Discount car insurance is like finding a hidden treasure chest full of savings. It’s all about getting the best deal on your car insurance by taking advantage of special offers and discounts. From safe driving records to bundling your insurance policies, there are tons of ways to lower your premiums and keep more cash in your pocket.

But navigating the world of car insurance discounts can feel like trying to decipher a secret code. That’s where we come in. We’ll break down the different types of discounts, explain how to find them, and even show you how much you can save. Buckle up, it’s time to get your insurance game strong!

Understanding Discount Car Insurance

You’re probably already aware that car insurance is a must-have, but did you know that there are ways to save money on your premiums? That’s where discount car insurance comes in. It’s all about getting the best deal possible on your car insurance by taking advantage of special discounts offered by insurance companies. Think of it as a secret code to unlock lower rates!

Common Car Insurance Discounts

Discounts are like free money, and car insurance companies love to give them out. These discounts can significantly lower your premiums, so it’s worth taking a closer look.

- Good Driver Discounts: If you’ve got a clean driving record, meaning no accidents or tickets, you’re basically a rockstar in the insurance world. You’ll get a discount for being a safe and responsible driver.

- Multi-Car Discounts: Got more than one car in your driveway? Insurance companies are all about the family vibe. They’ll reward you with a discount for insuring multiple vehicles with them.

- Safe Vehicle Discounts: Your car is a beauty, and insurance companies know it. They’ll give you a discount if your car has safety features like anti-theft systems, airbags, or advanced braking systems.

- Loyalty Discounts: Been with your insurance company for a while? They’re like your best friend, and they’ll show their appreciation with a loyalty discount for sticking with them.

- Bundling Discounts: Like a combo meal at your favorite fast-food joint, you can bundle your car insurance with other types of insurance, like home or renters insurance, to get a discount. It’s a win-win!

Factors Influencing Discount Eligibility

Not everyone gets the same discounts, so it’s important to know what factors influence your eligibility. It’s like a puzzle, and the pieces need to fit just right.

- Driving Record: Your driving history is a big factor. If you’ve got a clean slate, you’re in the clear for good driver discounts. But if you’ve got some bumps in the road, like accidents or tickets, you might not be eligible for all the discounts.

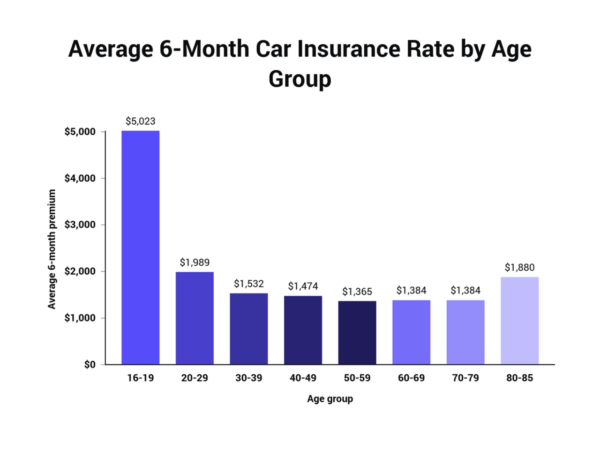

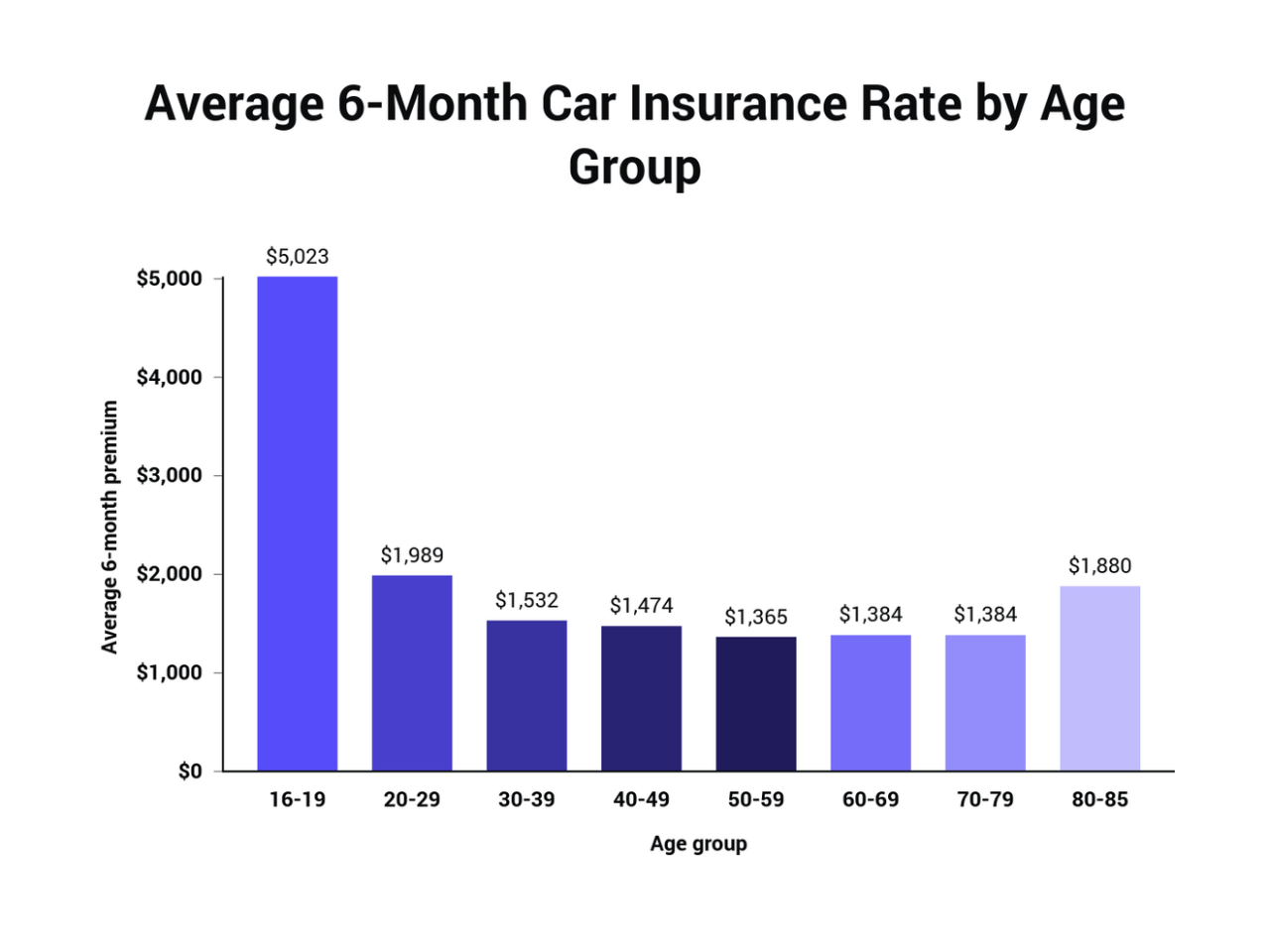

- Age and Gender: Believe it or not, age and gender can affect your discounts. Younger drivers, especially males, are statistically more likely to be involved in accidents.

- Location: Where you live matters. If you live in a high-risk area with a lot of traffic and accidents, you might not get as many discounts as someone who lives in a safer area.

- Vehicle Type: The type of car you drive also plays a role. Luxury cars or sports cars are generally considered riskier, so they might not qualify for the same discounts as more standard vehicles.

- Insurance History: Your insurance history is a key factor. If you’ve had gaps in coverage or frequent claims, you might not be eligible for certain discounts.

Types of Discounts: Discount Car Insurance

So, you’re looking to save some dough on your car insurance? Well, buckle up, because there are a ton of discounts out there, and we’re about to break them down like a pro! Think of it like this: the more discounts you qualify for, the more cash you’ll be saving. Who doesn’t love that?

Good Driver Discounts

This is where you shine, my friend! If you’ve got a clean driving record, you’re basically a rockstar in the eyes of insurance companies. They’ll reward you for being a responsible driver, and that means lower premiums for you.

- Safe Driver Discount: This is the bread and butter of good driver discounts. No accidents, no tickets, no problems! You’re a driving machine, and you’ll be rewarded for it.

- Defensive Driving Course Discount: Taking a defensive driving course shows you’re serious about being a safe driver. It’s like getting a gold star for your driving skills.

- Accident-Free Discount: If you’ve gone a certain number of years without an accident, insurance companies will give you a big thumbs up. It’s like a high-five for your driving prowess.

Vehicle-Related Discounts

Your car itself can help you save money on insurance! It’s all about the details, baby. The safer your ride, the less you’ll pay.

- New Car Discount: Buying a brand new car? You’re in luck! Insurance companies love newer cars because they’re usually loaded with safety features.

- Anti-theft Device Discount: If your car has a fancy alarm system or other anti-theft gadgets, you’ll get a discount. Insurance companies know these features make your car less likely to be stolen.

- Safety Feature Discount: Cars with airbags, anti-lock brakes, and other safety features are less likely to be involved in accidents. That means lower premiums for you!

Lifestyle Discounts

Your personal life can actually affect your car insurance rates. It’s not just about the car, it’s about you!

- Good Student Discount: Ace those exams, kid! Good grades mean good discounts on your car insurance. Insurance companies like to see you’re a responsible individual.

- Multi-Car Discount: Got a whole fleet of cars? Insurance companies love it! Bundling your policies can save you a ton of cash.

- Multi-Policy Discount: Got homeowners insurance, renters insurance, or even life insurance? Insurance companies will reward you for bundling all your policies together.

Other Discounts

There are a bunch of other discounts out there that can help you save money. It’s all about doing your research and seeing what you qualify for.

- Military Discount: If you’re serving your country, insurance companies want to show their appreciation. They’ll offer special discounts to military personnel.

- Occupation Discount: Some occupations are considered low-risk, which can mean lower insurance premiums. Think doctors, teachers, and other professionals.

- Payment Plan Discount: Paying your premium in full can sometimes earn you a discount. It’s like a bonus for being a responsible payer.

How to Find Discounts

Finding car insurance discounts can be a real game-changer, saving you a bunch of dough. It’s like finding a hidden level in your favorite video game, but instead of unlocking a new character, you’re unlocking lower premiums. But don’t worry, you don’t need to be a tech wizard or a discount code hunter to find these savings. It’s all about knowing where to look and how to ask the right questions.

Steps to Find Discounts

Here’s a step-by-step guide to help you find those sweet, sweet discounts:

- Check Your Current Policy: Start by reviewing your current policy. Your insurer might already be offering discounts you’re not taking advantage of. It’s like finding a forgotten twenty-dollar bill in your jeans pocket – pure joy!

- Contact Your Insurer: Don’t be shy, reach out to your insurance company. They’re the experts, and they know all the discounts they offer. They’ll be happy to walk you through the available options, just like your favorite barista knows all the secret menu items.

- Ask About Bundling: Think about your insurance needs. Do you have home, renters, or life insurance? Bundling your policies with the same company can often save you money. It’s like getting a combo meal at your favorite fast-food joint – more bang for your buck!

- Shop Around: Don’t be afraid to shop around. Get quotes from multiple insurers and compare their discount offerings. You might be surprised by the differences. It’s like trying out different restaurants – you might find a hidden gem you never knew existed.

Tips for Maximizing Discounts

Here are some pro tips to make sure you’re getting the most out of your discounts:

- Good Driving Record: A clean driving record is your best friend. Avoid speeding tickets and accidents like you’d avoid spoilers for your favorite movie. It’ll pay off big time.

- Safety Features: Your car’s safety features can work in your favor. Anti-theft devices, airbags, and anti-lock brakes can all earn you discounts. It’s like having a superhero sidekick – they’re always looking out for you.

- Pay in Full: Paying your premium in full can sometimes land you a discount. It’s like buying a season pass for your favorite theme park – you get more value for your money.

- Take a Defensive Driving Course: These courses can help you become a safer driver and earn you a discount. It’s like getting a crash course in driving etiquette, but without the actual crashes.

Discount Comparisons

Here’s a quick comparison of some popular insurance providers and their discount offerings:

| Provider | Discounts Offered |

|---|---|

| Geico | Good Student, Multi-Car, Safe Driver, Defensive Driving, Good Driver, Multi-Policy |

| Progressive | Good Student, Multi-Car, Safe Driver, Homeowner, Good Driver, Multi-Policy |

| State Farm | Good Student, Multi-Car, Safe Driver, Homeowner, Good Driver, Multi-Policy |

| Allstate | Good Student, Multi-Car, Safe Driver, Homeowner, Good Driver, Multi-Policy |

Remember, discount availability and specific terms may vary depending on your location and individual circumstances. Always check with your insurance provider for the most up-to-date information.

Impact of Discounts on Premiums

Car insurance discounts are like finding a hidden treasure chest full of savings. They can significantly reduce your premium, making your insurance more affordable. These discounts are often easy to qualify for and can make a real difference in your budget.

Potential Savings Achievable Through Car Insurance Discounts

Discounts can significantly reduce your car insurance premium. The amount of savings varies based on the specific discounts you qualify for and your individual circumstances. Here’s an example:

Let’s say your initial premium is $1,000 per year. If you qualify for a 10% good driver discount, a 5% multi-car discount, and a 15% safe driver discount, you could potentially save $350 per year!

Impact of Different Discount Combinations on Overall Premium Costs, Discount car insurance

The combination of discounts you qualify for can have a significant impact on your overall premium cost. Here’s a breakdown of how different discount combinations can affect your premium:

- Single Discount: A single discount, such as a good driver discount, can reduce your premium by a small percentage, say 5-10%.

- Multiple Discounts: Combining multiple discounts, such as a good driver discount, multi-car discount, and safe driver discount, can lead to substantial savings, potentially reducing your premium by 20% or more.

- Stacking Discounts: Some insurers allow you to “stack” discounts, meaning the discounts are applied consecutively. This can result in even greater savings.

Case Study: Financial Benefits of Discount Car Insurance

Imagine a young professional, Sarah, who recently purchased a new car. She initially received a quote for $1,200 per year. However, she qualifies for several discounts, including a good driver discount, a multi-car discount, and a safe driver discount. These discounts combined reduce her premium by 25%, saving her $300 per year. Over a five-year period, this translates to a total savings of $1,500!

Sarah’s story highlights the significant financial benefits of discount car insurance. By taking advantage of available discounts, you can save money and keep more of your hard-earned cash in your pocket.

Considerations and Caveats

Don’t get too excited about all these discounts, though. Like any good thing in life, there’s a catch. You gotta know the rules of the game to win, right? So let’s break down some things you need to keep in mind when it comes to discount car insurance.

Discounts are great, but they’re not always as straightforward as they seem. Some discounts might have limitations, like a maximum amount they can reduce your premium. Others might only apply to certain types of coverage or even specific car models. You’ll want to do your homework to make sure you’re getting the most out of these deals.

Understanding Discount Eligibility Requirements

Knowing the requirements for each discount is key to making sure you qualify. Think of it like being a VIP at a club – you need to meet the criteria to get in. Here’s the lowdown on some common eligibility requirements:

- Good driving record: This is a big one. No accidents or tickets, baby! Your insurance company loves drivers who play by the rules.

- Safety features: Got airbags, anti-theft systems, or fancy brakes? These can score you some sweet discounts. Think of it as your car showing off its skills.

- Safe driving courses: Taking a defensive driving course shows you’re serious about safety. This can help you land some extra discounts. It’s like getting a gold star for being a good driver.

- Bundle your insurance: Combining your car insurance with other types of insurance, like homeowners or renters, can save you some serious cash. It’s like getting a combo meal at your favorite restaurant – more bang for your buck!

Avoiding Common Pitfalls

You’ve done your research, you’re ready to snag those discounts, but hold your horses! There are some common pitfalls to avoid:

- Don’t overestimate your discounts: Don’t get caught up in the hype. Make sure you’re actually eligible for the discounts you’re claiming. You don’t want to get your hopes up only to be disappointed.

- Read the fine print: Always, always, always read the fine print! It’s like the “Terms and Conditions” – you gotta know what you’re signing up for. Some discounts might have hidden restrictions or limitations that you might not notice if you’re not paying attention.

- Don’t be afraid to ask questions: If you’re not sure about something, don’t be shy! Ask your insurance agent or representative. They’re there to help you understand your policy and make sure you’re getting the best deal.

Final Review

Discount car insurance is a game-changer for anyone looking to save money on their premiums. By understanding the different types of discounts, knowing how to find them, and being aware of potential limitations, you can unlock significant savings and keep more cash for the things you love. So, don’t just settle for the first insurance policy you find. Do your research, explore the discounts, and find the best deal for you. Your wallet will thank you!

FAQs

What are the most common car insurance discounts?

Common discounts include safe driver, good student, multi-car, and bundling discounts.

How do I find out if I qualify for a discount?

Contact your insurance provider or use online comparison tools to see what discounts are available to you.

Can I stack multiple discounts?

Yes, you can often stack multiple discounts, but check with your insurance provider for specific details.

What if I don’t qualify for certain discounts?

Don’t worry! There are still plenty of other discounts you may qualify for. Keep exploring your options.