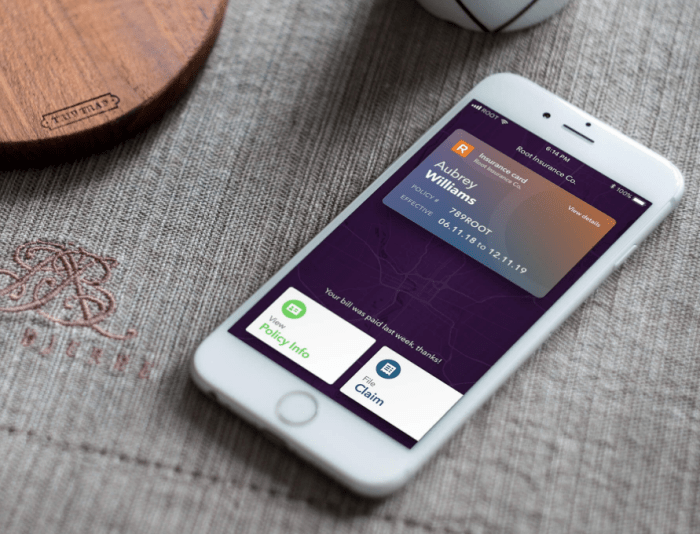

- Mobile App: Root’s app is user-friendly and provides a variety of features, including:

- Real-time tracking of your driving score

- Access to your insurance policy and payment information

- The ability to file a claim

- Roadside assistance

- Excellent Customer Service: Root is known for its excellent customer service. They offer 24/7 support via phone, email, and chat.

Pricing and Affordability

- Real-time tracking of your driving score

- Access to your insurance policy and payment information

- The ability to file a claim

- Roadside assistance

Root Insurance’s pricing model is unique and potentially appealing to drivers who believe they are safe and responsible behind the wheel. Unlike traditional insurance companies, Root Insurance uses a telematics-based system to assess risk and determine premiums.

Root Insurance’s Pricing Compared to Other Providers

Root Insurance’s pricing can vary significantly depending on individual driving habits. While Root may offer competitive rates for safe drivers, it’s crucial to compare quotes from other insurance providers to ensure you’re getting the best deal.

Root Insurance’s Pricing Model

Root Insurance uses a telematics-based system to determine rates. This means that your driving habits, such as braking, acceleration, and time of day you drive, are tracked through a mobile app and used to calculate your premium. Root claims that this data allows them to offer more accurate and personalized rates, potentially resulting in lower premiums for safe drivers.

How Root Insurance Uses Telematics to Determine Rates

Root Insurance’s telematics system monitors various driving behaviors:

* Braking: Sudden or harsh braking can increase your premium.

* Acceleration: Aggressive acceleration can also impact your rate.

* Time of Day: Driving during peak rush hour might lead to higher premiums.

* Distance Traveled: The more you drive, the more likely you are to be involved in an accident, potentially increasing your premium.

Root uses this data to create a personalized driving score, which is then used to determine your premium. The higher your driving score, the lower your premium.

Customer Experience

Root Insurance, like any insurance company, wants to make sure their customers are happy with their service. So, let’s dive into how they handle customer interactions and see what real customers have to say.

Customer Service Channels and Responsiveness

Root Insurance offers a variety of ways for customers to get in touch, making it easy to connect when you need them. You can reach them through:

- Phone: Root’s customer service line is available 24/7, so you can call anytime, day or night. They’re there to help with any issues, answer questions, or just walk you through things.

- Email: If you prefer to write things down, you can send an email to Root’s customer support team. They’ll respond as quickly as they can, typically within 24 hours.

- Online Chat: For quick questions or concerns, Root offers a live chat option on their website. This is a great way to get immediate assistance without having to wait on the phone.

- Mobile App: Root’s app isn’t just for managing your policy. You can also use it to contact customer service, submit claims, and more.

Customer Reviews and Ratings

To get a sense of what other customers think, let’s check out some reviews and ratings. Root Insurance generally receives positive feedback, with an average rating of 4.5 out of 5 stars on sites like Trustpilot and Google Reviews. Many customers praise Root’s user-friendly app, quick claims processing, and friendly customer service.

Here are some examples of what customers are saying:

“I’ve been with Root for a couple of years now, and I’ve been really happy with them. Their app is easy to use, and I’ve never had any problems with their customer service. They’ve always been helpful and responsive.” – John S.

“I had to file a claim recently, and Root made the process so easy. They were very helpful and understanding, and they got me taken care of quickly.” – Sarah M.

While Root has a strong reputation, there are some negative reviews, too. Some customers complain about long wait times on the phone or difficulty getting through to customer service. Others mention issues with their policy or claims process.

It’s important to remember that every customer experience is unique, and what works for one person might not work for another. It’s always a good idea to read reviews and do your research before making a decision.

Coverage and Options

Root Insurance offers a range of coverage options to meet the needs of different drivers. While they may not have all the bells and whistles of some other insurance providers, they offer a solid foundation of essential coverage.

Standard Coverage Options

Root Insurance provides the standard coverage options you’d expect from any car insurance provider. These include:

- Liability Coverage: This is the most basic type of car insurance, covering damage you cause to other people or their property in an accident. Root offers both bodily injury liability and property damage liability coverage.

- Collision Coverage: This coverage pays for repairs to your car if you’re involved in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for damage to your car caused by things other than a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault.

Additional Coverage Options

Root Insurance also offers some additional coverage options, though these are not as extensive as some of their competitors.

- Rental Car Coverage: This coverage helps pay for a rental car if your car is damaged in an accident and needs repairs.

- Roadside Assistance: This coverage provides assistance with things like jump-starts, flat tire changes, and towing.

Comparison to Other Providers

Root Insurance’s coverage options are generally comparable to those offered by other major insurance providers. However, some companies offer more specialized coverage options, such as:

- Gap Insurance: This coverage helps pay the difference between the actual cash value of your car and the amount you owe on your loan if your car is totaled.

- New Car Replacement Coverage: This coverage pays for a brand-new car if your car is totaled within a certain timeframe.

- Ride-Sharing Coverage: This coverage provides additional protection for drivers who use their personal vehicles for ride-sharing services.

Claims Process: Is Root Insurance A Good Insurance Company

So, you’ve been in a fender bender or had a hailstorm wreak havoc on your ride. Now what? Filing a claim with Root Insurance is a pretty straightforward process. They’ve got a few different ways to make it happen, and it’s usually pretty painless. Let’s break it down.

Filing a Claim

You can file a claim with Root Insurance in a few ways:

- Online: Head over to their website and file a claim through their secure portal. This is a quick and easy option, especially if you’re feeling techy.

- Mobile App: Root has a mobile app, so you can file a claim on the go, no matter where you are. Just download the app and follow the prompts.

- Phone: If you prefer a more personal touch, you can always call Root Insurance directly. They have customer service representatives available to help you file a claim over the phone.

Average Claim Processing Time

Root Insurance doesn’t officially advertise an average claim processing time, but based on customer reviews and industry data, you can expect to hear back from them within a few days to a week. Of course, this depends on the complexity of your claim. A simple claim for a minor fender bender might be processed much faster than a complex claim involving a total loss.

Customer Experiences with Root Insurance’s Claims Process

Overall, customers seem to be happy with Root Insurance’s claims process. They frequently praise the company for its quick response times and friendly customer service. There are a few instances where customers reported delays or issues, but these seem to be isolated cases.

“I was really impressed with how quickly Root Insurance handled my claim. I filed it online and received a call from a claims adjuster within a few hours. The whole process was very smooth and efficient.” – Satisfied Root Customer

Technology and Innovation

Root Insurance is all about using technology to make insurance more accessible and affordable. They’ve built their entire business model around using data and AI to personalize rates and provide a smooth customer experience.

The Impact of Telematics

Root Insurance’s core technology is telematics, which uses data collected from your phone’s sensors to assess your driving habits. This data helps Root determine your risk level and tailor your insurance premium accordingly. The more safely you drive, the lower your premium can be. This is a win-win situation for both Root and its customers.

“Root is a data-driven company that uses telematics to personalize insurance rates. Our technology allows us to offer lower rates to safe drivers, while also providing a more personalized and transparent experience.” – Alex Timm, CEO of Root Insurance

Examples of Root Insurance’s Innovative Features

Here are some examples of how Root Insurance uses technology to improve its services:

- Root Score: This is a unique scoring system that assesses your driving habits and determines your premium. It’s based on factors like speed, braking, acceleration, and phone usage while driving. The better your score, the lower your premium.

- Root App: The Root app is your one-stop shop for everything related to your insurance. You can track your Root Score, manage your policy, file claims, and even get roadside assistance. The app uses GPS technology to help you find the nearest repair shop or tow truck.

- AI-Powered Chatbot: Root uses an AI-powered chatbot to answer customer questions 24/7. The chatbot can help you find information about your policy, get a quote, or file a claim. This helps to improve customer satisfaction and reduce wait times.

- Personalized Recommendations: Based on your driving data, Root can provide you with personalized recommendations on how to improve your driving habits and potentially lower your premium. These recommendations can include tips on avoiding distractions, driving safely, and improving your fuel efficiency.

Financial Stability and Reputation

Root Insurance is a relatively new player in the insurance game, but they’ve been making waves with their tech-forward approach. So, how’s their financial stability and reputation looking? Let’s dive in.

Root Insurance is a publicly traded company, meaning their financial performance is open for everyone to see. It’s like having a window into their financial health.

Financial Performance and Ratings

Root Insurance has been steadily growing, with their revenue increasing year after year. But remember, growth doesn’t always mean profitability. Root Insurance is still working on turning a profit, but they’re making progress.

To understand their financial stability, it’s helpful to look at ratings from independent agencies. These agencies, like AM Best, evaluate insurance companies based on their financial strength, operating performance, and business profile. Think of them as the financial detectives of the insurance world.

Root Insurance currently holds a financial strength rating of “A-” from AM Best, which is considered to be a strong rating. This means that they are considered to be financially sound and able to meet their obligations to policyholders.

Reputation within the Insurance Industry

Root Insurance has garnered a lot of attention for its innovative approach to car insurance. They’re like the cool kid on the block, shaking things up with their technology and data-driven pricing. This has led to a mixed bag of reviews from both consumers and industry experts.

Some folks love Root’s user-friendly app and personalized pricing, while others have expressed concerns about their customer service and claims handling. It’s a bit like a celebrity, with both fans and critics.

Awards and Recognition, Is root insurance a good insurance company

Root Insurance has received several awards and recognitions for its technology and customer service. It’s like winning an Oscar for your insurance game. They’ve been recognized for their commitment to innovation, their use of data, and their commitment to customer satisfaction.

- Root Insurance has been named one of the “Best Places to Work” by Fortune magazine.

- They’ve also received several awards for their mobile app, including the “Best Insurance App” award from the American Banker.

Final Conclusion

In conclusion, Root Insurance offers a compelling alternative to traditional insurance providers, particularly for those who prioritize affordability and personalized rates. Its use of telematics and focus on driving behavior can lead to significant savings, especially for safe drivers. While Root Insurance might not be the perfect fit for everyone, its innovative approach and growing reputation make it a worthy contender in the insurance market. Whether you’re a seasoned driver or just starting out, exploring Root Insurance and its unique offerings could be a game-changer for your insurance journey.

Helpful Answers

Is Root Insurance available in all states?

No, Root Insurance is currently available in a limited number of states. It’s best to check their website to see if they operate in your area.

How does Root Insurance’s pricing model work?

Root Insurance uses telematics to track your driving habits and offer personalized rates based on your driving behavior. This means that safe drivers can potentially save money on their insurance premiums.

What are the pros and cons of using Root Insurance?

Pros: Potentially lower rates, personalized pricing, user-friendly app. Cons: Limited availability, potential for higher rates if you’re a less safe driver, limited coverage options compared to some traditional insurance companies.