Can life insurance be transferred to another company? It’s a question that pops up when you’re thinking about switching providers or if you’re just trying to make sure your loved ones are taken care of. The answer isn’t always a simple “yes” or “no,” and it depends on a few key factors. We’re breaking down everything you need to know about life insurance transferability, from the basics to the nitty-gritty details.

Life insurance portability is a complex topic, but understanding it can be a game-changer when it comes to protecting your family’s future. Different types of policies have different rules, and there are situations where transferring your policy could be a good move. We’ll cover everything from the circumstances where transfer is possible to the steps involved and the potential costs and benefits.

Understanding Life Insurance Transferability

Imagine you’re switching jobs and need to move your life insurance policy to a new provider. Can you do that? Life insurance portability is a hot topic, and it’s not always a simple “yes” or “no” answer. It’s a bit like trying to transfer your favorite playlist from one streaming service to another – sometimes it’s seamless, and sometimes it’s a bit more complicated.

Types of Life Insurance Policies and Transferability

The transferability of your life insurance policy depends on the type of policy you have. Let’s break it down:

- Term Life Insurance: Think of this as a temporary safety net. It’s generally the most affordable option, but it only provides coverage for a specific period. Term life insurance policies are usually not transferable. When the term ends, you’ll need to renew or purchase a new policy. It’s like renting a house – you can’t just take the house with you when you move!

- Permanent Life Insurance: This type of policy is like owning a house – it provides lifelong coverage, but it’s generally more expensive than term life insurance. Permanent life insurance policies can sometimes be transferred, but it depends on the specific policy and the insurance company. It’s like selling your house – you can’t just transfer ownership without going through the proper procedures.

- Whole Life Insurance: This is a type of permanent life insurance that builds cash value over time. Whole life insurance policies can sometimes be transferred, but it’s often a complex process. It’s like refinancing your mortgage – you need to work with the original lender and a new lender to make the transfer happen.

- Universal Life Insurance: This is another type of permanent life insurance that offers more flexibility than whole life insurance. Universal life insurance policies can sometimes be transferred, but it depends on the specific policy and the insurance company. It’s like selling your car – you can’t just transfer ownership without going through the proper procedures.

Key Factors Influencing Transferability

Several factors can influence whether or not you can transfer your life insurance policy:

- Policy Type: As we discussed earlier, the type of policy you have is a major factor. Term life insurance policies are typically not transferable, while permanent life insurance policies may be transferable.

- Insurance Company: Some insurance companies are more open to transferring policies than others. It’s always a good idea to check with your current insurance company to see if they offer transfer options. It’s like shopping for a new car – some dealerships are more flexible with financing options than others.

- Policy Terms: The terms of your policy can also impact transferability. For example, some policies may have restrictions on transferring them to another company. It’s like buying a house with a restrictive covenant – you may not be able to make certain changes to the property.

- Your Health: Your health status can also play a role in transferability. If your health has changed since you purchased the policy, the new insurance company may require you to undergo a medical exam. It’s like applying for a new credit card – your credit score and financial history can impact your approval.

Transfer Process and Considerations

So, you’re thinking about transferring your life insurance policy to another company? It’s like switching teams in a game, but with your financial future at stake. You’re looking for a better deal, maybe lower premiums, or maybe your current company isn’t cutting it anymore. Whatever your reason, let’s break down the process and things you need to know.

Steps Involved in Transferring a Life Insurance Policy

Transferring a life insurance policy isn’t like changing your phone plan. It’s a more involved process that requires some paperwork and might even involve a medical exam. Here’s a typical breakdown of the steps:

- Contact a New Insurance Company: First, you need to find a new insurance company that you think will be a good fit. Shop around, compare quotes, and see what’s out there. Remember, every company has its own policies and procedures, so do your homework.

- Get a Quote and Review the Policy: Once you’ve chosen a company, get a quote for a new policy that matches your needs. Read the policy carefully, and ask questions if anything isn’t clear. You want to make sure you understand the coverage, premiums, and any other terms and conditions.

- Complete an Application: If you’re happy with the quote and policy, you’ll need to complete an application with the new insurance company. This application will ask for personal information, medical history, and other details.

- Medical Exam: Depending on the policy and your age, you might need to undergo a medical exam. This is to assess your health and determine your risk.

- Policy Approval and Transfer: Once the new insurance company approves your application, they’ll start the process of transferring your policy. This involves canceling your old policy and setting up the new one. It’s important to ensure that there’s no gap in coverage between your old and new policies.

Costs and Fees Associated with Transferring a Policy

Like any financial transaction, transferring a life insurance policy comes with some costs. These can include:

- Application Fees: Some insurance companies charge application fees to process your application. These fees can vary depending on the company and the type of policy you’re applying for.

- Medical Exam Fees: If you need a medical exam, you’ll have to pay for it. The cost of the exam can vary depending on your location and the doctor who performs it.

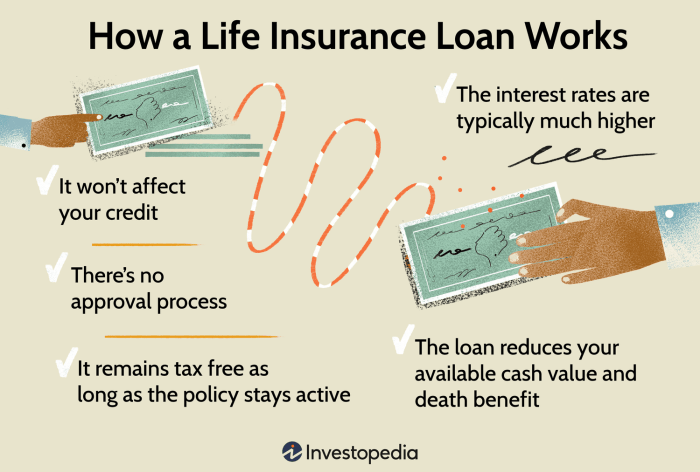

- Policy Surrender Charges: If you’re canceling your old policy, you might have to pay surrender charges. These charges are a penalty for canceling the policy early and can be significant, especially if you’re canceling within the first few years of the policy.

- Policy Conversion Fees: Some insurance companies charge fees to convert your existing policy to a new one. This can be a separate fee from the application fee.

Benefits and Drawbacks of Transferring a Life Insurance Policy

So, is transferring your life insurance policy worth it? It’s a decision you need to make based on your individual circumstances and financial goals. Here are some potential benefits and drawbacks to consider:

Benefits

- Lower Premiums: One of the main reasons people transfer their life insurance policies is to get lower premiums. If you’ve gotten a better rate with a different company, transferring can save you money over time.

- Better Coverage: Another reason to transfer might be to get better coverage. You might need more coverage than your current policy provides, or you might want to add riders or benefits that your current policy doesn’t offer.

- Improved Customer Service: If you’re unhappy with your current insurance company’s customer service, transferring to a company with a better reputation could be a good option.

Drawbacks

- Potential Fees and Charges: As mentioned earlier, transferring a life insurance policy can involve fees and charges. These can eat into any potential savings you might get from lower premiums.

- Medical Exam: If you’re older or have health issues, you might need to undergo a medical exam to qualify for a new policy. This can be a hassle and might even lead to higher premiums.

- Coverage Gaps: It’s crucial to ensure there’s no gap in coverage between your old and new policies. If you cancel your old policy before your new policy is in place, you’ll be left without coverage.

- Potential for Denial: Your application for a new policy could be denied if you don’t meet the new insurance company’s requirements. This could leave you without coverage and potentially lose any premiums you’ve already paid.

Alternatives to Transferring

Sometimes, transferring your life insurance policy isn’t the best move, especially if you’re dealing with a complicated situation or if the transfer process seems like a real headache. Don’t worry, you’ve got options! There are some pretty cool alternatives to consider, and we’ll break them down so you can make the best decision for your needs.

Keeping Your Current Policy

Keeping your current policy might sound like a no-brainer, but it’s worth exploring if it still meets your needs. Maybe you’re happy with the coverage, the premiums are manageable, and the company has a good reputation. If it’s not broken, don’t fix it, right? Think of it like your favorite pair of comfy sneakers – you might not need to upgrade if they’re still doing their job.

Adjusting Your Current Policy

Instead of starting fresh, consider adjusting your current policy. It’s like giving your old car a makeover! You might be able to increase the coverage, change the beneficiaries, or even adjust the premium payments. It’s like a mini-upgrade without all the hassle of a full-on transfer.

Purchasing a New Policy

Sometimes, the best approach is to ditch the old and embrace the new. Buying a new policy can give you a fresh start with a company that might offer better rates, features, or benefits. It’s like trading in your old phone for a brand-new model with all the latest bells and whistles.

Comparing and Contrasting Alternatives, Can life insurance be transferred to another company

Let’s compare these alternatives to transferring your policy:

| Alternative | Advantages | Disadvantages |

|---|---|---|

| Keeping Current Policy |

|

|

| Adjusting Current Policy |

|

|

| Purchasing New Policy |

|

|

Important Factors to Consider: Can Life Insurance Be Transferred To Another Company

Think of transferring your life insurance policy like switching teams in a game. You’re moving from one company to another, but there are some things to keep in mind before you make the big play. Here are some key factors to consider:

Impact on the Beneficiary

It’s crucial to understand how transferring your life insurance policy might affect the person or people named as your beneficiary. Think of it as passing the torch. The new policy might have different terms or conditions, and your beneficiary needs to be aware of any changes.

Implications for Existing Coverage

Switching life insurance companies is like changing your car insurance. You might be losing some of your current coverage, or getting new coverage that’s different from your old policy. Before you transfer, be sure to understand the impact on your current coverage, especially if you have any existing claims or pending requests.

Tax Consequences

Remember that transferring your life insurance policy can have tax implications. It’s like moving your money from one bank to another, and you need to know the rules. Consult with a tax professional to understand the potential tax consequences and make sure you’re not getting hit with any surprise fees.

Last Word

So, can you transfer your life insurance policy? Maybe, maybe not. The key is to know your options and understand the implications. Weighing the benefits and drawbacks, considering the impact on your beneficiary, and navigating the legal and regulatory requirements can be a bit of a maze. But armed with the right information, you can make the best decision for your unique situation.

FAQ Explained

What are the main reasons someone might want to transfer their life insurance policy?

There are a few common reasons, like getting a better rate with a new insurer, needing more coverage, or wanting to change the beneficiary. It’s important to understand the potential benefits and drawbacks of transferring before making a decision.

Is there a fee for transferring a life insurance policy?

Yes, there are often fees associated with transferring a life insurance policy. These fees can vary depending on the insurer and the type of policy. It’s important to factor these costs into your decision.

Can I transfer my life insurance policy if I’m in poor health?

This is a tricky one. Insurers often require medical underwriting for policy transfers, so your health could impact the transferability of your policy. If you’ve experienced a change in health since you first bought your policy, it’s best to speak with an insurance professional.