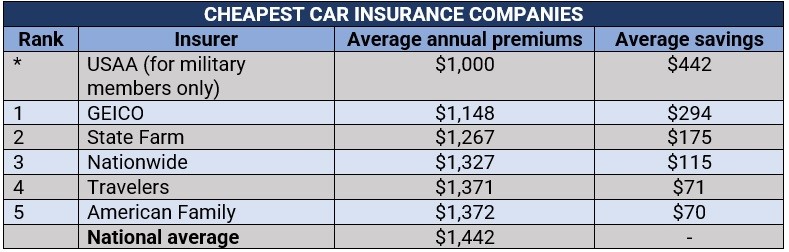

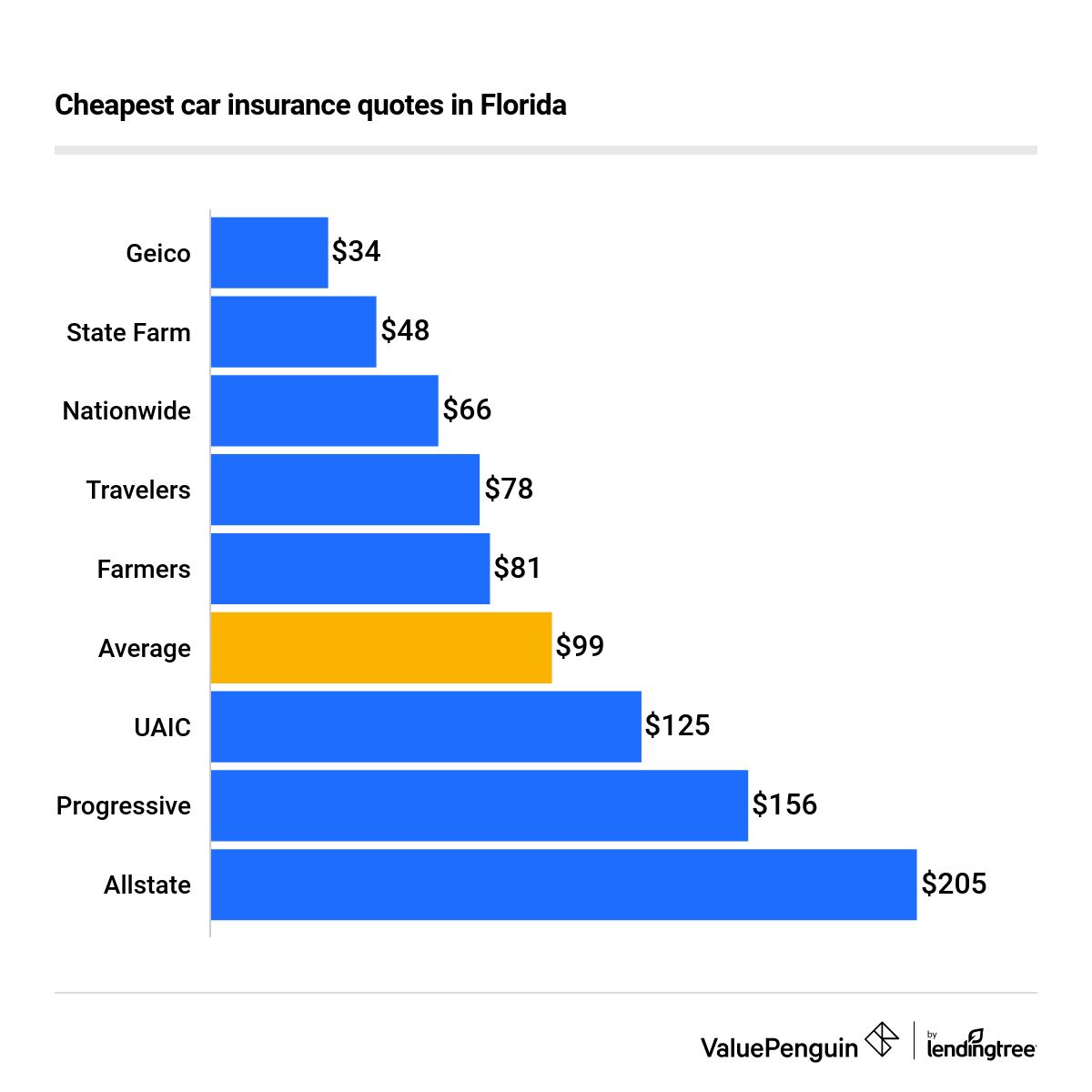

Most affordable car insurance in Florida can be a challenge to find, especially with the state’s high rates of uninsured motorists and frequent natural disasters. Florida’s unique insurance landscape is shaped by factors like demographics, driving history, vehicle type, and coverage levels. The Florida Department of Financial Services plays a crucial role in regulating the insurance industry, ensuring fair practices and protecting consumers.

Understanding the key factors affecting car insurance prices is essential for finding the best deal. Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your premiums. Vehicle factors like make, model, year, safety features, and theft risk also play a role. The coverage options you choose, such as liability, collision, comprehensive, and personal injury protection (PIP), directly influence the cost of your insurance. It’s also important to compare rates from various insurance companies, including traditional, online, and direct-to-consumer providers.

Choosing the Right Coverage for Your Needs

In Florida, you have the option to customize your car insurance policy to fit your individual needs and budget. While minimum coverage is required, you can choose to add additional coverage to protect yourself from unexpected financial burdens in case of an accident. Understanding the different coverage options and their benefits is crucial to make informed decisions that align with your driving habits, financial situation, and risk tolerance.

Comparing Coverage Options

Here’s a table that Artikels common car insurance coverage options, their benefits, and drawbacks:

| Coverage Type | Benefits | Drawbacks |

|---|---|---|

| Liability Coverage | Covers damages to other people’s property and injuries in case you are at fault in an accident. | Does not cover your own vehicle’s damages. |

| Collision Coverage | Covers repairs or replacement of your vehicle in case of an accident, regardless of fault. | May have a deductible, meaning you pay a portion of the repair costs. |

| Comprehensive Coverage | Covers damages to your vehicle from non-collision events like theft, vandalism, or natural disasters. | May have a deductible and may not cover all types of damages. |

| Uninsured/Underinsured Motorist Coverage | Protects you in case you are hit by an uninsured or underinsured driver. | May not cover all damages if the other driver’s insurance is insufficient. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other related costs for you and your passengers in case of an accident, regardless of fault. | May have a limit on coverage. |

| Medical Payments Coverage (Med Pay) | Covers medical expenses for you and your passengers, regardless of fault. | May have a lower limit than PIP. |

| Rental Reimbursement | Covers the cost of a rental car while your vehicle is being repaired after an accident. | May have a daily limit and a maximum duration. |

| Roadside Assistance | Provides services like towing, flat tire changes, and jump starts. | May have limitations on the number of services provided. |

Choosing the Right Coverage

Selecting the appropriate level of coverage is crucial and depends on various factors, including:

- Driving Habits: Drivers with a history of accidents or traffic violations may require higher coverage to mitigate risks.

- Financial Situation: Your ability to pay for repairs or legal expenses in case of an accident influences your coverage needs.

- Risk Tolerance: Your willingness to accept financial responsibility for potential damages affects your coverage decisions.

- Vehicle Type: The value of your vehicle and its age impact the amount of coverage you need. For example, a new car may require higher coverage than an older car.

Here are some recommendations for different types of drivers and vehicles:

- New Drivers: Consider higher liability coverage to protect yourself from potential accidents. Collision and comprehensive coverage may also be beneficial, especially if you are financing the vehicle.

- Drivers with a History of Accidents: Higher liability coverage is recommended. Collision and comprehensive coverage may also be essential, depending on your financial situation.

- Drivers with Limited Financial Resources: Focus on essential coverage like liability and PIP. Consider adding collision and comprehensive coverage if you can afford it.

- Drivers with High-Value Vehicles: Collision and comprehensive coverage are crucial to protect your investment. Consider adding additional coverage like gap insurance, which covers the difference between the actual cash value of your vehicle and the amount you owe on the loan.

Additional Tips for Saving on Car Insurance

Beyond choosing the right coverage and comparing quotes, there are several additional steps you can take to reduce your car insurance premiums in Florida. These strategies focus on demonstrating your responsible driving habits and minimizing risk, factors that insurance companies consider when setting rates.

Maintaining a Good Driving Record, Most affordable car insurance in florida

A clean driving record is crucial for securing lower insurance premiums. Avoid traffic violations like speeding tickets, reckless driving, and DUI charges. These offenses can significantly increase your insurance rates, sometimes even resulting in policy cancellation.

- Drive Safely and Defensively: Always follow traffic rules, maintain a safe distance from other vehicles, and avoid distractions while driving. Defensive driving courses can teach you valuable techniques for anticipating and avoiding potential hazards on the road.

- Be Mindful of Points: Traffic violations in Florida accumulate points on your driving record. A certain number of points can lead to license suspension or higher insurance premiums.

Wrap-Up

Finding the most affordable car insurance in Florida requires a strategic approach. By obtaining multiple quotes, improving your driving record, and exploring potential discounts, you can secure a more favorable rate. Understanding minimum coverage requirements and choosing the right coverage for your needs are crucial steps in the process. Remember to maintain a good driving record, consider car safety features, and explore driver education programs to further reduce your insurance costs. With careful planning and research, you can find the most affordable car insurance that meets your specific needs and provides the necessary protection.

User Queries: Most Affordable Car Insurance In Florida

What are the minimum insurance requirements in Florida?

Florida requires drivers to have personal injury protection (PIP) and property damage liability coverage.

What are some common discounts offered by car insurance companies?

Common discounts include good driver, safe driver, multi-policy, and defensive driving course discounts.

How can I improve my driving record to lower my insurance premiums?

Avoid traffic violations, maintain a clean driving record, and consider taking defensive driving courses.

What are some tips for negotiating with insurance companies?

Be prepared to discuss your driving history, vehicle details, and coverage needs. Compare quotes from multiple providers and be ready to negotiate based on your research.