How to insure a car is a question that pops up for everyone when they get behind the wheel. It’s not just about the law, it’s about protecting yourself and your ride from the unexpected. Whether you’re a seasoned driver or just starting out, understanding car insurance is key to hitting the road with confidence.

From the different types of coverage to finding the best rates, this guide will break down everything you need to know about car insurance. We’ll cover the basics, like liability and collision, and dive into some less-known aspects, like how your credit score can impact your premiums. So buckle up, it’s time to get insured!

Choosing the Right Coverage

Choosing the right car insurance coverage is like choosing the right outfit for a big night out – you want to be protected, but you also don’t want to overspend. It’s all about finding the sweet spot where you feel comfortable and confident.

Liability Coverage

Liability coverage is your safety net in case you cause an accident. Think of it like your personal bodyguard – it protects you financially from the other driver’s injuries, property damage, and legal fees. The minimum liability coverage required by your state is usually the bare minimum, so consider increasing your limits if you can afford it. Imagine you’re in a fender bender, and the other driver has serious injuries. You could be on the hook for thousands, even millions, of dollars in medical bills and lost wages. Liability coverage protects you from this financial nightmare.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are like your car’s personal insurance policy. They protect you from damage to your own vehicle, regardless of who’s at fault. Collision coverage helps pay for repairs or replacement if you’re in an accident, even if it’s your fault. Comprehensive coverage protects you from damage caused by things like theft, vandalism, natural disasters, or even falling objects.

These coverages are optional, but they can be super helpful if you have a new or expensive car. However, if your car is older and you have a limited budget, you might be able to skip these coverages and rely on your savings to cover repairs.

Here’s a table to compare and contrast the two:

| Coverage | Benefits | Drawbacks |

|---|---|---|

| Collision | Pays for repairs or replacement of your car if you’re in an accident, regardless of fault. | You’ll pay a deductible for each claim. |

| Comprehensive | Covers damage to your car from non-collision events like theft, vandalism, or natural disasters. | You’ll pay a deductible for each claim. |

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is like your backup plan in case you get hit by a driver who doesn’t have enough insurance or no insurance at all. It protects you from the financial burden of their negligence. Think of it as a safety net that catches you when others drop the ball. It’s super important, especially in states with a high number of uninsured drivers.

For example, if you’re in an accident with a driver who has no insurance, your uninsured motorist coverage will help pay for your medical bills, lost wages, and property damage. This coverage can be a lifesaver, especially in situations where the other driver is financially irresponsible or simply can’t afford to cover the costs of the accident.

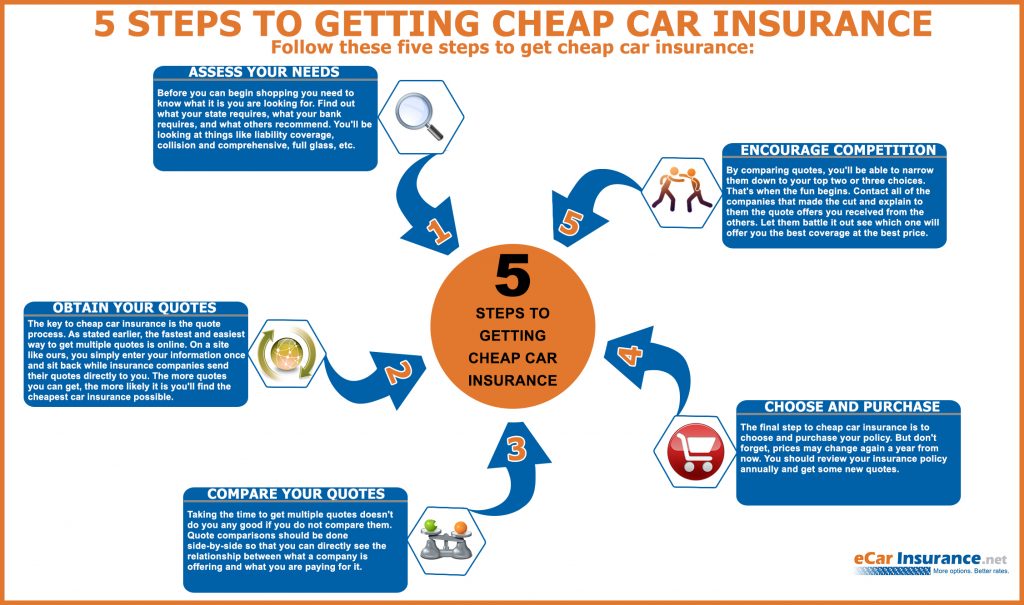

Getting the Best Rates

Alright, so you’ve figured out what kind of coverage you need, now it’s time to get the best price for it. Think of it like scoring a sweet deal on a new pair of kicks – you want to make sure you’re getting the most bang for your buck.

Discount Strategies

There are a bunch of ways to score discounts on your car insurance. It’s like having a secret code to unlock lower rates. Here’s the lowdown:

- Safe Driving Discounts: Insurance companies love safe drivers. If you’ve got a clean driving record, they’ll reward you with lower premiums. It’s like a pat on the back for being a good driver.

- Good Student Discounts: Brains over brawn! If you’re a good student, you might qualify for a discount. Insurance companies think good students are more responsible, and that translates to lower risks.

- Multi-Car Discounts: Insurance companies like it when you bundle your policies. If you insure multiple cars with the same company, you can get a discount. It’s like a loyalty bonus for sticking with them.

Lowering Your Premiums

Let’s talk about how to get those premiums down, because who doesn’t love saving money?

- Maintain a Good Driving Record: This is the big one. Avoid speeding tickets, accidents, and other driving violations. It’s like staying on the straight and narrow – the better your driving record, the lower your rates.

- Take Defensive Driving Courses: These courses can teach you how to be a safer driver, and insurance companies often give discounts to those who complete them. It’s like getting a degree in driving, and it can pay off big time.

- Bundle Insurance Policies: Combining your car insurance with other policies like home or renters insurance can save you money. It’s like getting a combo meal – you get more for less.

- Compare Quotes: Don’t just settle for the first quote you get. Shop around and compare prices from different insurance companies. It’s like trying on different pairs of shoes until you find the perfect fit.

Credit Score Impact

Hold up, did you know your credit score can impact your car insurance rates? It’s like a secret handshake that insurance companies use to assess your risk. A higher credit score generally means lower rates.

- Improve Your Credit Score: If your credit score isn’t so hot, there are ways to improve it. Pay your bills on time, keep your credit card balances low, and avoid opening too many new accounts. It’s like building your credit muscle – the stronger it is, the better your rates.

Beyond the Basics

Think of your car insurance as a safety net, catching you when things go wrong. But just like any safety net, the basic coverage might not be enough for every situation. That’s where additional coverage options come in, offering peace of mind and protection beyond the standard.

Additional Coverage Options

These additional coverage options can provide valuable protection and peace of mind, ensuring you’re covered in a wider range of scenarios.

- Rental Car Reimbursement: If your car is damaged or stolen and you need a rental car, this coverage can help pay for the rental costs.

- Roadside Assistance: This coverage can provide assistance for things like flat tires, dead batteries, and lockouts. It can also cover towing costs, saving you money and hassle in an emergency.

- Gap Insurance: This coverage helps pay the difference between the actual cash value of your car and the amount you owe on your loan or lease if your car is totaled or stolen. This can be especially helpful if you have a newer car or have financed a significant portion of the purchase price.

Car Insurance Brokers, How to insure a car

Navigating the world of car insurance can feel like a maze, especially when trying to find the best policy for your needs. This is where car insurance brokers can be your guide, helping you find the right coverage at the right price.

- Independent Expertise: Brokers work with multiple insurance companies, giving you access to a wider range of options and potentially better rates.

- Personalized Guidance: Brokers can take the time to understand your specific needs and recommend the best policy for you.

- Negotiation Power: Brokers often have leverage with insurance companies, which can help you secure better rates and terms.

Technology and Car Insurance

Technology is transforming the car insurance landscape, offering new ways to assess risk and provide personalized coverage.

- Telematics: This technology uses devices installed in your car to track your driving habits, such as speed, braking, and mileage. This data can be used to determine your insurance rates, rewarding safe drivers with lower premiums.

- Usage-Based Insurance (UBI): UBI programs use telematics data to calculate your premiums based on your actual driving behavior. This allows you to potentially save money if you’re a safe and responsible driver.

Final Wrap-Up: How To Insure A Car

Getting the right car insurance can be a game-changer. By understanding your options, comparing quotes, and taking advantage of discounts, you can find a policy that fits your needs and your budget. Remember, knowledge is power, and knowing how to insure your car can put you in the driver’s seat when it comes to financial protection and peace of mind.

FAQ Section

What is a deductible?

Your deductible is the amount of money you pay out-of-pocket before your insurance kicks in to cover the rest of the costs of an accident or other covered event.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least once a year, or even more often if your driving habits or financial situation change. You may be able to get better rates or find additional coverage options that you didn’t know about before.

What happens if I get into an accident and don’t have car insurance?

Driving without car insurance is illegal in most states. If you get into an accident without insurance, you could face hefty fines, license suspension, and even jail time. You’ll also be responsible for all of the costs associated with the accident, including repairs, medical bills, and legal fees.