Low car insurance rates are the holy grail for any driver, especially when gas prices are through the roof! But how do you score a sweet deal on your premiums? It’s all about understanding the factors that influence your rates, from your driving history to your credit score. This guide breaks down the secrets to getting the best possible car insurance rates, so you can hit the road with peace of mind and a lighter wallet.

We’ll dive into the nitty-gritty of car insurance, exploring everything from comparing quotes to understanding the impact of your driving record. We’ll also cover some savvy strategies for lowering your costs, like increasing your deductible or exploring discounts. Buckle up, because this is a ride you don’t want to miss!

Strategies for Lowering Insurance Costs

Lowering your car insurance costs is a common goal for many drivers. There are a number of strategies you can implement to potentially reduce your premiums. Here’s a breakdown of some effective methods:

Increasing Your Deductible

Raising your deductible, the amount you pay out-of-pocket before your insurance kicks in, can lead to lower premiums. This is because you’re essentially taking on more financial responsibility for smaller claims, which reduces the insurer’s risk.

For example, if you increase your deductible from $500 to $1000, you could potentially save 15-20% on your premium.

However, it’s crucial to weigh this against your financial capacity. Ensure you can afford the higher deductible in case of an accident.

Improving Your Driving Record

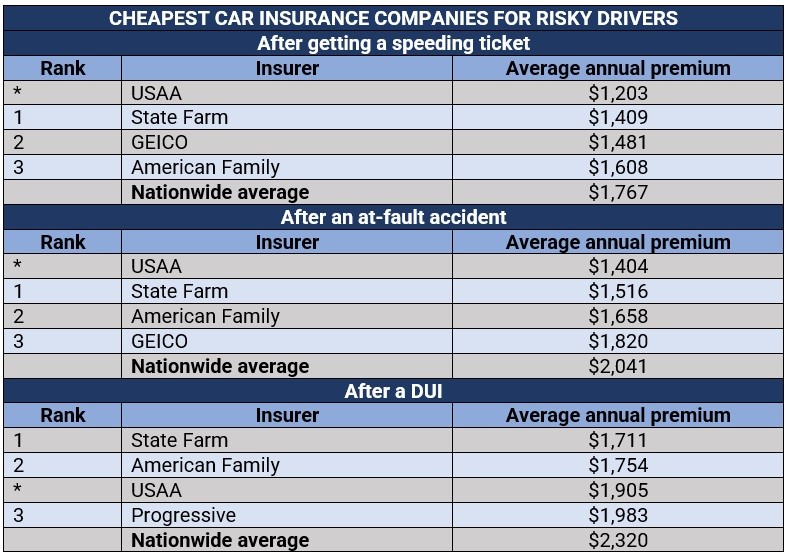

A clean driving record is a significant factor in determining your insurance rates. By taking steps to avoid accidents and traffic violations, you can significantly reduce your premiums.

Here are some tips to improve your driving record:

- Drive defensively: Pay attention to your surroundings, anticipate potential hazards, and maintain a safe distance from other vehicles.

- Avoid distractions: Put away your phone, refrain from eating or drinking while driving, and minimize distractions from passengers.

- Take defensive driving courses: These courses can enhance your driving skills and knowledge, potentially lowering your insurance rates.

- Maintain a safe speed: Adhere to posted speed limits and avoid excessive speeding.

Reducing Your Risk of Accidents and Theft

Taking proactive measures to minimize your risk of accidents and theft can also lead to lower insurance premiums.

Here are some strategies:

- Park in safe locations: Avoid parking in poorly lit or isolated areas. Choose well-lit and secure parking spots.

- Install security systems: Consider installing an alarm system, GPS tracker, or anti-theft devices in your car.

- Maintain your vehicle: Regular maintenance, including tire checks, oil changes, and brake inspections, can help prevent accidents.

- Drive during off-peak hours: Traffic congestion increases the risk of accidents. Try to avoid driving during rush hour or peak traffic times.

Car Insurance Coverage and Its Impact on Rates

Car insurance coverage is essential for protecting yourself financially in the event of an accident. Different types of coverage provide different levels of protection, and choosing the right coverage can significantly impact your insurance rates.

Understanding Different Types of Coverage

The different types of coverage you can purchase are:

- Liability Coverage: This is the most basic type of car insurance and is required by law in most states. It covers damages to other people’s property or injuries to others if you are at fault in an accident. Liability coverage is usually expressed as a per-person limit and a per-accident limit. For example, 25/50/10 means you have up to $25,000 in coverage for injuries to one person, up to $50,000 in coverage for injuries to all people involved in an accident, and up to $10,000 in coverage for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your car if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for damage to your car caused by events other than a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are hit by a driver who does not have insurance or does not have enough insurance to cover your damages.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Personal Injury Protection (PIP): This coverage is similar to Med Pay, but it also covers lost wages and other expenses.

State-Specific Considerations for Car Insurance Rates: Low Car Insurance Rates

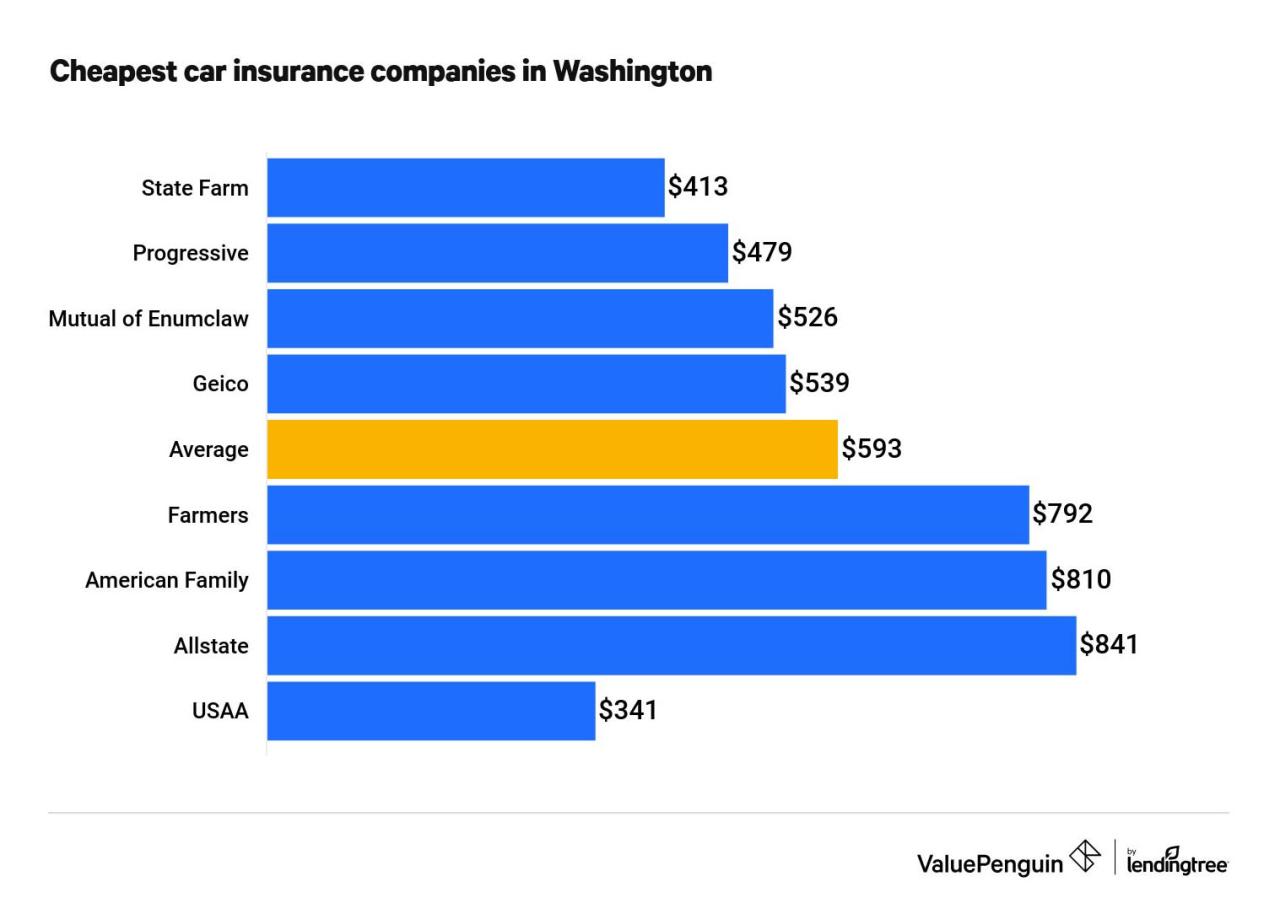

Car insurance rates aren’t a one-size-fits-all deal. They vary wildly depending on where you live, and that’s because state regulations, local driving conditions, and unique programs all play a part. Let’s dive into the world of state-specific car insurance factors.

State Regulations Influence Car Insurance Premiums, Low car insurance rates

Each state has its own set of rules about what car insurance companies must offer and how they can set their prices. These regulations can significantly impact your premiums. For example, some states require drivers to carry higher minimum liability coverage limits, which can result in higher premiums. Other states might have regulations that encourage insurers to offer discounts for things like good driving records or safety features, which can help lower premiums.

Local Driving Conditions Impact Insurance Rates

Where you live can have a big impact on your car insurance rates. States with high rates of accidents, theft, or natural disasters tend to have higher average insurance premiums. This is because insurance companies have to pay out more claims in these areas, so they need to charge higher premiums to cover their costs.

State-Specific Programs Offer Discounts or Assistance

Some states have programs designed to help drivers save money on car insurance or make coverage more accessible. These programs can include:

- Low-cost auto insurance programs: These programs offer affordable car insurance to low-income drivers. They might have lower premiums, fewer requirements, or other benefits.

- Discounts for safety features: Some states offer discounts for drivers who have cars with safety features like anti-theft devices, airbags, or anti-lock brakes. These discounts can help encourage drivers to invest in safety features and reduce the number of accidents.

- Discounts for good driving records: Many states offer discounts to drivers with clean driving records. This can help reward safe drivers and encourage them to continue driving safely.

Conclusion

So, there you have it! Armed with this knowledge, you can conquer the car insurance jungle and find a policy that fits your budget and your driving needs. Remember, it’s all about being smart and proactive. Shop around, compare quotes, and don’t be afraid to negotiate. With a little effort, you can score low car insurance rates and cruise into a brighter financial future.

FAQ Insights

How often should I review my car insurance rates?

It’s a good idea to review your car insurance rates at least once a year, or even more frequently if you’ve experienced any major life changes like getting married, moving, or buying a new car. Your rates could be affected by these changes.

Can I get a discount for having multiple cars insured with the same company?

Yes! Many insurance companies offer multi-car discounts for insuring two or more vehicles under the same policy. It’s definitely worth asking about.

What if I have a clean driving record but my credit score is low?

While a good credit score can lead to lower insurance rates, some states don’t allow insurers to use credit history in their rate calculations. It’s always best to check with your state’s insurance regulations to see what applies to you.

What’s good, my friend? I’m thrilled and incredibly grateful we could spend this quality time together.

This seems like a great addition for your website Ferrous metal baling

Have a wonderful day, and goodbye