Average car insurance cost per month is a significant expense for most car owners, and understanding the factors that influence these costs is crucial for making informed decisions. From your driving record to the type of vehicle you own, numerous elements contribute to the price you pay for coverage. This article delves into the key factors that impact car insurance premiums, providing insights into how you can potentially save money on your monthly payments.

Navigating the world of car insurance can feel overwhelming, but understanding the fundamentals can empower you to make choices that align with your needs and budget. By exploring the intricacies of average car insurance cost per month, we aim to equip you with the knowledge to secure the best possible coverage at a price that suits you.

Factors Influencing Car Insurance Costs

Your car insurance premium is not a fixed amount. It’s calculated based on several factors that assess your risk as a driver. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

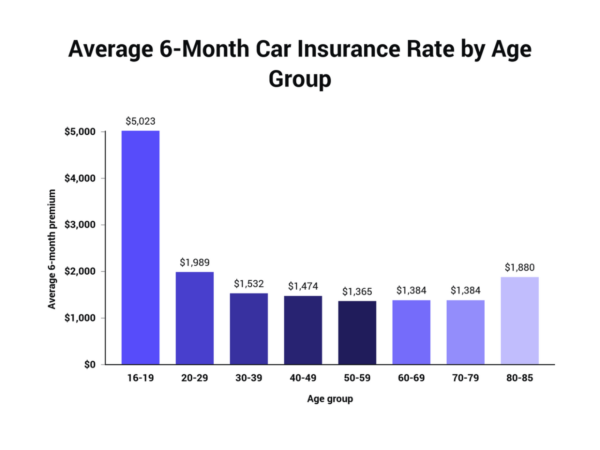

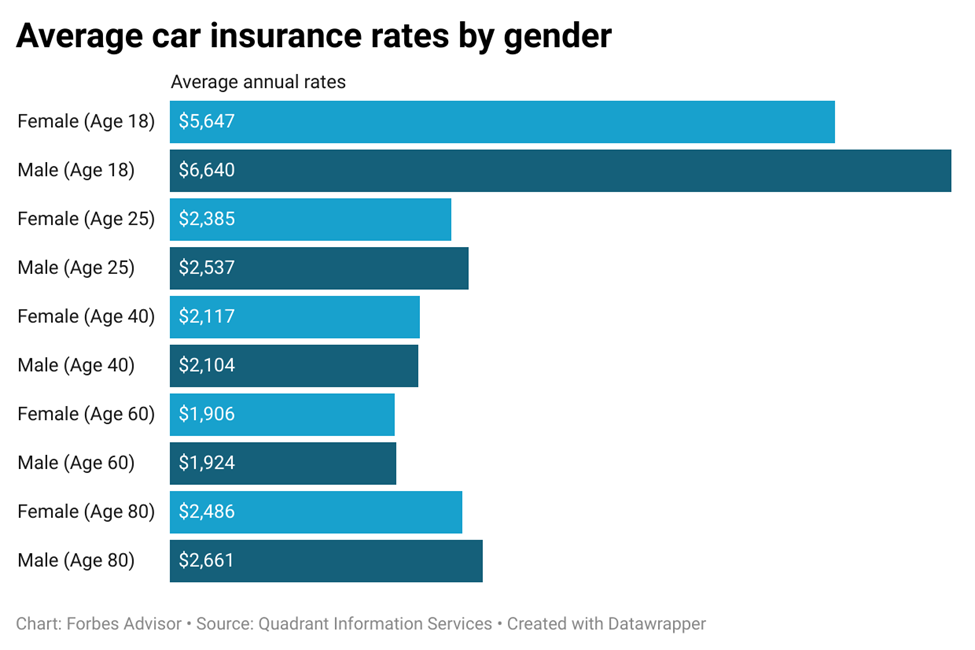

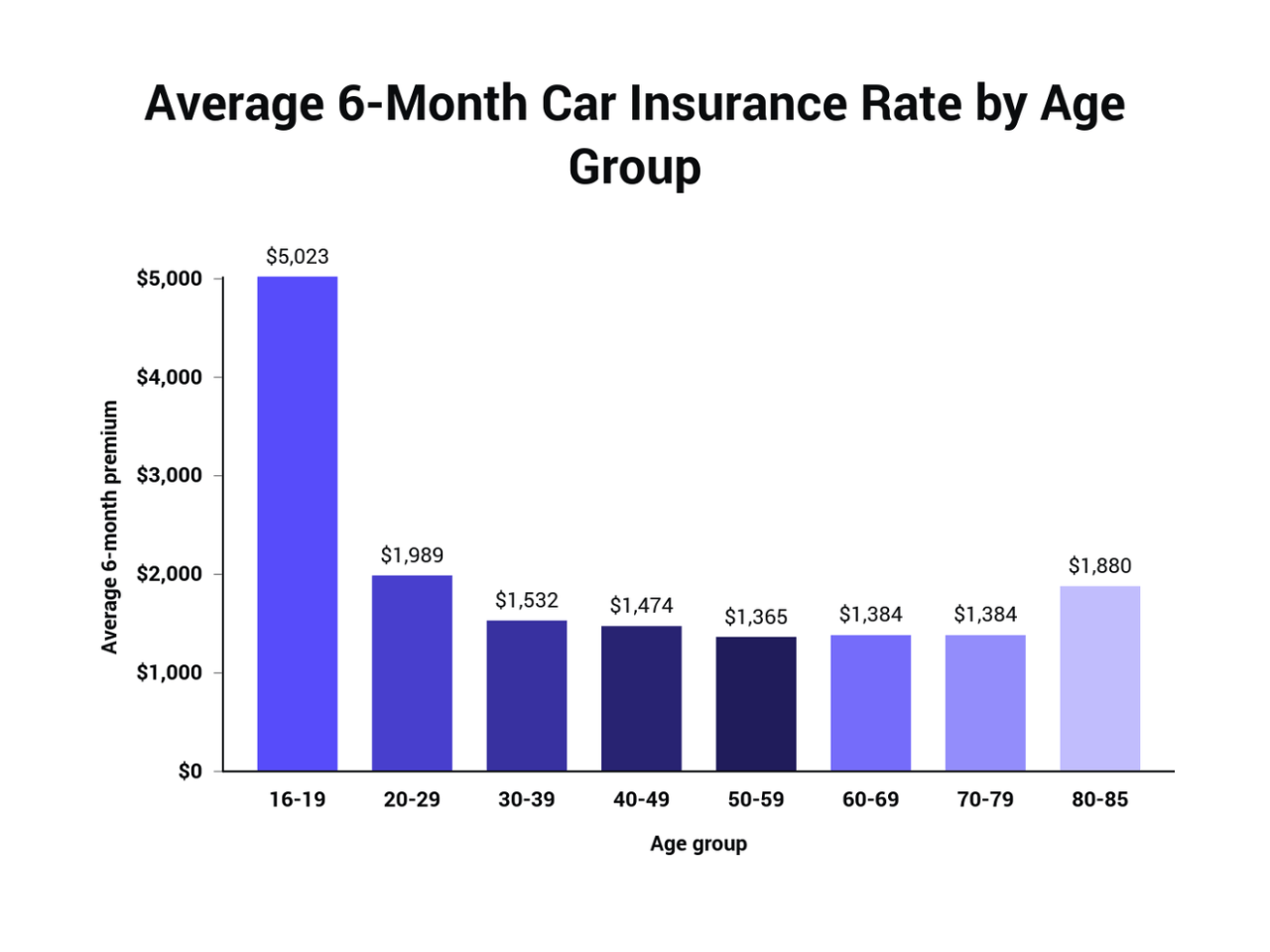

Age

Your age is a significant factor in determining your car insurance premium. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies perceive this increased risk and adjust premiums accordingly. As you gain experience and reach a certain age, typically around 25, your premium may decrease due to a lower perceived risk.

Driving History

Your driving history plays a crucial role in determining your car insurance premium. A clean driving record with no accidents, traffic violations, or DUI convictions will generally lead to lower premiums. Conversely, a history of accidents, speeding tickets, or other violations can significantly increase your premium.

Location

The location where you live and drive can impact your car insurance costs. Areas with higher crime rates, denser populations, or more traffic congestion tend to have higher accident rates. As a result, insurance companies may charge higher premiums in these areas to account for the increased risk.

Vehicle Type

The type of vehicle you drive also influences your car insurance premium. Sports cars, luxury vehicles, and high-performance cars are often associated with higher repair costs and a greater risk of accidents. Consequently, insurance companies may charge higher premiums for these vehicles. Conversely, smaller, less expensive cars may have lower premiums.

Coverage Options, Average car insurance cost per month

The coverage options you choose will significantly impact your car insurance premium. Comprehensive and collision coverage, which protect you against damage to your vehicle, typically cost more than liability coverage, which only covers damages to other vehicles or individuals.

National Average Car Insurance Costs: Average Car Insurance Cost Per Month

The cost of car insurance varies significantly across the United States. Several factors, including location, driving history, and the type of coverage you choose, influence the final price. This section explores the national average cost of car insurance and provides insights into how it differs across states.

Average Monthly Car Insurance Cost in the United States

The average monthly cost of car insurance in the United States is approximately $177. This figure represents the national average and can vary depending on individual circumstances and factors like those mentioned earlier.

Average Car Insurance Costs by State

Car insurance costs can vary considerably across different states. The following table displays the average monthly cost of car insurance in several states, offering a glimpse into the range of costs across the country:

| State | Average Monthly Cost |

|---|---|

| Michigan | $262 |

| Louisiana | $240 |

| Florida | $237 |

| New Jersey | $225 |

| Pennsylvania | $214 |

| Texas | $198 |

| California | $195 |

| New York | $190 |

| Illinois | $188 |

| Ohio | $175 |

Average Monthly Cost by Car Insurance Type

The cost of car insurance also depends on the type of coverage you choose. Here’s a breakdown of average monthly costs for various types of car insurance:

| Type of Coverage | Average Monthly Cost |

|---|---|

| Liability Only | $50 |

| Liability + Collision | $125 |

| Liability + Comprehensive | $100 |

| Full Coverage (Liability + Collision + Comprehensive) | $175 |

It’s crucial to remember that these figures represent averages. Your actual car insurance cost will depend on factors such as your driving history, age, location, vehicle type, and the specific coverage you choose.

Impact of Driving Habits on Costs

Your driving habits play a significant role in determining your car insurance premiums. Insurance companies assess your risk based on how you drive, and this directly impacts your monthly costs. Factors like your mileage, driving record, and use of safety features are all considered.

Impact of Driving Record on Insurance Costs

A clean driving record is essential for lower insurance premiums. Insurance companies view drivers with a history of accidents or traffic violations as higher risk.

- Clean Record: Drivers with no accidents or traffic violations in their history generally enjoy the lowest insurance rates.

- Speeding Tickets: A speeding ticket can significantly increase your premiums, as it indicates a higher likelihood of future accidents.

- Accidents: Being involved in an accident, regardless of fault, can result in a substantial increase in your insurance premiums.

Insurance companies often use a points system to assess driving records. Each violation or accident accumulates points, leading to higher premiums.

Impact of Mileage on Insurance Costs

The more you drive, the greater the chance of being involved in an accident. Insurance companies factor in your annual mileage when calculating your premiums.

- Low Mileage: Drivers who commute short distances or drive infrequently generally receive lower insurance rates.

- High Mileage: Drivers who travel long distances for work or pleasure often face higher premiums due to the increased risk of accidents.

It’s important to accurately report your mileage to your insurance company to ensure you’re paying the correct premium.

Impact of Safety Features on Insurance Costs

Modern vehicles come equipped with various safety features that can help prevent accidents and mitigate their severity. Insurance companies recognize these features and often offer discounts for their inclusion.

- Anti-theft Devices: Cars with alarms, immobilizers, and tracking systems are less likely to be stolen, leading to lower insurance premiums.

- Advanced Driver-Assistance Systems (ADAS): Features like lane departure warning, automatic emergency braking, and adaptive cruise control can help prevent accidents and may result in lower insurance costs.

The specific discounts offered for safety features vary depending on the insurance company and the type of feature.

Saving Money on Car Insurance

Car insurance is a necessity for most drivers, but it can also be a significant expense. Fortunately, there are several ways to reduce your premiums and save money. By understanding the factors that influence your rates and implementing smart strategies, you can make your car insurance more affordable.

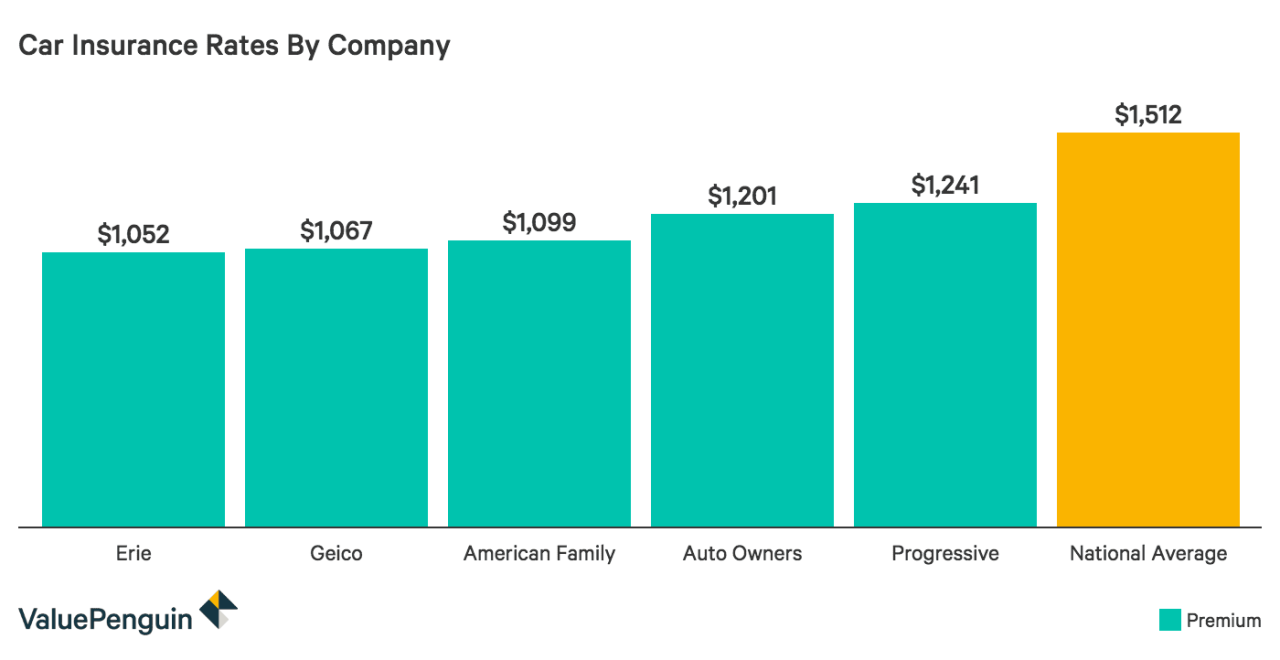

Shopping Around for Better Rates

Finding the best car insurance rates requires some effort, but it can be well worth it. Insurance companies use different formulas to calculate premiums, so rates can vary significantly from one provider to another.

- Use online comparison websites: Websites like Insurance.com and Bankrate.com allow you to compare quotes from multiple insurance companies simultaneously. This lets you see the rates side-by-side and quickly identify the most competitive options.

- Contact insurance companies directly: Don’t rely solely on comparison websites. Reach out to insurance companies directly to request personalized quotes. This allows you to ask specific questions and ensure you’re getting the best possible rate for your needs.

- Negotiate with your current insurer: If you’ve been with your current insurer for a while, consider negotiating a lower rate. You might be able to leverage your good driving record, loyalty, or recent improvements to your car (e.g., safety features) to secure a better deal.

Benefits of Bundling Insurance Policies

Bundling your car insurance with other policies, such as home, renters, or life insurance, can lead to significant discounts. This is because insurance companies often offer incentives to customers who purchase multiple policies from them.

- Lower premiums: Bundling policies can often lead to lower premiums than purchasing each policy separately. This is because insurance companies reward customers who choose to bundle their policies by offering discounts.

- Convenience: Having multiple policies with the same insurer can simplify your insurance management. You’ll only have one provider to contact for claims, billing, and policy updates, streamlining the process.

- Potential for additional discounts: Bundling your policies may also qualify you for additional discounts that you wouldn’t receive if you purchased each policy separately. For example, some insurers offer multi-policy discounts that can further reduce your premiums.

Common Car Insurance Coverage Options

Car insurance policies are often tailored to individual needs and can include a variety of coverage options. Understanding the different types of coverage available is essential for making informed decisions about your insurance policy.

Liability Coverage

Liability coverage is a crucial part of most car insurance policies. It protects you financially if you cause an accident that results in damage to another person’s property or injuries to another person. This coverage pays for:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages for injuries to other people in an accident you cause.

- Property Damage Liability: Covers damages to another person’s vehicle or property in an accident you cause.

The minimum liability coverage required varies by state, but it’s generally recommended to have higher limits than the minimum to protect yourself from significant financial losses.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional, but it’s often recommended for newer or more expensive vehicles. If you have a car loan, your lender may require you to have collision coverage.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than accidents, such as:

- Theft

- Vandalism

- Natural disasters (e.g., hail, floods)

- Animal collisions

This coverage is optional, but it can be beneficial for protecting your investment in your vehicle.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. This coverage can pay for your medical expenses, lost wages, and property damage.

Factors to Consider When Choosing Coverage Options

When deciding which coverage options to include in your car insurance policy, consider:

- Your vehicle’s value: If you have a newer or more expensive vehicle, you may want to consider collision and comprehensive coverage.

- Your financial situation: Liability coverage is essential, but you may want to consider additional coverage based on your financial ability to cover potential expenses.

- Your driving history: A clean driving record may allow you to get lower premiums, while a history of accidents or traffic violations could lead to higher premiums.

- Your state’s minimum coverage requirements: Each state has minimum liability coverage requirements that you must meet.

Understanding Car Insurance Quotes

Car insurance quotes are estimates of how much you’ll pay for coverage. They are essential for comparing different insurance policies and finding the best deal for your needs.

Components of a Car Insurance Quote

A car insurance quote typically includes several components that determine your premium. These components are:

- Coverage Limits: These limits specify the maximum amount your insurance company will pay for different types of claims, such as bodily injury liability, property damage liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Deductible: This is the amount you pay out of pocket for a claim before your insurance kicks in. A higher deductible generally leads to lower premiums.

- Premium: This is the monthly or annual amount you pay for your car insurance policy.

How Insurance Companies Calculate Premiums

Insurance companies use a complex formula to calculate premiums, taking into account various factors. The formula generally considers the following aspects:

- Vehicle Information: This includes the make, model, year, and value of your car. More expensive or higher-risk vehicles tend to have higher premiums.

- Driving History: Your driving record, including accidents, violations, and claims history, significantly impacts your premium. Drivers with a clean record generally receive lower premiums.

- Location: Your location, including your zip code and the overall risk of accidents in your area, influences your premium. Areas with high accident rates tend to have higher premiums.

- Age and Gender: Younger drivers, especially males, are statistically more likely to be involved in accidents, which can lead to higher premiums.

- Credit Score: In some states, insurance companies consider your credit score as a factor in determining your premium. Individuals with good credit scores may receive lower premiums.

- Coverage Options: The types of coverage you choose, such as collision, comprehensive, and uninsured/underinsured motorist coverage, also influence your premium. More comprehensive coverage typically leads to higher premiums.

Factors Affecting Quote Variations

Several factors can cause variations in car insurance quotes from different companies. These factors include:

- Company’s Risk Assessment: Different insurance companies have different risk assessments and pricing models, which can result in varying quotes for the same coverage.

- Discounts: Insurance companies offer various discounts, such as safe driver discounts, good student discounts, and multi-car discounts, which can significantly impact your premium. Comparing quotes from different companies can help you find the best discounts.

- Comparison Shopping: It is essential to compare quotes from multiple insurance companies to ensure you are getting the best deal. Online comparison tools and insurance brokers can help you compare quotes efficiently.

Final Summary

As you’ve learned, the average car insurance cost per month can vary greatly depending on individual circumstances. By understanding the factors that influence premiums and exploring strategies for reducing costs, you can take control of your car insurance expenses. Remember, taking the time to compare quotes, choose the right coverage, and adopt safe driving habits can lead to significant savings over time. So, be proactive, shop around, and secure the car insurance that provides you with peace of mind while staying within your budget.

FAQ Resource

What is the average car insurance cost per month in the US?

The average monthly car insurance cost in the United States is around $170, but this can vary significantly based on factors like location, coverage, and driving history.

How can I get a free car insurance quote?

Most insurance companies offer free online quote tools. Simply provide your information and they will generate a personalized quote based on your specific needs.

What are the different types of car insurance coverage?

Common types of car insurance coverage include liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP). Each coverage type provides different protection for you and your vehicle.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least once a year, especially if you’ve had any major life changes, such as a new car, a move, or a change in your driving record.