- Understanding Oregon Car Insurance Requirements

- Factors Affecting Car Insurance Costs in Oregon

- Finding the Cheapest Car Insurance Options in Oregon

- Discounts and Savings on Car Insurance in Oregon: Cheapest Car Insurance Oregon

- Tips for Lowering Your Car Insurance Costs in Oregon

- Understanding Oregon’s Insurance Marketplace

- Final Summary

- Expert Answers

Cheapest car insurance Oregon? You betcha! Navigating the world of car insurance can feel like a wild ride, especially in a state like Oregon, known for its scenic drives and sometimes unpredictable weather. But don’t worry, finding the best deals doesn’t have to be a drag. This guide will help you unlock the secrets to getting the most bang for your buck, making sure you’re covered without breaking the bank.

From understanding Oregon’s car insurance requirements to uncovering hidden discounts, we’ll equip you with the knowledge to find the perfect policy for your needs. So buckle up and let’s hit the road to savings!

Understanding Oregon Car Insurance Requirements

Oregon law requires all drivers to have car insurance. This means that you must have proof of insurance in your car at all times. Not having insurance can lead to fines and penalties, so it’s important to understand what’s required.

Oregon’s Minimum Liability Coverage Limits

Oregon requires drivers to carry a minimum amount of liability insurance. This coverage protects you financially if you cause an accident that injures someone or damages their property. The minimum liability limits in Oregon are:

* Bodily Injury Liability: $25,000 per person, $50,000 per accident

* Property Damage Liability: $20,000 per accident

Penalties for Driving Without Insurance

If you’re caught driving without insurance in Oregon, you could face several penalties, including:

- Fines of up to $1,000

- Suspension of your driver’s license

- Impoundment of your vehicle

- Possible jail time

In addition to these penalties, you’ll also be responsible for any damages or injuries you cause in an accident. This could include medical bills, property damage, and lost wages.

Factors Affecting Car Insurance Costs in Oregon

In Oregon, as in most states, a variety of factors determine your car insurance premiums. Understanding these factors can help you make informed decisions that could potentially lower your costs. Here are some key factors that influence car insurance premiums in Oregon:

Age

Your age plays a significant role in determining your car insurance premiums. Younger drivers, especially those under 25, tend to have higher premiums due to their lack of experience and higher risk of accidents. As you gain experience and reach a certain age, your premiums typically decrease. This is because insurance companies generally view older drivers as having a lower risk of accidents.

Driving History

Your driving history is another critical factor influencing your car insurance premiums. A clean driving record with no accidents, tickets, or violations will generally result in lower premiums. However, if you have a history of accidents, traffic violations, or driving under the influence (DUI), your premiums will likely increase.

Vehicle Type

The type of vehicle you drive also plays a role in determining your car insurance premiums. Sports cars, luxury vehicles, and high-performance vehicles are generally considered more expensive to repair and replace, resulting in higher premiums. On the other hand, smaller, less expensive vehicles typically have lower premiums.

Location

Your location in Oregon can also affect your car insurance premiums. Areas with higher crime rates, traffic congestion, or a higher number of accidents tend to have higher insurance premiums.

Other Factors

Other factors that can influence your car insurance premiums include:

- Credit Score: Your credit score can be a factor in determining your insurance premiums in some states, including Oregon. A good credit score can often lead to lower premiums.

- Coverage Levels: The amount of coverage you choose, such as liability, collision, and comprehensive, can impact your premiums. Higher coverage levels generally mean higher premiums.

- Deductibles: Your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can also influence your premiums. A higher deductible typically means lower premiums.

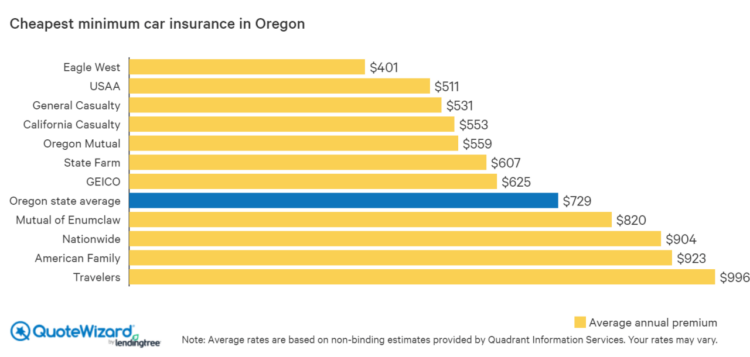

Finding the Cheapest Car Insurance Options in Oregon

Finding the cheapest car insurance in Oregon can be a challenge, but with a little effort, you can find a policy that fits your budget. It’s crucial to understand that the cheapest option might not always be the best, and you should prioritize coverage that protects you and your assets.

Comparing Quotes from Multiple Insurance Companies

Comparing quotes from multiple insurance companies is essential to finding the cheapest car insurance in Oregon. This allows you to see the different rates offered by various providers and find the most affordable option.

- Use online comparison tools: Many websites allow you to compare quotes from multiple insurers simultaneously. These tools streamline the process and help you quickly identify the best deals.

- Contact insurers directly: While online tools are convenient, contacting insurance companies directly can provide more personalized quotes. This allows you to discuss specific needs and potentially negotiate better rates.

- Don’t be afraid to haggle: Once you have quotes from multiple companies, don’t hesitate to negotiate. You may be able to get a better rate by discussing your driving record, previous insurance history, and any safety features in your car.

Reputable Car Insurance Providers in Oregon

Several reputable car insurance providers operate in Oregon, offering competitive rates and reliable coverage.

- GEICO: Known for its affordable rates and extensive coverage options, GEICO is a popular choice for Oregon drivers.

- State Farm: One of the largest insurance companies in the United States, State Farm provides comprehensive coverage and excellent customer service.

- Progressive: Progressive offers a variety of discounts and personalized insurance options, making it a good choice for drivers with unique needs.

- Farmers Insurance: Farmers Insurance is a reputable provider known for its strong financial stability and commitment to customer satisfaction.

- Allstate: Allstate offers a range of coverage options and a strong reputation for handling claims efficiently.

Remember, the cheapest car insurance option might not always be the best. Consider your individual needs and choose a policy that provides adequate coverage for your situation.

Discounts and Savings on Car Insurance in Oregon: Cheapest Car Insurance Oregon

Oregon car insurance companies are known for offering a variety of discounts to help drivers save money. These discounts can significantly reduce your premiums, making it even more important to shop around and compare quotes.

Discounts Offered by Car Insurance Companies

Oregon car insurance companies offer a range of discounts to help drivers save money. These discounts are designed to reward safe driving habits, responsible behavior, and smart choices.

- Safe Driver Discounts: Rewarding safe driving habits is a priority for insurance companies. These discounts can be substantial, and they vary depending on the insurance company and your driving record.

- Good Student Discounts: Students with good grades often qualify for discounts because they are perceived as less risky drivers. Insurance companies believe that good students are more responsible and likely to make safe choices behind the wheel.

- Multi-Policy Discounts: Bundle your car insurance with other policies, such as homeowners or renters insurance, and you could save even more. Insurance companies often offer discounts for bundling multiple policies, making it a smart move for those seeking to maximize their savings.

Qualifying for Discounts

To qualify for these discounts, you’ll need to meet certain criteria. These criteria can vary depending on the insurance company.

- Safe Driver Discounts: You’ll typically need a clean driving record, free of accidents or traffic violations, to qualify for a safe driver discount. The longer your driving history without incidents, the greater the discount you may receive.

- Good Student Discounts: Good student discounts often require a certain GPA or class rank. The specific requirements will vary depending on the insurance company, so it’s important to check with your provider.

- Multi-Policy Discounts: To qualify for a multi-policy discount, you’ll need to bundle your car insurance with other policies from the same insurance company. The discount can be applied to your car insurance premium as long as the bundled policies are active.

Maximizing Savings on Car Insurance Premiums

Here are some tips to maximize your savings on car insurance premiums in Oregon:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates. Don’t be afraid to switch providers if you find a better deal.

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is essential for keeping your premiums low. A clean driving record is a significant factor in determining your insurance rates.

- Consider a Higher Deductible: Choosing a higher deductible can lower your monthly premiums. However, you’ll be responsible for paying more out of pocket if you have an accident.

- Take Advantage of Discounts: Be sure to ask your insurance company about all the discounts you may qualify for. This could include safe driver discounts, good student discounts, and multi-policy discounts.

- Bundle Your Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can save you money.

Tips for Lowering Your Car Insurance Costs in Oregon

Want to keep your car insurance premiums from going off the rails? We’ve got some tips to help you save some dough.

Driving History and Credit Score Impact

Your driving record and credit score can play a big role in how much you pay for car insurance. Insurance companies use these factors to assess your risk as a driver.

- Driving Record: A clean driving record is your best friend when it comes to keeping premiums low. If you have a history of accidents or traffic violations, you’ll likely pay more. Keep your nose clean and drive responsibly to keep those insurance costs in check.

- Credit Score: It may seem weird, but your credit score can also impact your car insurance rates. Insurance companies use credit score as a proxy for financial responsibility. A higher credit score generally means lower insurance premiums.

Maintaining a Safe Driving Record

Staying safe on the road isn’t just about avoiding tickets; it’s about keeping your insurance costs in check.

- Defensive Driving: Take a defensive driving course to learn strategies for avoiding accidents and staying safe on the road. It’s like getting a crash course in safe driving, and it can even earn you a discount on your insurance.

- Avoid Distractions: Put the phone down, folks! Distracted driving is a major cause of accidents. Keep your eyes on the road and your hands on the wheel.

- Maintain Your Vehicle: Regular maintenance helps keep your car running smoothly and reduces the risk of breakdowns or accidents. It’s like giving your car a tune-up for safety and savings.

Improving Your Credit Score

Boosting your credit score can help you snag lower insurance premiums.

- Pay Bills on Time: Make sure you’re paying all your bills on time, especially your credit card bills. It’s like staying on top of your game financially, and it can help you score lower insurance rates.

- Keep Credit Utilization Low: Don’t max out your credit cards. Aim to keep your credit utilization (the amount of credit you’re using compared to your total credit limit) low. It’s like having a good credit score, which can help you save on car insurance.

- Check Your Credit Report: Make sure there are no errors on your credit report that could be dragging down your score. It’s like a credit score checkup, and it can help you improve your score and save on insurance.

Understanding Oregon’s Insurance Marketplace

Oregon’s insurance market is regulated by the Oregon Department of Insurance (DOI), which ensures fair practices and protects consumers. The DOI works to make sure that insurance companies operate responsibly and offer affordable coverage to Oregon residents.

Oregon Department of Insurance’s Role in Regulation

The Oregon Department of Insurance plays a crucial role in regulating the insurance industry in Oregon. It has several responsibilities, including:

- Licensing and overseeing insurance companies operating in Oregon.

- Ensuring that insurance companies comply with state laws and regulations.

- Investigating consumer complaints against insurance companies.

- Educating consumers about their rights and responsibilities related to insurance.

- Promoting a competitive and fair insurance market.

Consumer Protection Resources

The Oregon Department of Insurance provides a range of resources to help Oregon residents understand their insurance rights and navigate the insurance marketplace. These resources include:

- Online resources: The DOI website offers a wealth of information on insurance topics, including consumer guides, FAQs, and complaint forms. It also provides access to publications and reports on insurance issues.

- Telephone assistance: Consumers can call the DOI’s Consumer Services Division at 1-888-877-4877 to speak with a representative about insurance-related questions or concerns.

- In-person assistance: The DOI has offices located throughout Oregon where consumers can receive in-person assistance.

Filing a Complaint Against an Insurance Company, Cheapest car insurance oregon

If you have a complaint against an insurance company, you can file a complaint with the Oregon Department of Insurance. The DOI will investigate your complaint and attempt to resolve the issue.

To file a complaint, you can:

- File online: The DOI website offers an online complaint form that you can fill out and submit electronically.

- File by mail: You can download a complaint form from the DOI website and mail it to the following address:

Oregon Department of Insurance

Consumer Services Division

350 Winter Street NE

Salem, OR 97310 - File by phone: You can call the DOI’s Consumer Services Division at 1-888-877-4877 to file a complaint over the phone.

Final Summary

Finding the cheapest car insurance in Oregon doesn’t have to be a head-scratcher. By comparing quotes, taking advantage of discounts, and keeping a clean driving record, you can cruise confidently knowing you’ve got the best deal. So, go ahead and unleash your inner bargain hunter and hit the road with peace of mind! Remember, a little bit of research goes a long way, and you deserve to save some dough on your car insurance.

Expert Answers

What are the minimum car insurance requirements in Oregon?

Oregon requires drivers to have liability insurance, including bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. You’ll also need personal injury protection (PIP) and a minimum of $25,000 in coverage for each person injured and $50,000 per accident. Failure to have insurance can result in hefty fines and even suspension of your license.

What factors influence car insurance costs in Oregon?

Several factors can affect your car insurance premiums, including your age, driving history, the type of vehicle you drive, your location, and your credit score. For example, younger drivers or those with a history of accidents or traffic violations generally pay higher premiums. Living in an urban area with a higher risk of accidents can also lead to higher rates.

How can I lower my car insurance costs?

There are plenty of ways to save on your car insurance! Consider bundling your car insurance with other policies, such as homeowners or renters insurance. Taking a defensive driving course can also lower your premiums, and maintaining a good driving record is crucial. And don’t forget about those sweet discounts – ask your insurance company about discounts for good students, safe drivers, and more!