Types of Commercial Insurance Health Plans

Commercial insurance health plans offer a range of options to meet diverse healthcare needs. Each plan type has unique features and benefits.

Types of Commercial Insurance Health Plans

- Health Maintenance Organization (HMO): An HMO provides comprehensive coverage through a network of contracted healthcare providers. Members typically have lower premiums and co-pays, but limited provider choice and geographic restrictions.

- Preferred Provider Organization (PPO): A PPO offers more flexibility than an HMO. Members can visit any healthcare provider, but receive lower costs and benefits when using network providers.

- Point-of-Service (POS): A POS plan combines features of HMOs and PPOs. Members have a primary care physician (PCP) but can also visit out-of-network providers for higher costs.

- Exclusive Provider Organization (EPO): An EPO is similar to an HMO, but members have no out-of-network coverage.

- Fee-for-Service (FFS): An FFS plan allows members to choose any healthcare provider without a network. However, members pay higher premiums and costs for services.

Cost and Coverage of Commercial Insurance Health Plans

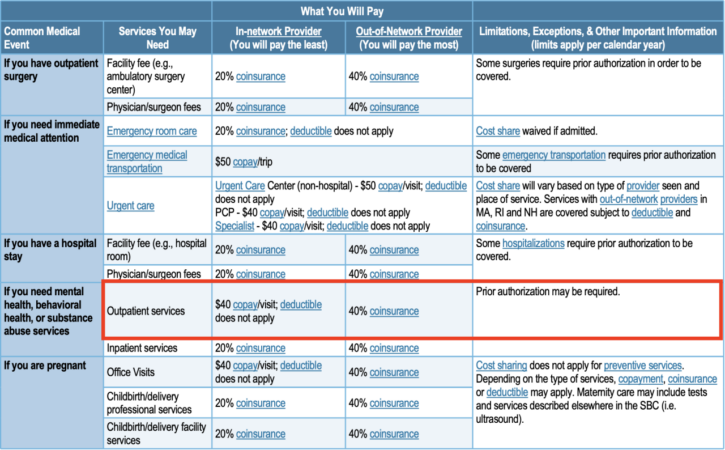

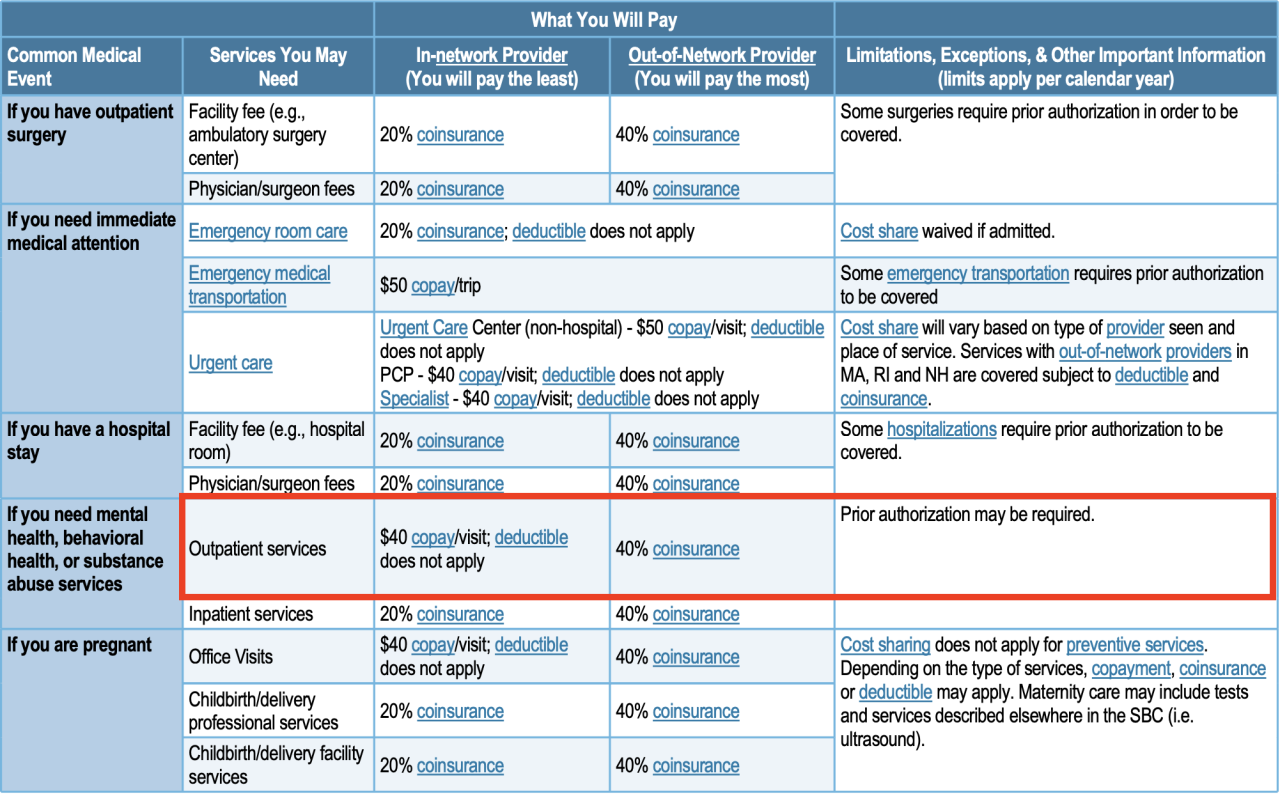

The cost of commercial insurance health plans varies depending on several factors, including the type of plan, the level of coverage, the size of the deductible, the amount of copays and coinsurance, and the age and health of the policyholder.

Deductibles are the amount you have to pay out-of-pocket before your insurance starts to cover the costs of your medical care. Copays are a fixed amount you pay for each doctor’s visit, prescription drug, or other covered service. Coinsurance is a percentage of the cost of a covered service that you have to pay after you’ve met your deductible.

The following table illustrates the cost and coverage of different plan options:

| Plan Type | Monthly Premium | Deductible | Copay | Coinsurance |

|---|---|---|---|---|

| Bronze | $250 | $6,000 | $25 | 20% |

| Silver | $350 | $4,000 | $15 | 10% |

| Gold | $450 | $2,000 | $10 | 5% |

| Platinum | $550 | $1,000 | $5 | 0% |

Benefits of Commercial Insurance Health Plans

Commercial insurance health plans offer numerous advantages that can significantly enhance an individual’s or family’s overall well-being. These plans provide access to quality healthcare, financial protection, and peace of mind, ensuring individuals can receive the medical care they need without facing excessive financial burdens.

Access to Quality Healthcare

Commercial insurance plans typically provide comprehensive coverage for a wide range of medical services, including preventive care, doctor visits, hospital stays, and prescription medications. This coverage allows individuals to seek medical attention promptly, enabling early detection and treatment of health conditions, leading to better health outcomes.

Financial Protection

Medical expenses can be substantial, and without insurance, individuals may face significant financial hardship. Commercial insurance plans act as a financial safety net, covering a substantial portion of medical costs. This protection ensures that individuals can access necessary healthcare without worrying about overwhelming financial burdens.

Peace of Mind

Knowing that you have commercial insurance coverage provides peace of mind. It eliminates the anxiety and uncertainty associated with potential medical expenses and ensures that you can focus on your health and well-being without financial worries.

Real-Life Examples

Numerous individuals and families have benefited from the advantages of commercial insurance health plans. For instance, a family with a young child who requires regular medical care for a chronic condition has found peace of mind knowing that their insurance covers a significant portion of the expenses. Similarly, an individual who suffered a serious accident was able to receive the necessary medical treatment without facing financial ruin due to their comprehensive insurance coverage.

Choosing the Right Commercial Insurance Health Plan

Selecting the right commercial insurance health plan is crucial to ensure you have the coverage you need at a cost you can afford. Consider the following factors:

Coverage Needs

Determine the types of medical services you and your family require. Consider preventive care, doctor visits, hospitalizations, prescription drugs, and any specialized treatments you may need.

Budget

Commercial insurance health plans vary in cost. Compare premiums, deductibles, and co-pays to find a plan that fits your budget. Remember to factor in potential out-of-pocket expenses, such as coinsurance and co-payments.

Health Status

Your health status can influence your plan selection. If you have chronic conditions or require ongoing treatments, choose a plan that covers those specific needs.

Tips for Comparing Plans

* Get quotes from multiple insurers. This will give you a range of options to compare.

* Review the plan details carefully. Pay attention to coverage, premiums, deductibles, and out-of-pocket expenses.

* Consider your current health status and future needs. Choose a plan that meets your current needs and provides flexibility for future changes.

* Talk to a licensed insurance agent. They can help you understand the different plans and make recommendations based on your specific situation.

Market Trends in Commercial Insurance Health

The commercial insurance health industry is undergoing significant transformations driven by technology, regulation, and consumer demand. These trends are reshaping the landscape and creating new opportunities and challenges for individuals and businesses.

Technology is playing a pivotal role in enhancing healthcare delivery, reducing costs, and improving access to care. Telemedicine, wearable devices, and data analytics are revolutionizing the way healthcare is provided and consumed. Regulation is also impacting the industry, with governments implementing measures to ensure affordability, transparency, and quality of care.

Impact of Consumer Demand

Consumer demand is another key driver of market trends. Individuals and businesses are increasingly seeking personalized, value-based healthcare solutions. They expect insurers to offer flexible plans that meet their specific needs and provide comprehensive coverage at an affordable cost.

Future Trends

Looking ahead, several future trends are expected to shape the commercial insurance health industry. These include the continued rise of technology, increased focus on value-based care, and growing demand for consumer-centric solutions. Insurers that adapt to these trends will be well-positioned to meet the evolving needs of individuals and businesses.