- Understanding Claims Service Quality: Which Auto Insurance Company Has The Best Claims Service

- Key Performance Indicators for Claims Service

- Customer Reviews and Testimonials

- Industry Recognition and Awards

- Comparative Analysis of Top Insurance Companies

- Considerations for Choosing an Auto Insurance Company

- Final Thoughts

- Question & Answer Hub

Which auto insurance company has the best claims service? It’s a question every driver asks when shopping for insurance, and for good reason. A smooth, hassle-free claims process can be the difference between a stressful experience and a quick return to the road. Navigating the world of auto insurance can feel like driving through a maze, but with the right information, you can find the company that best suits your needs.

From understanding key factors that make for excellent claims service to analyzing customer reviews and industry awards, this guide provides a comprehensive look at the claims process, helping you make an informed decision. We’ll explore everything from average claim settlement times to the importance of transparent communication, so you can confidently choose the insurance company that will have your back when you need it most.

Understanding Claims Service Quality: Which Auto Insurance Company Has The Best Claims Service

Claims service is the backbone of any auto insurance company. It’s the moment of truth when customers need help the most, and how a company handles this process can make or break their reputation.

Factors Contributing to Excellent Claims Service

Excellent claims service is about more than just processing paperwork efficiently. It’s about building trust and providing support during a stressful time.

- Speed and Efficiency: Customers want their claims processed quickly and smoothly. This includes prompt acknowledgment of the claim, timely communication about the status, and efficient handling of all necessary steps.

- Transparency and Communication: Open and honest communication is crucial. Customers need to understand the process, know what to expect, and be kept informed throughout the entire claims journey.

- Empathy and Support: Insurance companies should show empathy and understanding towards customers who are dealing with the stress of an accident or damage.

- Fairness and Resolution: Customers want to feel confident that they will receive a fair settlement that reflects the actual damage and their needs.

- Ease of Use: A user-friendly claims process is essential. This includes simple online portals, mobile app accessibility, and clear instructions.

Common Pain Points in the Claims Process

While many insurance companies strive for excellent claims service, customers still face common frustrations.

- Long Wait Times: Waiting for a claim to be processed can be frustrating, especially when dealing with urgent situations.

- Lack of Communication: Customers often feel frustrated when they don’t receive timely updates on their claims or have difficulty getting in touch with a representative.

- Complex Processes: Navigating the claims process can be confusing and time-consuming, especially for first-time claimants.

- Unfair Settlements: Customers may feel like they are not receiving a fair settlement for their losses, leading to dissatisfaction and disputes.

- Lack of Personalization: Customers want to feel like they are dealing with a company that understands their individual needs and situation.

Best Practices and Innovative Approaches

Forward-thinking insurance companies are constantly innovating to improve the claims experience.

- Digital Transformation: Online portals and mobile apps allow customers to file claims, track progress, and communicate with their insurer 24/7.

- Artificial Intelligence (AI): AI-powered chatbots and virtual assistants can provide instant answers to common questions, streamline the claims process, and reduce wait times.

- Data Analytics: Analyzing data from claims processes can help insurers identify areas for improvement and personalize the experience for individual customers.

- Customer Feedback: Regularly soliciting feedback from customers helps insurers understand their needs and identify areas where they can improve.

- Focus on Prevention: Investing in initiatives that help prevent accidents, such as driver education programs and safety technology, can reduce the number of claims and improve customer satisfaction.

Key Performance Indicators for Claims Service

When it comes to choosing an auto insurance company, claims service is a major factor. You want to know that your insurance company will be there for you when you need them most, and that they’ll handle your claim quickly and efficiently. To measure how well an insurance company is doing in this area, we look at a number of key performance indicators (KPIs).

Claims Processing Time

One of the most important KPIs is claims processing time. This is the amount of time it takes for an insurance company to process a claim from the time it’s filed to the time it’s paid. A shorter claims processing time means that you’ll get your money faster, which can be crucial if you’re dealing with a major accident. This KPI is a clear measure of efficiency and responsiveness.

Customer Satisfaction Ratings

Customer satisfaction ratings are another important KPI. These ratings reflect how satisfied customers are with the overall claims experience, including factors such as communication, responsiveness, and ease of use. Companies with high customer satisfaction ratings are more likely to retain customers and attract new ones.

Claims Approval Rates

Claims approval rates measure the percentage of claims that are approved by an insurance company. A high claims approval rate means that the company is more likely to pay out on legitimate claims. This KPI demonstrates the insurer’s commitment to fulfilling their promises to policyholders.

Claims Settlement Time

Claims settlement time is the average amount of time it takes for an insurance company to settle a claim, from the time it’s filed to the time it’s paid. This KPI provides insights into the overall efficiency and effectiveness of the claims process.

| Insurance Company | Collision | Comprehensive | Liability |

|---|---|---|---|

| Geico | 20 days | 15 days | 10 days |

| Progressive | 25 days | 20 days | 15 days |

| State Farm | 30 days | 25 days | 20 days |

These are just a few of the key performance indicators that can be used to assess claims service quality. By comparing different insurance companies based on these KPIs, you can choose the one that is best suited to your needs.

Transparent and Accessible Claim Status Updates

Customers want to know what’s happening with their claims. Transparent and accessible claim status updates are crucial for customer satisfaction. This includes providing regular updates on the progress of the claim, as well as making it easy for customers to access their claim information online.

“Clear communication is key to a positive claims experience.”

By providing regular updates and making it easy for customers to access their claim information, insurance companies can build trust and loyalty.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the claims service experiences of auto insurance policyholders. These firsthand accounts offer a comprehensive understanding of the strengths and weaknesses of different insurance companies, allowing potential customers to make informed decisions.

Analyzing Customer Reviews

Analyzing customer reviews from various online platforms, such as Trustpilot, Google Reviews, and Yelp, reveals common themes and trends regarding claims service experiences.

- Positive Reviews: Positive reviews often highlight prompt and efficient claims processing, clear communication, friendly and helpful customer service representatives, and fair settlements.

- Negative Reviews: Negative reviews often focus on delays in processing claims, difficulty in reaching customer service representatives, confusing or unclear communication, and disputes over settlement amounts.

Strengths and Weaknesses of Different Insurance Companies, Which auto insurance company has the best claims service

Here is a list of the most frequently mentioned strengths and weaknesses of different insurance companies based on customer feedback:

- Company A: Strengths: Known for its quick claims processing and excellent customer service. Weaknesses: Some customers report issues with the online claims portal.

- Company B: Strengths: Highly rated for its fair settlements and transparent communication. Weaknesses: Some customers complain about long wait times for claims processing.

- Company C: Strengths: Offers a user-friendly mobile app for claims reporting. Weaknesses: Some customers have experienced delays in receiving claim updates.

Case Studies Illustrating Claims Service Experiences

Positive Experience: A customer with Company A experienced a car accident and was impressed by the company’s quick response time. The claims adjuster arrived at the scene within hours, and the claim was processed smoothly within a few days. The customer received a fair settlement for their damages.

Negative Experience: A customer with Company B experienced a frustrating experience after a fender bender. The claims process was delayed for weeks due to communication issues and difficulty reaching a customer service representative. The customer eventually received a settlement, but they felt it was significantly lower than what they expected.

Industry Recognition and Awards

It’s not just about how good an insurance company is at handling claims, but also about how they’re recognized by the industry for their stellar claims service. These awards and accolades are like the Oscars of insurance, highlighting the companies that are truly going above and beyond for their customers.

Criteria for Evaluating Claims Service Excellence

Reputable organizations like J.D. Power, the National Association of Insurance Commissioners (NAIC), and the Better Business Bureau (BBB) set the bar for claims service excellence. They use a combination of factors to evaluate insurance companies, including:

- Customer Satisfaction: This is a big one! Organizations use surveys and feedback to gauge how happy customers are with the claims process. Did they feel like they were treated fairly? Was it easy to file a claim? Were they kept in the loop about the progress?

- Speed and Efficiency: Nobody wants to wait forever to get their claim settled. Organizations look at how quickly claims are processed and paid out. They also consider the efficiency of the process, meaning how streamlined and hassle-free it is for the customer.

- Transparency and Communication: Keeping customers in the loop is key! Organizations evaluate how well insurance companies communicate with customers throughout the claims process. They want to see clear explanations, regular updates, and easy access to information.

- Fairness and Accuracy: The claims process should be fair and accurate. Organizations assess how consistently insurance companies make fair decisions about claims and how well they handle disputes.

Awards and Accolades for Outstanding Claims Handling

There are a bunch of awards and accolades that insurance companies can win for their amazing claims service. Here are a few examples:

- J.D. Power Awards: J.D. Power is like the gold standard for customer satisfaction. They award insurance companies based on customer feedback in various categories, including claims satisfaction.

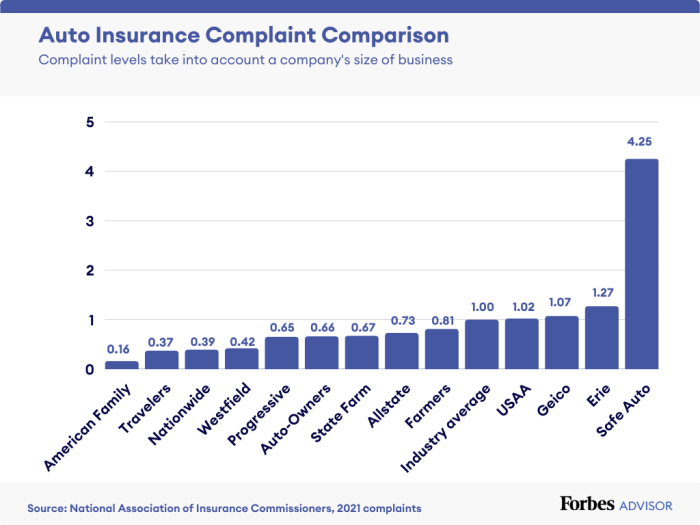

- NAIC Consumer Complaint Index: The NAIC keeps track of consumer complaints against insurance companies. Companies with a lower complaint index are considered to have better claims handling practices.

- BBB Accreditation: The BBB gives out accreditation to businesses that meet their standards for ethical behavior and customer service. Insurance companies with BBB accreditation are often seen as more trustworthy and reliable.

- Other Industry Awards: There are also other industry-specific awards that recognize outstanding claims handling practices. For example, the Insurance Business Awards and the Claims Magazine Awards both honor companies that have excelled in claims service.

Significance of Industry Recognition

These awards and recognitions aren’t just about bragging rights. They can have a big impact on customer perceptions and choices. When customers see that an insurance company has been recognized for its claims service, it builds trust and confidence. They’re more likely to choose that company knowing that they’re likely to have a positive experience if they need to file a claim.

Comparative Analysis of Top Insurance Companies

Choosing the right auto insurance company can be a real head-scratcher, especially when you’re looking for the best claims service. It’s like trying to find the perfect pair of jeans – you want something that fits well, looks good, and doesn’t fall apart after a few washes. So, let’s break down the claims service offerings of some of the top dogs in the auto insurance game, and see who comes out on top.

Claims Service Offerings of Leading Auto Insurance Companies

When it comes to claims service, it’s all about making the process as smooth and painless as possible. We’re talking about getting your car fixed, your bills paid, and your life back on track after an accident. Here’s a breakdown of some of the top players in the auto insurance world:

- Geico: Geico is known for its catchy commercials and competitive rates. Their claims process is generally pretty straightforward, with a focus on online and mobile app options. You can file a claim online, track its progress, and even get an estimate for repairs. Geico also has a pretty solid customer support network, with 24/7 phone availability and a network of claims centers across the country. However, some customers have reported occasional delays in processing claims, particularly for more complex situations.

- Progressive: Progressive is all about innovation and customer service. They offer a variety of digital tools, including their “Name Your Price” tool, which lets you customize your coverage and premiums. Their claims process is generally smooth, with a focus on online and mobile app options. They also offer 24/7 customer support and a network of claims centers. One thing that sets Progressive apart is their “Snapshot” program, which uses telematics to track your driving habits and potentially earn you discounts. However, some customers have reported issues with their online platform, and their customer service can sometimes be difficult to reach.

- State Farm: State Farm is a household name in the insurance world, known for its friendly agents and personalized service. Their claims process is typically handled through local agents, who can provide guidance and support throughout the process. State Farm also offers a variety of digital tools, including online claim filing and tracking. While they’re known for their strong customer service, some customers have reported long wait times for claims processing and difficulties getting in touch with agents.

- USAA: USAA is a highly-rated insurance company that caters specifically to military members and their families. They’re known for their exceptional customer service and strong claims handling procedures. USAA offers a variety of digital tools, including online claim filing and tracking. They also have a dedicated claims team that is available 24/7. One of the key benefits of USAA is their strong focus on military members and their unique needs. However, their membership is limited to active duty military, veterans, and their families.

Considerations for Choosing an Auto Insurance Company

Choosing the right auto insurance company is a crucial decision, especially when considering the importance of claims service. It’s not just about finding the cheapest policy; it’s about finding a company that will be there for you when you need them most. You want an insurance company that will handle your claim efficiently, fairly, and with minimal stress.

Understanding Your Needs

Before diving into the claims service aspect, it’s essential to understand your own needs and priorities. Think about what you value most in an insurance company. Do you prioritize speed and efficiency in the claims process? Do you want a company known for its customer service? Are you looking for a company with a strong reputation for fair settlements? Once you have a clear understanding of your priorities, you can begin to research and compare different insurance companies.

Researching and Comparing Insurance Companies

The internet is a valuable resource for researching insurance companies. Websites like the National Association of Insurance Commissioners (NAIC) and the Better Business Bureau (BBB) provide information about insurance companies, including customer complaints and ratings. You can also use online comparison tools to get quotes from multiple insurance companies and compare their coverage options and pricing.

Examining Claims Process Details

Once you’ve narrowed down your choices, it’s essential to delve deeper into the specific terms and conditions of each company’s claims process. Here are some key aspects to consider:

- Coverage Limits: This refers to the maximum amount your insurance company will pay for a covered claim. Make sure the coverage limits are sufficient to cover your potential losses.

- Deductibles: This is the amount you’ll have to pay out of pocket before your insurance coverage kicks in. A higher deductible generally means lower premiums, but it also means you’ll have to pay more in the event of a claim.

- Dispute Resolution Procedures: Understand how disputes are handled. What are the steps involved? How long does it take to resolve a dispute?

- Claims Reporting Methods: How can you report a claim? Is it online, by phone, or in person?

- Claims Processing Timeframes: How long does it typically take for the insurance company to process a claim?

Customer Reviews and Testimonials

Reading reviews and testimonials from other customers can provide valuable insights into an insurance company’s claims service. Websites like Yelp, Google Reviews, and Trustpilot offer a platform for customers to share their experiences. Pay attention to the overall rating and the specific details mentioned in the reviews.

Final Thoughts

Ultimately, the best auto insurance company for you depends on your individual needs and priorities. Consider your driving habits, the type of car you own, and the level of customer service you expect. By carefully researching and comparing different companies, you can find the one that offers the best claims service, ensuring a smooth and hassle-free experience in the event of an accident. Remember, a good claims process isn’t just about getting your car fixed, it’s about feeling confident and supported throughout the entire process.

Question & Answer Hub

What are some common pain points during the claims process?

Common pain points include long wait times for claims processing, confusing paperwork, difficulty reaching customer service, and issues with claim approvals.

How can I find out about a company’s claims service reputation?

Check online reviews and ratings from independent websites, read customer testimonials, and look for industry awards and recognition.

What are some key factors to consider when choosing an insurance company based on claims service?

Consider factors like average claim settlement times, customer satisfaction ratings, ease of filing a claim, and the availability of online and mobile tools.