- Understanding Car Insurance in New Jersey

- Factors Influencing Car Insurance Quotes in NJ

- Finding the Best Car Insurance Quotes in NJ

- Tips for Getting Affordable Car Insurance in NJ: Car Insurance Quotes Nj

- Understanding Car Insurance Policies in NJ

- Filing a Car Insurance Claim in NJ

- Final Review

- Q&A

Car insurance quotes NJ: navigating the complex world of car insurance in New Jersey can feel overwhelming, but it doesn’t have to be. Understanding the factors that influence your rates, comparing different insurance providers, and knowing how to negotiate for the best deal are all crucial steps in finding affordable coverage.

This guide will provide you with a comprehensive overview of car insurance in New Jersey, covering everything from mandatory requirements to tips for securing the most competitive quotes. We’ll break down the factors that affect your premiums, explore different coverage options, and highlight resources to help you make informed decisions.

Understanding Car Insurance in New Jersey

Navigating the world of car insurance in New Jersey can feel overwhelming, but understanding the basics is crucial. This guide will walk you through the essential aspects of car insurance in the state, helping you make informed decisions for your needs.

Mandatory Car Insurance Requirements in New Jersey

New Jersey mandates specific car insurance coverage for all drivers, ensuring financial protection in case of accidents. The state requires:

- Liability Coverage: This protects you financially if you cause an accident, covering the other driver’s medical expenses, property damage, and legal fees. It’s divided into bodily injury liability and property damage liability, with minimum limits set by the state. For example, the minimum bodily injury liability coverage required is $15,000 per person and $30,000 per accident, while the minimum property damage liability coverage is $5,000.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs if you’re injured in an accident, regardless of who is at fault. The minimum PIP coverage in New Jersey is $15,000.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It covers your medical expenses, lost wages, and other costs. New Jersey requires you to have UM/UIM coverage equal to your liability limits.

Types of Car Insurance Coverage in New Jersey

Beyond the mandatory coverage, there are additional options you can choose to customize your car insurance policy based on your needs and risk tolerance. Here’s a breakdown of common types:

- Collision Coverage: This covers repairs or replacement costs for your vehicle if it’s damaged in an accident, regardless of fault. This is optional but recommended if you have a loan or lease on your car.

- Comprehensive Coverage: This protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It’s also optional but recommended for newer vehicles.

- Rental Reimbursement: This covers the cost of a rental car while your vehicle is being repaired after an accident. It’s optional and can be helpful if you rely on your car for daily transportation.

- Roadside Assistance: This provides services like towing, jump starts, flat tire changes, and lockout assistance. It’s often available as an add-on to your policy and can be a valuable safety net.

- Gap Insurance: This covers the difference between the actual cash value of your car and the amount you owe on your loan or lease if your vehicle is totaled. It’s especially helpful for newer cars that depreciate quickly.

The New Jersey Motor Vehicle Commission (MVC)

The New Jersey Motor Vehicle Commission (MVC) plays a crucial role in regulating car insurance in the state. The MVC:

- Enforces Insurance Requirements: The MVC ensures all drivers comply with the state’s mandatory car insurance requirements. They check insurance records and impose penalties on those who fail to maintain coverage.

- Provides Resources for Drivers: The MVC offers various resources for drivers, including information on insurance requirements, coverage options, and how to file complaints against insurance companies.

- Manages Driver Licensing and Vehicle Registration: The MVC handles the licensing of drivers and the registration of vehicles, which are closely linked to car insurance requirements.

Factors Influencing Car Insurance Quotes in NJ

Getting a car insurance quote in New Jersey can feel like navigating a maze of variables. The price you pay depends on several factors, and understanding these can help you find the best deal.

Driving History

Your driving history is a major factor in determining your car insurance rates. A clean driving record with no accidents or violations will result in lower premiums. Conversely, a history of accidents, traffic violations, or even DUI convictions will significantly increase your rates.

Insurance companies consider your driving history a reliable indicator of your risk as a driver.

Age

Your age plays a crucial role in how much you pay for car insurance. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. As a result, they often face higher premiums.

As you gain more experience on the road and reach a certain age, your rates tend to decrease.

Vehicle Type

The type of vehicle you drive also impacts your car insurance rates. Luxury cars, sports cars, and high-performance vehicles are generally more expensive to repair and replace, leading to higher insurance premiums.

For example, a sports car with a high horsepower engine and advanced safety features may have a higher insurance cost than a standard sedan.

Credit Score

Surprisingly, your credit score can influence your car insurance premiums in New Jersey. Insurance companies use credit scores as a proxy for risk assessment. A higher credit score is associated with a lower risk of filing claims, resulting in lower insurance rates.

While controversial, this practice is legal in New Jersey and other states.

Location

Where you live in New Jersey can also impact your car insurance rates. Areas with higher crime rates, traffic congestion, or a greater frequency of accidents generally have higher insurance premiums.

Insurance companies analyze the risk profile of different locations and adjust their rates accordingly.

Finding the Best Car Insurance Quotes in NJ

Finding the most affordable car insurance in New Jersey can feel like navigating a maze. With numerous companies vying for your business, it’s essential to compare quotes carefully to secure the best deal. This involves understanding the nuances of different insurance providers, their coverage options, and their pricing structures.

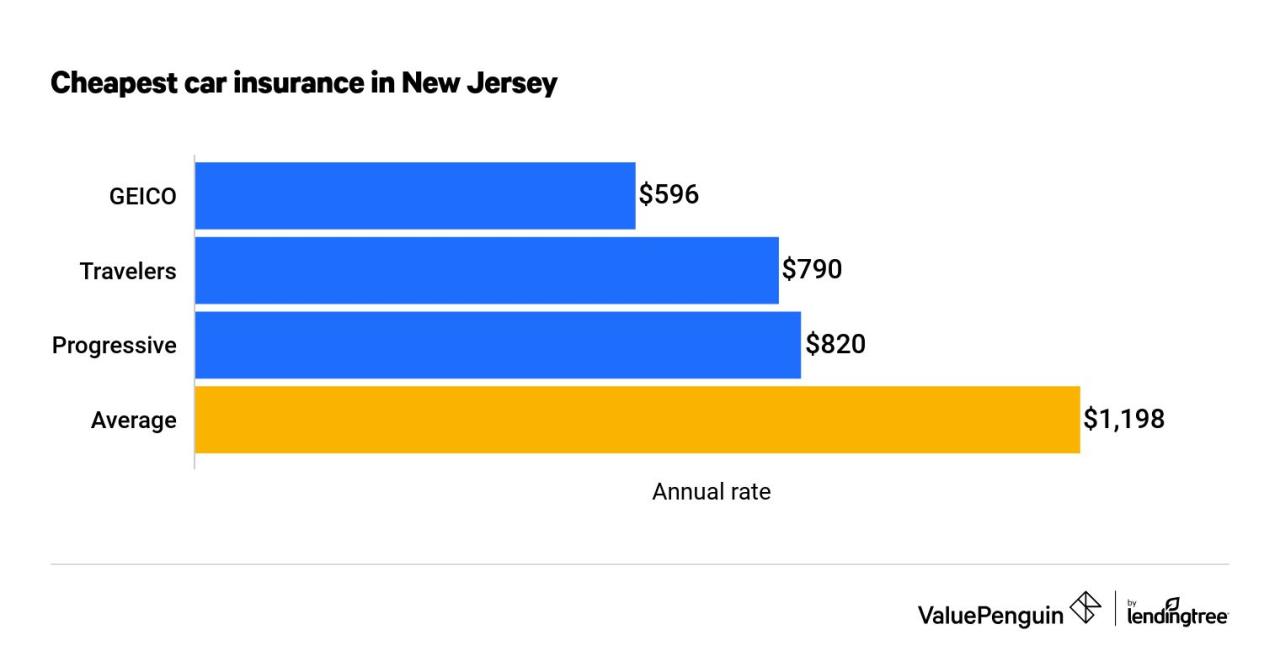

Comparing Car Insurance Companies in New Jersey

New Jersey’s insurance market is diverse, offering a wide range of options. It’s crucial to compare different companies to identify the best fit for your needs and budget. Here’s a breakdown of some key factors to consider:

- Financial Stability: Look for companies with strong financial ratings, ensuring they can fulfill their obligations in case of a claim. Check reputable rating agencies like AM Best or Standard & Poor’s for company financial strength assessments.

- Customer Service: Good customer service is vital. Read online reviews, check customer satisfaction ratings, and inquire about their claims processing procedures. A company’s responsiveness and efficiency during claims can make a significant difference.

- Coverage Options: Compare the types of coverage offered by each company. Some may provide more comprehensive coverage or specialized options like roadside assistance or rental car reimbursement. Ensure the coverage aligns with your specific needs and risk tolerance.

- Discounts: Explore available discounts, such as safe driver discounts, multi-car discounts, or good student discounts. Companies often offer various discounts to attract customers, and maximizing these can significantly reduce your premiums.

- Price: While price is a significant factor, don’t solely focus on the lowest quote. Consider the overall value proposition, including coverage, customer service, and financial stability. A slightly higher premium might be worth it if the company offers superior service or comprehensive coverage.

Top Car Insurance Providers in New Jersey

Here’s a table comparing key features, coverage options, and pricing of some top insurance providers in New Jersey:

| Company | Key Features | Coverage Options | Pricing (Average Annual Premium) |

|---|---|---|---|

| Geico | Wide range of discounts, strong financial rating, excellent customer service | Comprehensive, collision, liability, uninsured motorist, personal injury protection | $1,200 – $1,500 |

| State Farm | Extensive network of agents, strong financial rating, various discounts | Comprehensive, collision, liability, uninsured motorist, personal injury protection | $1,300 – $1,600 |

| Progressive | Innovative online tools, personalized quotes, multiple coverage options | Comprehensive, collision, liability, uninsured motorist, personal injury protection | $1,100 – $1,400 |

| Allstate | Strong financial rating, comprehensive coverage options, excellent customer service | Comprehensive, collision, liability, uninsured motorist, personal injury protection | $1,400 – $1,700 |

| Liberty Mutual | Wide range of discounts, strong financial rating, personalized service | Comprehensive, collision, liability, uninsured motorist, personal injury protection | $1,250 – $1,550 |

Note: These are just a few examples, and pricing can vary significantly based on individual factors like driving history, vehicle type, and location.

Reputable Car Insurance Comparison Websites and Tools

Several online tools and websites can help you compare car insurance quotes from multiple providers simultaneously. Here’s a list of reputable options:

- Insurify: This platform allows you to compare quotes from over 20 insurance companies in minutes. It’s user-friendly and provides detailed information on each provider.

- Policygenius: This website simplifies the comparison process, providing personalized quotes and expert advice. It offers a comprehensive overview of various coverage options.

- The Zebra: This platform compares quotes from over 100 insurance companies, making it a comprehensive resource for finding the best deals. It also provides insights into different coverage options and discounts.

- Compare.com: This website offers a user-friendly interface for comparing quotes and understanding different coverage options. It also provides detailed information on each insurance provider.

- Bankrate: This website provides comprehensive coverage options, allowing you to compare quotes from top providers and identify the best fit for your needs. It also offers insightful articles on car insurance topics.

Tips for Getting Affordable Car Insurance in NJ: Car Insurance Quotes Nj

Car insurance is a necessity for all vehicle owners in New Jersey. It provides financial protection in case of accidents, theft, or other covered events. While car insurance is essential, it can be a significant expense. Fortunately, there are several strategies you can implement to lower your car insurance premiums and save money.

Maintaining a Good Driving Record

A clean driving record is crucial for securing affordable car insurance rates. In New Jersey, your driving history plays a major role in determining your insurance premiums. Avoiding traffic violations, accidents, and driving under the influence of alcohol or drugs can significantly reduce your insurance costs.

“Maintaining a good driving record is the most effective way to reduce your car insurance premiums.”

Safe Driving Practices

Engaging in safe driving practices is essential for reducing the risk of accidents, which can lead to higher insurance premiums. Some effective safe driving practices include:

- Buckling up every time you drive.

- Avoiding distractions while driving, such as using your phone or eating.

- Maintaining a safe distance from other vehicles.

- Driving at a safe speed and adjusting your speed based on road conditions.

- Being aware of your surroundings and anticipating potential hazards.

Negotiating Car Insurance Rates

It’s important to shop around and compare car insurance quotes from multiple insurers. Once you’ve found a few quotes you like, you can try to negotiate lower rates.

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Ask about discounts: Many insurers offer discounts for good students, safe drivers, and those who install anti-theft devices in their vehicles.

- Increase your deductible: Choosing a higher deductible can lead to lower premiums. However, make sure you can afford to pay the deductible in case of an accident.

- Pay your premium in full: Paying your premium annually or semi-annually can often result in a lower rate compared to paying monthly.

Understanding Car Insurance Policies in NJ

It’s crucial to carefully review your car insurance policy in New Jersey. Understanding the key sections and terms within your policy can help you make informed decisions about your coverage and ensure you have adequate protection in case of an accident or other covered event.

Key Sections and Terms in a New Jersey Car Insurance Policy

The standard New Jersey car insurance policy includes several key sections and terms that Artikel your coverage and responsibilities. These sections are essential for understanding the scope of your insurance protection.

- Declarations Page: This page summarizes your policy’s key information, including your name, address, vehicle details, coverage limits, deductibles, and premium amount.

- Coverages: This section Artikels the specific types of coverage you have purchased, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Exclusions: This section lists the situations or events that are not covered by your policy. For example, your policy might exclude coverage for damage caused by wear and tear or for accidents involving driving under the influence of alcohol or drugs.

- Conditions: This section Artikels your responsibilities as a policyholder, including reporting accidents, cooperating with investigations, and paying your premiums on time.

Coverage Limits, Deductibles, and Exclusions, Car insurance quotes nj

Understanding the relationship between coverage limits, deductibles, and exclusions is vital to making informed choices about your insurance policy.

- Coverage Limits: These limits represent the maximum amount your insurance company will pay for a covered loss. For example, a liability coverage limit of $100,000 per person and $300,000 per accident means your insurance company will pay up to $100,000 for injuries to one person in an accident and up to $300,000 for all injuries in that accident.

- Deductibles: The deductible is the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in. For example, if you have a $500 deductible for collision coverage and your car sustains $2,000 in damage, you would pay $500, and your insurance company would cover the remaining $1,500.

- Exclusions: These are specific situations or events that are not covered by your policy. For example, your policy might exclude coverage for damage caused by wear and tear or for accidents involving driving under the influence of alcohol or drugs.

Filing a Car Insurance Claim in NJ

Filing a car insurance claim in New Jersey is a necessary step when you’ve been involved in an accident. It’s crucial to understand the process to ensure a smooth and timely resolution. This section will guide you through the steps involved in filing a claim and provide valuable information on the required documentation, reporting procedures, and claim processing timelines.

Reporting an Accident

Reporting an accident to your insurance company is the first crucial step. You must promptly inform your insurer about the accident, typically within 24 hours, to initiate the claims process. This initial notification sets the wheels in motion for the investigation and claim assessment.

Required Documentation

To ensure a smooth claims process, it’s essential to gather the necessary documentation. This includes:

- Police Report: If the accident involved property damage or injuries, it’s crucial to file a police report. The report serves as a legal record of the incident, documenting details like the date, time, location, and parties involved.

- Contact Information: Exchange contact information with all parties involved, including their names, addresses, phone numbers, and insurance details. This ensures you can easily communicate with them and their insurers during the claims process.

- Photos and Videos: Document the accident scene by taking clear photos and videos of the damage to your vehicle, the other vehicles involved, and the surrounding area. This visual evidence helps support your claim and provide a comprehensive picture of the incident.

- Witness Information: If any witnesses were present at the accident, obtain their contact information. Their statements can provide valuable insights and corroborate your account of the incident.

- Medical Records: If you sustained injuries in the accident, gather your medical records, including treatment notes, diagnoses, and bills. This documentation supports your claim for medical expenses.

Claim Processing Timeframes

The time it takes to process a car insurance claim in New Jersey can vary depending on the complexity of the case and the insurer’s procedures. However, you can generally expect the following timelines:

- Initial Claim Review: Once you file your claim, your insurer will review the initial documentation to assess the validity and scope of the claim. This review process typically takes a few days.

- Investigation: The insurer may conduct an investigation to gather further information, including witness statements, accident reconstruction reports, and medical evaluations. This stage can take several weeks or even months, depending on the complexity of the case.

- Claim Settlement: Once the investigation is complete, the insurer will assess the damages and determine the amount of compensation you’re entitled to. This process may involve negotiations with the other parties involved in the accident. Depending on the nature of the claim and the parties involved, this stage can take a few weeks or months.

- Payment: After the claim is settled, the insurer will issue payment for the damages, which may include repair costs, medical expenses, lost wages, and other related expenses. The payment timeframe depends on the insurer’s payment procedures and the type of claim. Some insurers may issue payment within a few weeks, while others may take several months to process the payment.

Final Review

By understanding the ins and outs of car insurance in New Jersey, you can empower yourself to find the right coverage at the right price. Remember, taking the time to compare quotes, explore discounts, and negotiate rates can lead to significant savings on your car insurance premiums. So, take charge of your insurance journey and find the best car insurance quotes in New Jersey.

Q&A

What are the minimum car insurance requirements in New Jersey?

New Jersey requires all drivers to carry liability insurance, including bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How can I get a free car insurance quote in New Jersey?

Many insurance companies offer free online quotes. You can also use comparison websites to get quotes from multiple providers at once.

What are some common discounts offered by car insurance companies in New Jersey?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining home and auto insurance.