A+ rated life insurance companies are like the rockstars of the financial world – they’ve got the stability, the reliability, and the track record to make sure your family’s future is covered, no matter what. Think of them as the insurance equivalent of a superhero, ready to swoop in and save the day (or, in this case, your finances) when you need them most.

But what exactly does an A+ rating mean? Well, it’s like a gold star for financial strength and reliability. These companies have been vetted and assessed by reputable rating agencies, who consider factors like their financial reserves, claims-paying ability, and overall business practices. Essentially, they’ve earned the trust and confidence of the industry, and that’s good news for you.

Understanding A+ Ratings

An A+ rating in the life insurance industry is a coveted distinction, signaling a company’s financial strength and ability to fulfill its obligations to policyholders. It represents a high level of confidence in the insurer’s ability to pay claims and remain solvent in the long term.

Factors Contributing to an A+ Rating

Rating agencies meticulously evaluate various factors to determine a life insurance company’s financial stability and assign a rating. Here are some key considerations:

- Financial Strength: This encompasses factors like the company’s capital reserves, investment performance, and overall profitability. A strong financial position indicates the insurer has sufficient resources to cover claims and unexpected events.

- Operating Performance: This assesses the company’s efficiency in managing its operations, including its expense ratios, underwriting practices, and claims handling processes. A well-run company with a track record of sound business practices is more likely to receive a high rating.

- Management Quality: This evaluates the company’s leadership team, its strategic planning, and its ability to adapt to changing market conditions. Strong management is essential for ensuring the company’s long-term sustainability and financial health.

- Claims Paying Ability: This factor focuses on the company’s track record of paying claims promptly and fairly. A company with a strong history of meeting its obligations to policyholders demonstrates its commitment to providing financial security.

Reputable Rating Agencies

Several reputable rating agencies assign A+ ratings to life insurance companies, providing valuable insights into their financial health. Here are some of the most prominent:

- AM Best: Founded in 1899, AM Best is one of the oldest and most respected rating agencies. It provides a comprehensive assessment of insurers’ financial strength, operating performance, and overall business profile.

- Standard & Poor’s (S&P): S&P is a global credit rating agency that provides ratings for a wide range of financial instruments, including life insurance companies. Its ratings are based on a thorough analysis of the insurer’s financial condition, operating performance, and business strategy.

- Moody’s Investors Service: Moody’s is another well-known credit rating agency that provides ratings for a variety of entities, including life insurance companies. Its ratings are based on a detailed assessment of the insurer’s financial strength, operating performance, and management quality.

Benefits of Choosing A+ Rated Companies

Choosing a life insurance company with an A+ rating from A.M. Best can provide you with peace of mind knowing that you’ve selected a financially stable and reliable company to protect your loved ones. An A+ rating signifies that the company has a strong ability to meet its financial obligations and is likely to remain in business for the long term.

Financial Stability and Reliability

A+ rated life insurance companies have demonstrated a strong track record of financial performance and stability. This means they have sufficient capital reserves to cover their obligations, even in challenging economic conditions. This stability is essential because it ensures that your policy will be paid out when you need it most.

A life insurance company with a strong financial rating is less likely to face financial difficulties, which could jeopardize your policy’s payout.

Implications of Lower Ratings, A+ rated life insurance companies

Choosing a life insurance company with a lower rating could potentially increase the risk of your policy not being paid out. Companies with lower ratings may have a weaker financial position, making them more vulnerable to economic downturns or other unforeseen events. This could lead to financial instability and potentially impact the company’s ability to fulfill its obligations to policyholders.

A company with a lower rating may be more likely to face financial difficulties, which could affect your policy’s payout.

Key Considerations When Choosing A+ Rated Companies

It’s great that you’ve narrowed down your search to A+ rated life insurance companies. This ensures financial stability and a lower risk of the company going under. But, just like choosing a favorite pizza topping, there are other factors to consider beyond the rating to find the perfect fit for your needs.

Comparing A+ Rated Companies

Beyond the A+ rating, you need to compare different companies based on their policy offerings, pricing, and customer service. Think of it like choosing the right streaming service – you want a mix of great content (policies), a fair price (premiums), and easy-to-use customer service (claims process).

- Policy Offerings: Not all A+ rated companies offer the same types of policies. You’ll need to consider your specific needs. Do you want a simple term life insurance policy, or do you need a more complex permanent life insurance policy? Some companies specialize in specific types of coverage, like final expense insurance, which covers funeral costs.

- Pricing: Premiums can vary significantly between A+ rated companies, even for the same type of policy. Factors like your age, health, and lifestyle can impact your premium. It’s crucial to get quotes from multiple companies and compare them side-by-side.

- Customer Service: While an A+ rating indicates financial stability, it doesn’t guarantee excellent customer service. Look for companies with a strong reputation for responsiveness and helpfulness. Read online reviews, check with the Better Business Bureau, and consider contacting the company directly to ask questions.

Top 5 A+ Rated Life Insurance Companies

To give you a better idea of how A+ rated companies compare, here’s a table showcasing the top 5 with their key features. Think of it like a Top 5 list on a music streaming service – each company offers a unique blend of features.

| Company | Policy Types | Pricing | Customer Service |

|---|---|---|---|

| Northwestern Mutual | Term, Whole, Universal, Variable | Higher premiums | Excellent reputation |

| New York Life | Term, Whole, Universal, Variable | Competitive premiums | Strong customer service |

| Prudential | Term, Whole, Universal, Variable | Mid-range premiums | Above-average customer service |

| MassMutual | Term, Whole, Universal, Variable | Competitive premiums | Strong reputation |

| Guardian Life | Term, Whole, Universal, Variable | Competitive premiums | Good customer service |

Understanding Life Insurance Policy Types

Life insurance policies are like different flavors of ice cream: there’s one for everyone, but each one has its own unique taste and benefits. Understanding the different types of life insurance policies is crucial to choosing the right one for your individual needs and financial goals.

Term Life Insurance

Term life insurance is like renting a car: you pay a premium for a specific period, and if you pass away during that term, your beneficiaries receive a death benefit. If you don’t pass away during the term, you don’t get anything back.

Term life insurance is generally the most affordable type of life insurance, making it a good option for people who need coverage for a specific period, such as while they have young children or a mortgage.

Key Features of Term Life Insurance:

- Provides coverage for a specific period, typically 10, 20, or 30 years.

- Premiums are generally lower than permanent life insurance.

- No cash value accumulation.

- Can be renewed at the end of the term, but premiums will likely increase.

Permanent Life Insurance

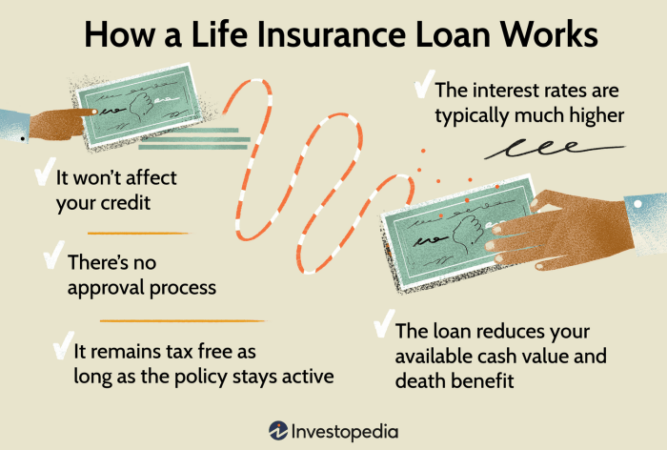

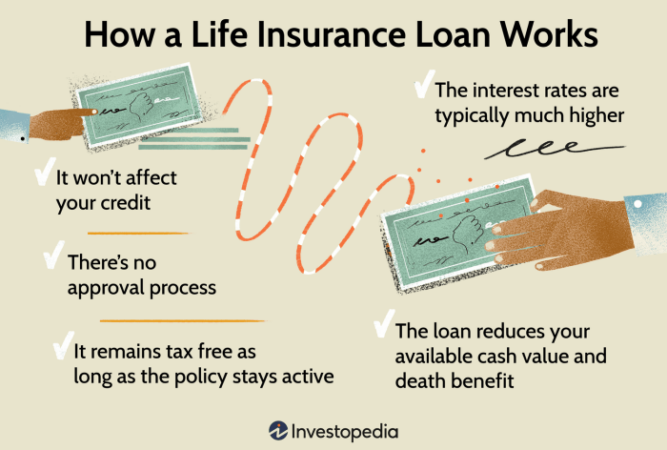

Permanent life insurance is like buying a car: you pay premiums for the rest of your life, and your beneficiaries receive a death benefit when you pass away. But unlike term life insurance, permanent life insurance also builds up cash value that you can borrow against or withdraw.

Permanent life insurance is typically more expensive than term life insurance, but it can be a good option for people who want long-term coverage and the ability to build cash value.

Types of Permanent Life Insurance:

- Whole Life Insurance: Whole life insurance has a fixed premium and death benefit, and it builds cash value at a guaranteed rate. This makes it a predictable and stable option for long-term coverage.

- Universal Life Insurance: Universal life insurance offers more flexibility than whole life insurance. You can adjust your premiums and death benefit, and you have more control over how your cash value grows. However, this flexibility comes with a higher risk, as the cash value is not guaranteed.

- Variable Life Insurance: Variable life insurance allows you to invest your cash value in sub-accounts that are similar to mutual funds. This can potentially lead to higher returns, but it also comes with a higher risk. Your death benefit is not guaranteed and may fluctuate depending on the performance of your investments.

Pros and Cons of Different Life Insurance Types

| Type | Pros | Cons |

|---|---|---|

| Term Life Insurance |

|

|

| Whole Life Insurance |

|

|

| Universal Life Insurance |

|

|

| Variable Life Insurance |

|

|

Finding the Right Policy for Your Needs

Finding the right life insurance policy is like finding the perfect pair of jeans: it’s all about finding the right fit for your individual needs and circumstances. You wouldn’t wear the same jeans to a fancy dinner as you would to a casual picnic, right? The same logic applies to life insurance.

Determining Your Life Insurance Needs

To find the right life insurance policy, you need to understand your individual needs and circumstances. This includes considering your family’s financial situation, any outstanding debts, and your dependents’ needs. For example, if you have a young family and a mortgage, you’ll need more life insurance than someone who is single and debt-free.

Here’s a step-by-step guide to help you determine your life insurance needs:

- Calculate your outstanding debts. This includes your mortgage, car loans, credit card debt, and any other loans. This helps you determine the minimum amount of life insurance you need to cover these obligations.

- Consider your dependents’ needs. This includes your spouse, children, and any other individuals who rely on your income. Calculate the cost of their living expenses, including housing, food, education, and healthcare.

- Estimate your future income needs. Consider the cost of raising children, paying for college, and supporting your spouse in retirement.

- Factor in your current savings and assets. This includes your retirement savings, investments, and any other assets that can help your family cover their expenses after your death.

Consulting with a Financial Advisor

Once you’ve considered your needs, it’s a good idea to talk to a financial advisor. They can help you develop a personalized life insurance plan that meets your specific goals and circumstances.

Asking the Right Questions

When you’re ready to shop for life insurance, it’s important to ask the right questions. This will help you compare different policies and find the best option for your needs. Here’s a checklist of questions to ask potential life insurance companies:

- What types of life insurance policies do you offer? This will help you understand the different options available and choose the policy that best fits your needs.

- What are the premiums for different policy types? Premiums vary depending on the type of policy, your age, health, and other factors. It’s important to compare premiums from different companies to find the best value.

- What are the policy’s terms and conditions? This includes the death benefit, the coverage period, and any exclusions or limitations.

- What are the company’s financial ratings? This will give you an idea of the company’s financial stability and its ability to pay claims.

- What are the company’s customer service policies? This will help you understand how easy it is to file a claim and how responsive the company is to customer inquiries.

Closing Notes

So, if you’re looking for a life insurance company that’s got your back, an A+ rating should be at the top of your list. Think of it as a safety net for your family’s financial future. It’s a peace of mind knowing that you’ve got a company with a solid reputation and the financial muscle to keep your promises safe and secure. After all, when it comes to your family’s well-being, you want a company that’s as dependable as a good friend, and an A+ rating is a pretty good indicator of just that.

FAQ Explained: A+ Rated Life Insurance Companies

What happens if a life insurance company loses its A+ rating?

If a company loses its A+ rating, it doesn’t necessarily mean they’re going bankrupt. However, it’s a red flag that you should consider. You might want to explore other options or contact your current insurer to see if they’re taking steps to improve their financial standing.

Can I get a lower rate with a company that has a lower rating?

It’s possible, but it’s not always a good trade-off. While a lower-rated company might offer lower premiums, you’re taking a risk with their financial stability. It’s like buying a cheaper car – it might save you money upfront, but you could end up with more headaches down the road.

What are the other factors to consider when choosing a life insurance company?

Besides the rating, you should also consider factors like policy offerings, pricing, customer service, and the company’s reputation. It’s important to do your research and compare different options to find the best fit for your needs and budget.