Cheap car insurance quotes Florida are a necessity for anyone living in the Sunshine State. With its unique climate, high population density, and active driving culture, Florida presents a distinct set of factors that influence car insurance costs. Navigating the complexities of Florida’s insurance market can be challenging, but finding affordable coverage doesn’t have to be a daunting task.

This guide will equip you with the knowledge and tools to effectively compare quotes, understand the key factors that impact your premiums, and ultimately secure the best car insurance deal for your specific needs.

Understanding Florida Car Insurance

Florida’s unique environment and driving conditions make car insurance rates significantly different from other states. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Factors Influencing Car Insurance Costs in Florida

Florida’s car insurance market is heavily influenced by a number of factors, including:

- High Number of Accidents: Florida consistently ranks among the top states for car accidents, leading to higher claims and insurance premiums.

- Frequent Natural Disasters: Hurricanes, floods, and other natural disasters are common in Florida, resulting in costly claims for insurers.

- High Cost of Healthcare: Florida’s high cost of healthcare drives up medical expenses related to car accidents, contributing to higher insurance premiums.

- Aggressive Driving Culture: A perception of aggressive driving in Florida can lead to more accidents and higher insurance rates.

- High Number of Uninsured Drivers: Florida has a significant number of uninsured drivers, increasing the risk for insured drivers in case of accidents.

- PIP (Personal Injury Protection) Coverage: Florida mandates PIP coverage, which pays for medical expenses regardless of fault, contributing to higher premiums.

Mandatory Coverage Requirements in Florida

Florida requires all drivers to carry specific minimum liability insurance coverage, including:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured and passengers, regardless of fault, up to $10,000.

- Property Damage Liability: This coverage protects the insured against financial losses due to damage caused to another person’s property, up to $10,000.

- Bodily Injury Liability: This coverage protects the insured against financial losses due to injuries caused to another person, up to $10,000 per person and $20,000 per accident.

Common Insurance Add-ons Available in Florida

In addition to mandatory coverage, Florida drivers can choose from a variety of optional add-ons to customize their insurance policies, including:

- Collision Coverage: Pays for repairs or replacement of the insured vehicle in case of an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to the insured vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection in case of an accident with an uninsured or underinsured driver.

- Rental Reimbursement Coverage: Covers rental car expenses while the insured vehicle is being repaired after an accident.

- Roadside Assistance Coverage: Provides assistance with towing, flat tire changes, and other roadside emergencies.

- Gap Coverage: Covers the difference between the actual cash value of the insured vehicle and the outstanding loan balance in case of a total loss.

Finding Cheap Car Insurance Quotes

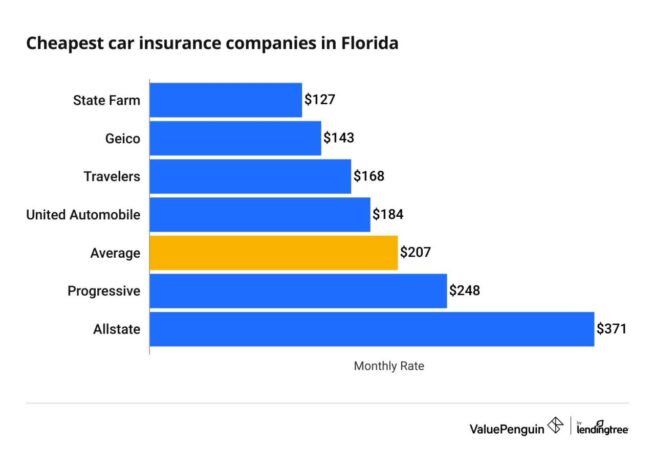

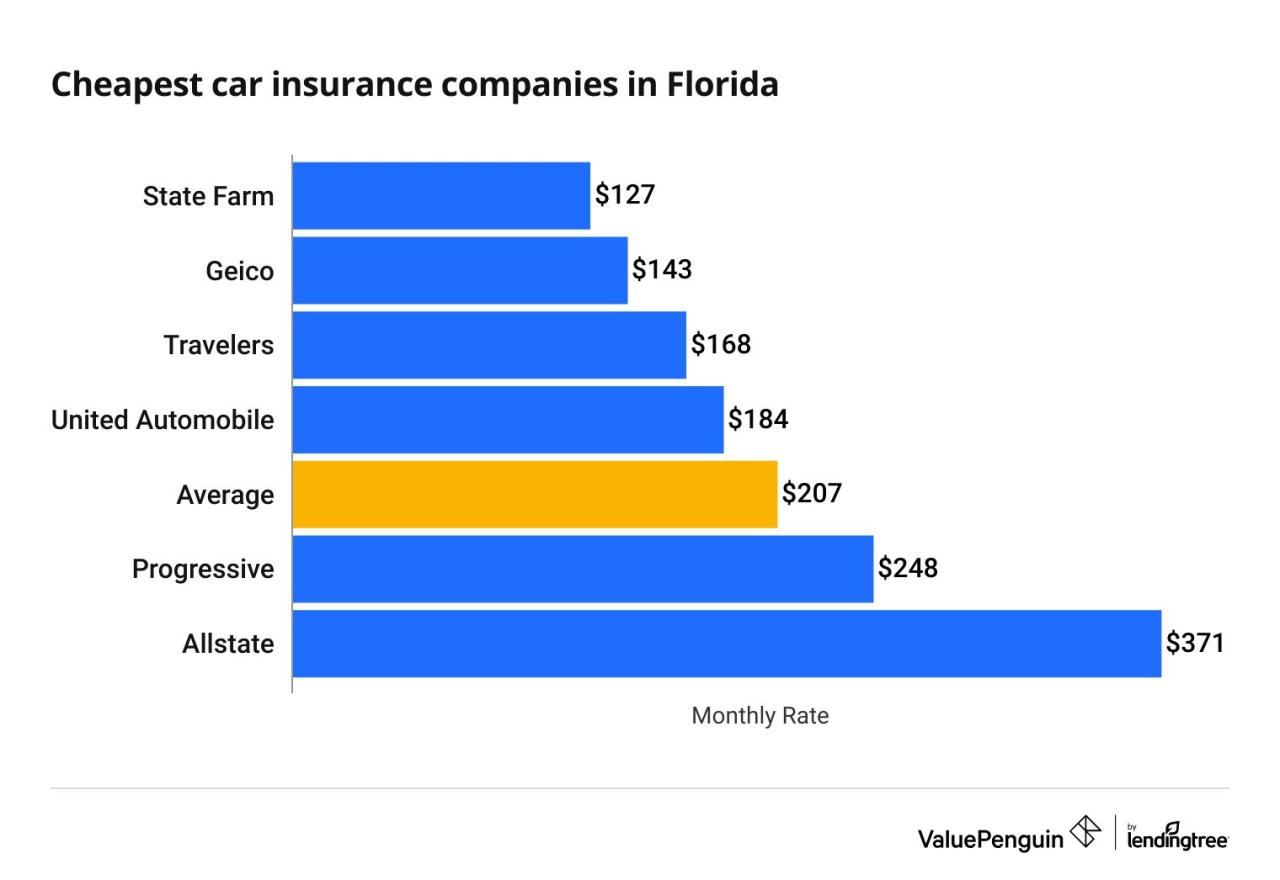

Securing affordable car insurance in Florida requires careful research and comparison. The state’s unique climate, driving conditions, and high population density all contribute to the cost of car insurance. By following a strategic approach, you can find the best deals that meet your specific needs and budget.

Step-by-Step Guide to Obtaining Multiple Car Insurance Quotes

Before requesting quotes, it’s essential to gather all the necessary information, including your driving history, vehicle details, and coverage preferences. This information helps insurance providers accurately assess your risk and generate personalized quotes.

- Start with Online Comparison Platforms: Many websites specialize in comparing car insurance quotes from multiple providers. These platforms are often free and user-friendly, allowing you to enter your information once and receive quotes from various insurers. Popular examples include:

- Insurify: This platform compares quotes from over 20 insurance companies and offers features like personalized recommendations and insights into coverage options.

- QuoteWizard: QuoteWizard partners with numerous insurance providers and offers a streamlined process for obtaining multiple quotes.

- The Zebra: The Zebra provides a comprehensive comparison of quotes from a wide range of insurance companies, allowing you to filter by coverage options and price.

- Contact Insurance Brokers: Insurance brokers act as intermediaries between you and insurance companies. They can help you find the best coverage options and negotiate rates on your behalf. Brokers often have access to a wider range of insurance companies than online platforms, giving you more choices. When choosing a broker, consider their experience, reputation, and expertise in Florida car insurance.

- Reach Out to Individual Insurance Companies: Directly contacting insurance companies allows you to gather information about their specific policies and discounts. This approach is particularly useful if you have unique coverage needs or prefer to work with a specific insurer.

- Review and Compare Quotes: Once you have collected multiple quotes, carefully review each one, paying attention to:

- Coverage: Ensure that the coverage options meet your needs and comply with Florida’s minimum insurance requirements.

- Deductibles: Higher deductibles typically lead to lower premiums, but you’ll pay more out of pocket if you file a claim.

- Discounts: Many insurers offer discounts for safe driving, good credit, and other factors. Inquire about any discounts that may apply to you.

- Customer Service: Consider the insurer’s reputation for customer service and claims handling.

Comparing Online Platforms and Insurance Brokers

Online platforms and insurance brokers offer distinct advantages and disadvantages when comparing car insurance quotes.

| Feature | Online Platforms | Insurance Brokers |

|---|---|---|

| Convenience | Highly convenient, allowing you to compare quotes from multiple insurers in one place. | May require more effort to contact and gather quotes from different brokers. |

| Transparency | Typically transparent, providing clear information about coverage options and pricing. | Can offer personalized advice and guidance, but may not always be as transparent about their fees. |

| Coverage Options | May not offer as wide a range of coverage options as brokers, especially for specialized needs. | Often have access to a wider range of insurance companies and coverage options. |

| Negotiation | Limited negotiation capabilities, as platforms primarily facilitate quote comparisons. | Can negotiate rates on your behalf and advocate for your interests with insurance companies. |

| Personalized Advice | Limited personalized advice, as platforms primarily focus on quote comparisons. | Provide personalized advice and recommendations based on your specific needs and circumstances. |

Key Factors to Consider When Choosing an Insurance Provider in Florida

When selecting a car insurance provider in Florida, consider the following factors:

| Factor | Description |

|---|---|

| Financial Stability | Choose an insurer with a strong financial rating, ensuring they can cover your claims in the event of an accident. |

| Customer Service | Select an insurer known for excellent customer service, prompt claims handling, and responsive communication. |

| Coverage Options | Ensure the insurer offers the coverage options you need, including liability, collision, comprehensive, and personal injury protection. |

| Discounts | Inquire about available discounts, such as safe driver, good student, and multi-car discounts. |

| Pricing | Compare quotes from multiple insurers to find the most competitive rates while balancing coverage options and financial stability. |

Factors Affecting Car Insurance Rates

Car insurance premiums are determined by a variety of factors, and understanding these factors can help you find the most affordable coverage for your needs. By knowing what influences your insurance rates, you can take steps to potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your car insurance rates. Insurance companies assess your risk based on your past driving record, specifically focusing on:

- Accidents: Accidents, especially those resulting in injuries or property damage, significantly increase your insurance premiums. The severity of the accident and your level of responsibility also impact the rate increase.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can lead to higher insurance rates. Insurance companies view these violations as indicators of risky driving behavior.

- DUI/DWI Convictions: Driving under the influence (DUI) or driving while intoxicated (DWI) convictions carry the most severe penalties in terms of insurance rates. These convictions indicate a significant risk to insurance companies, resulting in substantial premium increases or even policy cancellations.

Age

Age is a major factor in car insurance rates, with younger and older drivers generally paying higher premiums.

- Young Drivers: Inexperience and higher risk-taking tendencies among young drivers contribute to their higher insurance rates. They are statistically more likely to be involved in accidents, making them a higher risk for insurance companies.

- Older Drivers: While older drivers have more experience, they may face physical limitations or health conditions that increase their risk of accidents. This factor can result in higher insurance premiums for older drivers.

Credit Score

While not directly related to driving, your credit score can impact your car insurance rates. This practice is prevalent in some states, but not all.

- Credit Score and Risk: Insurance companies believe that a good credit score reflects responsible financial behavior, which may translate into safer driving habits. Conversely, a poor credit score may indicate a higher risk of financial instability, potentially leading to an increased risk of claims.

- State Regulations: The use of credit score in determining insurance rates varies by state. Some states prohibit this practice, while others allow it. It’s essential to check your state’s regulations regarding the use of credit scores in insurance pricing.

Vehicle Type, Make, and Model

The type, make, and model of your vehicle significantly influence your insurance premiums.

- Vehicle Type: Sports cars, SUVs, and luxury vehicles are often associated with higher insurance rates due to their higher repair costs, increased risk of theft, and potential for higher speeds. Conversely, compact cars and sedans typically have lower insurance rates.

- Make and Model: Certain makes and models are known for their safety features, reliability, and overall performance. Vehicles with advanced safety features, such as anti-lock brakes and electronic stability control, may qualify for discounts. Conversely, models with a history of frequent accidents or expensive repairs can lead to higher premiums.

- Vehicle Value: The value of your vehicle also influences your insurance rates. More expensive vehicles require higher coverage amounts, leading to higher premiums.

Location

Your location plays a crucial role in determining your car insurance rates.

- Population Density: Urban areas with higher population density tend to have higher traffic volume and accident rates, leading to higher insurance premiums. Rural areas, with lower population density and less traffic, generally have lower rates.

- Crime Rates: Areas with higher crime rates, particularly vehicle theft, can result in higher insurance premiums. Insurance companies consider the risk of theft and other criminal activity when setting rates.

- Weather Conditions: Areas prone to severe weather events, such as hurricanes, tornadoes, or heavy snowfall, can have higher insurance premiums. These weather events can increase the risk of accidents and damage to vehicles.

Driving Habits

Your driving habits significantly influence your insurance rates.

- Mileage: Drivers who commute long distances or frequently use their vehicles for work or personal errands generally pay higher insurance premiums. Higher mileage increases the risk of accidents and claims.

- Driving History: As mentioned earlier, your driving history, including accidents, traffic violations, and DUI/DWI convictions, significantly impacts your insurance rates.

- Driving Style: Your driving style, such as aggressive driving, speeding, or distracted driving, can also influence your premiums. Insurance companies may offer discounts for safe driving habits.

Discounts and Savings Opportunities

In Florida, numerous discounts can help you lower your car insurance premiums. By understanding these discounts and taking advantage of them, you can significantly reduce your overall insurance costs.

Common Car Insurance Discounts

Car insurance companies in Florida offer a wide range of discounts to incentivize safe driving practices and responsible car ownership. These discounts are designed to reward policyholders for factors that minimize the risk of accidents.

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, free of accidents or traffic violations for a specified period.

- Safe Driver Discount: This discount is similar to the good driver discount, but it may also consider factors like defensive driving courses or other safety programs.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a discount on your premiums.

- Multi-Policy Discount: Bundling your car insurance with other policies like homeowners or renters insurance can lead to significant savings.

- Anti-theft Device Discount: Installing anti-theft devices like alarms or GPS tracking systems can lower your premiums.

- Good Student Discount: Students with good grades may qualify for a discount, as they are statistically less likely to be involved in accidents.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and potentially earn you a discount.

Discount Summary Table

Here is a table summarizing various discounts available based on safety features, driving experience, and other factors:

| Discount Type | Description | Eligibility |

|---|---|---|

| Good Driver Discount | Reward for a clean driving record. | No accidents or traffic violations for a specified period. |

| Safe Driver Discount | Recognizes safe driving practices. | Completion of defensive driving courses or other safety programs. |

| Multi-Car Discount | Insuring multiple vehicles with the same company. | Two or more vehicles insured with the same provider. |

| Multi-Policy Discount | Bundling car insurance with other policies. | Homeowners, renters, or other insurance policies bundled with car insurance. |

| Anti-theft Device Discount | Installing anti-theft devices. | Presence of alarms, GPS tracking systems, or other anti-theft features. |

| Good Student Discount | Reward for academic performance. | Maintaining good grades in school. |

| Defensive Driving Course Discount | Completion of a defensive driving course. | Successful completion of an approved defensive driving program. |

Maximizing Savings with Bundling

Bundling your car insurance with other policies, like homeowners or renters insurance, can significantly reduce your overall insurance costs. By consolidating your insurance needs with a single provider, you can often take advantage of multi-policy discounts, which can save you a substantial amount of money.

Choosing the Right Coverage: Cheap Car Insurance Quotes Florida

Choosing the right car insurance coverage is crucial in Florida, as it can significantly impact your financial well-being in the event of an accident. Understanding the different types of coverage and their implications will help you make informed decisions about your insurance needs.

Types of Car Insurance Coverage

- Liability Coverage: This coverage is mandatory in Florida and protects you financially if you cause an accident that injures another person or damages their property. It covers the costs of medical expenses, lost wages, and property damage up to the limits of your policy.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional, but it can be essential if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by non-collision events, such as theft, vandalism, fire, or natural disasters. Like collision coverage, comprehensive coverage is optional.

Factors Affecting Coverage Needs

The appropriate level of coverage depends on several factors, including:

- Financial Situation: Your financial resources play a significant role in determining the amount of coverage you can afford. If you have a limited budget, you might opt for lower liability limits, but it’s crucial to ensure you have adequate coverage to protect yourself from financial ruin in case of a serious accident.

- Vehicle Value: If you have a newer or more expensive vehicle, it’s generally advisable to consider higher coverage limits for collision and comprehensive coverage. This ensures you receive sufficient compensation for repairs or replacement in case of an accident or damage.

- Driving History: Your driving record influences your insurance premiums and coverage options. Drivers with a history of accidents or violations may face higher premiums and limited coverage options.

Determining the Right Coverage, Cheap car insurance quotes florida

It’s recommended to consult with an insurance agent or broker to discuss your specific needs and determine the most appropriate coverage for your situation. They can help you evaluate your financial situation, vehicle value, driving history, and other factors to recommend a personalized insurance plan.

Epilogue

Armed with this information, you’ll be well-prepared to embark on your quest for affordable car insurance in Florida. Remember, securing the best deal involves understanding your individual needs, comparing multiple quotes, and taking advantage of available discounts. With a little effort and the right strategy, you can find cheap car insurance quotes Florida that offer the protection you need without breaking the bank.

Question & Answer Hub

What are the mandatory car insurance coverages in Florida?

Florida requires drivers to carry at least the following coverages: Personal Injury Protection (PIP), Property Damage Liability (PDL), and Uninsured Motorist Coverage (UM). PIP covers medical expenses for you and your passengers, while PDL covers damage to other people’s property. UM coverage protects you if you are hit by an uninsured driver.

How can I get the best car insurance quote in Florida?

To secure the best quote, it’s crucial to compare quotes from multiple insurance providers. Use online platforms, insurance brokers, and contact insurers directly. Be sure to provide accurate information and consider factors like your driving history, vehicle type, and desired coverage levels.

What discounts are available for car insurance in Florida?

Florida offers a variety of discounts, including those for good driving records, safety features, multiple policies, and more. Ask your insurer about available discounts and make sure you qualify for them.