Cheap car insurance Georgia sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of car insurance in Georgia can be a complex journey, but finding affordable coverage doesn’t have to be a daunting task. This guide provides valuable insights into understanding Georgia’s car insurance market, identifying affordable options, and ultimately securing the best protection for your vehicle and your wallet.

From exploring the factors that influence car insurance costs to uncovering strategies for negotiating lower premiums, this comprehensive resource equips you with the knowledge and tools to make informed decisions. We’ll delve into the different types of car insurance available, highlight key features offered by various insurance companies, and discuss the potential consequences of driving without insurance. With a focus on clarity and practicality, this guide aims to empower Georgia drivers to navigate the insurance landscape with confidence and find the most suitable coverage for their individual needs.

Understanding Georgia’s Car Insurance Market

Navigating the car insurance market in Georgia can feel overwhelming, with numerous factors influencing your premiums. Understanding these factors and the different types of coverage available can help you make informed decisions and secure the best insurance policy for your needs.

Factors Influencing Car Insurance Costs in Georgia

Several factors determine your car insurance premiums in Georgia. These factors are used by insurance companies to assess your risk profile and determine the likelihood of you filing a claim.

- Your Driving Record: A clean driving record with no accidents or traffic violations will generally lead to lower premiums. Conversely, a history of accidents or traffic violations can significantly increase your rates.

- Your Age and Gender: Younger drivers and males typically face higher insurance rates due to their higher risk of accidents. This is because young drivers have less experience on the road, while males tend to drive more aggressively.

- Your Vehicle: The type of vehicle you drive plays a crucial role in determining your insurance costs. High-performance cars or vehicles with a history of theft are often associated with higher premiums. The age and safety features of your vehicle also influence your rates.

- Your Location: Where you live in Georgia can impact your insurance premiums. Areas with high traffic density or higher crime rates may have higher insurance costs.

- Your Credit History: In some states, including Georgia, insurance companies can use your credit history to assess your risk. A good credit history may lead to lower premiums.

- Your Coverage: The type and amount of coverage you choose will directly impact your premiums. More comprehensive coverage typically means higher premiums.

Types of Car Insurance in Georgia, Cheap car insurance georgia

Understanding the different types of car insurance available in Georgia is essential for making informed decisions about your coverage.

- Liability Coverage: This is the most basic type of car insurance and is required by law in Georgia. Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other driver’s medical expenses, lost wages, and property damage up to the limits of your policy.

- Collision Coverage: Collision coverage protects you if your vehicle is damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement of your vehicle, minus your deductible.

- Comprehensive Coverage: Comprehensive coverage protects you against damage to your vehicle caused by events other than an accident, such as theft, vandalism, fire, or natural disasters. It also covers the cost of repairs or replacement, minus your deductible.

- Personal Injury Protection (PIP): PIP coverage pays for your medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of who is at fault. It is mandatory in Georgia.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance. It covers your medical expenses, lost wages, and property damage.

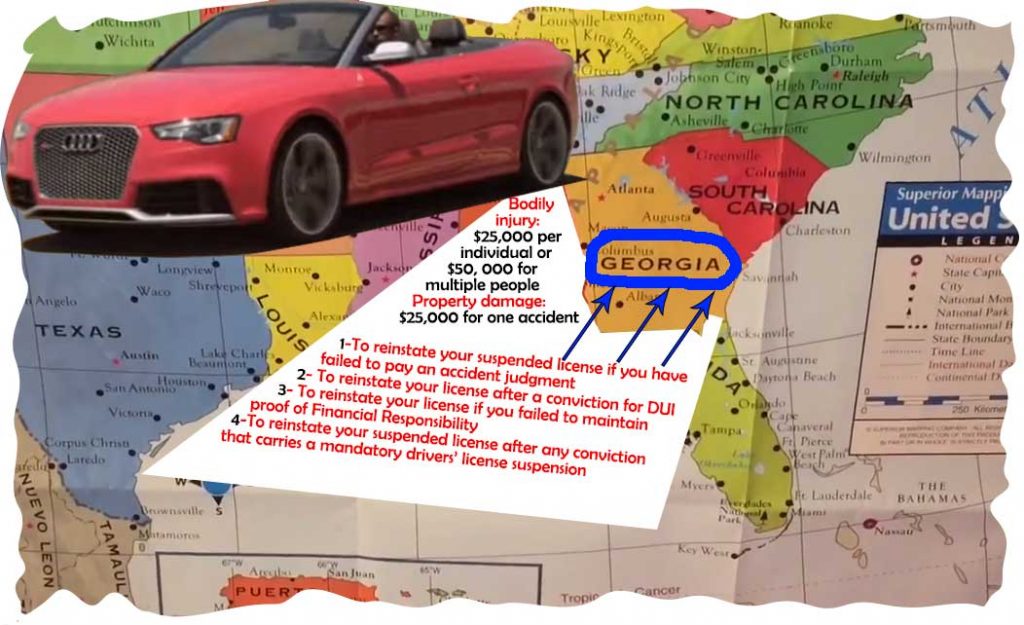

Mandatory Insurance Requirements in Georgia

Georgia requires all drivers to carry a minimum amount of liability insurance to protect themselves and others on the road. These minimum requirements are:

25/50/25 coverage

This means you must have at least:

- $25,000 in bodily injury liability coverage per person

- $50,000 in bodily injury liability coverage per accident

- $25,000 in property damage liability coverage per accident

Consequences of Driving Without Insurance in Georgia

Driving without insurance in Georgia is illegal and can result in serious consequences. If you are caught driving without insurance, you could face:

- Fines and Penalties: You could be fined up to $1,000 for driving without insurance. Your license could also be suspended.

- Imprisonment: In some cases, you could be imprisoned for up to 12 months for driving without insurance.

- Higher Insurance Rates: If you are caught driving without insurance, your insurance rates will likely increase significantly when you eventually get insurance.

- Financial Responsibility: If you are involved in an accident without insurance, you will be personally responsible for all damages and injuries, even if you were not at fault. This could lead to significant financial hardship.

Finding Affordable Car Insurance Options: Cheap Car Insurance Georgia

Finding the most affordable car insurance in Georgia can feel like a daunting task. With so many insurance providers and policies available, navigating this complex landscape can be overwhelming. This section will equip you with the knowledge and strategies to find the best deals on car insurance in Georgia.

Comparing Car Insurance Providers in Georgia

It’s crucial to compare different car insurance providers to find the best rates and coverage.

- Major National Providers: These companies offer nationwide coverage and often have established reputations. Some popular national providers in Georgia include State Farm, Geico, Progressive, and Allstate. They usually offer competitive rates and a wide range of coverage options.

- Regional and Local Providers: Smaller, regional insurance companies often focus on specific areas and may offer competitive rates for local drivers. These companies can provide personalized service and cater to the needs of their local communities.

- Direct-to-Consumer Providers: These companies operate online and often have lower overhead costs, allowing them to offer competitive rates. They can provide a convenient and efficient way to obtain car insurance quotes.

Key Features and Benefits of Car Insurance Companies

Each car insurance company offers a unique set of features and benefits.

- Coverage Options: Companies offer various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It’s essential to choose coverage that aligns with your specific needs and risk tolerance.

- Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safe driving courses, multiple policies, and vehicle safety features. Taking advantage of these discounts can significantly reduce your premium.

- Customer Service: A good car insurance company should provide excellent customer service, including prompt claims processing, helpful representatives, and 24/7 availability.

- Financial Stability: It’s important to choose a financially stable insurance company that can pay out claims in the event of an accident. You can research a company’s financial rating through agencies like A.M. Best or Standard & Poor’s.

Negotiating Lower Car Insurance Premiums in Georgia

While car insurance premiums are determined by various factors, you can employ strategies to negotiate lower rates.

- Shop Around: Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Improve Your Driving Record: Maintain a clean driving record by avoiding traffic violations and accidents.

- Consider Bundling Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in the event of an accident, but it can also lead to lower premiums.

- Ask About Discounts: Inquire about available discounts, such as safe driver discounts, good student discounts, and multi-car discounts.

- Negotiate With Your Current Provider: If you’re a loyal customer, you may be able to negotiate a lower rate with your existing insurance company.

Obtaining Car Insurance Quotes from Multiple Providers

You can easily obtain car insurance quotes from multiple providers using these steps.

- Gather Your Information: Have your driver’s license, vehicle information (make, model, year), and any relevant details about your driving history readily available.

- Visit Insurance Company Websites: Many insurance companies offer online quote tools that allow you to enter your information and receive an instant quote.

- Contact Insurance Agents: You can also contact insurance agents directly by phone or email to request a quote.

- Compare Quotes: Once you have received quotes from multiple providers, carefully compare the rates, coverage options, and benefits to find the best deal.

Factors Affecting Car Insurance Premiums

In Georgia, like in most states, car insurance premiums are not a one-size-fits-all proposition. Several factors come into play, influencing the cost of your coverage. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a key factor in determining your car insurance premiums. Insurance companies consider your driving record, looking for any instances of accidents, traffic violations, or DUI convictions.

- Accidents: If you’ve been involved in accidents, especially those deemed your fault, your premiums will likely increase. Insurance companies see this as a higher risk of future accidents.

- Traffic Violations: Speeding tickets, running red lights, and other traffic violations can also lead to higher premiums. These violations indicate a higher likelihood of risky driving behavior.

- DUI Convictions: A DUI conviction carries the most significant impact on your premiums. Insurance companies view this as a serious risk factor and may significantly increase your rates or even refuse to insure you.

Age and Gender

Age and gender are factors that insurance companies use to assess risk.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Therefore, they often pay higher premiums. As drivers gain experience and age, premiums tend to decrease.

- Gender: Historically, insurance companies have found that men tend to have higher accident rates than women. This difference has led to some insurance companies charging men higher premiums. However, this practice is being challenged in some states, including Georgia, where gender-based pricing is prohibited.

Vehicle Type and Value

The type and value of your car play a significant role in your insurance premiums.

- Vehicle Type: Sports cars, luxury vehicles, and vehicles with powerful engines are generally considered higher risk. They tend to be more expensive to repair and are more attractive to thieves. As a result, premiums for these types of vehicles are often higher.

- Vehicle Value: The value of your car also affects your insurance costs. Higher-value vehicles typically have higher premiums because the cost of replacing or repairing them is greater.

Other Factors

In addition to the factors mentioned above, several other aspects can influence your car insurance premiums.

- Credit Score: In some states, including Georgia, insurance companies can use your credit score to assess your risk. A higher credit score generally indicates a lower risk and can lead to lower premiums.

- Location: Where you live can also impact your insurance premiums. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents tend to have higher insurance rates.

- Driving History: Your driving history is a key factor in determining your car insurance premiums. Insurance companies consider your driving record, looking for any instances of accidents, traffic violations, or DUI convictions.

Concluding Remarks

In conclusion, securing cheap car insurance in Georgia requires a strategic approach that involves understanding the market, comparing options, and utilizing available resources. By carefully considering factors that influence premiums, implementing cost-saving strategies, and exploring available discounts, Georgia drivers can significantly reduce their insurance costs while ensuring adequate coverage. With a proactive mindset and a commitment to finding the right insurance solution, you can drive confidently knowing that you have the financial protection you need on the road.

Top FAQs

What is the minimum car insurance coverage required in Georgia?

Georgia requires drivers to carry a minimum of $25,000 in liability coverage per person, $50,000 per accident, and $25,000 in property damage coverage.

How can I get a free car insurance quote in Georgia?

Most insurance companies offer online quote tools on their websites. You can also contact an insurance agent or broker to get a quote over the phone or in person.

What are some common car insurance discounts in Georgia?

Some common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for bundling insurance policies.

What is the Georgia Department of Insurance’s role?

The Georgia Department of Insurance regulates the insurance industry in the state and provides consumer protection.

What should I do if I’m involved in a car accident in Georgia?

If you are involved in a car accident, it is important to stay calm, exchange information with the other driver, and call the police to report the accident. You should also contact your insurance company to report the claim.