Car insurance phone number – those digits are your secret weapon when life throws you a curveball on the road. Whether it’s a fender bender, a flat tire, or a need for roadside assistance, having that number handy is like having a superhero on speed dial. It’s your lifeline to peace of mind and a quick solution to any automotive dilemma.

Imagine this: you’re cruising down the highway, enjoying the open road, when suddenly – BAM! – you get into an accident. Panic sets in, but then you remember that little piece of paper tucked away in your glove compartment – your car insurance phone number. With a few quick dials, you’re connected to a friendly voice ready to guide you through the next steps. From filing a claim to arranging for a tow truck, your insurance provider becomes your rock, helping you navigate the chaos and get back on track.

Utilizing Car Insurance Phone Numbers

Sometimes, you need to talk to a real person about your car insurance. Maybe you got in a fender bender, or maybe you just want to get a quote for a new car. Whatever the reason, your car insurance company’s phone number is your lifeline to getting the help you need.

Contacting Your Insurance Provider

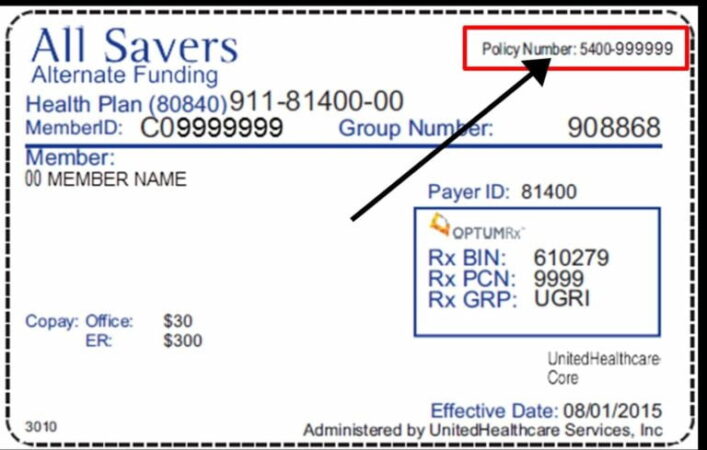

It’s pretty simple to reach your insurance provider by phone. You’ll usually find their number on your insurance card or on their website. When you call, you’ll likely be greeted by an automated system that will ask you for your policy number or other identifying information.

After that, you’ll be connected to a customer service representative. This is your chance to get your questions answered and resolve any issues you may have.

Tips for Effective Communication

Here are some tips for making sure your phone call goes smoothly:

- Have your policy number handy. This will help the representative quickly locate your account and answer your questions efficiently.

- Be clear and concise about your reason for calling. The more information you provide upfront, the faster you’ll get the help you need.

- Stay calm and polite, even if you’re frustrated. This will make it easier for the representative to help you.

- Take notes. This will help you remember important information, such as claim numbers or deadlines.

Types of Calls You Might Make

Here are some of the most common reasons why people call their car insurance company:

- Reporting an accident: If you’ve been in an accident, you’ll need to report it to your insurance company as soon as possible. This will help them start the claims process and ensure you receive the coverage you need.

- Requesting a quote: If you’re shopping around for car insurance, you can call your insurance company to get a quote for a new policy. This will help you compare prices and coverage options.

- Making a payment: You can usually make a payment over the phone by providing your credit card information.

- Changing your policy: If you need to make changes to your policy, such as adding a new driver or changing your coverage, you can call your insurance company to do so.

- Asking questions: If you have any questions about your policy or coverage, you can always call your insurance company for assistance.

Benefits of Car Insurance Phone Numbers

In today’s fast-paced world, having quick and reliable access to your car insurance provider is essential. Car insurance phone numbers offer a direct line to your insurance company, providing numerous advantages that can make a significant difference when you need them most.

Convenience and Accessibility

Car insurance phone numbers offer unparalleled convenience and accessibility. They allow you to connect with your insurance provider anytime, anywhere, from the comfort of your own home or while on the go. This eliminates the need for lengthy wait times at insurance offices or navigating complex online portals.

- 24/7 Availability: Many insurance companies offer 24/7 phone support, ensuring you can reach them whenever you need assistance, whether it’s a late-night accident or a question about your policy.

- Accessibility from Anywhere: You can call your insurance provider from any location with a phone signal, whether you’re at home, work, or traveling. This flexibility is particularly helpful in emergencies when you may be away from your usual location.

Speed and Efficiency

When you need to file a claim, report an accident, or make changes to your policy, calling your insurance provider directly is often the fastest and most efficient way to get things done.

- Quick Claim Processing: Calling your insurance provider allows you to start the claim process immediately, saving you time and hassle.

- Direct Communication: You can get answers to your questions directly from a representative, eliminating the need for email exchanges or waiting for responses.

Emergency Support, Car insurance phone number

Car insurance phone numbers are invaluable in emergencies. They provide a direct line to your insurance provider when you need immediate assistance.

- Accident Reporting: In the event of an accident, you can call your insurance provider to report the incident, get guidance on next steps, and receive support.

- Roadside Assistance: Many insurance companies offer roadside assistance as part of their policy, and you can reach them via phone to request assistance in situations like flat tires, dead batteries, or lockouts.

Personalized Service

While online resources and automated systems can be helpful, sometimes you need the personalized touch of a human representative.

- Expert Advice: Insurance agents can provide personalized advice and guidance on your policy, helping you make informed decisions about coverage and options.

- Problem Solving: They can assist you with complex issues, such as resolving disputes or navigating unexpected situations.

Additional Resources and Information

In addition to readily available phone numbers, several other resources can help you navigate the world of car insurance.

Major Car Insurance Providers

This table lists the websites of some of the largest car insurance providers in the United States, allowing you to easily compare coverage options and get quotes.

| Provider | Website |

|---|---|

| State Farm | https://www.statefarm.com/ |

| Geico | https://www.geico.com/ |

| Progressive | https://www.progressive.com/ |

| Allstate | https://www.allstate.com/ |

| Liberty Mutual | https://www.libertymutual.com/ |

Guidance on Navigating Insurance Claims and Procedures

These resources offer valuable insights and guidance on navigating the process of filing and managing car insurance claims:

- The National Association of Insurance Commissioners (NAIC): This organization provides information on insurance regulations and consumer rights. Their website offers resources for understanding insurance claims and dispute resolution processes. https://www.naic.org/

- The Insurance Information Institute (III): The III is a non-profit organization dedicated to providing consumer education on insurance-related matters. Their website features a wealth of information on car insurance, including tips on filing claims and understanding policy terms. https://www.iii.org/

- Your State Insurance Department: Each state has an insurance department that regulates insurance companies and protects consumer rights. You can find contact information for your state’s insurance department online. https://www.naic.org/documents/state_web_sites.htm

Alternative Contact Methods

While phone numbers remain a primary point of contact for car insurance providers, many offer alternative methods for communication, including:

- Email: Most insurers have dedicated email addresses for customer service and claims inquiries. This allows for asynchronous communication, providing a written record of interactions.

- Live Chat: Some insurance companies offer live chat features on their websites, allowing you to connect with customer service representatives in real-time. This can be a convenient option for quick questions or inquiries.

- Social Media: Many insurers maintain active social media presences on platforms like Facebook, Twitter, and Instagram. These channels can be used to contact customer service, get updates on claims, or find general information.

Summary

So, keep your car insurance phone number close at hand, whether it’s in your wallet, your glove compartment, or even memorized. It’s your secret weapon for navigating the unexpected twists and turns of the road. Because when things go sideways, having that number ready can make all the difference in turning a stressful situation into a smooth and successful resolution.

Question Bank

What if I lose my car insurance card?

Don’t panic! Most insurance companies have online portals or apps where you can access your policy information, including the phone number. You can also contact your insurance agent directly.

Can I use my car insurance phone number for anything besides accidents?

Absolutely! You can use it for a variety of reasons, such as getting a quote, making changes to your policy, or asking questions about your coverage. It’s your direct line to your insurance provider.

What if I need to call my insurance company after hours?

Most insurance companies have 24/7 customer service lines. You can usually find the number on your insurance card or on their website.