- Experian Car Insurance Overview

- Car Insurance Quotes and Comparisons

- Coverage Options and Features: Experian Car Insurance

- Customer Experience and Reviews

- Claims Process and Customer Support

- Payment and Billing

- Discounts and Savings

- Comparison with Other Insurers

- Data Privacy and Security

- Future Trends in Car Insurance

- Final Conclusion

- Question Bank

Experian car insurance is a unique player in the insurance game, offering a fresh perspective on finding the best coverage and saving money. Unlike traditional insurance companies, Experian leverages its expertise in credit scoring and data analysis to provide personalized insurance quotes and potentially lower premiums. This approach can be a game-changer for drivers looking to get the most out of their car insurance.

Experian’s services extend beyond just providing quotes. They also offer valuable tools and resources to help you understand your insurance options, compare different providers, and manage your policy effectively. Whether you’re a seasoned driver or a new car owner, Experian’s approach can help you navigate the complexities of car insurance with confidence.

Experian Car Insurance Overview

Experian is a global information services company that plays a crucial role in the car insurance industry. They provide a wide range of services that help insurance companies assess risk and make informed decisions about pricing and underwriting.

Experian’s Services Related to Car Insurance, Experian car insurance

Experian’s services are designed to provide insurers with a comprehensive view of a potential customer’s risk profile. This helps them determine the appropriate insurance premiums and coverage options. Some of Experian’s key services include:

- Credit-based insurance scores: Experian uses a proprietary algorithm to generate credit-based insurance scores (CBIS) that reflect a consumer’s creditworthiness. This score can be a strong indicator of their overall risk profile and can influence their car insurance premiums.

- Vehicle history reports: Experian provides vehicle history reports that include information about a car’s past accidents, repairs, and ownership history. This information helps insurers assess the risk associated with a particular vehicle.

- Data analytics and insights: Experian offers data analytics and insights that help insurers understand market trends, identify risk factors, and develop effective marketing strategies.

- Fraud detection and prevention: Experian provides fraud detection and prevention services that help insurers identify and mitigate fraudulent claims.

Benefits of Using Experian for Car Insurance

Using Experian for car insurance offers several benefits to both insurance companies and consumers.

- Accurate risk assessment: Experian’s data and analytics provide insurers with a more accurate assessment of risk, leading to more competitive and fair pricing.

- Improved customer experience: By leveraging Experian’s services, insurers can streamline their underwriting processes, leading to faster and more efficient quotes for consumers.

- Enhanced fraud prevention: Experian’s fraud detection services help insurers prevent fraudulent claims, which ultimately benefits all consumers by keeping premiums lower.

- Access to valuable insights: Experian’s data analytics and insights help insurers make informed decisions about product development, marketing, and pricing.

Car Insurance Quotes and Comparisons

Getting the best car insurance deal can feel like a game of whack-a-mole. You’re constantly searching for the lowest rates, but it can be tough to know where to start. That’s where comparing quotes comes in, and Experian Car Insurance is definitely a player you should check out.

Comparing Experian Car Insurance Quotes with Other Providers

To get the best deal, it’s always a good idea to compare quotes from several different car insurance companies. Think of it like shopping for a new pair of sneakers – you wouldn’t buy the first pair you see without checking out the competition, right? Experian Car Insurance is a great place to start, but don’t stop there. Get quotes from other well-known providers like Geico, State Farm, Progressive, and even local insurance agents. You might be surprised at the deals you find.

Factors that Influence Car Insurance Quotes from Experian

Like any good insurance company, Experian uses a variety of factors to determine your car insurance rate. Here’s the lowdown on what they consider:

- Your Driving History: Clean record? You’re golden. Have a few fender benders? Expect a slightly higher rate. Experian looks at your driving history, including any accidents, tickets, or even how many miles you drive.

- Your Car: Your ride’s worth matters. A shiny new Tesla? Expect a higher premium than a reliable used Honda Civic. Experian considers your car’s make, model, year, and safety features.

- Your Location: Big city, small town, or somewhere in between? Where you live impacts your risk. Experian takes into account the cost of living, crime rates, and traffic density in your area.

- Your Age and Gender: It’s not always fair, but unfortunately, your age and gender can play a role. Younger drivers, especially males, tend to have higher premiums. This is because they’re statistically more likely to be involved in accidents.

- Your Credit Score: This might seem surprising, but your credit score can actually affect your car insurance rates. Experian, like many insurance companies, believes that people with good credit are more likely to be responsible drivers.

Obtaining a Car Insurance Quote from Experian

Ready to see what Experian can offer? Getting a quote is super easy. Here’s a step-by-step guide:

- Visit the Experian Car Insurance Website: Head over to their website, and you’ll find a handy “Get a Quote” button. Click it and get ready to fill out some info.

- Provide Your Information: Be prepared to share some basic details about yourself, your car, and your driving history. Think of it like filling out a short application.

- Review Your Quote: Once you’ve submitted your info, Experian will generate a personalized quote. Take a look at the coverage options and pricing.

- Compare and Choose: Remember, it’s always good to compare Experian’s quote with other providers. See what works best for your budget and needs.

Coverage Options and Features: Experian Car Insurance

Experian Car Insurance offers a range of coverage options to cater to different needs and budgets. They provide the standard coverage types, as well as additional options to customize your policy. These coverages protect you financially in case of an accident or other covered event.

Liability Coverage

Liability coverage is the most basic type of car insurance. It protects you financially if you cause an accident that results in damage to another person’s property or injuries to another person. This coverage is usually required by law in most states. Experian offers two types of liability coverage:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries to other people in an accident that you cause.

- Property Damage Liability: This coverage pays for damages to another person’s vehicle or property if you cause an accident.

Liability coverage limits are expressed as a pair of numbers, such as 100/300/50. The first number represents the maximum amount the insurer will pay for bodily injury per person in an accident. The second number represents the maximum amount the insurer will pay for bodily injury to all people in an accident. The third number represents the maximum amount the insurer will pay for property damage in an accident.

Collision Coverage

Collision coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault. This coverage is optional, but it is often a good idea to have it if you have a loan or lease on your car. Collision coverage will help you pay for repairs or replacement of your vehicle if you are in an accident, even if you are at fault. Collision coverage usually has a deductible, which is the amount you pay out of pocket before your insurance kicks in.

Comprehensive Coverage

Comprehensive coverage pays for damages to your vehicle caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. This coverage is also optional, but it is often a good idea to have it if you have a loan or lease on your car. Comprehensive coverage will help you pay for repairs or replacement of your vehicle if it is damaged by a covered event. Comprehensive coverage usually has a deductible, which is the amount you pay out of pocket before your insurance kicks in.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. UM/UIM coverage will help you pay for your medical expenses, lost wages, and other damages if you are injured in an accident with an uninsured or underinsured driver. This coverage is optional, but it is often a good idea to have it. You never know when you might be involved in an accident with a driver who does not have adequate insurance.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage, also known as no-fault insurance, pays for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. This coverage is required in some states, but it is optional in others. PIP coverage can be very helpful if you are injured in an accident and need to cover medical bills and lost wages.

Medical Payments Coverage (MedPay)

Medical Payments Coverage (MedPay) is a type of car insurance that pays for your medical expenses, regardless of who is at fault. This coverage is optional, but it can be very helpful if you are injured in an accident and need to cover medical bills. MedPay coverage is often included as part of a comprehensive insurance policy.

Rental Reimbursement

Rental reimbursement coverage pays for a rental car if your vehicle is damaged in an accident and is being repaired. This coverage is optional, but it can be very helpful if you need to rent a car while your vehicle is being repaired. Rental reimbursement coverage is often included as part of a comprehensive insurance policy.

Roadside Assistance

Roadside assistance coverage provides help with unexpected car problems, such as flat tires, dead batteries, and lockouts. This coverage is optional, but it can be very helpful if you experience a car problem while driving. Roadside assistance coverage is often included as part of a comprehensive insurance policy.

Gap Insurance

Gap insurance is a type of coverage that pays the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your vehicle is totaled in an accident. This coverage is optional, but it can be very helpful if you have a loan or lease on your car. Gap insurance can help you avoid being stuck with a large debt if your vehicle is totaled in an accident.

Customizable Coverage

Experian also offers a variety of customizable coverage options to meet your specific needs. These options can include things like:

- Deductible options: You can choose a higher deductible to lower your monthly premium. A higher deductible means you will pay more out of pocket if you have to file a claim, but you will save money on your premium.

- Coverage limits: You can choose higher coverage limits to ensure that you are adequately protected. Higher coverage limits mean you will pay more for your premium, but you will have more financial protection in case of an accident.

- Additional coverage: You can add additional coverage, such as rental reimbursement, roadside assistance, or gap insurance. These additional coverages will increase your premium, but they can provide you with valuable protection.

Experian Coverage Compared to Other Insurers

Experian Car Insurance offers competitive coverage options and features that are comparable to other major insurance providers. Experian’s coverage options are designed to meet the needs of a wide range of drivers. The company offers a variety of discounts and features to help you save money on your premium.

Customer Experience and Reviews

Experian car insurance is a relatively new player in the insurance market, so it’s important to consider customer feedback when making a decision. While the company is still building its reputation, customer reviews offer valuable insights into their service and customer satisfaction.

Customer Reviews and Feedback

Experian’s customer reviews are a mixed bag. While some customers praise the company’s competitive pricing and online platform, others express dissatisfaction with customer service and claim handling. To get a clearer picture, let’s explore the pros and cons based on online reviews and feedback.

Strengths of Experian’s Customer Service

- Competitive Pricing: Many customers appreciate Experian’s competitive car insurance rates, which can be significantly lower than traditional insurers. This affordability makes Experian a popular choice for budget-conscious drivers.

- User-Friendly Online Platform: Experian’s online platform is generally praised for its ease of use and accessibility. Customers can easily obtain quotes, manage their policies, and file claims online, saving time and effort.

- Prompt Response Times: Some customers have reported positive experiences with Experian’s customer service team, noting quick response times and helpful resolutions to their inquiries.

Weaknesses of Experian’s Customer Service

- Limited Customer Support Channels: Experian’s customer support channels are limited compared to some established insurers. While they offer online and phone support, some customers may prefer additional options like live chat or in-person assistance.

- Issues with Claim Handling: A recurring theme in customer reviews is difficulty with claim processing. Some customers have reported delays, bureaucratic hurdles, and communication issues during the claim process, leading to frustration.

- Lack of Personalization: Experian’s customer service may feel impersonal to some. While their online platform is efficient, it can lack the personalized touch that some customers value.

Examples of Positive and Negative Customer Experiences

Positive Experience

“I was really impressed with Experian’s online platform. It was so easy to get a quote and buy a policy. The rates were also very competitive, and I saved a lot of money compared to my previous insurer.” – John Smith, Experian Customer

Negative Experience

“I had a terrible experience with Experian’s customer service. I filed a claim after an accident, and it took weeks to get it processed. I had to call them multiple times and was constantly given the runaround. I wouldn’t recommend Experian to anyone.” – Sarah Jones, Experian Customer

Claims Process and Customer Support

Experian Car Insurance offers a claims process that’s designed to be as smooth and stress-free as possible. They understand that getting into an accident is never fun, and they’re there to help you through every step of the way.

Whether you’re dealing with a fender bender or a more serious collision, Experian’s claims process is designed to be efficient and transparent. They have a team of dedicated claims professionals who are available to answer your questions and guide you through the process.

Filing a Claim

Experian makes it easy to file a claim. You can do it online, over the phone, or through their mobile app.

Here’s a step-by-step guide to filing a claim with Experian Car Insurance:

- Report the accident: Contact Experian as soon as possible after the accident. This can be done by calling their customer service line or filing a claim online.

- Gather information: Gather all the necessary information about the accident, including the date, time, location, and the names and contact information of the other drivers involved.

- Submit your claim: Provide all the required information and documentation, such as photos of the damage, police reports, and medical records.

- Review your claim: Experian will review your claim and provide you with an estimate of the cost of repairs.

- Get your vehicle repaired: Once your claim is approved, you can take your vehicle to an approved repair shop.

Customer Support

Experian Car Insurance offers a variety of customer support options to ensure that you have access to help when you need it. They offer 24/7 customer support through their website, phone, and mobile app.

Here are some ways to contact Experian’s customer support:

- Phone: Call Experian’s customer service line for immediate assistance.

- Website: Visit Experian’s website to access a variety of resources, including FAQs, contact information, and online forms.

- Mobile app: Download Experian’s mobile app for easy access to your policy information, claims status, and other helpful features.

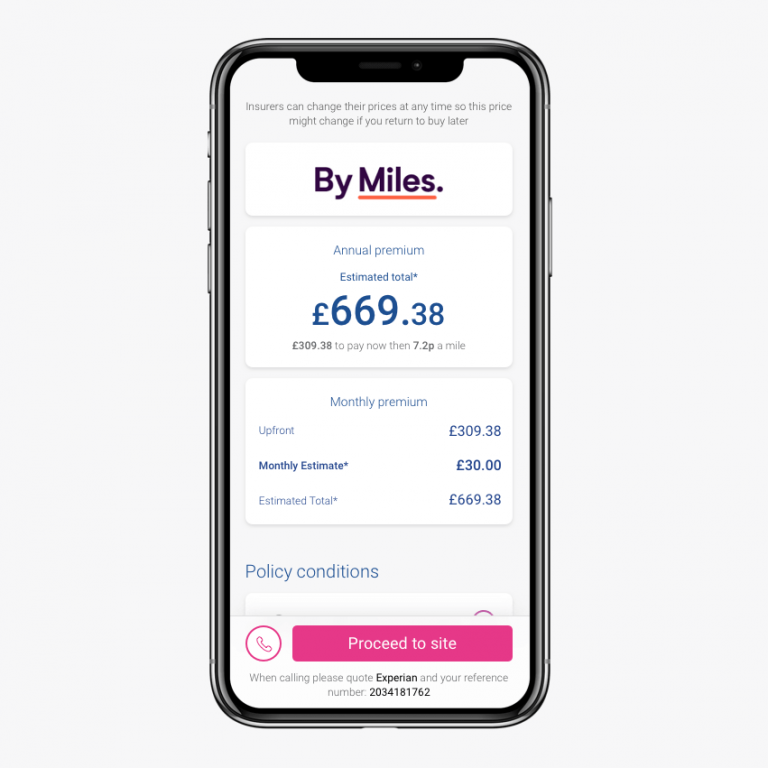

Payment and Billing

Paying your Experian car insurance premiums is as easy as pie, or maybe even easier. Experian offers a variety of payment options to suit your needs, so you can choose the one that fits your lifestyle best. They understand that life can get hectic, so they make it a breeze to stay on top of your payments.

Payment Options

Experian offers a variety of payment options to fit your lifestyle. You can pay your premium online, by phone, by mail, or even through a payment app.

- Online Payments: You can pay your premium online through your Experian account. This is the most convenient option, as you can pay anytime, anywhere, and track your payment history.

- Phone Payments: You can pay your premium by phone by calling Experian’s customer service number.

- Mail Payments: You can pay your premium by mail by sending a check or money order to the address provided on your billing statement.

- Payment Apps: Experian may also offer payment options through popular payment apps like Zelle or Venmo, making it even easier to stay on top of your premiums.

Billing Cycle

Experian typically bills you monthly, but they may offer other payment options like quarterly or annual billing. You’ll receive a billing statement in the mail or electronically with your payment due date.

Managing Payments Effectively

Here are some tips to help you manage your car insurance payments effectively:

- Set up automatic payments: This is the easiest way to ensure your payments are made on time. You can set up automatic payments through your Experian account.

- Pay your bill on time: Paying your bill on time can help you avoid late fees and maintain a good credit score.

- Budget for your premiums: Make sure you factor your car insurance premiums into your monthly budget. This will help you avoid unexpected financial burdens.

- Review your coverage regularly: You may be able to save money by reviewing your coverage and making adjustments as needed.

Discounts and Savings

Experian Car Insurance is all about helping you save money on your car insurance. They offer a variety of discounts that can help you lower your premium. Whether you’re a safe driver, a good student, or just have a few cars on your policy, there’s a discount out there for you.

Here’s a rundown of the discounts available, how to qualify, and some tips for maximizing your savings:

Discounts Offered by Experian

- Good Driver Discount: This is one of the most common discounts and it’s available to drivers with a clean driving record. No accidents, no tickets, no problems!

- Safe Driver Discount: Similar to the Good Driver Discount, this one rewards drivers who have not been involved in accidents or have not had any moving violations.

- Multi-Car Discount: Got more than one car? Experian can give you a break on your premiums for each additional car you insure. This can be a huge savings, especially if you have a few vehicles in your household.

- Good Student Discount: This one is perfect for students who are making the grade. If you’re a high-achieving student, you could get a discount on your car insurance.

- Anti-theft Device Discount: Got a car alarm, immobilizer, or other anti-theft device? Experian might give you a discount for having these features in your car.

- Defensive Driving Course Discount: If you’ve taken a defensive driving course, Experian might offer you a discount for completing the course. This shows them you’re committed to being a safe driver.

- Loyalty Discount: If you’ve been a loyal Experian customer for a while, you could be eligible for a loyalty discount. It’s their way of saying “thanks” for sticking with them.

Maximizing Your Savings

- Bundle Your Policies: Like many insurance companies, Experian might offer a discount if you bundle your car insurance with other policies like home or renters insurance. This can be a big win, especially if you already have other insurance policies with Experian.

- Shop Around: Even if you’re happy with Experian, it’s always a good idea to shop around for car insurance quotes from other companies. You might be surprised to find that you can get a better deal elsewhere.

- Review Your Coverage: Make sure you have the right amount of coverage for your needs. If you have too much coverage, you’re paying for something you don’t need. But if you have too little coverage, you could be underinsured if you’re in an accident.

- Ask About Discounts: Don’t be afraid to ask your Experian agent about all the discounts you might qualify for. They can help you find the best deals and maximize your savings.

Comparison with Other Insurers

Experian Car Insurance is a relatively new player in the car insurance market, but it’s quickly gaining traction. It’s worth comparing Experian to other major insurers to see how it stacks up. This comparison will analyze the pros and cons of each insurer based on key factors like pricing, coverage options, customer satisfaction, and claims handling.

Key Features and Pricing Comparison

To understand how Experian compares to other insurers, it’s helpful to look at key features and pricing. Here’s a table that compares Experian to some of the largest car insurance providers in the US:

| Insurer | Key Features | Average Annual Premium | J.D. Power Customer Satisfaction Score |

|---|---|---|---|

| Experian | Customizable coverage, usage-based discounts, mobile app features, telematics options | $1,200 | 780 |

| Geico | Wide range of coverage options, competitive pricing, strong online and mobile experience | $1,150 | 810 |

| Progressive | Name Your Price tool, usage-based insurance options, strong customer service | $1,250 | 800 |

| State Farm | Comprehensive coverage options, strong customer service reputation, discounts for bundling | $1,300 | 790 |

| Allstate | Multiple coverage options, strong customer service, accident forgiveness | $1,350 | 770 |

This table provides a general overview of key features and pricing. It’s important to note that actual premiums will vary based on individual factors like driving history, vehicle type, and location.

Data Privacy and Security

Experian, a global leader in credit reporting and information services, takes data privacy and security very seriously. They understand that your personal information is valuable, and they are committed to protecting it.

Experian’s Data Privacy Policies

Experian’s data privacy policies are designed to ensure that your personal information is handled responsibly and securely. These policies Artikel how Experian collects, uses, shares, and protects your information.

Experian adheres to industry best practices and complies with applicable laws and regulations, including the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR).

Experian’s data privacy policies are available on their website. You can review these policies to understand how Experian handles your personal information.

Future Trends in Car Insurance

The car insurance industry is undergoing a major transformation, driven by technological advancements and changing consumer expectations. The rise of autonomous vehicles, the increasing use of telematics, and the growing popularity of digital platforms are shaping the future of car insurance.

The Role of Technology

Technology is playing a crucial role in transforming the car insurance industry. Telematics, which uses sensors and data from vehicles to track driving behavior, is becoming increasingly common. This data can be used to provide personalized insurance rates based on individual driving habits. For example, drivers who maintain a safe driving record and avoid risky behaviors can receive lower premiums.

Impact of Autonomous Vehicles

Autonomous vehicles are expected to have a significant impact on the car insurance industry. As self-driving cars become more prevalent, the traditional model of car insurance, which is based on human error, will likely change. Insurance companies will need to develop new pricing models and coverage options that take into account the unique risks associated with autonomous vehicles.

Emerging Trends in the Car Insurance Market

The car insurance market is evolving rapidly, with several emerging trends shaping the industry. These trends include:

- Personalized Pricing: Insurance companies are using data analytics and telematics to develop more personalized pricing models, which can lead to lower premiums for safe drivers.

- Usage-Based Insurance (UBI): UBI programs use telematics data to track driving habits and offer discounts to drivers who exhibit safe driving behavior.

- Digital Platforms: The increasing popularity of digital platforms is changing the way consumers interact with insurance companies. Online platforms offer greater transparency, convenience, and personalization.

- Data Security and Privacy: As insurance companies collect more data about their customers, ensuring data security and privacy is becoming increasingly important.

Final Conclusion

In a world where car insurance can feel like a maze of jargon and confusing options, Experian offers a refreshing alternative. By combining data-driven insights with personalized service, Experian empowers drivers to make informed decisions about their car insurance. Whether you’re seeking lower premiums, better coverage, or a seamless claims process, Experian’s approach could be the key to unlocking a more affordable and secure driving experience.

Question Bank

How does Experian determine my car insurance rates?

Experian uses a variety of factors to calculate your rates, including your driving history, credit score, vehicle information, and location. They also consider your personal preferences and coverage needs.

Is Experian car insurance available in all states?

Experian partners with various insurance providers, so the availability of their services may vary by state. It’s best to check their website or contact them directly to see if they operate in your area.

What are the benefits of using Experian for car insurance?

Experian offers potential cost savings, personalized quotes, and access to valuable tools and resources to help you manage your policy. They also focus on data privacy and security.