American car insurance in Canada presents a unique set of challenges for travelers. While the basic principles of car insurance remain the same, differences in coverage, legal requirements, and even the cost of insurance can be significant. This guide aims to provide a comprehensive overview of the key considerations for Americans driving in Canada, helping you navigate the complexities of finding the right insurance and ensuring a smooth and safe journey.

Understanding the nuances of Canadian car insurance is crucial for Americans planning a road trip. Whether you’re visiting for a short vacation or relocating permanently, it’s essential to be aware of the differences in coverage options, legal requirements, and the potential impact on your driving experience. This guide will break down the key factors to consider, from choosing the right insurance provider to understanding the essential coverage options and navigating the claims process.

Understanding American Car Insurance in Canada

Navigating the world of car insurance can be complex, especially when you’re an American driving in Canada. While the concept remains the same – protecting you and your vehicle against financial losses – there are significant differences to be aware of.

Unique Challenges Faced by Americans Driving in Canada

Driving in Canada with an American license and insurance presents a unique set of challenges. The most notable is the potential for insurance coverage gaps, which can leave you financially vulnerable in the event of an accident.

- Limited Coverage: Your American insurance may not cover you for accidents in Canada. Many policies have limited or no coverage outside the United States, requiring you to purchase additional insurance.

- Provincial Regulations: Each Canadian province has its own unique set of insurance regulations, which can differ significantly from US standards. These regulations can affect your coverage, the types of insurance required, and even the cost of your policy.

- Non-Standard Coverage: Certain types of coverage commonly available in the US, such as uninsured motorist coverage, might not be standard in Canada. This can leave you unprotected if you are involved in an accident with an uninsured driver.

Differences in Coverage Between American and Canadian Car Insurance Policies

The coverage offered by American and Canadian car insurance policies can differ significantly, affecting the level of protection you receive in the event of an accident.

- Liability Coverage: This coverage protects you from financial responsibility if you cause an accident. While the minimum liability coverage required in Canada is similar to the US, the maximum coverage limits may differ.

- Collision and Comprehensive Coverage: These coverages protect your vehicle against damage from accidents and other events, such as theft or vandalism. Canadian policies often include additional benefits, such as coverage for windshield damage or rental car reimbursement, which may not be standard in the US.

- Uninsured Motorist Coverage: This coverage protects you if you are involved in an accident with an uninsured or hit-and-run driver. While common in the US, this coverage may not be automatically included in Canadian policies.

Legal Requirements for Driving in Canada with an American License and Insurance

To drive legally in Canada with an American license, you must meet specific legal requirements.

- Valid Driver’s License: You must possess a valid driver’s license issued in your home state or province. However, it’s important to note that some provinces may have specific requirements regarding the duration of your license or the type of vehicle you can drive.

- Insurance: You are required to have valid car insurance that meets the minimum requirements of the province you are driving in. It is recommended to purchase a non-resident insurance policy that provides coverage for the duration of your stay in Canada.

- International Driving Permit (IDP): While not always required, an IDP can be helpful in some provinces as it translates your driver’s license into multiple languages.

Finding the Right Insurance Provider

Navigating the world of car insurance in Canada can be a bit daunting, especially for Americans. With so many providers and plans available, finding the right fit for your needs and budget can feel overwhelming. But don’t worry, this guide will help you navigate the process and make an informed decision.

Comparing Major Insurance Providers

Understanding the differences between the major insurance providers is crucial for making the right choice. Some popular options for Americans in Canada include:

- Desjardins Insurance: Known for its comprehensive coverage options and competitive pricing, Desjardins is a popular choice for Americans in Quebec and other parts of Canada. They offer a range of insurance products, including car insurance, home insurance, and life insurance.

- Intact Insurance: One of Canada’s largest insurers, Intact offers a wide range of coverage options, including specialized coverage for American drivers. They have a strong reputation for customer service and claim handling.

- TD Insurance: TD Insurance is a well-known brand with a strong presence across Canada. They offer competitive rates and a convenient online platform for managing your insurance.

Key Factors to Consider When Choosing an Insurance Provider

Several key factors should be considered when choosing an insurance provider, including:

- Coverage Options: The type of coverage you need will vary depending on your individual circumstances. For example, if you’re driving a newer vehicle, you might want to consider comprehensive and collision coverage. If you’re on a tight budget, you might opt for basic liability coverage.

- Pricing: Insurance premiums can vary significantly between providers. It’s essential to compare quotes from multiple providers to find the best value.

- Customer Service: Good customer service is essential, especially if you need to file a claim. Look for providers with a strong reputation for responsiveness and helpfulness.

Top 3 Insurance Providers Compared

Here’s a table comparing the top 3 insurance providers based on coverage, pricing, and customer satisfaction:

| Provider | Coverage Options | Pricing | Customer Satisfaction |

|---|---|---|---|

| Desjardins Insurance | Comprehensive | Competitive | High |

| Intact Insurance | Wide range | Competitive | High |

| TD Insurance | Competitive | Competitive | Average |

Essential Coverage Options

When driving in Canada with an American car insurance policy, it’s crucial to understand the essential coverage options available to you. These coverages protect you financially in the event of an accident or other incidents.

Liability Coverage, American car insurance in canada

Liability coverage is the most basic and essential type of car insurance. It protects you financially if you cause an accident that results in damage to another person’s property or injuries to another person.

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries caused to other people in an accident you are responsible for.

- Property Damage Liability: Covers damages to another person’s vehicle or property if you are at fault in an accident.

The minimum liability coverage requirements vary by province, so it’s essential to check the specific requirements for the province you’ll be driving in.

Collision Coverage

Collision coverage protects you financially if you are involved in an accident with another vehicle or object, regardless of who is at fault.

This coverage helps pay for repairs or replacement of your vehicle, minus your deductible.

It’s important to note that collision coverage is typically optional and may not be necessary if you have an older vehicle or can afford to pay for repairs out of pocket.

Comprehensive Coverage

Comprehensive coverage protects you financially from damage to your vehicle caused by events other than a collision, such as theft, vandalism, fire, or natural disasters.

Like collision coverage, comprehensive coverage is typically optional and may not be necessary if you have an older vehicle or can afford to pay for repairs out of pocket.

Uninsured Motorist Coverage

Uninsured motorist coverage protects you financially if you are injured in an accident caused by a driver who is uninsured or underinsured.

This coverage helps pay for medical expenses, lost wages, and pain and suffering. It also provides coverage for damage to your vehicle.

It’s important to note that uninsured motorist coverage is typically optional but highly recommended, especially when driving in a province with a high percentage of uninsured drivers.

Minimum Coverage Requirements by Province

| Province | Minimum Liability Coverage |

|---|---|

| Alberta | $200,000 |

| British Columbia | $200,000 |

| Manitoba | $200,000 |

| New Brunswick | $500,000 |

| Newfoundland and Labrador | $500,000 |

| Nova Scotia | $500,000 |

| Ontario | $200,000 |

| Prince Edward Island | $500,000 |

| Quebec | $50,000 |

| Saskatchewan | $200,000 |

| Yukon | $200,000 |

| Northwest Territories | $200,000 |

| Nunavut | $200,000 |

Remember that these are minimum requirements, and it’s always advisable to have higher coverage limits to protect yourself financially in case of a serious accident.

Ultimate Conclusion: American Car Insurance In Canada

Driving in Canada as an American requires careful planning and a thorough understanding of the local insurance landscape. By carefully considering your coverage needs, exploring the various insurance providers, and adhering to the local traffic laws, you can ensure a safe and enjoyable journey. Remember, being informed and prepared is the key to a smooth and hassle-free driving experience in Canada.

FAQ Resource

Is my American car insurance valid in Canada?

While your American car insurance may provide some basic coverage in Canada, it’s generally not sufficient to meet Canadian legal requirements. It’s highly recommended to obtain specific coverage for driving in Canada from a Canadian insurer.

Do I need a Canadian driver’s license to drive in Canada?

You can drive in Canada with a valid American driver’s license for a limited period. However, it’s important to check the specific regulations for each province as they may vary. If you plan to stay longer, you may need to obtain a Canadian driver’s license.

What are the minimum coverage requirements for driving in Canada?

The minimum coverage requirements vary by province. Generally, you’ll need liability insurance, which covers damages to other vehicles and injuries to other people in an accident. Some provinces may also require additional coverage, such as accident benefits or uninsured motorist coverage.

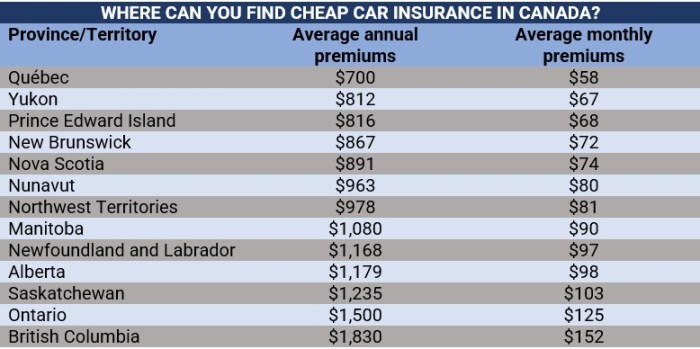

How can I reduce the cost of my car insurance in Canada?

Several factors can influence the cost of car insurance, including your age, driving history, vehicle type, and location. To potentially reduce your premiums, consider increasing your deductible, maintaining a good driving record, choosing a safe vehicle, and comparing quotes from different insurers.