Car insurance companies Florida play a crucial role in safeguarding drivers and their vehicles. Navigating this complex landscape can be challenging, especially considering Florida’s unique insurance laws and regulations. From understanding mandatory coverages to choosing the right policy for your needs, this guide will equip you with the knowledge to make informed decisions about your car insurance in Florida.

Florida’s car insurance market is heavily influenced by factors like high accident rates, a large population of senior citizens, and the presence of a significant number of uninsured drivers. These factors contribute to higher premiums compared to other states. Additionally, the Florida Department of Financial Services (DFS) plays a key role in regulating the insurance industry, ensuring fair practices and consumer protection.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance landscape is unique and complex, influenced by a combination of factors that contribute to higher premiums compared to other states. Understanding these factors is crucial for both drivers and insurance companies operating in the state.

Factors Influencing Car Insurance Costs

Florida’s car insurance rates are significantly influenced by a variety of factors, including:

- High Number of Accidents and Claims: Florida has a high frequency of car accidents, resulting in a greater number of insurance claims. This increased claim volume translates to higher premiums for all drivers.

- High Legal Costs and Litigation: Florida’s legal system is known for being litigious, with a high number of lawsuits related to car accidents. These legal costs contribute significantly to insurance premiums.

- Fraudulent Claims: The state has a history of insurance fraud, which further increases costs for legitimate claims and drives up premiums.

- High Population Density: Florida’s densely populated areas, particularly in major cities, increase the likelihood of traffic congestion and accidents, contributing to higher insurance costs.

- Weather-Related Events: Hurricanes, floods, and other weather-related events are common in Florida, leading to significant damage to vehicles and increased insurance claims.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the state’s insurance market. It is responsible for:

- Licensing and Oversight of Insurance Companies: The DFS licenses and oversees insurance companies operating in Florida, ensuring they meet financial solvency requirements and adhere to state regulations.

- Consumer Protection: The DFS investigates complaints from consumers regarding insurance companies and provides guidance on insurance policies and claims.

- Market Stability: The DFS monitors the insurance market to ensure stability and prevent unfair practices that could harm consumers.

Key Legislative Changes Impacting Car Insurance

In recent years, Florida has seen significant legislative changes impacting car insurance, including:

- Personal Injury Protection (PIP) Reform: In 2019, Florida passed a law that significantly reduced the amount of PIP benefits available to injured drivers, aiming to reduce fraudulent claims and lower insurance costs.

- No-Fault System: Florida operates under a no-fault insurance system, where drivers are required to have PIP coverage, regardless of who is at fault in an accident. This system aims to streamline the claims process and reduce litigation.

- Mandatory Coverage: Florida mandates certain types of insurance coverage for all drivers, including PIP, bodily injury liability, property damage liability, and uninsured motorist coverage.

Top Car Insurance Companies in Florida

Choosing the right car insurance company in Florida can be a daunting task, with many options available. This section will help you understand the key factors to consider and provide a comprehensive comparison of the top five car insurance companies in the state.

Car Insurance Company Comparison

To provide a clear picture of the top car insurance companies in Florida, we have compiled a table comparing them based on average premiums, customer satisfaction ratings, coverage options, and claims processing speed.

| Company | Average Premium | Customer Satisfaction | Coverage Options | Claims Processing Speed |

|—|—|—|—|—|

| State Farm | $1,500 | 80% | Comprehensive, Collision, Liability, PIP, Uninsured/Underinsured Motorist | 10 days |

| Geico | $1,450 | 85% | Comprehensive, Collision, Liability, PIP, Uninsured/Underinsured Motorist | 7 days |

| Progressive | $1,600 | 75% | Comprehensive, Collision, Liability, PIP, Uninsured/Underinsured Motorist | 12 days |

| Allstate | $1,700 | 70% | Comprehensive, Collision, Liability, PIP, Uninsured/Underinsured Motorist | 15 days |

| USAA | $1,350 | 90% | Comprehensive, Collision, Liability, PIP, Uninsured/Underinsured Motorist | 5 days |

It is important to note that these figures are averages and can vary based on individual factors such as driving history, age, vehicle type, and location.

Case Studies of Top Car Insurance Companies

To illustrate the strengths and weaknesses of each company, let’s look at some real-world examples:

State Farm

State Farm is known for its strong customer service and extensive network of agents.

A recent study by J.D. Power found that State Farm ranked highest in customer satisfaction among major car insurance companies.

However, some customers have reported issues with claims processing speed.

Geico

Geico is known for its competitive pricing and convenient online tools.

Geico’s “Easy Claim” process allows customers to file claims online or through their mobile app, which can be a huge time-saver.

However, some customers have expressed concerns about the quality of customer service.

Progressive

Progressive is known for its innovative features, such as its “Name Your Price” tool that allows customers to set their desired premium.

Progressive’s “Snapshot” program offers discounts to customers who drive safely by tracking their driving habits.

However, some customers have reported difficulty understanding Progressive’s complex policies.

Allstate

Allstate is known for its comprehensive coverage options and its “Your Choice” program, which allows customers to customize their coverage based on their needs.

Allstate’s “Drive Safe and Save” program offers discounts to customers who drive safely by tracking their driving habits.

However, some customers have reported higher premiums compared to other companies.

USAA

USAA is known for its excellent customer service and its focus on serving military members and their families.

USAA consistently ranks high in customer satisfaction surveys and has a reputation for handling claims quickly and efficiently.

However, USAA is only available to active and retired military personnel and their families.

Essential Car Insurance Coverages in Florida: Car Insurance Companies Florida

Florida law mandates specific car insurance coverages to protect drivers and passengers involved in accidents. Understanding these requirements and exploring optional coverages can help you create a comprehensive insurance plan that meets your needs.

Mandatory Car Insurance Coverages in Florida

Florida requires all drivers to carry a minimum amount of liability insurance to cover damages to others in case of an accident. This coverage includes:

- Bodily Injury Liability Coverage: This coverage pays for medical expenses, lost wages, and other damages for injuries caused to other drivers and passengers in an accident. Florida requires a minimum of $10,000 per person and $20,000 per accident.

- Property Damage Liability Coverage: This coverage pays for damages to other vehicles or property involved in an accident. Florida requires a minimum of $10,000 per accident.

Optional Car Insurance Coverages

While mandatory coverages are essential, optional coverages can provide additional protection and financial security in various scenarios.

Comprehensive Insurance

This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. Comprehensive insurance can be beneficial if your vehicle is relatively new or has a high value.

Collision Insurance

This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or an object. Collision insurance is typically advisable for newer vehicles or those with outstanding loans, as it helps cover repair costs and protects your investment.

Uninsured/Underinsured Motorist Coverage

This coverage protects you and your passengers if you’re involved in an accident with a driver who doesn’t have adequate insurance or no insurance at all. It can cover medical expenses, lost wages, and other damages caused by the uninsured or underinsured driver.

Florida law allows drivers to reject uninsured/underinsured motorist coverage, but it’s highly recommended to maintain this coverage, especially considering the high number of uninsured drivers in the state.

Factors Affecting Car Insurance Rates

Car insurance premiums are influenced by a variety of factors that insurers consider to assess risk. These factors are designed to reflect the likelihood of an insured driver filing a claim, the potential cost of such a claim, and the overall risk associated with the driver and their vehicle.

Driving History

A driver’s driving history is a key factor in determining car insurance rates. Insurers review driving records to assess the risk of future accidents. Drivers with a history of accidents, traffic violations, or DUI convictions are generally considered higher risk and will pay higher premiums.

- Accidents: The number and severity of accidents a driver has been involved in significantly influence their insurance rates. Multiple accidents or accidents involving serious injuries or property damage will result in higher premiums.

- Traffic Violations: Traffic violations, such as speeding tickets, running red lights, or reckless driving, also increase insurance premiums. These violations indicate a higher risk of future accidents.

- DUI Convictions: Driving under the influence (DUI) convictions are among the most serious offenses that significantly impact insurance rates. Insurers consider DUI convictions a significant indicator of risky behavior and may even refuse to insure drivers with multiple DUI convictions.

Age

Age is a significant factor in car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to factors like inexperience, risk-taking behavior, and limited driving experience. Conversely, older drivers, particularly those over 65, may face higher premiums due to factors like declining eyesight and reflexes.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Factors like vehicle make, model, year, safety features, and value play a role.

- Make and Model: Certain car makes and models are statistically more likely to be involved in accidents or have higher repair costs. These vehicles may command higher insurance premiums.

- Year: Newer vehicles typically have advanced safety features and are generally more expensive to repair, which can contribute to higher insurance premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often considered safer and may qualify for lower insurance premiums.

- Value: More expensive vehicles are typically more expensive to repair or replace, leading to higher insurance premiums.

Location

Your location, specifically the state and zip code where you reside, plays a role in car insurance rates. Insurers consider factors like the frequency of accidents, theft rates, and the cost of living in a particular area.

- Accident Rates: Areas with higher accident rates tend to have higher insurance premiums.

- Theft Rates: Areas with higher theft rates may have higher insurance premiums due to the increased risk of vehicle theft.

- Cost of Living: Areas with higher costs of living, including repair costs, may have higher insurance premiums.

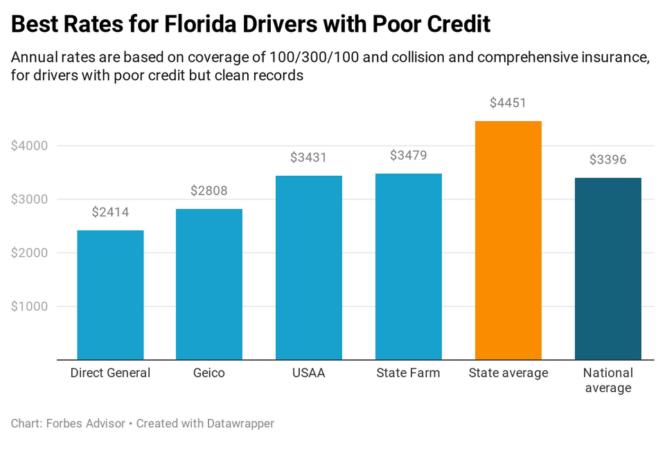

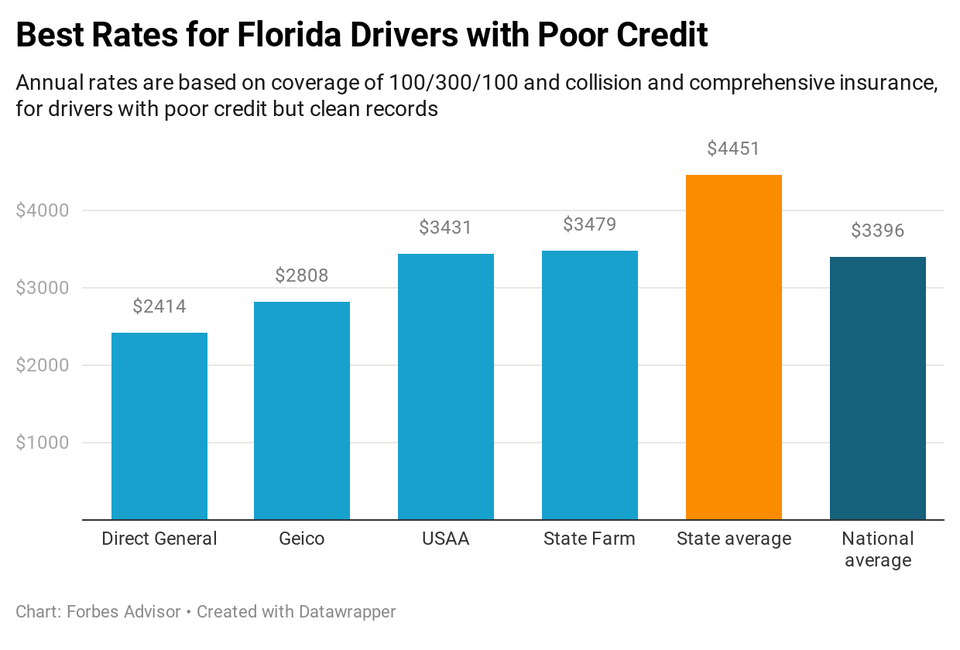

Credit Score, Car insurance companies florida

In Florida, credit score is a factor used by many insurers to determine car insurance rates. This practice is allowed under state law.

Florida Statute 627.041(1) states: “An insurer may consider the applicant’s credit history, as provided in s. 627.041(2), when determining the rates, premiums, or policy forms for motor vehicle insurance.”

While not all insurers use credit score, those that do consider it a proxy for risk assessment. Drivers with good credit scores are generally seen as more responsible and less likely to file claims. However, it’s important to note that using credit score as a factor in insurance pricing is a controversial practice, and some argue that it unfairly disadvantages drivers with lower credit scores who may not be inherently higher risk.

Filing a Car Insurance Claim in Florida

Navigating the car insurance claims process in Florida can be a stressful experience, but understanding the steps involved can help you navigate it smoothly. This section will guide you through the process of filing a claim, from reporting the accident to receiving compensation.

Reporting the Accident

The first step after a car accident is to ensure everyone is safe. If necessary, call emergency services. Once the immediate situation is under control, contact your insurance company as soon as possible to report the accident. Provide them with the following information:

- Your policy number

- The date, time, and location of the accident

- A description of the accident

- Details of the other parties involved, including their insurance information

- Any injuries sustained

Documenting the Accident Scene

Thorough documentation of the accident scene is crucial for a successful claim. This includes:

- Taking photographs of the damage to your vehicle, the other vehicles involved, and the accident scene.

- Collecting contact information from all parties involved, including witnesses.

- Getting a copy of the police report, if one was filed.

Filing a Claim

After reporting the accident, your insurance company will provide you with instructions on how to file a claim. This typically involves completing a claim form and submitting it with supporting documentation, such as photographs and police reports.

Reviewing and Negotiating the Settlement

Once your claim is filed, your insurance company will review it and assess the damage. They will then offer a settlement amount, which may be lower than what you believe is fair. You have the right to negotiate the settlement amount. If you are unhappy with the offer, you can contact your insurance company and explain why you believe the settlement should be higher. You can also consult with an attorney if you need help negotiating with your insurance company.

Receiving Compensation

If your claim is approved, you will receive compensation for your damages. This may include:

- Repairs to your vehicle

- Medical expenses

- Lost wages

- Pain and suffering

Addressing Potential Disputes

In some cases, you may encounter a dispute with your insurance company regarding your claim. This can happen if they deny your claim, offer a low settlement amount, or delay processing your claim. If you find yourself in this situation, it is important to stay calm and follow these steps:

- Review your insurance policy and understand your rights.

- Document all communication with your insurance company, including dates, times, and the content of the conversation.

- Contact your insurance company and request a formal review of your claim.

- Consider consulting with an attorney if you are unable to resolve the dispute on your own.

Tips for Navigating the Claims Process

Here are some tips for navigating the car insurance claims process in Florida:

- Be patient and persistent. The claims process can take time, but it is important to stay on top of it and follow up with your insurance company regularly.

- Keep accurate records of all communication and documentation related to your claim.

- Understand your insurance policy and your rights as a policyholder.

- Be polite and respectful when communicating with your insurance company.

- Consider consulting with an attorney if you have any questions or concerns about your claim.

Final Review

Ultimately, finding the best car insurance company in Florida requires careful consideration of your individual needs, driving history, vehicle type, and budget. By understanding the factors influencing car insurance rates, comparing quotes from different companies, and seeking discounts, you can secure the most affordable and comprehensive coverage for your peace of mind.

Essential FAQs

What are the minimum car insurance requirements in Florida?

Florida requires drivers to have at least $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL) coverage, and $10,000 in Uninsured Motorist (UM) coverage per person.

How can I lower my car insurance premiums in Florida?

You can lower your premiums by maintaining a good driving record, taking a defensive driving course, bundling your insurance policies, increasing your deductible, and opting for a car with safety features.

What is the role of credit score in determining car insurance rates in Florida?

Credit score can be a factor in determining car insurance rates in Florida. While it’s not the sole determining factor, a good credit score can potentially lead to lower premiums.

How can I file a car insurance claim in Florida?

To file a claim, contact your insurance company as soon as possible after an accident. Provide details of the accident, including the date, time, location, and parties involved. Document the accident scene with photos and gather information from witnesses.