Can you keep your car if insurance company totals – Ever gotten in a fender bender and wondered if you could keep your car, even if the insurance company says it’s totaled? It’s a common question, and the answer isn’t always black and white. Insurance companies have their own set of rules for determining when a car is a total loss, and you, as the owner, have rights and options you might not know about.

We’re diving deep into the world of totaled cars, exploring the factors insurance companies consider, your rights, and the potential benefits and drawbacks of keeping your car even if it’s declared a total loss. Buckle up, because this is a ride you won’t want to miss!

Determining Total Loss

So, your car’s been in a wreck, and the insurance company is talking about totaling it. You’re probably wondering what that means, and if you’ll get to keep your car. Let’s break it down.

Factors Considered for Total Loss

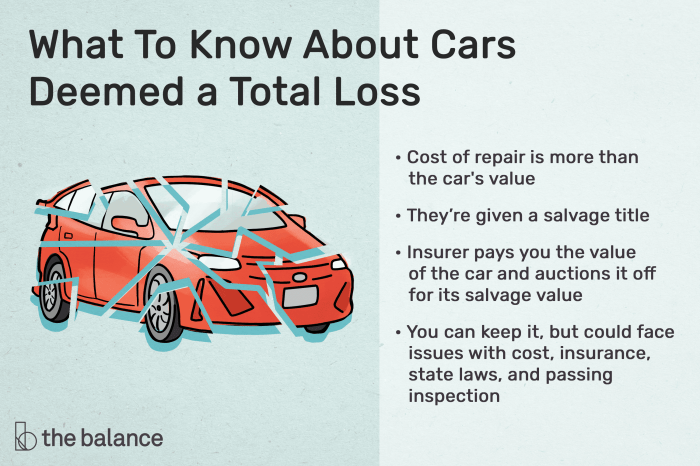

Insurance companies have a pretty clear set of rules for deciding if your car is a total loss. They consider a few key things:

- Repair Costs: If the cost to fix your car is higher than the car’s actual cash value (ACV), it’s usually totaled.

- Safety: Even if the repairs are within the ACV, if the damage is significant enough to compromise the car’s safety, it might still be totaled.

- State Laws: Each state has its own rules for determining total loss, which can vary. For example, some states have a “threshold” where the damage must be a certain percentage of the ACV before the car is totaled.

Scenarios Where a Car Might Be Totaled

Here are some common scenarios where a car might be declared a total loss:

- Major Collision: A serious accident involving significant structural damage to the car’s frame, engine, or suspension.

- Flood Damage: If your car has been submerged in water, the damage can be extensive and difficult to repair.

- Fire Damage: A fire can cause significant damage to a car’s interior, electrical system, and engine.

- Theft: If your car is stolen and recovered, but it’s been significantly damaged or stripped of parts, it might be totaled.

Determining the Actual Cash Value (ACV)

The ACV is what your car is worth before the accident. It’s not the same as the price you paid for it or its current market value. Here’s how insurance companies typically calculate ACV:

- Market Value: They use databases and online tools to estimate the value of your car based on its make, model, year, mileage, condition, and other factors.

- Depreciation: They factor in depreciation, which is the decrease in value over time. Older cars depreciate more quickly than newer ones.

- Local Market: They may consider the value of similar cars in your local area to ensure the ACV is accurate.

Your Rights and Options

Your car has been totaled, and you’re probably feeling a bit overwhelmed. But don’t worry, you have rights and options. Let’s break down what you can do.

Understanding Your Rights

Your rights as a car owner after a total loss are defined by your state’s laws and your insurance policy. Generally, the insurance company must pay you the actual cash value (ACV) of your car, which is its fair market value before the accident. This value is usually determined by looking at comparable vehicles in your area, considering factors like mileage, condition, and any upgrades. It’s important to understand that the ACV will likely be less than what you paid for the car initially, especially if it was newer.

Options After a Total Loss

You have a few options when your car is totaled. Let’s explore them:

Accepting the Insurance Payout and Releasing the Vehicle

This is the most common option. The insurance company will offer you a payout based on the ACV of your car, and you’ll sign a release form transferring ownership of the vehicle to them. They will then either sell it at auction or dispose of it.

- Benefits: This is the easiest and fastest option. You receive the payout and don’t have to deal with the hassle of selling or repairing the car.

- Drawbacks: You receive less than what you paid for the car initially. You lose the opportunity to sell the car yourself, potentially getting a higher price.

Keeping the Totaled Vehicle and Negotiating a Lower Payout

You can choose to keep the totaled vehicle, but this means you’ll receive a lower payout. The insurance company will deduct the salvage value of the car from the ACV. This means you’ll receive less money, but you’ll have the option to sell the car yourself for parts or repair it.

- Benefits: You can keep the car and potentially get some value from it. You have more control over the outcome.

- Drawbacks: You’ll receive a lower payout. You’ll need to find a way to dispose of the car or find a buyer for it.

Repairing the Vehicle at Your Expense

If you believe the car can be repaired at a reasonable cost, you can choose to pay for the repairs yourself. However, this is often not a good option because the insurance company will likely deem the car a total loss for a reason. The cost of repairs may exceed the value of the car, making it a financial burden.

- Benefits: You can keep your car and potentially save money if the repairs are less expensive than the insurance payout.

- Drawbacks: You’ll be responsible for all repair costs. The car may not be safe to drive after repairs. You may have difficulty finding parts or a mechanic willing to repair a totaled car.

Considerations Before Keeping a Totaled Vehicle

You might be tempted to keep your totaled car, especially if it holds sentimental value or if you think you can fix it yourself. However, before making that decision, it’s crucial to weigh the pros and cons carefully. There are several factors to consider that might make keeping your totaled vehicle more trouble than it’s worth.

Factors to Consider, Can you keep your car if insurance company totals

- The Extent of the Damage: A thorough inspection is necessary to assess the extent of the damage. If the car has sustained significant structural damage, it might be impossible or extremely costly to repair.

- Cost of Repair: Obtain multiple quotes from reputable repair shops to get an accurate estimate of the repair costs. Consider the cost of parts, labor, and any potential hidden damage.

- Availability of Parts: Check if the parts needed for the repair are readily available, especially for older vehicles. Limited availability can significantly increase the repair time and cost.

- Your Mechanical Skills: If you plan to fix the car yourself, evaluate your skills and experience. Attempting repairs beyond your capabilities can lead to further damage and potentially unsafe driving conditions.

- Time Commitment: Repairing a totaled vehicle can be a time-consuming process, especially if you are doing it yourself. Factor in the time needed to source parts, perform the repairs, and potentially deal with any bureaucratic hurdles.

- Resale Value: If you plan to sell the vehicle after repairs, understand that its resale value will likely be significantly lower than a comparable vehicle without a history of being totaled.

- Insurance Coverage: Check your insurance policy to understand the implications of keeping the vehicle. Some policies might have stipulations or limitations regarding totaled vehicles.

- Legal Requirements: Depending on your state, there might be specific regulations regarding the repair and registration of totaled vehicles.

Potential Risks and Challenges

- Safety Concerns: A totaled vehicle might have hidden damage that could compromise its safety. Driving a car that is not properly repaired can be dangerous for you and others on the road.

- Mechanical Issues: Even if you manage to repair the car, it might continue to experience mechanical problems in the future due to the severity of the damage.

- Insurance Complications: If you keep the car, your insurance premiums might increase due to the higher risk associated with a previously totaled vehicle.

- Resale Value: Selling a previously totaled vehicle can be challenging and result in a lower selling price. Potential buyers might be hesitant due to the car’s history.

Keeping the Vehicle vs. Accepting the Payout

| Keeping the Vehicle | Accepting the Payout | Pros | Cons |

|---|---|---|---|

| You retain ownership of the vehicle. | You receive a cash settlement from the insurance company. | You have the option to repair the vehicle and potentially sell it at a later date. | You might not be able to afford the repairs, and the vehicle may never be restored to its pre-accident condition. |

| You might be able to salvage parts for future use. | You can use the money to purchase a new or used vehicle that meets your needs. | You have the potential to gain valuable experience by repairing the vehicle yourself. | You lose ownership of the vehicle and may have to pay for a new one. |

| You might have sentimental value attached to the vehicle. | You have the peace of mind of not having to deal with the hassle of repairing a totaled vehicle. | You might be able to sell the vehicle for parts or scrap. | You might not be able to get the full market value for your vehicle. |

Conclusion

So, can you keep your car if the insurance company totals it? The answer is a resounding maybe! Understanding the factors that influence this decision, your rights, and the potential implications of keeping a totaled vehicle is key. Remember, knowledge is power, and it’s your best tool when navigating the complex world of insurance claims. Stay informed, ask questions, and know your options, and you’ll be in the driver’s seat when it comes to making the best decision for you.

Detailed FAQs: Can You Keep Your Car If Insurance Company Totals

What if the insurance company’s offer is too low?

You have the right to negotiate with the insurance company. If you believe their offer is too low, gather evidence like repair estimates and market values for similar vehicles to support your claim.

Can I keep my car if it’s a classic or vintage vehicle?

It depends. Some insurance companies have specific policies for classic or vintage cars. It’s crucial to review your policy and discuss your options with your insurance agent.

What happens to my car if I keep it?

You’ll need to pay any remaining loan balance and cover any repair costs. It’s essential to consider the potential resale value of the vehicle, as well as the cost and availability of parts.