Car insurance in NY is a necessity for all drivers, providing financial protection in case of accidents or other incidents. Understanding the intricacies of car insurance in New York can seem daunting, but with the right information, you can navigate the process with confidence.

From choosing the right coverage to finding the best deals, this guide will equip you with the knowledge to make informed decisions about your car insurance in NY.

Understanding Car Insurance in NY

Driving in New York State requires you to have car insurance, which protects you financially in case of an accident. Understanding the different types of coverage and the factors that influence premiums is crucial for making informed decisions.

Types of Car Insurance Coverage

In New York, there are several types of car insurance coverage. You are required to have a minimum amount of liability coverage, but you can also choose to purchase additional coverage for more comprehensive protection. Here’s a breakdown of the common types:

- Liability Coverage: This covers damages to other people’s property or injuries to other people in an accident that you cause. It is further divided into two parts:

- Bodily Injury Liability: Pays for medical expenses, lost wages, and other damages related to injuries sustained by other people in an accident that you caused.

- Property Damage Liability: Covers the cost of repairing or replacing damaged property, such as another vehicle or a building, if you are at fault for an accident.

- Collision Coverage: Pays for repairs or replacement of your own vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: Covers damages to your vehicle from events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other damages related to injuries you sustain in an accident, regardless of who is at fault. This coverage is mandatory in New York State.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Provides protection if you are injured in an accident caused by a driver who is uninsured or underinsured.

Minimum Liability Coverage Requirements

New York State requires all drivers to carry a minimum amount of liability insurance. This minimum coverage is referred to as the “Financial Responsibility Law.” The required minimum liability coverage amounts are:

- Bodily Injury Liability: $25,000 per person, $50,000 per accident

- Property Damage Liability: $10,000 per accident

Factors Influencing Car Insurance Premiums

The cost of car insurance in New York is influenced by several factors. Understanding these factors can help you make choices that could potentially lower your premiums.

- Age: Younger drivers typically have higher premiums because they are statistically more likely to be involved in accidents. As you age and gain more driving experience, your premiums generally decrease.

- Driving History: Your driving record plays a significant role in determining your premiums. Accidents, traffic violations, and DUI convictions can all lead to higher premiums. Maintaining a clean driving record is essential for keeping your insurance costs low.

- Vehicle Type: The type of vehicle you drive impacts your insurance premiums. Higher-performance cars, luxury vehicles, and newer models often have higher insurance rates due to their higher repair costs and potential for greater damage in an accident.

- Location: Your location can also influence your insurance rates. Areas with higher crime rates or more traffic congestion generally have higher insurance premiums. Insurance companies assess the risk of accidents and claims in different areas, which can impact your premiums.

Choosing the Right Car Insurance Policy

Finding the right car insurance policy in New York can feel overwhelming, with so many providers and options available. But it doesn’t have to be a stressful process. By understanding your needs and comparing policies, you can find the best coverage at a price that fits your budget.

Comparing Car Insurance Providers in NY

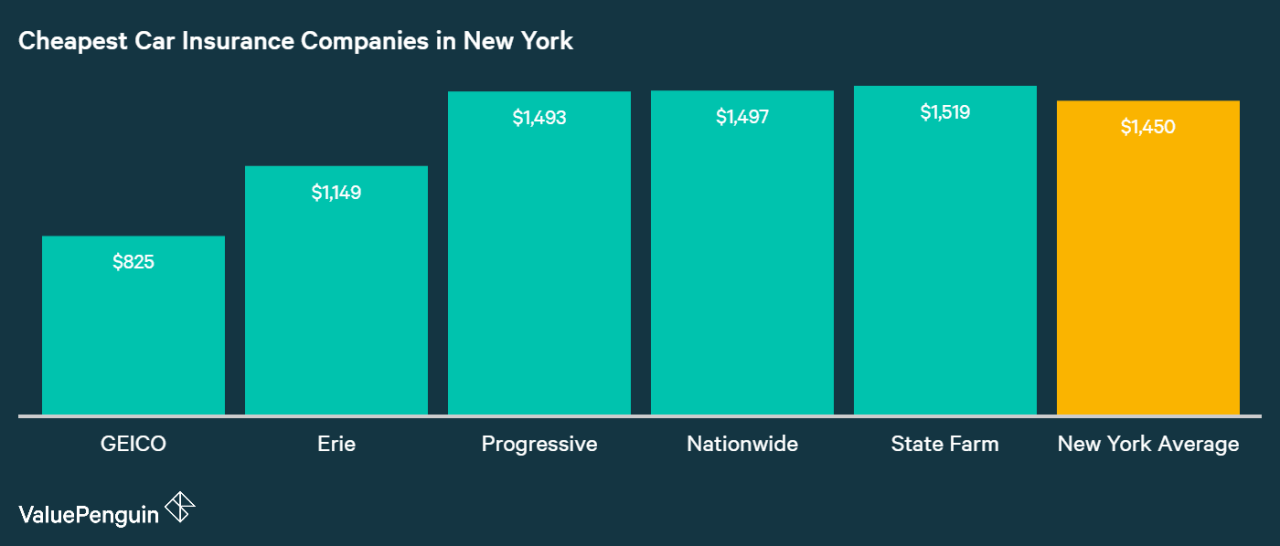

It’s essential to compare different car insurance providers in New York to find the best deal. Each provider offers unique features and benefits, so it’s important to understand their strengths and weaknesses.

- Geico: Known for its competitive rates and straightforward policies. They offer a wide range of discounts, including multi-car and good driver discounts.

- State Farm: Offers comprehensive coverage options and excellent customer service. They have a strong reputation for handling claims efficiently.

- Progressive: Known for its innovative features, such as its “Name Your Price” tool, which allows you to set your desired premium and find a policy that matches. They also offer a variety of discounts.

- Allstate: Offers a wide range of coverage options, including accident forgiveness and roadside assistance. They also have a strong reputation for customer service.

- Liberty Mutual: Known for its personalized coverage options and discounts for safe drivers and those who bundle their insurance policies.

Getting Car Insurance Quotes from Multiple Providers

Getting car insurance quotes from multiple providers is crucial for finding the best deal. Here’s a step-by-step guide:

- Gather Your Information: Before contacting providers, have your driver’s license, vehicle information, and any relevant details about your driving history readily available.

- Use Online Quote Tools: Many providers offer online quote tools, allowing you to quickly and easily compare rates. These tools are usually available on their websites.

- Contact Providers Directly: Reach out to providers directly by phone or email to discuss your specific needs and get personalized quotes.

- Compare Quotes: Carefully compare the quotes you receive, paying attention to the coverage options, deductibles, and premiums. Consider factors like your driving history, vehicle type, and location.

Benefits of Bundling Car Insurance with Other Insurance Types

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often lead to significant savings.

- Discounts: Many providers offer discounts for bundling multiple insurance policies, reducing your overall premiums.

- Convenience: Bundling simplifies your insurance management by having all your policies under one roof.

- Improved Customer Service: Bundling often leads to better customer service, as you have a single point of contact for all your insurance needs.

Saving Money on Car Insurance in NY

Car insurance is a necessary expense for all vehicle owners in New York. However, there are ways to save money on your premiums. Understanding the various discounts available, improving your driving record, and exploring options for your deductible can significantly reduce your insurance costs.

Discounts Offered by Car Insurance Providers in NY

Car insurance companies in New York offer a variety of discounts to help policyholders save money. These discounts are often based on factors such as your driving history, vehicle features, and other personal circumstances.

- Safe Driver Discount: This discount is typically awarded to drivers with a clean driving record, demonstrating a history of safe driving practices. It can be a significant reduction in premiums, reflecting the lower risk associated with safe drivers.

- Good Student Discount: This discount is available to students who maintain a certain GPA or academic standing. It acknowledges the responsibility and maturity associated with academic achievement, often translating to lower insurance premiums.

- Multi-Car Discount: This discount is offered to policyholders who insure multiple vehicles with the same insurance company. It reflects the economies of scale achieved by bundling multiple policies, resulting in lower premiums for all insured vehicles.

- Anti-theft Device Discount: Installing anti-theft devices like alarms or GPS trackers can make your vehicle less attractive to thieves. Insurance companies often recognize this effort by offering discounts to policyholders who equip their vehicles with such devices.

- Loyalty Discount: Some insurance companies offer discounts to policyholders who have been with them for a certain period of time. This demonstrates loyalty and a long-term commitment to the company, which can result in lower premiums.

Improving Your Driving Record, Car insurance in ny

Your driving record is a crucial factor in determining your car insurance premiums. Maintaining a clean driving record can significantly reduce your costs.

- Avoid Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can significantly increase your premiums. By adhering to traffic laws and driving responsibly, you can avoid these penalties and maintain a clean driving record.

- Complete Defensive Driving Courses: Enrolling in defensive driving courses can demonstrate your commitment to safe driving practices. These courses often offer discounts on car insurance premiums, reflecting the reduced risk associated with drivers who have completed such training.

- Maintain a Safe Driving History: A consistent history of safe driving practices is crucial for maintaining low premiums. Avoiding accidents, maintaining a good driving record, and adhering to traffic regulations are essential for keeping your insurance costs down.

Impact of Choosing a Higher Deductible

Your deductible is the amount you pay out-of-pocket before your car insurance coverage kicks in. Choosing a higher deductible can significantly reduce your premiums.

A higher deductible means you pay more out-of-pocket in the event of an accident, but you’ll pay less in monthly premiums.

- Evaluate Your Risk Tolerance: Carefully consider your financial situation and risk tolerance when choosing a deductible. A higher deductible might be advantageous if you are financially stable and comfortable with paying a larger amount out-of-pocket in case of an accident.

- Estimate Potential Costs: Consider the potential cost of repairs or replacement for your vehicle. If you can comfortably afford a higher deductible in case of an accident, it can significantly reduce your monthly premiums.

- Compare Options: Obtain quotes from multiple insurance providers to compare the impact of different deductible options on your premiums. This allows you to make an informed decision based on your individual circumstances and financial capabilities.

Filing a Car Insurance Claim in NY

Filing a car insurance claim in New York can be a daunting process, but understanding the steps involved and the types of claims can help you navigate it more smoothly. This section will guide you through the process, from reporting the accident to receiving compensation.

Reporting the Accident

It is crucial to report the accident to your insurance company as soon as possible. You should contact your insurance company directly by phone or online to report the accident. Be prepared to provide the following information:

- Your policy number

- The date, time, and location of the accident

- A detailed description of the accident, including the parties involved, any injuries, and the damage to the vehicles

- The names and contact information of any witnesses

- The police report number (if applicable)

Your insurance company will then guide you through the next steps in the claims process.

Types of Car Insurance Claims in NY

Car insurance claims in New York can be categorized into three main types:

- Collision Claims: These claims cover damages to your vehicle if you are involved in an accident with another vehicle or an object, regardless of who is at fault. You can file a collision claim even if the accident was your fault, but your deductible will apply.

- Comprehensive Claims: These claims cover damages to your vehicle from incidents other than collisions, such as theft, vandalism, fire, or natural disasters. You can file a comprehensive claim even if the accident was your fault, but your deductible will apply.

- Liability Claims: These claims cover damages to other people or their property if you are at fault in an accident. Liability coverage is mandatory in New York, and it protects you from significant financial losses if you cause an accident.

Document Checklist for Filing a Claim

To ensure a smooth and efficient claims process, it is essential to have the following documents readily available:

- Your insurance policy: This document contains all the details of your coverage, including your policy number, deductible, and limits.

- Your driver’s license: This document verifies your identity and driving privileges.

- Registration: This document proves ownership of the vehicle.

- Police report: This document provides an official record of the accident, including the details of the incident and any citations issued.

- Photos and videos: These documents can help to support your claim by providing visual evidence of the damage to your vehicle and the accident scene.

- Witness statements: These documents can provide additional information about the accident and support your version of events.

- Medical records: If you or anyone else was injured in the accident, you will need to provide medical records to support your claim for medical expenses.

- Repair estimates: You will need to provide repair estimates from a qualified mechanic to support your claim for vehicle damage.

Navigating Car Insurance Regulations in NY

New York State has a comprehensive set of regulations governing car insurance, designed to ensure all drivers are adequately protected and financially responsible. Understanding these regulations is crucial for navigating the car insurance landscape in NY.

The New York State Insurance Department (NYSDIF) plays a central role in overseeing the state’s car insurance market. The NYSDIF sets minimum coverage requirements, regulates insurance companies, and protects consumers’ rights.

Driving Without Car Insurance in NY

Driving without car insurance in New York is a serious offense. If caught, you face significant consequences, including:

- Fines: You can be fined up to $1,500 for the first offense and even higher for subsequent offenses.

- License Suspension: Your driver’s license can be suspended for up to 90 days.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Surcharges: You may face higher insurance premiums for future policies.

- Criminal Charges: In some cases, driving without insurance can lead to criminal charges.

Appealing a Car Insurance Decision in NY

If you disagree with a car insurance decision made by your insurer, you have the right to appeal. The appeal process involves:

- Filing a Complaint: Contact the NYSDIF and file a formal complaint outlining your concerns.

- Mediation: The NYSDIF may attempt to mediate a resolution between you and your insurer.

- Formal Hearing: If mediation fails, you can request a formal hearing before an administrative law judge.

The NYSDIF provides detailed information and guidance on the appeal process.

Epilogue

Navigating the world of car insurance in NY can feel overwhelming, but by understanding the basics, comparing options, and utilizing available resources, you can secure the coverage you need at a price that fits your budget. Remember, car insurance is more than just a legal requirement; it’s a vital safety net that can protect you and your loved ones in unforeseen circumstances.

Expert Answers

What is the minimum car insurance coverage required in NY?

New York State requires all drivers to have a minimum amount of liability coverage, including bodily injury liability, property damage liability, and personal injury protection (PIP).

How can I get car insurance quotes from multiple providers?

Many online platforms and insurance comparison websites allow you to enter your information and receive quotes from various providers in NY. You can also contact insurance companies directly to request quotes.

What are some common car insurance discounts in NY?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and discounts for anti-theft devices.

What happens if I drive without car insurance in NY?

Driving without car insurance in NY is illegal and can result in fines, license suspension, and even jail time.