Car insurance quotes NYC can seem overwhelming, but finding the right coverage doesn’t have to be a stressful experience. The Big Apple presents unique challenges for drivers, from congested streets to a high concentration of vehicles, making it crucial to understand the factors that influence car insurance rates. This guide will walk you through the process of obtaining quotes, comparing options, and securing the best deal for your needs.

Navigating the car insurance landscape in NYC requires a clear understanding of the various types of coverage available, the factors that impact pricing, and the strategies for securing favorable rates. We’ll explore the different types of car insurance, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage, and delve into the key factors that influence pricing, such as driving history, vehicle type, age, and credit score.

Understanding Car Insurance in NYC: Car Insurance Quotes Nyc

Navigating the complex world of car insurance in New York City can feel overwhelming. This guide will help you understand the unique factors that influence car insurance rates in NYC and the different types of coverage available.

Factors Influencing Car Insurance Rates in NYC

The cost of car insurance in NYC is significantly higher than the national average due to several factors.

- Traffic Congestion: NYC’s notorious traffic congestion increases the likelihood of accidents, which in turn drives up insurance premiums.

- High Population Density: With a high concentration of vehicles and pedestrians, the risk of accidents is greater in NYC, contributing to higher insurance rates.

- Potential for Accidents: The combination of heavy traffic, limited parking, and aggressive driving habits increases the risk of accidents, leading to higher insurance costs.

Types of Car Insurance Coverage in NYC

Understanding the different types of car insurance coverage available in NYC is crucial for making informed decisions.

- Liability Coverage: This essential coverage protects you financially if you are at fault in an accident. It covers the other driver’s medical expenses, property damage, and lost wages.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. It is typically optional.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It is also typically optional.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. It covers your medical expenses and property damage.

Factors Considered by Insurance Companies

Car insurance companies use a variety of factors to calculate your premium, including:

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your insurance rates. A clean driving record can lead to lower premiums.

- Vehicle Type: The make, model, and year of your vehicle influence your insurance rates. Higher-performance vehicles and luxury cars often have higher premiums due to their higher repair costs.

- Age: Younger drivers generally have higher insurance rates because they have less driving experience. Older drivers may also face higher premiums due to age-related health concerns.

- Credit Score: Surprisingly, your credit score can influence your car insurance rates. Insurance companies often use credit scores as an indicator of financial responsibility.

- Location: Your address in NYC can impact your insurance rates. Areas with higher accident rates typically have higher premiums.

Navigating the Car Insurance Quote Process

Obtaining car insurance quotes in NYC is an essential step in finding the best coverage for your needs and budget. There are several methods to explore, each with its advantages and disadvantages. It’s crucial to compare multiple quotes to ensure you’re getting the most competitive rates.

Methods for Obtaining Quotes

Different methods offer varying levels of convenience, personalization, and control over the quote process.

- Online Platforms: Websites dedicated to car insurance comparison allow you to enter your details and receive quotes from multiple insurers simultaneously. This method offers convenience and speed, enabling you to compare quotes from various providers without leaving your home.

- Phone Calls: Contacting insurance companies directly by phone allows for personalized assistance and detailed explanations of coverage options. However, this method may be time-consuming, requiring multiple calls to compare quotes from different insurers.

- In-Person Visits: Visiting insurance agents in person provides an opportunity for face-to-face consultations and personalized advice. While this method offers a higher level of personalized service, it can be time-consuming and may require multiple visits to different agencies.

Comparing Quotes

Comparing multiple quotes from different insurers is essential for finding the best value for your needs.

- Consider Coverage Options: Compare the types of coverage offered by each insurer, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Ensure the coverage options align with your needs and legal requirements in NYC.

- Evaluate Premiums: Analyze the premiums quoted by each insurer, taking into account the coverage options, deductibles, and other factors. Look for insurers that offer competitive premiums without compromising coverage.

- Read Reviews and Ratings: Research insurers’ reputations by reading customer reviews and ratings from reputable sources. This can provide insights into their customer service, claims handling, and overall satisfaction levels.

Information Required for a Quote

Insurers need specific information to assess your risk and provide accurate quotes.

- Personal Details: This includes your name, address, date of birth, driving history, and contact information.

- Vehicle Information: This includes the make, model, year, and VIN (Vehicle Identification Number) of your car.

- Driving History: Insurers require details about your driving record, including accidents, violations, and driving experience. They use this information to assess your risk and determine your premium.

- Coverage Preferences: Specify your desired coverage options, including liability limits, deductibles, and optional add-ons. This information helps insurers tailor the quote to your specific needs.

Finding the Best Car Insurance Deal

You’ve compared quotes, and now it’s time to make a decision. But how do you choose the best deal for your needs? Finding the right car insurance policy involves a careful evaluation of several factors.

Evaluating Car Insurance Quotes

It’s not just about finding the cheapest option. You need to balance price with coverage, customer service, and other crucial elements. Here’s a breakdown of key factors to consider:

- Price: This is often the primary concern, but remember that the cheapest option might not offer the coverage you need. Consider the overall value, not just the initial premium.

- Coverage: Ensure the policy provides sufficient protection for your car, yourself, and others in case of an accident. This includes liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Customer Service: Look for an insurer with a good reputation for responsiveness and helpfulness. Consider factors like claims processing speed, availability of online tools, and customer reviews.

- Financial Stability: Check the insurer’s financial strength to ensure they can pay claims in the event of a major accident. You can find this information from reputable rating agencies like AM Best.

Negotiating Car Insurance Rates

You don’t have to settle for the first quote you receive. Here are some strategies to negotiate better rates:

- Bundle Policies: Combining your car insurance with other policies like homeowners or renters insurance can often lead to significant discounts.

- Explore Discounts: Many insurers offer discounts for safe driving records, good grades, vehicle safety features, and more. Ask about all available discounts and ensure you’re taking advantage of those that apply to you.

- Adjust Coverage Levels: Review your current coverage and consider if you can reduce some levels without compromising your protection. For example, if you have an older car, you might lower collision and comprehensive coverage.

- Shop Around Regularly: Insurance rates can fluctuate, so it’s wise to compare quotes from different insurers periodically. You can use online comparison tools or contact insurers directly.

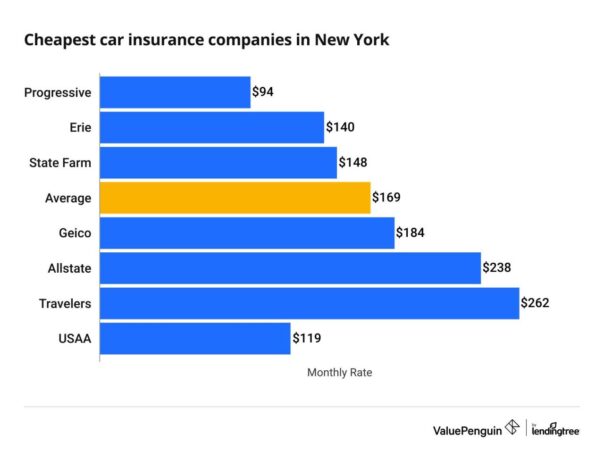

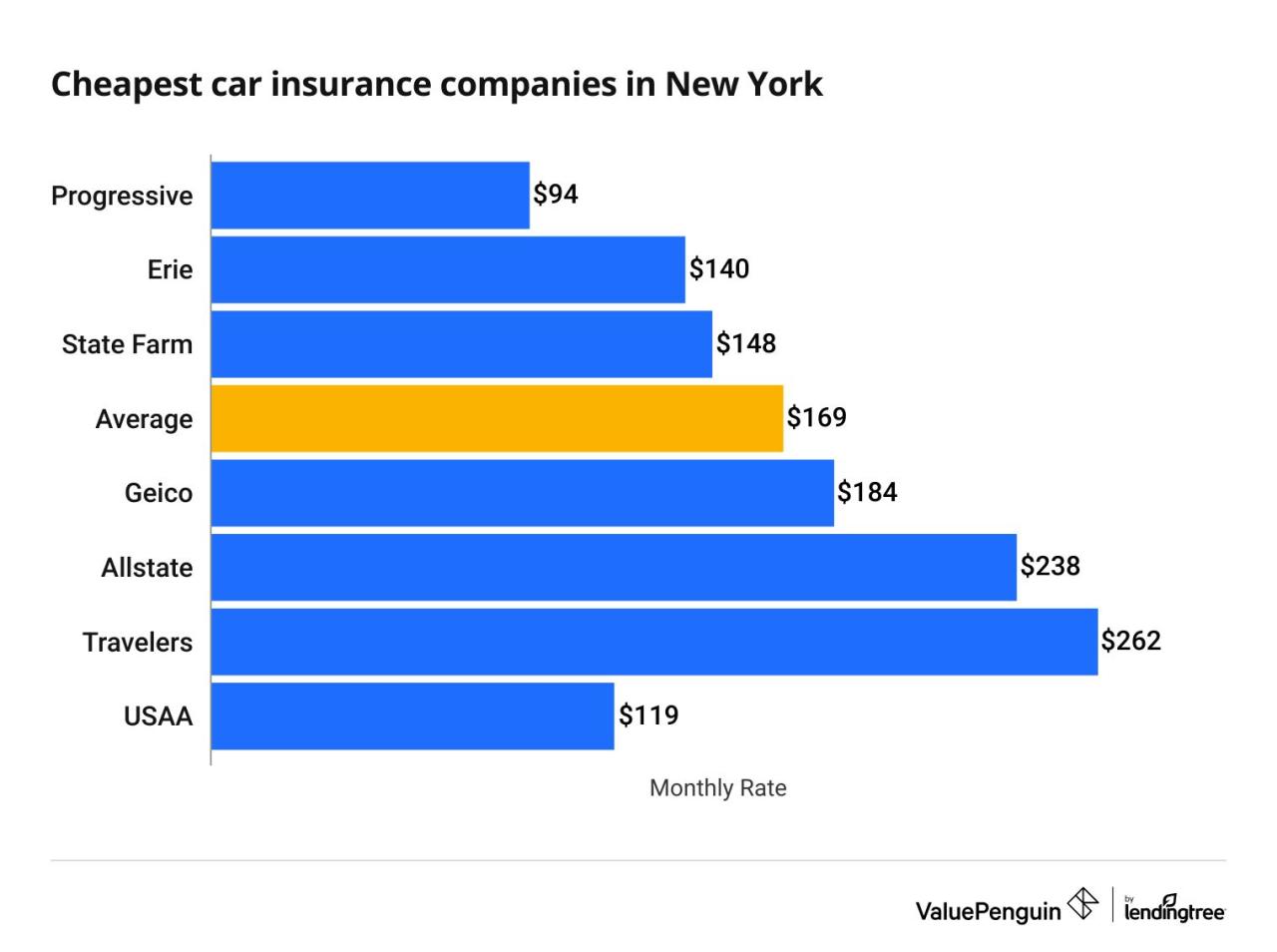

Reputable Car Insurance Providers in NYC

Several reputable car insurance providers operate in New York City. Here are some of the top contenders:

- Geico: Known for its competitive pricing and extensive online tools.

- Strengths: Wide range of discounts, easy online quote process, 24/7 customer service.

- Weaknesses: Limited customer service options beyond online channels, can be difficult to reach a representative by phone.

- State Farm: One of the largest insurance companies in the US, offering a comprehensive suite of insurance products.

- Strengths: Strong financial stability, wide agent network, excellent customer service reputation.

- Weaknesses: Prices can be higher than some competitors, some agents might not be as knowledgeable about specific insurance nuances.

- Progressive: Focuses on personalized coverage options and a user-friendly online experience.

- Strengths: Innovative features like Name Your Price tool, extensive discount options, strong online presence.

- Weaknesses: Can be more expensive for drivers with less-than-perfect records, some online features might not be as user-friendly for everyone.

Essential Considerations for NYC Drivers

Navigating the bustling streets of New York City requires a unique set of driving skills and awareness. Understanding the specific challenges and risks posed by the urban environment is crucial for safe and efficient driving. This section explores essential considerations for NYC drivers, emphasizing defensive driving techniques, traffic violation implications, and resources for resolving insurance disputes.

Defensive Driving Techniques in NYC, Car insurance quotes nyc

Defensive driving is a proactive approach to driving that prioritizes safety by anticipating potential hazards and taking preventive measures. In NYC, where traffic is dense and unpredictable, defensive driving is paramount. Here are some tips for NYC drivers:

- Maintain a Safe Following Distance: Keep a safe distance from the vehicle in front of you to allow for braking time and avoid rear-end collisions. A good rule of thumb is to maintain a distance of at least three seconds.

- Be Aware of Your Surroundings: Stay vigilant and constantly scan your surroundings for potential hazards, including pedestrians, cyclists, and other vehicles. Be aware of blind spots and use mirrors frequently.

- Anticipate Potential Hazards: Observe traffic patterns and anticipate potential hazards, such as sudden stops, merging vehicles, and pedestrians crossing the street. Be prepared to react quickly and safely.

- Avoid Distractions: Refrain from using mobile devices, eating, or engaging in other activities that distract you from driving. Focus your attention on the road and your surroundings.

- Drive Defensively at Intersections: Exercise caution at intersections, where traffic flow can be complex and accidents are common. Be aware of pedestrians, cyclists, and other vehicles, and be prepared to yield the right of way.

Impact of Traffic Violations and Accidents

Traffic violations and accidents can significantly impact your car insurance rates in NYC. Insurance companies consider these factors when determining your risk profile and calculating premiums. Here’s how:

- Increased Premiums: Traffic violations, such as speeding tickets, running red lights, or reckless driving, will likely result in higher insurance premiums. The severity of the violation and the frequency of offenses influence the rate increase.

- Policy Cancellation: Multiple serious traffic violations or accidents can lead to policy cancellation by your insurance company. This means you may be unable to find affordable insurance or may be forced to purchase high-risk coverage at significantly higher rates.

- Higher Deductibles: Accidents can lead to increased deductibles, the amount you pay out of pocket before your insurance coverage kicks in. This can be a substantial financial burden, especially for major accidents.

Resources for Resolving Insurance Disputes

Disputes with your car insurance company can be frustrating and challenging. However, various resources are available to help you navigate these issues:

- New York State Department of Financial Services (DFS): The DFS is the primary regulatory body for the insurance industry in New York. They offer resources for consumers, including information on insurance laws, complaint resolution processes, and consumer rights.

- New York State Insurance Department (NYSD): The NYSD provides information on insurance policies, consumer rights, and dispute resolution. They also offer mediation services to help resolve insurance disputes.

- Consumer Protection Organizations: Organizations like the Better Business Bureau (BBB) and the National Association of Insurance Commissioners (NAIC) can provide guidance and support in dealing with insurance disputes.

Last Word

By understanding the complexities of car insurance in NYC and following the steps Artikeld in this guide, you can confidently navigate the quote process, compare options, and find the best car insurance deal that meets your specific needs and budget. Remember, taking the time to research, compare, and negotiate can save you significant money in the long run. Armed with the right information and strategies, you can secure the coverage you need while ensuring you’re not paying more than you should.

Question & Answer Hub

What factors affect car insurance rates in NYC?

Several factors influence car insurance rates in NYC, including your driving history, vehicle type, age, credit score, and the specific coverage you choose.

How can I get the best car insurance deal in NYC?

Compare quotes from multiple insurers, explore discounts, bundle policies, and consider adjusting coverage levels to find the best deal.

What are some reputable car insurance providers in NYC?

Some reputable car insurance providers in NYC include Geico, State Farm, Liberty Mutual, Allstate, and Progressive. It’s essential to compare quotes and research the strengths and weaknesses of each provider.

What should I do if I have a car insurance dispute in NYC?

Contact your insurance company first and try to resolve the dispute through their customer service department. If you can’t reach a resolution, consider seeking assistance from the New York State Department of Financial Services.