- What is Full Coverage Car Insurance?

- Benefits of Full Coverage Car Insurance

- Factors Affecting Full Coverage Insurance Costs

- Choosing the Right Full Coverage Policy

- Understanding Policy Exclusions and Limitations

- The Importance of Maintaining Coverage

- Additional Considerations for Full Coverage Insurance

- Conclusion: Full Coverage Car Insurance

- Frequently Asked Questions

Full coverage car insurance is a type of insurance policy that provides comprehensive protection for your vehicle, offering peace of mind and financial security in the event of an accident or other unforeseen circumstances. This type of insurance goes beyond the basic liability coverage required by most states, providing a wide range of benefits that can help you recover from a variety of situations.

Full coverage car insurance typically includes collision coverage, which pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault. It also includes comprehensive coverage, which protects against damage caused by events such as theft, vandalism, fire, or natural disasters. These comprehensive benefits can help you avoid significant financial burdens and ensure that you can get back on the road quickly and safely.

What is Full Coverage Car Insurance?

Full coverage car insurance is a type of insurance that protects you financially if your car is damaged or stolen. It combines several different types of coverage into one policy, providing comprehensive protection for your vehicle.

Full coverage car insurance is often a requirement for car loans, and it’s a good idea to consider it if you have a newer car or if you’re worried about the financial impact of an accident.

Types of Coverage Included

Full coverage car insurance typically includes the following types of coverage:

- Collision Coverage: This coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of who is at fault.

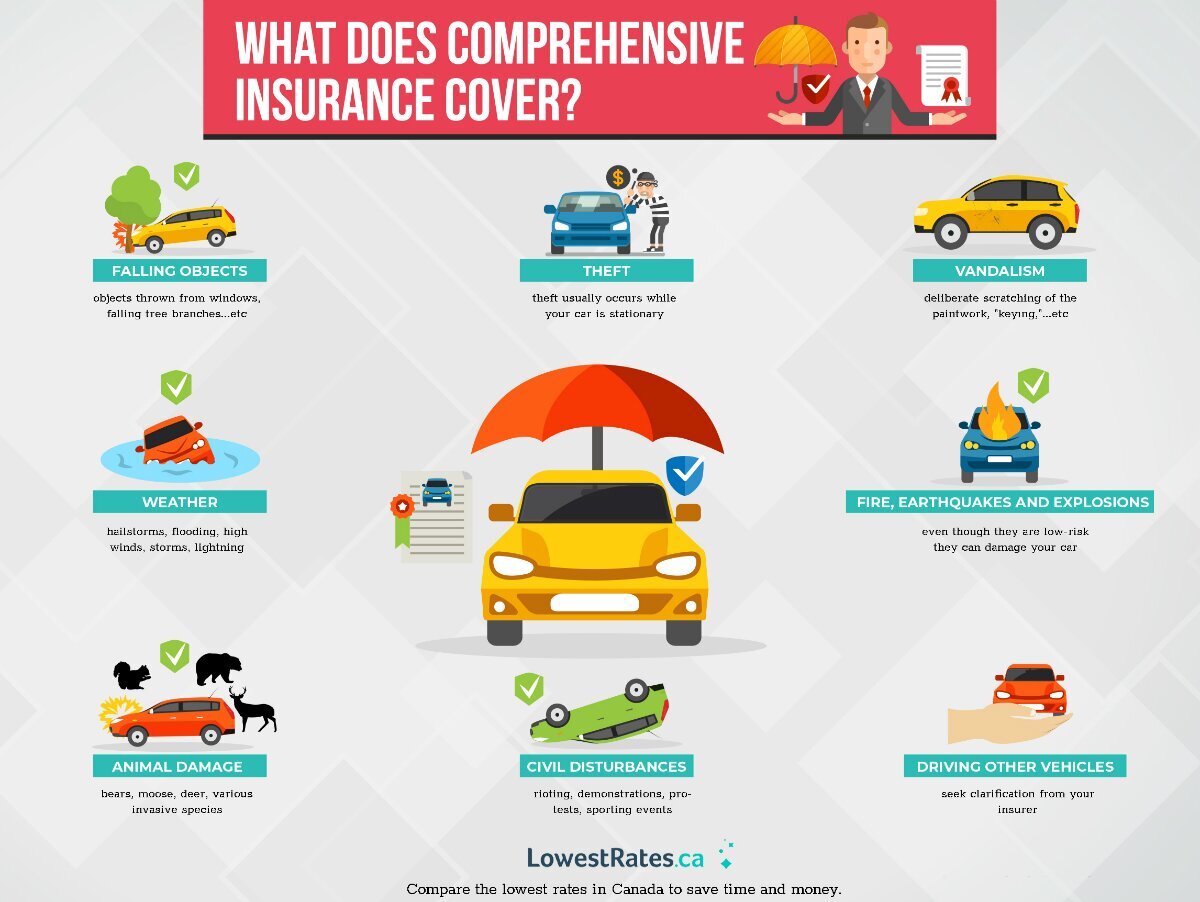

- Comprehensive Coverage: This coverage pays for repairs or replacement of your car if it’s damaged by something other than an accident, such as theft, vandalism, or a natural disaster.

- Liability Coverage: This coverage pays for damages to other people’s property or injuries to other people if you are at fault in an accident. It includes bodily injury liability and property damage liability.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with someone who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other expenses if you are injured in an accident, regardless of who is at fault.

When is Full Coverage Beneficial?

Full coverage car insurance can be beneficial in a variety of situations, such as:

- If you have a newer car: Newer cars are more expensive to repair or replace, so full coverage can help protect your investment.

- If you have a car loan: Most lenders require full coverage insurance as a condition of the loan.

- If you live in an area with a high risk of accidents: If you live in an area with a lot of traffic or bad weather, full coverage can provide extra protection.

- If you are worried about the financial impact of an accident: Full coverage can help you avoid significant out-of-pocket expenses if you are involved in an accident.

Benefits of Full Coverage Car Insurance

Full coverage car insurance provides comprehensive financial protection in the event of an accident, ensuring you’re covered for a wide range of potential expenses. It offers peace of mind knowing you’re financially secure, allowing you to focus on recovery and getting back on the road.

Financial Protection in Accidents

Full coverage car insurance offers significant financial protection in case of an accident. It covers various expenses, including:

* Repair or Replacement of Your Vehicle: If your car is damaged or totaled in an accident, full coverage insurance will pay for repairs or a replacement vehicle, depending on the severity of the damage.

* Medical Expenses: Full coverage insurance covers medical expenses for you and your passengers if you’re injured in an accident. This includes hospital bills, doctor’s visits, and rehabilitation costs.

* Liability Coverage: Full coverage insurance also includes liability coverage, which protects you from financial responsibility if you cause an accident that results in injuries or property damage to others.

* Other Expenses: Full coverage insurance can also cover other expenses related to an accident, such as towing, rental car fees, and lost wages.

Repair or Replacement of a Damaged Vehicle

Full coverage car insurance includes collision and comprehensive coverage, which are essential for repairing or replacing a damaged vehicle.

* Collision Coverage: Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

* Comprehensive Coverage: Comprehensive coverage pays for repairs or replacement of your vehicle if it’s damaged by events other than an accident, such as theft, vandalism, fire, or natural disasters.

Peace of Mind

Having full coverage car insurance provides peace of mind knowing you’re financially protected in the event of an accident. It eliminates the worry of facing significant financial burdens due to unexpected events. Full coverage insurance allows you to focus on recovering from the accident and getting back on the road without the added stress of financial concerns.

Factors Affecting Full Coverage Insurance Costs

The cost of full coverage car insurance is influenced by several factors. These factors are used by insurance companies to assess your risk as a driver and determine the premium you will pay. Understanding these factors can help you make informed decisions that may lower your insurance costs.

Age

Age is a significant factor in determining your car insurance premium. Younger drivers, especially those under 25, tend to have higher insurance rates. This is due to their lack of experience, higher risk-taking behavior, and statistically higher accident rates. As you age and gain more driving experience, your insurance rates usually decrease.

Driving History

Your driving history plays a crucial role in your insurance premium. A clean driving record with no accidents, traffic violations, or DUI convictions will result in lower insurance rates. Conversely, a history of accidents, speeding tickets, or other violations will lead to higher premiums. Insurance companies view these incidents as indicators of increased risk and adjust premiums accordingly.

Vehicle Type, Full coverage car insurance

The type of vehicle you drive also influences your insurance cost. Expensive, high-performance cars are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents. Vehicles with advanced safety features, such as anti-lock brakes and airbags, may qualify for discounts.

Location

Your location, including the city, state, and even neighborhood, can affect your insurance rates. Areas with higher crime rates, traffic congestion, and a greater frequency of accidents tend to have higher insurance premiums.

Driving Behaviors

Certain driving behaviors can impact your insurance rates, even if you haven’t had an accident. For example, using a mobile phone while driving, driving under the influence of alcohol or drugs, and speeding can all increase your risk of an accident. Insurance companies may offer discounts for drivers who participate in safe driving programs or use telematics devices that monitor their driving habits.

Choosing the Right Full Coverage Policy

Choosing the right full coverage car insurance policy involves carefully considering your individual needs, financial situation, and driving habits. It’s about finding a balance between adequate protection and affordability.

Comparing Quotes from Different Insurance Providers

Comparing quotes from multiple insurance providers is crucial to ensure you get the best value for your money. Different companies offer varying coverage options and premiums based on factors like your driving history, vehicle type, and location.

- Online comparison websites: These platforms allow you to enter your information once and receive quotes from multiple insurers, simplifying the comparison process.

- Directly contacting insurance companies: You can contact insurance companies directly to request quotes and discuss your specific needs. This allows for more personalized communication and potential negotiation.

It’s important to compare apples to apples when comparing quotes. Make sure you’re comparing the same coverage levels and deductibles across different insurers to ensure a fair comparison.

Understanding Policy Exclusions and Limitations

While full coverage car insurance offers extensive protection, it’s essential to understand that it doesn’t cover every possible scenario. There are specific exclusions and limitations that might prevent you from receiving coverage for certain events or damages.

It’s crucial to carefully read and understand the terms and conditions of your policy to avoid any surprises or disappointments when you need to file a claim.

Common Exclusions and Limitations

Exclusions and limitations are designed to prevent abuse of the insurance system and ensure fair pricing for all policyholders. Here are some common exclusions and limitations that you might encounter:

- Wear and Tear: Normal wear and tear on your vehicle, such as faded paint, worn tires, or a broken radio, is generally not covered by full coverage car insurance.

- Cosmetic Damage: Minor scratches, dents, or other cosmetic damage that doesn’t affect the functionality of your vehicle might not be covered.

- Damage Caused by Neglect: If your vehicle sustains damage due to your negligence, such as leaving it unlocked and unattended, your insurance might not cover the loss.

- Driving Under the Influence: If you are involved in an accident while driving under the influence of alcohol or drugs, your insurance coverage may be limited or denied.

- Unlicensed or Unregistered Vehicles: If your vehicle is not properly licensed or registered, you may not be covered by your insurance policy.

- Uninsured or Underinsured Motorists: If you are involved in an accident with an uninsured or underinsured driver, your coverage may be limited to the amount of coverage the other driver has.

- Acts of War: Damage caused by acts of war or terrorism is generally excluded from full coverage car insurance policies.

- Natural Disasters: While some full coverage policies may include coverage for certain natural disasters, such as earthquakes or floods, others may have specific exclusions or limitations.

Situations Where Coverage Might Not Be Provided

Understanding specific situations where coverage might not be provided is crucial. Here are some examples:

- Driving without a valid license: If you are involved in an accident while driving without a valid license, your insurance company might deny your claim.

- Using your vehicle for business purposes: Most personal car insurance policies exclude coverage for vehicles used for business purposes.

- Driving outside of your policy’s geographic limitations: If you are driving outside of the geographic area specified in your policy, your insurance coverage might be limited or denied.

- Modifying your vehicle without informing your insurance company: If you modify your vehicle without informing your insurance company, your coverage might be affected.

Importance of Reading and Understanding Policy Terms and Conditions

It is crucial to carefully read and understand the terms and conditions of your full coverage car insurance policy. This includes understanding:

- Exclusions and limitations: Familiarize yourself with the specific events or damages that are not covered by your policy.

- Deductibles: Understand the amount you are responsible for paying out of pocket before your insurance coverage kicks in.

- Coverage limits: Understand the maximum amount of coverage your insurance policy provides for different types of claims.

- Claim procedures: Familiarize yourself with the steps you need to take to file a claim and the documentation required.

The Importance of Maintaining Coverage

While full coverage insurance offers comprehensive protection, it’s crucial to understand the potential consequences of canceling or letting your coverage lapse. This decision can have significant financial implications, especially in the event of an accident or unexpected incident.

Maintaining full coverage insurance provides a safety net that shields you from substantial financial burdens.

Financial Hardship

- Unexpected Accidents: Even the most cautious drivers can find themselves in unforeseen accidents. Without full coverage, you’ll be responsible for all repair costs, potentially leading to significant out-of-pocket expenses.

- Theft or Vandalism: Your car is vulnerable to theft or vandalism, especially if you live in a high-crime area. Full coverage helps cover the cost of replacement or repairs, preventing you from shouldering the financial burden alone.

- Natural Disasters: Natural disasters like floods, earthquakes, or hailstorms can cause extensive damage to your vehicle. Full coverage helps you recover from these unexpected events and avoid substantial financial loss.

Risks of Driving Without Adequate Coverage

- Financial Ruin: A single accident without adequate insurance can result in substantial financial losses, potentially exceeding your savings and impacting your credit score.

- Legal Liability: If you’re involved in an accident and cause injury or damage to others, you could face lawsuits and legal fees, even if you’re not at fault. Full coverage insurance protects you from these liabilities.

- Driving Restrictions: In some states, driving without minimum insurance coverage is illegal and can result in fines, license suspension, or even jail time.

Additional Considerations for Full Coverage Insurance

Beyond the core coverage elements of full coverage insurance, you might find yourself considering additional options that can enhance your protection and peace of mind. These options, often referred to as “add-ons” or “riders,” provide specific benefits that may be valuable depending on your individual needs and driving habits.

Optional Coverage Options

Understanding the availability of optional coverage options allows you to tailor your policy to your specific needs. These extras can enhance your protection and provide added peace of mind, but it’s important to weigh their benefits against their costs to make informed decisions.

- Rental Car Reimbursement: This coverage helps you pay for a rental car if your insured vehicle is damaged or stolen and requires repairs. The amount reimbursed usually has a daily limit and a maximum duration.

- Roadside Assistance: This coverage provides assistance in case of breakdowns, flat tires, lockouts, or other emergencies. It typically covers services like towing, jump-starts, and tire changes.

- Gap Insurance: This coverage helps pay the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your car is totaled. This can be particularly useful if you have a new car or one with a high loan balance.

- Loan/Lease Gap Insurance: Similar to Gap insurance, this coverage protects you from owing more than the actual cash value of your vehicle if it’s totaled. This can be essential for those with new cars or cars with a significant loan balance.

- Collision Coverage Deductible Waiver: This coverage eliminates your deductible for collision claims, meaning you won’t have to pay anything out of pocket for repairs after an accident. However, it’s important to note that this coverage comes with an additional premium.

- Comprehensive Coverage Deductible Waiver: This coverage eliminates your deductible for comprehensive claims, such as those related to theft, vandalism, or damage from natural disasters. Like the collision deductible waiver, this coverage incurs an additional premium.

- Emergency Medical Expense Coverage: This coverage provides financial assistance for medical expenses incurred in the event of an accident, even if you’re not at fault. It can supplement your health insurance and cover expenses such as ambulance fees, hospital stays, and surgery.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance or no insurance at all. It can help cover your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault. It can be particularly beneficial in states with no-fault insurance laws.

Conclusion: Full Coverage Car Insurance

Full coverage car insurance offers a robust safety net for drivers, providing financial protection and peace of mind. By understanding the different types of coverage, factors influencing costs, and available options, you can make an informed decision about the right policy for your individual needs. Remember to regularly review your policy and consider the potential consequences of canceling coverage, as maintaining adequate insurance can help you avoid financial hardship and ensure your safety on the road.

Frequently Asked Questions

What is the difference between full coverage and liability insurance?

Liability insurance covers damages to other people’s property or injuries caused by you in an accident. Full coverage includes liability coverage plus collision and comprehensive coverage, protecting your own vehicle in addition to others.

Is full coverage insurance mandatory?

No, full coverage is not mandatory. However, many lenders require it if you have a financed or leased vehicle.

How do I know if I need full coverage insurance?

Consider the value of your vehicle, your financial situation, and the potential risks you face. If you have a newer car with a high loan balance, full coverage may be a good idea.

Can I reduce my full coverage insurance premiums?

Yes, you can often lower your premiums by maintaining a good driving record, increasing your deductible, and taking defensive driving courses.