Cheap car insurance Florida is a hot topic for drivers in the Sunshine State, as the state’s unique landscape can impact insurance costs. From frequent weather events to high population density, finding affordable coverage requires understanding the factors influencing premiums and exploring available options. This guide will provide insights into navigating the Florida car insurance market, offering tips and strategies to help you secure the best rates.

Understanding the factors influencing car insurance costs in Florida is crucial. Weather events, such as hurricanes and heavy rains, contribute to higher premiums. The state’s demographics, with a large population of senior citizens and tourists, also play a role. Furthermore, Florida’s “no-fault” insurance system, where drivers are responsible for their own damages, can affect costs. Knowing these factors can help you make informed decisions about your insurance coverage.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance landscape is unique and often presents higher costs compared to other states. Several factors contribute to this, making it essential for drivers to understand the nuances of insurance in the Sunshine State.

Factors Influencing Car Insurance Costs in Florida

Florida’s car insurance rates are influenced by a combination of factors, including:

- High Frequency of Accidents: Florida has a high rate of car accidents, which directly impacts insurance costs. This is attributed to various factors, such as a large population, heavy tourist traffic, and a significant number of elderly drivers.

- Climate and Weather: Florida’s tropical climate and frequent storms, including hurricanes, can lead to increased damage to vehicles, resulting in higher insurance premiums.

- Demographics: Florida has a large population of retirees and older drivers, who are statistically more likely to be involved in accidents. This demographic factor also contributes to higher insurance costs.

- Legal Considerations: Florida is a “no-fault” insurance state, meaning drivers are primarily responsible for their own injuries in an accident, regardless of fault. This system can lead to higher claims and insurance costs. Additionally, Florida’s “PIP” (Personal Injury Protection) coverage requires drivers to carry a minimum of $10,000 in coverage, which contributes to the overall cost of car insurance.

- Fraudulent Claims: Unfortunately, Florida has a history of fraudulent insurance claims, which can drive up insurance rates for all drivers.

Types of Car Insurance Coverage in Florida

Florida law requires drivers to carry certain types of car insurance coverage. These include:

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for the insured driver and passengers, regardless of fault. It’s mandatory in Florida, with a minimum coverage requirement of $10,000.

- Property Damage Liability: This coverage protects the insured driver from financial responsibility for damages to another person’s property in an accident. The minimum coverage requirement is $10,000.

- Bodily Injury Liability: This coverage protects the insured driver from financial responsibility for injuries to another person in an accident. The minimum coverage requirement is $10,000 per person and $20,000 per accident.

- Uninsured Motorist Coverage: This coverage protects the insured driver in case of an accident with an uninsured or underinsured driver. It covers medical expenses and property damage.

- Collision Coverage: This coverage pays for repairs or replacement of the insured vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects the insured vehicle from damages caused by events other than accidents, such as theft, vandalism, or natural disasters.

Car Insurance Costs in Florida Compared to Other States

Florida consistently ranks among the states with the highest average car insurance premiums.

According to the Insurance Information Institute, the average annual premium for car insurance in Florida in 2022 was $2,626, significantly higher than the national average of $1,771.

Several factors contribute to this difference, including the high frequency of accidents, the no-fault insurance system, and the state’s high cost of living. However, it’s important to note that car insurance costs can vary significantly depending on individual factors, such as driving history, age, vehicle type, and location.

Finding Affordable Car Insurance Options

Finding the right car insurance policy in Florida can be a challenging task, especially when you’re on a tight budget. Luckily, there are strategies you can use to find affordable options that meet your specific needs. By understanding how to compare quotes, exploring discounts, and choosing the right coverage, you can significantly reduce your car insurance premiums.

Obtaining Multiple Car Insurance Quotes

The most effective way to find affordable car insurance is to compare quotes from multiple insurance providers. This allows you to see a range of prices and coverage options, enabling you to make an informed decision. Here’s a step-by-step guide on how to obtain quotes:

- Gather your information: Before you start, collect essential details such as your driver’s license number, vehicle information (make, model, year), and driving history.

- Utilize online comparison tools: Many websites, like Insurance.com or NerdWallet, offer free quote comparison services. These tools allow you to enter your information once and receive quotes from multiple insurers simultaneously.

- Contact insurance providers directly: Besides online tools, you can contact insurance companies directly through their websites or by phone. This allows you to ask specific questions and get personalized quotes.

- Consider local insurance agents: Independent insurance agents can help you compare quotes from various companies and find policies tailored to your needs. They often have access to exclusive discounts and can provide valuable advice.

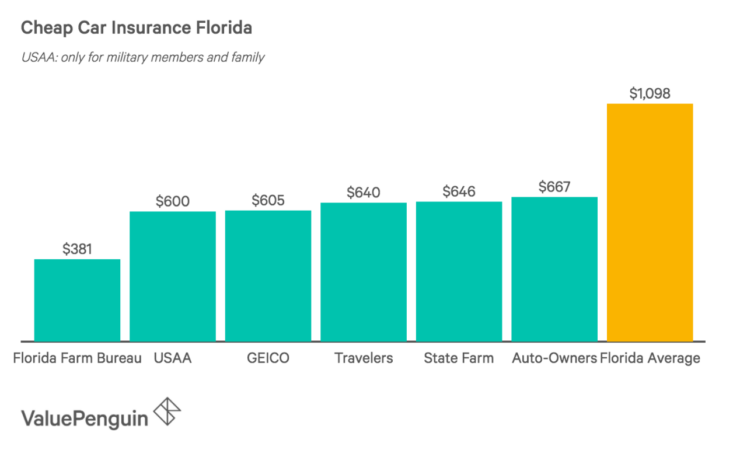

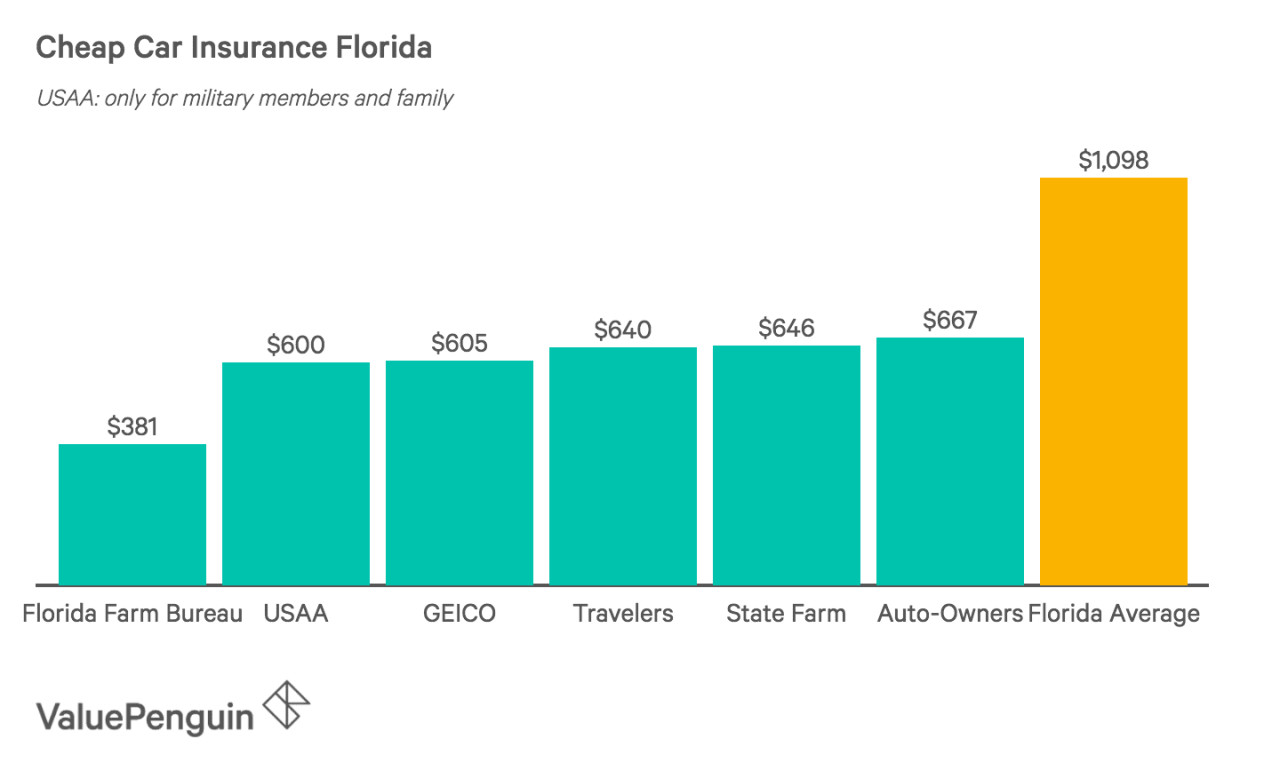

Top 5 Cheapest Car Insurance Companies in Florida

While prices can vary depending on your individual circumstances, here’s a comparison of the top 5 cheapest car insurance companies in Florida based on average premiums, customer satisfaction ratings, and available discounts (as of 2023):

| Company | Average Premium | J.D. Power Customer Satisfaction Rating | Discounts |

|---|---|---|---|

| State Farm | $1,500 | 800 | Safe Driver, Good Student, Multi-Car, Multi-Policy, Defensive Driving |

| Geico | $1,450 | 820 | Safe Driver, Good Student, Multi-Car, Multi-Policy, Defensive Driving |

| Progressive | $1,400 | 810 | Safe Driver, Good Student, Multi-Car, Multi-Policy, Defensive Driving, Usage-Based Insurance |

| USAA | $1,350 | 840 | Safe Driver, Good Student, Multi-Car, Multi-Policy, Military Discounts |

| Nationwide | $1,300 | 830 | Safe Driver, Good Student, Multi-Car, Multi-Policy, Defensive Driving, Bundled Discounts |

Remember, these are just averages, and your actual premium will depend on factors like your driving history, age, and the type of coverage you choose.

Common Car Insurance Discounts in Florida, Cheap car insurance florida

Insurance companies offer various discounts to lower premiums. Here’s a list of common car insurance discounts available in Florida:

- Safe Driver Discount: Awarded to drivers with a clean driving record, typically for 3-5 years without accidents or violations. This discount can be significant, as it reflects a lower risk profile.

- Good Student Discount: Available to students with high GPAs, typically for those under 25. This discount acknowledges responsible behavior and academic achievement.

- Multi-Car Discount: Offered when you insure multiple vehicles under the same policy. This discount reflects the reduced risk associated with insuring multiple vehicles.

- Multi-Policy Discount: Applies when you bundle multiple insurance policies, such as car, home, or renters insurance, with the same company. This discount rewards customer loyalty and creates a more comprehensive insurance portfolio.

- Defensive Driving Discount: Awarded to drivers who complete a certified defensive driving course. These courses aim to improve driving skills and reduce the likelihood of accidents.

- Usage-Based Insurance: This program tracks your driving habits using a device installed in your car. If you drive safely and responsibly, you may qualify for a discount based on your driving data.

- Military Discount: Offered to active-duty military personnel, veterans, and their families. This discount acknowledges the service and sacrifices of those in the military.

- Bundled Discounts: Some insurance companies offer discounts when you bundle specific coverage options, such as comprehensive and collision coverage, or when you choose higher deductibles.

It’s crucial to inquire about available discounts and their eligibility criteria with each insurance company. This can help you find significant savings on your premiums.

Final Wrap-Up: Cheap Car Insurance Florida

Securing cheap car insurance in Florida is achievable by being proactive and informed. By understanding the unique factors influencing costs, exploring available discounts, and comparing quotes from multiple providers, you can find coverage that meets your needs and budget. Remember, the key is to shop around, compare options, and choose the policy that best fits your driving habits and financial situation. Armed with the right knowledge, you can navigate the Florida car insurance market and secure the best possible rates.

Top FAQs

What are the most common car insurance discounts available in Florida?

Florida offers a variety of discounts, including good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts. Additionally, some companies offer discounts for completing defensive driving courses or installing safety features in your vehicle.

How can I improve my credit score to potentially lower my car insurance premiums?

Pay your bills on time, reduce your credit utilization, and avoid opening too many new credit accounts. Consider disputing any errors on your credit report. Building a strong credit history can lead to better insurance rates.

What should I do if I need to file a car insurance claim in Florida?

Contact your insurance company immediately and report the accident. Gather all relevant information, such as police reports, witness statements, and photographs of the damage. Be sure to follow your insurer’s claim filing procedures carefully.