Can illegal immigrants get car insurance in Texas? This question often arises for undocumented individuals seeking to drive legally and safely. Texas, like many states, has specific requirements for obtaining car insurance, and navigating these regulations can be challenging for those without legal status. This guide will explore the various aspects of car insurance accessibility for undocumented immigrants in Texas, examining the legal framework, available options, and financial considerations.

Understanding the complexities of insurance laws and finding affordable coverage is crucial for undocumented individuals who wish to drive legally. This guide will provide valuable insights and resources to help navigate these challenges, ensuring a safer and more secure driving experience for all Texans, regardless of immigration status.

Legal Status and Residency Requirements

In Texas, obtaining car insurance requires meeting specific legal status and residency requirements. These requirements ensure that individuals are properly identified and held accountable for their actions on the road.

Residency Requirements

To obtain car insurance in Texas, individuals must establish residency within the state. This means they must have a permanent address in Texas and intend to reside there permanently.

- Proof of residency can be provided through documents such as a driver’s license, utility bills, voter registration card, or lease agreement.

- Insurance companies may require individuals to provide additional documentation to verify residency, especially if they have recently moved to Texas.

Legal Status Requirements

While Texas law does not explicitly require individuals to be U.S. citizens or legal residents to obtain car insurance, insurance companies typically require proof of legal presence in the United States. This can be provided through documents such as a Social Security number, a valid passport, or a visa.

“Insurance companies have the right to refuse coverage to individuals who cannot provide proof of legal presence in the United States.”

Undocumented Immigrants and Car Insurance

Undocumented immigrants in Texas can face challenges obtaining car insurance. While they can apply for coverage, insurance companies may require them to provide additional documentation or proof of residency. They may also be subject to higher premiums or limited coverage options.

- Some insurance companies offer specialized programs for undocumented immigrants, which may include lower premiums or more flexible payment options.

- Undocumented immigrants should be aware of the potential risks associated with driving without insurance, including fines, penalties, and potential deportation.

Insurance Options for Undocumented Immigrants

While obtaining car insurance in Texas can be challenging for undocumented immigrants, there are still options available to them. Here’s a breakdown of the common insurance options and providers that cater to their needs.

SR-22 Insurance

SR-22 insurance is a type of high-risk auto insurance required by the state of Texas for drivers with a history of traffic violations or accidents. It’s often a requirement for those who have had their license suspended or revoked due to driving violations.

While SR-22 insurance is generally available to undocumented immigrants, it is important to note that they may face higher premiums and stricter requirements compared to documented individuals.

Non-Standard Insurance Companies

Non-standard insurance companies are specialized providers that cater to drivers with less-than-perfect driving records or limited financial history. These companies often have more flexible underwriting criteria, making them a suitable option for undocumented immigrants who may have difficulty securing coverage through traditional insurance providers.

Insurance Brokers

Insurance brokers act as intermediaries between individuals seeking insurance and various insurance companies. They can often help undocumented immigrants find coverage options that best suit their specific circumstances.

Mexico-Based Insurance

Some undocumented immigrants choose to obtain insurance through Mexico-based insurance providers. This option may be more affordable, but it’s crucial to understand that the coverage may not be valid in Texas.

It’s essential to confirm the validity of any insurance policy obtained from a foreign provider before driving in Texas.

Coverage Options and Pricing

Insurance options for undocumented immigrants in Texas often include:

- Liability Coverage: This is the most basic type of car insurance, covering damages to other vehicles or property caused by an accident.

- Collision Coverage: This option covers damages to your own vehicle in the event of an accident, regardless of fault.

- Comprehensive Coverage: This protects your vehicle against non-accident related damages, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other costs incurred due to injuries sustained in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you are involved in an accident with a driver who is uninsured or underinsured.

Pricing for these insurance options can vary widely depending on factors such as:

- Driving history

- Age and gender

- Vehicle type and value

- Location and coverage limits

Undocumented immigrants may face higher premiums compared to documented individuals due to their perceived higher risk. It’s essential to shop around and compare quotes from multiple providers to secure the most affordable option.

Financial Considerations and Affordability

Securing car insurance as an undocumented immigrant in Texas can be a complex process, with financial implications that go beyond the standard premium calculations. Understanding these financial aspects is crucial for making informed decisions about car insurance and ensuring affordability.

Factors Influencing Higher Premiums

Undocumented immigrants often face higher car insurance premiums due to a combination of factors. These factors can significantly impact the overall cost of car insurance, making it challenging to find affordable options.

- Limited Credit History: Lack of a credit history can make it difficult for insurance companies to assess risk, leading to higher premiums. This is because credit history is often used as a proxy for financial responsibility, and undocumented immigrants may have limited access to credit due to their immigration status.

- Lack of Driving History: Without a valid driver’s license, undocumented immigrants may struggle to build a driving history, making it harder to demonstrate safe driving habits. Insurance companies may view this lack of history as a higher risk, resulting in higher premiums.

- Higher Risk Perception: Insurance companies may perceive undocumented immigrants as a higher risk due to factors like potential language barriers, limited access to legal representation, and the possibility of facing deportation, which could impact their ability to fulfill insurance obligations.

Finding Affordable Car Insurance Options

Despite the challenges, finding affordable car insurance options is possible. Undocumented immigrants can explore several strategies to mitigate the impact of higher premiums and secure coverage within their budget.

- Shop Around: Comparing quotes from multiple insurance companies is crucial to find the most competitive rates. Online comparison tools and independent insurance brokers can assist in this process.

- Consider State-Mandated Minimum Coverage: Opting for the minimum coverage required by the state can help reduce premiums, but it’s essential to understand the limitations of this coverage and its potential consequences in case of an accident.

- Bundle Policies: Combining multiple insurance policies, such as home and car insurance, with the same company can lead to discounts, potentially lowering the overall cost of car insurance.

- Maintain a Good Driving Record: Avoiding accidents and traffic violations can improve your driving record, potentially earning you discounts and lower premiums in the future.

- Consider SR-22 Insurance: If you have been convicted of a serious traffic violation, an SR-22 insurance policy may be required. While this can increase premiums, it demonstrates financial responsibility and could potentially lower premiums in the long run.

Driving Legally and Insurance Implications

Driving without a valid driver’s license in Texas can have serious legal consequences. It’s crucial to understand the rules and regulations surrounding driving and insurance in the state, especially if you are an undocumented immigrant.

Driving Without a Valid Driver’s License

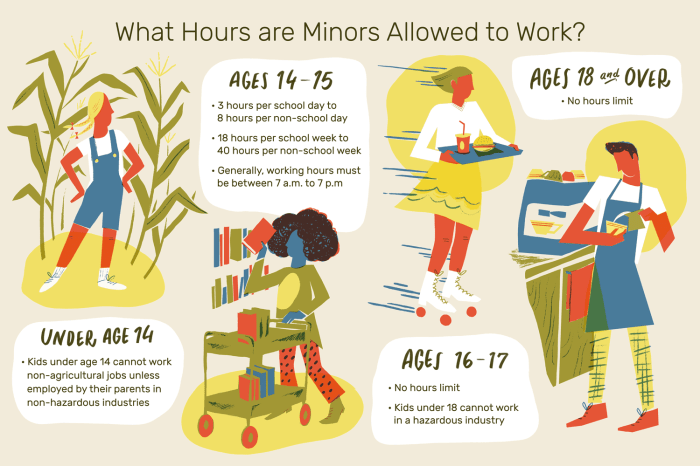

Driving without a valid driver’s license in Texas is a serious offense. It can result in fines, license suspension, and even jail time. The Texas Department of Public Safety (DPS) has strict rules about who can obtain a driver’s license.

- You must provide proof of legal presence in the United States, such as a valid passport or visa.

- You must pass a written exam, a driving test, and a vision test.

- You must be at least 16 years old.

If you are an undocumented immigrant, you may not be eligible for a Texas driver’s license. However, you can apply for a driver’s license in your home country and use it to drive in Texas. You can also apply for a Texas driver’s license if you have a valid work permit.

Driving Without Insurance, Can illegal immigrants get car insurance in texas

Driving without insurance in Texas is also a serious offense. It can result in fines, license suspension, and even jail time. You can be required to pay for damages if you are involved in an accident. Texas is a “no-fault” insurance state, meaning that your insurance company is required to pay for your injuries and damages, regardless of who is at fault in an accident.

- Texas requires all drivers to have at least $30,000 in liability coverage per person, $60,000 in liability coverage per accident, and $25,000 in property damage coverage.

- Drivers can be fined up to $350 for driving without insurance.

- In the event of an accident, you may be required to pay for damages out of pocket if you do not have insurance.

Importance of Car Insurance

Having valid car insurance is crucial for legal protection in case of an accident. It can help you pay for medical expenses, car repairs, and other costs associated with an accident.

- Car insurance can protect you from financial ruin in the event of an accident.

- It can also help you avoid legal trouble.

- Car insurance can provide peace of mind knowing that you are protected if you are involved in an accident.

Resources and Support Organizations

Navigating the car insurance landscape as an undocumented immigrant in Texas can be challenging. However, there are various resources and support organizations available to provide assistance and guidance.

These organizations offer valuable services, including information on insurance options, financial aid, and legal advice. They can help undocumented immigrants understand their rights and responsibilities when it comes to driving and obtaining car insurance in Texas.

Organizations Offering Support

Here is a list of organizations that provide assistance to undocumented immigrants in Texas seeking car insurance.

| Organization | Phone Number | Website | Address |

|---|---|---|---|

| Immigrant Legal Resource Center (ILRC) | (510) 268-1460 | https://www.ilrc.org/ | 1111 University Ave., Suite 500, Berkeley, CA 94707 |

| National Immigration Law Center (NILC) | (202) 544-0004 | https://www.nilc.org/ | 1730 Rhode Island Ave. NW, Suite 1000, Washington, DC 20036 |

| Texas Legal Services Center | (512) 477-4521 | https://www.texaslegalservicescenter.org/ | 111 East 11th Street, Suite 300, Austin, TX 78701 |

| Catholic Charities of the Diocese of Austin | (512) 476-5150 | https://www.ccaustin.org/ | 1100 East 51st Street, Austin, TX 78723 |

| Texas Appleseed | (512) 477-1386 | https://www.texasappleseed.org/ | 111 East 11th Street, Suite 100, Austin, TX 78701 |

Closure

Navigating the world of car insurance as an undocumented immigrant in Texas can be daunting, but it is not impossible. By understanding the legal framework, exploring available options, and seeking support from organizations dedicated to helping undocumented individuals, access to car insurance can be achieved. Remember, driving safely and legally is a fundamental right for all Texans, and this guide aims to empower undocumented individuals to exercise this right confidently and responsibly.

Detailed FAQs: Can Illegal Immigrants Get Car Insurance In Texas

What are the penalties for driving without insurance in Texas?

Driving without insurance in Texas is illegal and carries significant penalties, including fines, license suspension, and even jail time. It’s essential to have valid car insurance to protect yourself and others on the road.

Can I use a foreign driver’s license to obtain car insurance in Texas?

While you may be able to use a foreign driver’s license to obtain car insurance in Texas, it is important to consult with an insurance provider to understand specific requirements and documentation needed. It’s always best to verify with the insurance company directly.

Are there any government programs or subsidies available for undocumented immigrants seeking car insurance?

While government-sponsored programs for undocumented immigrants seeking car insurance are limited, some organizations offer assistance and guidance. It’s advisable to contact local non-profit groups or legal aid services for potential resources and support.