Full coverage car insurance is like having a superhero on your side, protecting your ride from the unexpected. It’s not just about keeping your car shiny and new, it’s about peace of mind knowing you’re covered if something goes bump in the night.

Full coverage car insurance bundles several types of coverage, including collision, comprehensive, and liability. This means you’re protected if you’re in an accident, your car gets stolen, or even if a tree falls on it. It’s like having a safety net for all the crazy things that can happen on the road.

Understanding Full Coverage Car Insurance

Think of full coverage car insurance as your car’s ultimate safety net. It’s designed to protect you financially if something unfortunate happens to your vehicle.

Types of Coverage Included in Full Coverage

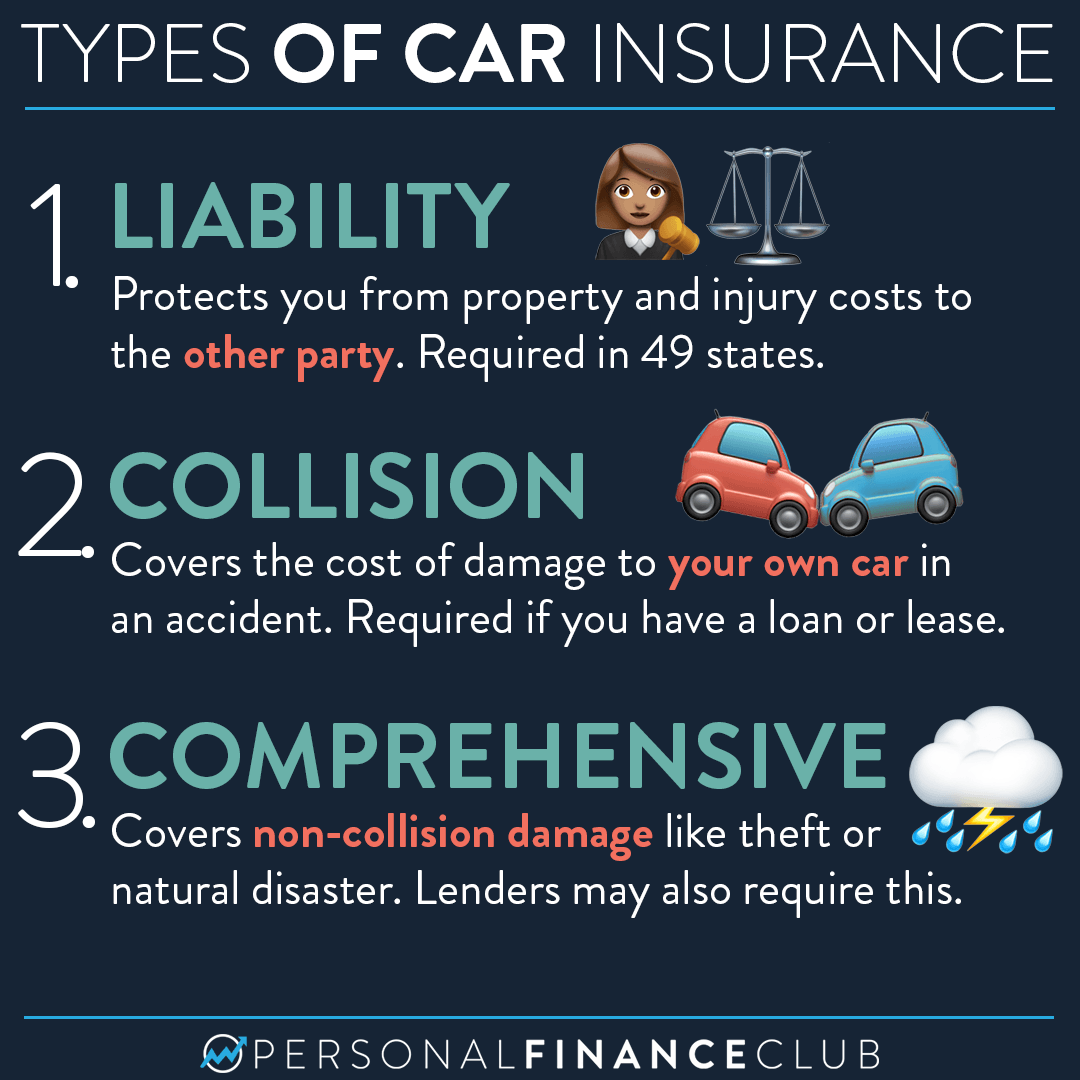

Full coverage car insurance is a combination of different types of coverage. These types of coverage can help you pay for repairs or replacement costs, medical expenses, and more. Here’s a breakdown of what’s typically included:

- Collision Coverage: This coverage helps pay for repairs or replacement of your car if you’re involved in an accident, regardless of who’s at fault. Imagine you accidentally back into a parked car – collision coverage could help with the repairs.

- Comprehensive Coverage: This coverage protects you from damages that aren’t caused by an accident, like theft, vandalism, or natural disasters. For example, if a tree falls on your car during a storm, comprehensive coverage can help you get it fixed.

- Liability Coverage: This coverage is essential. It protects you financially if you’re at fault in an accident that causes damage to another person’s property or injuries to another person. Think of it as a safety net if you cause an accident and need to pay for the other driver’s medical bills or car repairs.

- Uninsured/Underinsured Motorist Coverage: This coverage helps you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. It’s like having a backup plan in case the other driver can’t cover the costs.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses, lost wages, and other related costs if you’re injured in an accident, regardless of who’s at fault. Think of it as a safety net for your own well-being.

Full Coverage vs. Other Options

Full coverage car insurance is a good option for many people, but it’s not always the best choice for everyone. Here’s a comparison to help you decide:

- Liability-Only Coverage: This is the minimum amount of insurance required by law in most states. It only covers the other driver’s damages if you’re at fault in an accident. This option is the most affordable, but it doesn’t protect your own vehicle. It’s often a good option for older cars with lower value.

- Collision Coverage Only: This option covers damages to your car if you’re involved in an accident, regardless of who’s at fault. It’s a good option for newer cars with higher value, as it helps protect your investment.

Benefits of Full Coverage Car Insurance

Full coverage car insurance is more than just a financial safety net; it’s a peace of mind investment that can help you navigate the unexpected twists and turns of life. Whether you’re a seasoned driver or just starting out, understanding the benefits of full coverage can empower you to make informed decisions about your insurance needs.

Financial Protection in the Face of Accidents

Full coverage car insurance provides financial protection against significant financial losses in the event of an accident. It encompasses both collision and comprehensive coverage, ensuring you’re covered for a wide range of scenarios.

- Collision Coverage: This covers repairs or replacement costs for your vehicle if you’re involved in an accident with another vehicle or an object, regardless of who’s at fault. Imagine a scenario where you’re driving down the street and a deer suddenly darts out in front of your car. With collision coverage, you wouldn’t have to shoulder the entire cost of repairs or replacement, providing financial relief during a stressful time.

- Comprehensive Coverage: This covers damages to your vehicle caused by events beyond your control, such as theft, vandalism, natural disasters, or falling objects. Picture a hailstorm pummeling your car while it’s parked in your driveway. Comprehensive coverage would help cover the cost of repairs or replacement, shielding you from a potentially hefty financial burden.

Peace of Mind and Security

Having full coverage car insurance can provide peace of mind and security, knowing that you’re protected against unexpected financial losses. It offers a safety net that allows you to focus on what matters most – your well-being and recovery – without worrying about the financial implications of an accident or theft.

“Full coverage car insurance is like having a safety net for your vehicle. It provides peace of mind knowing that you’re protected against significant financial losses in case of an accident or theft.”

Factors Influencing Full Coverage Costs

So you’ve decided to go full coverage with your car insurance, but how much will it cost? Like a good movie, there are a lot of factors that go into determining your premium, from the car itself to your driving history and even where you live. Let’s break down the key players that affect your full coverage insurance price.

Vehicle Type, Full coverage car insurance

The type of car you drive is a major factor in determining your full coverage insurance cost. Think of it like this: a sleek sports car is like a movie star – everyone wants to drive it, and it attracts attention, which can mean more risk of accidents and theft. So, insurance companies charge more for high-performance cars, luxury vehicles, and those with a history of being frequently stolen.

For example, a 2023 Tesla Model S will likely have a higher premium than a 2018 Toyota Corolla.

Driving History

Your driving history is like your movie resume. A clean record, with no accidents or traffic violations, will land you a lower premium. But, if you’ve got some bumps in the road, like speeding tickets or accidents, you can expect a higher premium. Insurance companies see you as a higher risk, just like a movie director might be hesitant to cast an actor with a history of bad behavior on set.

Location

Where you live is another big factor in your full coverage insurance cost. Imagine your car is a character in a movie – if it’s in a bustling city with a lot of traffic and crime, it’s going to face more risks than if it’s parked in a quiet suburban neighborhood. Insurance companies take into account the risk of accidents, theft, and vandalism in your area when calculating your premium.

For instance, living in a major metropolitan area like New York City will likely result in higher insurance premiums compared to living in a rural town in Wyoming.

Age

Age is a factor that affects full coverage insurance costs, but it’s not as simple as “older is cheaper.” Insurance companies consider age in two ways:

- Younger Drivers: They are statistically more likely to be involved in accidents, so they often pay higher premiums. Think of it like a young actor starting out – they have less experience and might make some mistakes.

- Older Drivers: They may have more experience, but their reaction times and vision might decline with age, potentially leading to accidents. This can lead to higher premiums, similar to how a seasoned actor might be more expensive to hire because of their high demand and experience.

Insurance Company Pricing Strategies

Just like different movie studios have different approaches to filmmaking, insurance companies also have different pricing strategies. Some companies may focus on offering lower premiums for certain demographics, while others might specialize in high-risk drivers.

- Discounts: Many insurance companies offer discounts for things like good driving records, safety features in your car, and even being a good student. It’s like getting a discount on your movie ticket for being a loyal customer.

- Risk Assessment: Each company uses its own methods to assess risk and determine premiums. Some companies may use more complex algorithms, while others rely on more traditional factors.

- Competition: The insurance market is competitive, just like the movie industry. Companies are constantly trying to attract new customers with lower premiums and better coverage.

Choosing the Right Full Coverage Policy: Full Coverage Car Insurance

You’ve got the lowdown on full coverage car insurance, but now it’s time to get down to business and pick the perfect policy for your ride. Think of it like choosing your favorite flavor of ice cream – you want something that’s delicious and fits your needs, right?

Comparing Quotes from Multiple Insurance Providers

Before you commit to a full coverage policy, it’s crucial to compare quotes from different insurance providers. Think of it like shopping for a new pair of kicks – you wouldn’t just grab the first pair you see, would you? You’d browse around, check out the prices, and find the best deal, right? The same applies to car insurance.

- Online Comparison Websites: Websites like [website name] or [website name] make it super easy to compare quotes from multiple insurers all in one place. It’s like having a personal shopper for car insurance, but way cheaper!

- Directly Contact Insurers: You can also call or visit the websites of individual insurance companies to get quotes. This gives you a chance to chat with a rep and ask any questions you might have.

Key Features and Benefits of Different Policy Options

Okay, so you’ve got your quotes in hand, but how do you choose the best policy for your needs? It’s all about finding the right balance between coverage, cost, and your personal preferences.

| Policy Option | Key Features | Benefits |

|---|---|---|

| Basic Full Coverage | Covers collision and comprehensive damage, liability, and uninsured motorist coverage. | Provides essential protection for your car and others in case of an accident. |

| Enhanced Full Coverage | Includes additional coverage like rental car reimbursement, roadside assistance, and gap insurance. | Offers more peace of mind with extra protection in case of unexpected events. |

| Customized Full Coverage | Allows you to tailor your coverage to your specific needs, such as adding coverage for specific types of damage or higher liability limits. | Provides the most flexibility and control over your policy, ensuring you only pay for the coverage you need. |

Common Misconceptions about Full Coverage

Full coverage car insurance is a popular term, but it can be a bit misleading. Many people think that “full coverage” means their car is covered for everything, but that’s not always the case. It’s important to understand the limitations of full coverage car insurance so you can make informed decisions about your policy.

Difference between Full Coverage and Comprehensive Coverage

Full coverage car insurance is actually a combination of two types of coverage: collision and comprehensive. Collision coverage pays for repairs or replacement of your vehicle if you’re in an accident, regardless of who’s at fault. Comprehensive coverage covers damage to your car from things like theft, vandalism, fire, and natural disasters.

Limits and Exclusions of Full Coverage Policies

While full coverage can seem like a safety net, there are limits and exclusions you should be aware of.

Deductibles

You’ll have to pay a deductible for any claim you make, even with full coverage. Think of it as your “out-of-pocket” expense before your insurance kicks in. Deductibles can range from a few hundred dollars to thousands, depending on your policy.

Exclusions

Full coverage policies often have exclusions, meaning certain situations are not covered. For example, your insurance might not cover damage caused by:

- Wear and tear

- Mechanical breakdowns

- Driving under the influence of alcohol or drugs

- Using your car for business purposes

Limits

There are also limits on how much your insurance will pay for a claim. This limit is usually based on the actual cash value (ACV) of your car, which is its current market value. If your car is totaled, your insurance will only pay you the ACV, even if you paid more for it.

Remember: Full coverage is not a guarantee that your insurance will cover every situation. It’s important to read your policy carefully and understand its limits and exclusions.

Full Coverage in Specific Situations

Full coverage car insurance, while often considered a luxury, can be a smart financial decision in certain situations. It provides comprehensive protection against a wide range of risks, offering peace of mind and financial security for drivers. Here are some specific scenarios where full coverage proves particularly valuable:

Full Coverage for New Car Owners

New car owners are particularly vulnerable to financial losses in the event of an accident. Since new vehicles have higher value, the cost of repairs or replacement can be substantial. Full coverage protects new car owners by covering collision and comprehensive damages, ensuring they can get their vehicle repaired or replaced without significant out-of-pocket expenses. This protection is crucial for drivers who have taken out a car loan, as it helps to safeguard their investment and prevent financial hardship.

Full Coverage for Drivers with High-Value Vehicles

Drivers with high-value vehicles, such as luxury cars or classic automobiles, stand to lose a considerable amount in the event of an accident. Full coverage insurance provides essential protection by covering repairs or replacement costs, even if the damage is extensive. This coverage is especially beneficial for drivers who have invested significantly in their vehicle and want to ensure its financial protection.

Full Coverage for Drivers in High-Risk Areas

Drivers residing in areas prone to accidents, natural disasters, or theft should consider full coverage insurance. These areas pose a higher risk of vehicle damage or loss, making full coverage a prudent choice. For example, drivers living in urban areas with high traffic density or coastal regions susceptible to hurricanes and floods benefit from the comprehensive protection offered by full coverage insurance.

Epilogue

Full coverage car insurance might seem like a big investment, but it can be a lifesaver in the long run. It’s like having a financial guardian angel looking out for you, keeping you safe and sound on the road. So, do your research, compare quotes, and choose the full coverage policy that fits your needs like a glove. You’ll be glad you did when you’re cruising down the highway knowing you’re protected.

FAQ Guide

Is full coverage car insurance really necessary?

Whether you need full coverage depends on your situation. If you have a newer car or one with a high loan balance, full coverage can be a good idea. It can also be helpful if you have a less-than-perfect driving record or live in an area with high crime rates.

How much does full coverage car insurance cost?

The cost of full coverage car insurance varies depending on factors like your driving history, the type of car you drive, where you live, and the insurance company you choose. It’s always a good idea to get quotes from multiple companies to find the best price.

What is the difference between full coverage and comprehensive coverage?

Full coverage car insurance includes both collision and comprehensive coverage. Collision coverage protects you if you’re in an accident, while comprehensive coverage covers damage from things like theft, vandalism, and natural disasters.

Can I cancel my full coverage car insurance?

You can usually cancel your full coverage car insurance at any time, but you may have to pay a cancellation fee. It’s important to weigh the costs and benefits before making a decision.