Affordable car insurance Florida can be a challenge, given the state’s unique factors that influence premiums. From high accident rates to mandatory insurance requirements, Florida drivers face a complex landscape. This guide aims to help you navigate the complexities of finding affordable car insurance in Florida, equipping you with the knowledge and strategies to secure the best possible rates.

We’ll delve into the intricacies of Florida’s car insurance market, exploring key components that impact premiums, highlighting reputable insurance providers known for competitive rates, and revealing effective strategies for lowering your costs.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance market is unique and often more expensive than other states. Several factors contribute to this higher cost, including the state’s high population density, frequent severe weather events, and a large number of uninsured drivers. Understanding these factors can help you navigate the Florida car insurance landscape and find the most affordable coverage for your needs.

Factors Influencing Florida Car Insurance Costs

Several factors contribute to the high cost of car insurance in Florida. Here’s a breakdown of some key influences:

- High Population Density: Florida’s large population leads to more vehicles on the road, increasing the likelihood of accidents. This higher accident frequency translates to higher insurance premiums for all drivers.

- Frequent Severe Weather Events: Florida is prone to hurricanes, tornadoes, and other severe weather events. These events cause significant property damage, including vehicle damage, driving up insurance costs.

- Large Number of Uninsured Drivers: Florida has a higher percentage of uninsured drivers compared to other states. When an uninsured driver causes an accident, the injured party may have to file a claim against their own insurance, increasing premiums for everyone.

- High Litigation Rates: Florida has a high rate of car accident lawsuits, which increases insurance costs. Insurance companies must pay for legal defense and settlements, leading to higher premiums.

- State-Mandated Coverage: Florida requires drivers to carry Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage, which can add to the overall cost of insurance.

Components of Florida Car Insurance Premiums

Understanding the components of your car insurance premium can help you make informed decisions about your coverage. Here’s a breakdown of the key factors:

- Driving Record: Your driving history, including accidents, tickets, and DUI convictions, significantly impacts your premium. Drivers with clean records typically pay lower premiums.

- Age and Gender: Younger drivers and males often pay higher premiums due to their higher risk of accidents.

- Vehicle Type and Value: The type and value of your vehicle affect your premium. Expensive or high-performance vehicles generally require higher coverage and therefore cost more to insure.

- Location: Where you live can impact your premium. Areas with high crime rates or frequent accidents may have higher premiums.

- Coverage Levels: The amount of coverage you choose, including deductibles and limits, affects your premium. Higher coverage levels generally result in higher premiums.

- Discounts: Many insurers offer discounts for various factors, such as good driving records, safety features, and bundling insurance policies.

Florida’s Mandatory Insurance Requirements

Florida law requires all drivers to carry specific types of insurance. These requirements are designed to protect drivers and passengers in case of an accident. Here’s a breakdown of Florida’s mandatory car insurance coverage:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. Florida law requires a minimum PIP coverage of $10,000.

- Property Damage Liability (PDL): This coverage pays for damage to another person’s property if you are at fault in an accident. Florida law requires a minimum PDL coverage of $10,000.

- Uninsured Motorist Coverage (UM): This coverage protects you and your passengers if you are injured in an accident caused by an uninsured or underinsured driver. UM coverage is not mandatory but highly recommended.

Identifying Affordable Car Insurance Options

Finding affordable car insurance in Florida can be challenging, given the state’s high rate of accidents and insurance premiums. However, by understanding your options and comparing different insurance providers, you can find a policy that meets your needs without breaking the bank.

Comparing Car Insurance Providers in Florida

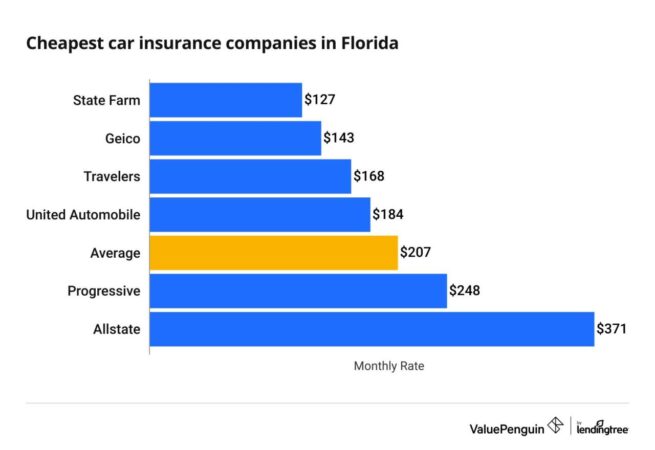

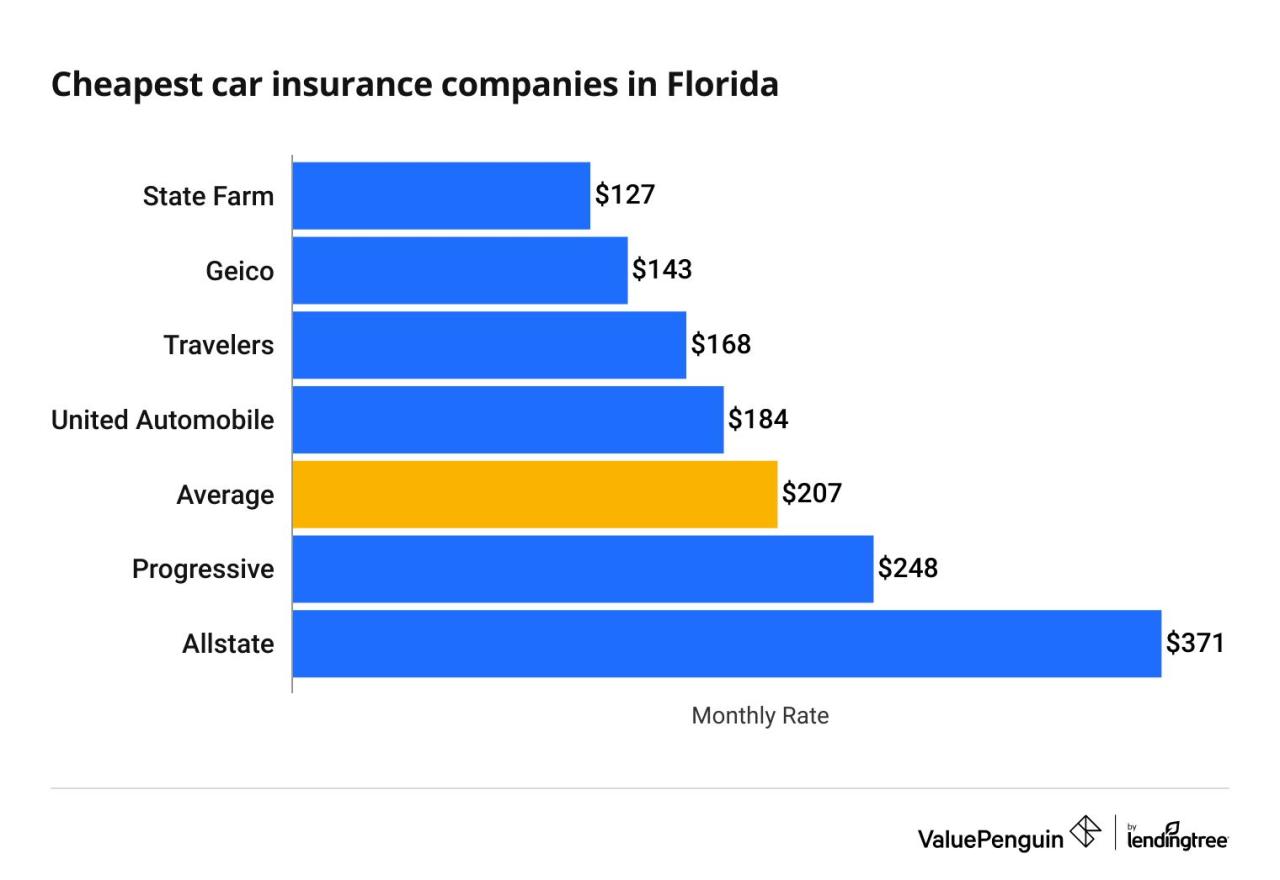

Numerous insurance companies operate in Florida, each offering varying coverage options and rates. Comparing these providers is crucial to finding the most affordable policy for your specific needs.

- State Farm: Known for its comprehensive coverage options and competitive rates, State Farm is a popular choice among Florida drivers. Their customer service is generally well-regarded, and they offer a range of discounts, including good driver and multi-policy discounts.

- Geico: Geico is another leading provider, recognized for its affordability and convenient online tools. They offer a variety of coverage options and have a strong reputation for fast claims processing.

- Progressive: Progressive stands out for its customizable policies and personalized pricing. They offer a wide range of coverage options, including unique features like their “Name Your Price” tool, which allows you to set your desired premium and see the corresponding coverage options.

- USAA: USAA specializes in insurance for military members and their families. They offer competitive rates and excellent customer service, making them a strong contender for those eligible for their services.

- Florida Peninsula Insurance Company: This company focuses on providing affordable insurance to Florida residents, especially those who have been denied coverage by other insurers. They offer a variety of coverage options and are known for their commitment to customer satisfaction.

Factors to Consider When Selecting an Affordable Car Insurance Policy

While comparing insurance providers is essential, understanding the factors that influence your premium is equally crucial. By analyzing these factors, you can make informed decisions to lower your insurance costs.

| Factor | Explanation | Impact on Premium |

|---|---|---|

| Driving History | Your driving record, including accidents, tickets, and violations, directly impacts your premium. | A clean driving record usually results in lower premiums. Accidents and violations significantly increase premiums. |

| Age and Gender | Younger drivers, especially males, are statistically more likely to be involved in accidents, leading to higher premiums. | Older drivers generally pay lower premiums than younger drivers. |

| Vehicle Type and Value | The make, model, and year of your vehicle, as well as its safety features and value, influence your premium. | High-performance or luxury vehicles often have higher premiums due to their higher repair costs and greater risk of theft. |

| Location | The area where you reside impacts your premium due to factors like crime rates, traffic density, and weather conditions. | Urban areas with high traffic and crime rates typically have higher premiums than rural areas. |

| Coverage Options | The type and amount of coverage you choose, such as liability, collision, and comprehensive, determine your premium. | Higher coverage limits and additional options, like roadside assistance, generally lead to higher premiums. |

| Discounts | Insurance companies offer various discounts, such as good driver, multi-policy, and safe driving discounts, which can significantly reduce your premium. | Taking advantage of available discounts can significantly lower your overall premium. |

Strategies for Lowering Car Insurance Costs: Affordable Car Insurance Florida

In Florida, navigating the car insurance landscape can be a complex and costly endeavor. However, with the right strategies, you can significantly reduce your premiums and save money. Here are some effective ways to lower your car insurance costs in the Sunshine State.

Discounts Available in Florida

Discounts are a significant factor in reducing car insurance costs. Florida insurers offer a variety of discounts, many of which are specific to the state. Here are some common discounts you can explore:

- Good Driver Discount: This discount rewards drivers with a clean driving record. Typically, you can qualify for this discount if you have not been involved in any accidents or received traffic violations for a specific period. The discount can vary depending on the insurer and your driving history.

- Safe Driver Discount: Similar to the good driver discount, the safe driver discount rewards drivers who demonstrate safe driving habits. Some insurers may offer this discount based on factors like your driving history, defensive driving course completion, or telematics programs that track your driving behavior.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you can qualify for a multi-car discount. This discount can be substantial, especially if you have more than two vehicles on your policy.

- Multi-Policy Discount: Insurers often offer discounts if you bundle your car insurance with other insurance policies, such as homeowners or renters insurance.

- Loyalty Discount: Many insurers reward long-term customers with loyalty discounts. The longer you remain with the same insurer, the higher the discount you may receive.

- Student Discount: Students who maintain good grades and are enrolled in college or university may qualify for a student discount.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices and qualify you for a discount.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or GPS tracking systems, can deter theft and qualify you for a discount.

- Good Credit Discount: In Florida, insurers can use your credit score as a factor in determining your car insurance rates. Having a good credit score can qualify you for a discount.

Impact of Driving History

Your driving history plays a crucial role in determining your car insurance rates. A clean driving record with no accidents or violations will result in lower premiums. However, if you have a history of accidents, traffic violations, or even DUI convictions, your insurance rates will significantly increase. It is essential to maintain a safe driving record and avoid any incidents that could impact your insurance costs.

Impact of Credit Score, Affordable car insurance florida

In Florida, insurers are allowed to use your credit score as a factor in determining your car insurance rates. This practice is known as “credit-based insurance scoring” and is legal in many states. Insurers believe that drivers with good credit scores are more likely to be responsible and less likely to file claims. If you have a poor credit score, your car insurance premiums may be higher. It is advisable to improve your credit score if you want to lower your car insurance costs.

Impact of Vehicle Safety Features

Modern vehicles are equipped with various safety features that can significantly reduce the risk of accidents and injuries. Insurers recognize the importance of these safety features and often offer discounts for vehicles with advanced safety technology. These features include:

- Anti-lock brakes (ABS): ABS helps prevent wheel lock-up during braking, improving vehicle control and reducing the risk of accidents.

- Electronic stability control (ESC): ESC helps maintain vehicle stability during sharp turns or slippery road conditions, reducing the risk of rollovers and skidding.

- Airbags: Airbags deploy in the event of a collision, providing cushioning and protection for the driver and passengers.

- Backup cameras: Backup cameras provide rear visibility, reducing the risk of accidents when reversing.

- Lane departure warning: Lane departure warning systems alert drivers if they drift out of their lane without signaling, helping to prevent accidents.

Improving Driving Habits

Adopting safe driving habits is essential for reducing the risk of accidents and lowering your car insurance costs. Here are some practical tips:

- Avoid Distracted Driving: Distracted driving, including texting, talking on the phone, or eating while driving, is a major cause of accidents. It is crucial to stay focused on the road and avoid distractions.

- Obey Speed Limits: Speeding is a major contributing factor to accidents. Always adhere to speed limits and adjust your speed according to road conditions.

- Maintain a Safe Following Distance: Maintaining a safe following distance allows you to react quickly to sudden stops or unexpected events. Use the “three-second rule” to ensure a safe distance.

- Avoid Driving Under the Influence: Driving under the influence of alcohol or drugs is illegal and extremely dangerous. Always plan for a safe ride home or use public transportation if you are planning to drink.

- Get Regular Vehicle Maintenance: Regular vehicle maintenance, including oil changes, tire rotations, and brake inspections, helps ensure your car is in good working condition and reduces the risk of breakdowns or accidents.

Exploring Alternative Coverage Options

In addition to traditional car insurance policies, there are alternative coverage options available in Florida that can be more affordable and cater to specific needs. These options offer flexibility and potential savings, allowing you to tailor your coverage to your driving habits and financial situation.

Usage-Based Insurance

Usage-based insurance (UBI) programs, also known as pay-per-mile or telematics insurance, are becoming increasingly popular in Florida. These programs use telematics devices, such as smartphone apps or plug-in dongles, to track your driving behavior. By monitoring factors like mileage, time of day, speed, and braking habits, insurers can assess your risk and adjust your premium accordingly.

- Pros: UBI programs can be beneficial for drivers who drive less than average, have a safe driving record, and prefer a more personalized approach to insurance. They offer the potential for significant discounts, particularly for those who drive fewer miles or have a good driving history.

- Cons: UBI programs might not be suitable for drivers who frequently travel long distances or have less predictable driving patterns. Some individuals may also be uncomfortable with the constant monitoring of their driving behavior.

Comparing Different Types of Coverage

Understanding the different types of car insurance coverage is crucial for making informed decisions about your policy. In Florida, there are three primary types of coverage:

- Liability Coverage: This is the most basic type of coverage required by law in Florida. It protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries to another person. Liability coverage includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

Determining the Optimal Level of Coverage

The optimal level of coverage depends on your individual needs and financial constraints. Consider the following factors:

- Your financial situation: If you have limited financial resources, you might opt for the minimum liability coverage required by law. However, if you can afford it, you might consider additional coverage, such as collision and comprehensive, to protect yourself financially in case of a major accident or other unforeseen events.

- The value of your vehicle: If you own a new or high-value vehicle, it’s generally advisable to have collision and comprehensive coverage to ensure you can replace or repair it if it is damaged.

- Your driving history: If you have a clean driving record, you might be able to afford a higher level of coverage. However, if you have a history of accidents or violations, you may need to consider a lower level of coverage to manage your premiums.

- Your personal risk tolerance: Your risk tolerance plays a significant role in determining your coverage needs. If you are comfortable assuming a higher level of risk, you might choose to have lower coverage. However, if you are risk-averse, you might opt for a higher level of coverage.

Navigating the Insurance Buying Process

Securing the best car insurance rates in Florida requires a strategic approach. You need to compare quotes from multiple providers, understand the essential information needed for a quote, and know how to negotiate for favorable terms.

Obtaining Quotes from Multiple Providers

Comparing quotes from different insurance companies is crucial for finding the most affordable option. Here’s a step-by-step guide to obtaining quotes:

- Identify Potential Providers: Start by researching reputable insurance companies operating in Florida. Consider factors like customer reviews, financial stability, and coverage options.

- Utilize Online Comparison Tools: Online insurance comparison websites allow you to enter your information once and receive quotes from multiple providers simultaneously. These tools streamline the process and save time.

- Contact Insurance Companies Directly: Reach out to insurance companies directly via phone, email, or their websites. This allows for personalized interactions and detailed discussions about coverage options.

- Request Quotes from Local Agents: Consider contacting local insurance agents. They can provide personalized advice and help you navigate the process, especially if you have specific needs or complex situations.

Essential Information for Quotes

When requesting a quote, insurance companies require specific information to assess your risk profile and determine your premium. Here are the key details:

- Personal Information: This includes your name, address, date of birth, driving history, and contact information.

- Vehicle Information: Provide details about your car, including the make, model, year, and VIN (Vehicle Identification Number). You’ll also need to specify the car’s usage (e.g., daily commute, occasional use).

- Driving History: Insurance companies require your driving history, including any accidents, violations, or suspensions.

- Coverage Preferences: Specify your desired coverage levels, including liability, collision, comprehensive, and personal injury protection (PIP).

Negotiating Rates and Securing Favorable Terms

Once you have multiple quotes, you can start negotiating for the best rates and policy terms. Here are some strategies:

- Compare Quotes Carefully: Review each quote thoroughly, paying attention to coverage levels, deductibles, and premiums. Identify any discrepancies or areas for potential negotiation.

- Ask About Discounts: Inquire about available discounts, such as good driver discounts, multi-car discounts, or safe driver discounts.

- Consider Bundling Policies: If you have other insurance policies, such as homeowners or renters insurance, ask about bundling discounts.

- Shop Around Regularly: It’s a good practice to re-evaluate your insurance needs and shop around for new quotes every year or two. This ensures you’re getting the most competitive rates.

Epilogue

By understanding Florida’s car insurance landscape, exploring various coverage options, and employing smart strategies, you can find affordable car insurance that meets your needs and protects you on the road. Remember, the key is to compare quotes from multiple providers, leverage available discounts, and maintain a safe driving record. With a little effort, you can secure the best possible rates and enjoy peace of mind knowing you’re adequately insured.

Top FAQs

What is the minimum car insurance coverage required in Florida?

Florida requires all drivers to carry a minimum amount of liability insurance, known as Personal Injury Protection (PIP) and Property Damage Liability (PDL). The minimum coverage amounts are $10,000 for PIP, $10,000 for PDL, and $10,000 for uninsured motorist coverage.

How can I get a free car insurance quote in Florida?

Most insurance companies offer free online quotes. You can also contact insurance agents directly to request a quote. Be prepared to provide personal information, vehicle details, and your driving history.

What factors influence car insurance rates in Florida?

Several factors can impact your car insurance rates, including your age, driving history, credit score, vehicle type, and location. Florida’s high accident rates also contribute to higher premiums.