Compare car insurance and find the best rates for your needs. Navigating the world of car insurance can be a confusing and time-consuming process, especially when you’re trying to find the best value for your money. With so many different insurance companies offering a wide range of coverage options and premiums, it can be overwhelming to know where to start.

This guide will walk you through the essential steps of comparing car insurance quotes, understanding key factors to consider, and evaluating different insurance companies to find the best fit for your specific situation. We’ll explore everything from basic coverage types and premium influencers to tips for saving money and negotiating rates.

Understanding Car Insurance Basics: Compare Car Insurance

Car insurance is a vital financial safety net that protects you from the potential financial burdens associated with accidents, theft, or damage to your vehicle. It’s a legal requirement in most jurisdictions, ensuring that you can cover the costs of repairs, medical bills, and other expenses that may arise from unforeseen events.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is crucial for choosing the right policy that meets your specific needs and budget. Here’s a breakdown of common coverage types:

- Liability Coverage: This is the most basic type of car insurance, and it’s legally required in most states. It covers damages to other people’s property or injuries caused by an accident for which you are at fault. Liability coverage typically includes two components:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party involved in the accident due to your negligence.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or any other property damaged due to your negligence.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s optional but highly recommended, especially if you have a financed or leased vehicle.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, fire, natural disasters, or falling objects. Like collision coverage, it’s optional but recommended to safeguard your investment.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you are involved in an accident with a driver who doesn’t have adequate insurance or is uninsured. It covers your medical expenses and property damage, ensuring you’re not left financially responsible for another driver’s negligence.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, covers your medical expenses and lost wages, regardless of who is at fault in an accident. It’s often required in certain states.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. It’s a supplemental coverage that can be added to your policy.

Factors Influencing Car Insurance Premiums

Several factors contribute to the calculation of your car insurance premium. Understanding these factors can help you make informed decisions to potentially lower your costs.

- Driving Record: Your driving history plays a significant role in determining your premium. A clean driving record with no accidents or violations will generally result in lower premiums. However, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

- Age and Gender: Younger and inexperienced drivers are statistically more likely to be involved in accidents, leading to higher premiums. Gender also plays a role, as some insurance companies may charge different rates based on historical claims data.

- Vehicle Type: The make, model, and year of your vehicle can influence your premium. Higher-performance vehicles or luxury cars often have higher insurance costs due to their greater repair costs and higher risk of theft.

- Location: Your location can impact your premium due to variations in traffic density, crime rates, and the prevalence of accidents in your area. Urban areas with higher traffic and crime rates generally have higher insurance costs.

- Credit Score: Some insurance companies use your credit score as a factor in determining your premium. A good credit score can often result in lower rates, while a poor credit score may lead to higher premiums.

- Coverage Options: The types of coverage you choose, such as deductibles, limits, and optional add-ons, can also influence your premium. Higher deductibles generally result in lower premiums, while comprehensive and collision coverage can increase your costs.

Tips for Getting the Best Car Insurance Rates, Compare car insurance

Shopping around and comparing quotes from multiple insurance companies is essential to securing the best car insurance rates. Here are some tips to help you find the most competitive deals:

- Compare Quotes from Multiple Insurers: Don’t settle for the first quote you receive. Use online comparison tools or contact multiple insurance companies directly to obtain quotes and compare coverage options and pricing.

- Bundle Your Policies: Many insurance companies offer discounts if you bundle your car insurance with other policies, such as homeowners or renters insurance. This can lead to significant savings on your premiums.

- Consider Discounts: Ask your insurance company about available discounts, such as safe driver discounts, good student discounts, or discounts for anti-theft devices.

- Improve Your Driving Record: Maintaining a clean driving record is crucial for keeping your premiums low. Avoid traffic violations and strive to be a safe and responsible driver.

- Increase Your Deductible: Choosing a higher deductible can lower your premium. However, make sure you can afford to pay the deductible out of pocket if you need to file a claim.

- Shop Around Regularly: Don’t assume your current insurance company is offering you the best rates. Review your policy annually and compare quotes from other insurers to ensure you’re getting the best deal.

Comparing Car Insurance Quotes

Getting the best car insurance deal involves more than just picking the first quote you see. It’s crucial to compare quotes from different insurers to find the most suitable coverage at the most competitive price. This approach allows you to make an informed decision based on your specific needs and budget.

Obtaining Car Insurance Quotes

To compare car insurance quotes effectively, follow these steps:

- Gather Your Information: Before you start, have your driver’s license, vehicle registration, and any relevant details about your driving history ready. This will streamline the quote process.

- Use Online Comparison Tools: Many websites and apps allow you to compare quotes from multiple insurers simultaneously. These platforms are user-friendly and can save you considerable time. Enter your details, and the tools will generate quotes from various providers.

- Contact Insurers Directly: Reach out to insurance companies directly to get personalized quotes. You can call, email, or visit their websites. This allows you to discuss specific coverage needs and ask questions about their policies.

- Consider Your Coverage Options: Each insurer offers different coverage options, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Carefully review the details of each policy to determine what best suits your needs.

- Compare Prices and Coverage: Once you have gathered quotes from multiple insurers, compare the premiums and coverage levels offered. Look for policies that provide adequate protection at a price you can afford.

The Importance of Comparing Quotes

Comparing car insurance quotes is essential because:

- Competitive Pricing: Insurance companies compete for your business, and comparing quotes helps you find the best deals. You may discover significant price differences between insurers, even for similar coverage.

- Diverse Coverage Options: Each insurer offers unique coverage options and benefits. Comparing quotes allows you to identify the best combination of coverage and price that meets your individual needs.

- Finding Hidden Value: Some insurers may offer discounts or special features that are not readily apparent. By comparing quotes, you can uncover these hidden value propositions and maximize your savings.

Features and Benefits Offered by Insurance Companies

Insurance companies offer a range of features and benefits to attract customers. These can include:

- Discounts: Many insurers provide discounts for good driving records, safety features in your vehicle, multiple policies, and other factors. These discounts can significantly reduce your premiums.

- Customer Service: The quality of customer service can vary between insurers. Consider factors like responsiveness, accessibility, and the availability of online resources when making your decision.

- Claims Process: The claims process can be a significant factor in your overall experience. Research how each insurer handles claims and their reputation for fairness and efficiency.

- Financial Stability: It’s essential to choose an insurer with a strong financial standing. This ensures they can fulfill their obligations in the event of a claim.

- Technology and Innovation: Some insurers offer innovative features, such as mobile apps for managing your policy, telematics programs that track your driving habits, and digital claims processing.

Key Factors to Consider When Comparing

Choosing the right car insurance policy can feel overwhelming, especially with so many options available. Understanding your needs and priorities is crucial to making an informed decision. Several factors can influence your choice, and weighing these elements carefully will help you find the best coverage for your specific circumstances.

Coverage Options and Costs

Understanding the different types of coverage and their associated costs is essential for making a sound decision. Each coverage type addresses specific risks, and knowing what you need will help you avoid paying for unnecessary protection.

- Liability Coverage: This covers damages to other people’s property or injuries caused by an accident. It’s usually required by law, and the minimum limits vary by state. Higher liability limits offer greater financial protection in case of a serious accident.

- Collision Coverage: This covers repairs or replacement of your vehicle if you’re involved in an accident, regardless of who’s at fault. It’s optional but essential if you have a loan on your car or if your vehicle is relatively new.

- Comprehensive Coverage: This covers damage to your vehicle from events like theft, vandalism, natural disasters, or collisions with animals. It’s optional but valuable if your car is worth a significant amount or if you live in an area prone to natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It’s essential for peace of mind, as it can cover your medical bills and vehicle repairs.

- Personal Injury Protection (PIP): This covers your medical expenses, lost wages, and other expenses if you’re injured in an accident, regardless of fault. It’s optional in some states but can provide crucial financial support during a difficult time.

Insurance Company Comparison

Comparing insurance companies is crucial to finding the best deal. Each company offers different coverage options, discounts, and customer service experiences. Consider these factors when comparing:

| Factor | Pros | Cons |

|---|---|---|

| Price | Lower premiums can save you money in the long run. | Lower premiums might indicate less comprehensive coverage or fewer benefits. |

| Coverage Options | A wide range of coverage options allows you to customize your policy to meet your specific needs. | Too many options can make it difficult to choose the right coverage. |

| Discounts | Discounts can significantly reduce your premium, making insurance more affordable. | Not all companies offer the same discounts, and some discounts might not be applicable to you. |

| Customer Service | Excellent customer service can make dealing with insurance claims and inquiries smoother. | Poor customer service can be frustrating and make the process more challenging. |

| Financial Stability | A financially stable company is more likely to be able to pay claims in the event of a major disaster. | It can be difficult to assess a company’s financial stability without professional guidance. |

Evaluating Insurance Companies

Choosing the right car insurance company is a crucial decision that can significantly impact your financial well-being. Beyond comparing prices and coverage, it’s essential to evaluate the reputation and financial stability of potential insurers.

Reputation and Financial Stability

The reputation and financial stability of an insurance company are crucial indicators of its reliability. A reputable company with a strong financial foundation is more likely to honor its commitments and pay claims promptly. To evaluate these aspects, consider the following:

- Financial Ratings: Reputable rating agencies like AM Best, Standard & Poor’s, and Moody’s assess the financial strength of insurance companies. Look for companies with high ratings, indicating a strong financial position and a lower risk of insolvency.

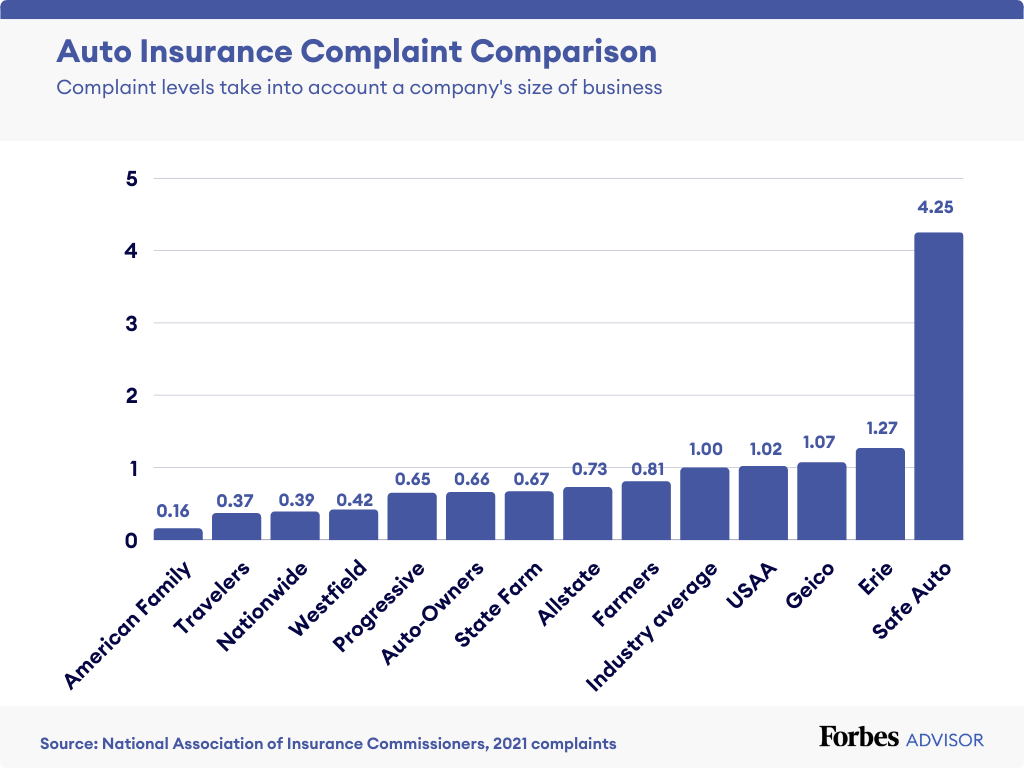

- Customer Reviews and Complaints: Explore online reviews and complaints from customers on platforms like Trustpilot, Consumer Reports, and the Better Business Bureau. These insights can reveal valuable information about customer satisfaction, claims handling, and overall service quality.

- Industry Recognition and Awards: Companies that consistently receive industry awards and recognition for their customer service, financial stability, and claims handling practices often demonstrate a commitment to excellence.

Customer Service and Claims Handling

Exceptional customer service and a streamlined claims process are critical when you need to file a claim. A smooth and hassle-free experience can make a significant difference during a stressful time. Here are some factors to consider:

- Availability and Responsiveness: Look for companies that offer multiple communication channels, such as phone, email, and online chat, with readily available representatives. Responsiveness to inquiries and prompt resolution of issues are key indicators of good customer service.

- Claims Process Transparency: Ensure the claims process is clearly Artikeld, with detailed information on required documentation, timelines, and contact points. Transparency fosters trust and reduces potential confusion or delays.

- Customer Testimonials: Read customer testimonials and reviews that highlight their experiences with the company’s customer service and claims handling processes. These accounts can provide valuable insights into the company’s responsiveness, fairness, and overall customer satisfaction.

Customer Satisfaction Ratings

Several organizations collect and publish customer satisfaction ratings for insurance companies. These ratings can provide a valuable benchmark for comparing different insurers based on their customer experiences. Here’s a table comparing the customer satisfaction ratings of some prominent insurance companies:

| Insurance Company | J.D. Power Rating | Consumer Reports Rating | NerdWallet Rating |

|---|---|---|---|

| Progressive | 818 | 77 | 4.5 |

| Geico | 820 | 79 | 4.6 |

| State Farm | 815 | 78 | 4.4 |

| USAA | 853 | 83 | 4.8 |

| Allstate | 805 | 75 | 4.3 |

Note: These ratings are subject to change based on the latest data and may vary depending on the specific region or product being considered.

Additional Tips for Saving Money

Saving money on car insurance is a smart move, and you’ve already learned about comparing quotes and choosing the right coverage. But there are even more ways to reduce your premiums. Here are some additional tips to consider.

Discounts and Bundling

Discounts can significantly reduce your car insurance costs. Insurers offer a wide variety of discounts, so it’s worth exploring what’s available to you.

- Good Driver Discounts: These reward drivers with clean driving records. If you’ve been accident-free for a certain period, you may qualify for a discount.

- Safe Driver Discounts: These are often tied to your driving habits. Many insurers now offer discounts for drivers who use telematics devices or smartphone apps to track their driving behavior. These devices monitor things like speed, braking, and acceleration, and they can help insurers assess your risk.

- Multi-Car Discounts: If you insure multiple vehicles with the same insurer, you may qualify for a discount on your premiums. This is because insurers consider you a less risky customer when you insure multiple vehicles with them.

- Bundling Discounts: Many insurers offer discounts when you bundle your car insurance with other types of insurance, such as homeowners or renters insurance. This is another way to reduce your overall insurance costs.

Improving Your Driving Record

Your driving record is a major factor in determining your car insurance premiums. A clean record can save you a lot of money. Here are some strategies to improve your driving record:

- Avoid Accidents: This may seem obvious, but it’s the most important factor. Defensive driving courses can help you learn safe driving habits and reduce your risk of accidents.

- Avoid Traffic Violations: Speeding tickets, parking tickets, and other traffic violations can increase your premiums. Drive safely and obey traffic laws to avoid these violations.

- Consider a Defensive Driving Course: Completing a defensive driving course can sometimes result in a discount on your car insurance. These courses teach you safe driving practices and can help you avoid accidents and traffic violations.

Negotiating Car Insurance Rates

Don’t be afraid to negotiate your car insurance rates with your insurer. You may be able to get a lower rate by:

- Comparing Quotes: Show your insurer quotes from other companies. This can encourage them to match or beat the lower rates you’ve found.

- Discussing Your Driving Record: Highlight any positive aspects of your driving record, such as years of accident-free driving or recent completion of a defensive driving course.

- Asking About Discounts: Make sure you’re aware of all the discounts available to you and ask your insurer about them.

- Exploring Payment Options: You might be able to get a lower rate by paying your premium annually instead of monthly.

Conclusive Thoughts

By understanding the basics of car insurance, comparing quotes from multiple providers, and considering factors like coverage options, customer service, and financial stability, you can make an informed decision and secure the best car insurance policy for your needs. Don’t settle for the first quote you see; take the time to compare and find the right coverage at the right price. Remember, your car insurance is an important investment in your financial security, and it’s worth putting in the effort to ensure you have the best protection possible.

Key Questions Answered

What is the best car insurance company?

The best car insurance company for you depends on your individual needs and preferences. Consider factors like coverage options, premiums, customer service, and financial stability when choosing a company.

How often should I compare car insurance quotes?

It’s a good idea to compare car insurance quotes at least once a year, or even more frequently if you’ve had any major life changes, such as a new car, a change in your driving record, or a move to a new location.

What are some common car insurance discounts?

Many insurance companies offer discounts for good driving records, safety features in your car, bundling multiple policies, and being a member of certain organizations.