Car insurance quote Florida is a crucial step for any driver in the Sunshine State. Florida’s unique driving environment, characterized by high population density, frequent hurricanes, and a high rate of uninsured drivers, significantly impacts insurance costs. Understanding these factors and the various coverage options available is essential to securing affordable and comprehensive protection.

The cost of car insurance in Florida is influenced by a range of factors, including your driving history, age, gender, vehicle type, credit score, and location. Insurance companies use these factors to assess your risk and calculate your premium. By understanding how these factors affect your quote, you can take steps to improve your rate and potentially save money.

Understanding Car Insurance in Florida

Florida is a state with unique factors that significantly influence car insurance costs. Understanding these factors and the different types of coverage available can help you make informed decisions about your car insurance needs.

Factors Influencing Car Insurance Costs in Florida

Florida’s car insurance landscape is shaped by several key factors:

- High Population Density: Florida’s large population, particularly in urban areas, leads to increased traffic congestion and a higher likelihood of accidents. This translates into higher insurance claims and, consequently, higher premiums.

- Frequent Hurricanes: Florida is prone to hurricanes, which can cause widespread damage to vehicles. Insurance companies factor in the risk of hurricane-related claims, resulting in higher premiums for drivers in hurricane-prone areas.

- High Rate of Uninsured Drivers: Florida has a high number of uninsured drivers, which increases the risk for insured drivers involved in accidents with uninsured motorists. This risk is reflected in higher premiums.

- High Medical Costs: Florida has relatively high medical costs, which can impact the cost of personal injury protection (PIP) coverage, a mandatory coverage in the state.

Types of Car Insurance Coverage in Florida

Florida offers various types of car insurance coverage, each addressing different aspects of potential risks:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injury or property damage to others. It covers the other party’s medical expenses, lost wages, and property damage up to the limits of your policy.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of fault. It helps cover the cost of repairs or a new vehicle if yours is totaled.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It helps cover the cost of repairs or replacement for damages not covered by collision coverage.

- Personal Injury Protection (PIP): This mandatory coverage in Florida covers your medical expenses, lost wages, and other related expenses if you’re injured in an accident, regardless of fault. It provides financial protection for your own injuries, regardless of who caused the accident.

- Uninsured Motorist Coverage: This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It helps cover your medical expenses, lost wages, and property damage if the other driver doesn’t have sufficient insurance to cover your losses.

Mandatory Car Insurance Coverage in Florida

Florida law requires all drivers to carry a minimum amount of car insurance coverage. These mandatory coverages include:

- Personal Injury Protection (PIP): $10,000 per person

- Property Damage Liability: $10,000 per accident

- Bodily Injury Liability: $10,000 per person and $20,000 per accident

It’s important to note that these minimum requirements may not be sufficient to cover all potential losses in a serious accident. Consider increasing your coverage limits to ensure adequate protection for yourself and others.

Obtaining Car Insurance Quotes in Florida

Securing the best car insurance rates in Florida involves comparing quotes from various insurance providers. You can obtain quotes through various methods, each offering its own advantages and disadvantages.

Methods for Obtaining Car Insurance Quotes

There are three primary methods for obtaining car insurance quotes in Florida:

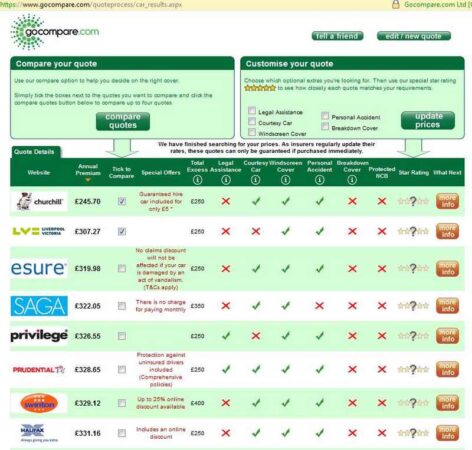

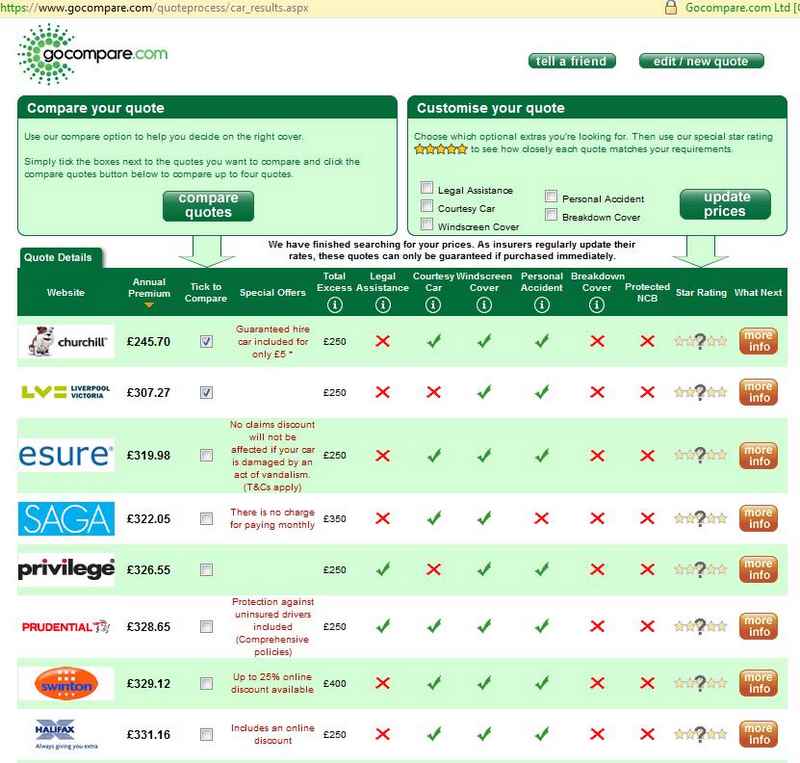

- Online Quote Tools: Many insurance companies offer online quote tools on their websites, allowing you to input your information and receive an instant quote. This method is highly convenient and fast, enabling you to compare quotes from multiple insurers within minutes. However, online quote tools may not always provide the most accurate or personalized quotes.

- Phone Calls to Insurance Agents: You can also obtain quotes by calling insurance agents directly. This allows you to speak with a knowledgeable representative who can answer your questions and provide personalized recommendations. However, this method may take longer than using online tools, and you may need to contact multiple agents to compare quotes.

- In-Person Visits: Visiting an insurance agent’s office in person offers the most personalized experience, allowing you to discuss your specific needs and receive tailored advice. However, this method is the least convenient and can be time-consuming.

Comparing the Methods

The following table summarizes the advantages and disadvantages of each method for obtaining car insurance quotes in Florida:

| Method | Advantages | Disadvantages |

|---|---|---|

| Online Quote Tools | Convenient, fast, allows comparison of multiple quotes | May not be personalized, may not be accurate |

| Phone Calls to Insurance Agents | Personalized recommendations, allows questions to be answered | May take longer, requires contacting multiple agents |

| In-Person Visits | Most personalized experience, tailored advice | Least convenient, time-consuming |

Steps Involved in Obtaining an Online Quote

To obtain an online car insurance quote, you typically need to follow these steps:

- Visit the insurance company’s website: Begin by navigating to the website of the insurance company you are interested in.

- Click on the “Get a Quote” button: Most websites have a prominent button that allows you to start the quote process.

- Provide your personal information: You will be asked to enter information such as your name, address, date of birth, and driver’s license number.

- Enter your vehicle information: This includes the make, model, year, and VIN of your vehicle.

- Provide your driving history: You may be asked to provide information about your driving record, including any accidents or violations.

- Select your coverage options: You will need to choose the type and amount of coverage you want, such as liability, collision, and comprehensive.

- Review and submit your quote: Before submitting your quote, review the information you have provided to ensure accuracy.

Once you have submitted your information, the insurance company will generate a quote, typically within a few minutes.

Choosing the Right Car Insurance Provider in Florida

Finding the right car insurance provider in Florida is crucial for ensuring you have adequate coverage at a reasonable price. With numerous companies offering various policies, it’s essential to consider several factors before making a decision.

Financial Stability

A financially stable car insurance company is critical for ensuring they can fulfill their obligations in case of a claim. You can assess a company’s financial strength by checking its ratings from independent agencies like AM Best, Standard & Poor’s, and Moody’s. These agencies evaluate insurers’ financial health, including their ability to pay claims and remain solvent.

Customer Service

Excellent customer service is essential for a positive car insurance experience. Look for companies with high customer satisfaction ratings, available through online reviews and independent surveys. Consider factors like responsiveness to inquiries, claim processing efficiency, and overall communication quality.

Claim Handling Processes

How efficiently and fairly a company handles claims is a crucial indicator of their reliability. Research companies’ claim handling processes, including their speed of processing, communication with policyholders, and the overall fairness of claim settlements. You can also check customer reviews and complaints to gain insights into their claim handling practices.

Discounts Offered

Car insurance companies often offer discounts to reduce premiums. These discounts can vary significantly, so it’s essential to compare the available options. Common discounts include:

- Good driver discounts: For drivers with a clean driving record.

- Safe driver discounts: For drivers who complete defensive driving courses.

- Multi-car discounts: For insuring multiple vehicles with the same company.

- Bundled discounts: For combining car insurance with other insurance policies, like homeowners or renters insurance.

- Anti-theft device discounts: For vehicles equipped with anti-theft devices.

- Loyalty discounts: For long-term policyholders.

Comparison of Major Car Insurance Companies in Florida, Car insurance quote florida

| Company | Strengths | Weaknesses |

|---|---|---|

| State Farm | Wide network of agents, extensive coverage options, strong financial stability. | Can be expensive compared to some competitors, customer service can vary depending on the agent. |

| Geico | Highly competitive pricing, convenient online and mobile services, strong customer service. | Limited coverage options compared to some competitors, can be challenging to reach a customer service representative by phone. |

| Progressive | Innovative features like Name Your Price tool, customizable coverage options, strong financial stability. | Customer service can be inconsistent, claim handling processes can be complex. |

| Allstate | Wide range of discounts, strong financial stability, extensive coverage options. | Can be expensive compared to some competitors, customer service can be inconsistent. |

| USAA | Excellent customer service, competitive pricing, strong financial stability, dedicated to serving military members and their families. | Only available to military members and their families. |

Reputable Car Insurance Providers in Florida

- State Farm: Known for its extensive network of agents and comprehensive coverage options. Offers a wide range of discounts and has a strong financial rating.

- Geico: Offers competitive pricing and convenient online and mobile services. Has a strong customer service reputation and a solid financial rating.

- Progressive: Known for its innovative features, including the Name Your Price tool, and customizable coverage options. Offers a wide range of discounts and has a strong financial rating.

- Allstate: Offers a wide range of discounts and has a strong financial rating. Provides comprehensive coverage options and has a large network of agents.

- USAA: Exclusively serves military members and their families. Offers excellent customer service, competitive pricing, and a strong financial rating.

Tips for Saving on Car Insurance in Florida

Car insurance is a significant expense for most Floridians. However, there are several strategies you can use to reduce your premiums and save money. By implementing these tips, you can find affordable coverage that meets your needs.

Maintaining a Good Driving Record

A clean driving record is crucial for obtaining lower car insurance rates. Florida insurance companies typically offer discounts to drivers with no accidents, traffic violations, or DUI convictions. To maintain a good driving record, practice safe driving habits, obey traffic laws, and avoid risky behaviors.

Increasing Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lead to lower premiums, as you are essentially taking on more financial responsibility. However, ensure you can afford to pay the higher deductible in case of an accident.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can result in significant savings. Insurance companies often offer discounts for bundling multiple policies, as it indicates loyalty and reduces administrative costs.

Taking Advantage of Discounts

Florida insurance companies offer a variety of discounts to eligible drivers. These discounts can significantly reduce your premiums. Some common discounts include:

- Safe Driver Discount: This discount is typically offered to drivers with a clean driving record and no accidents or violations.

- Good Student Discount: Students who maintain a certain GPA or academic standing may qualify for this discount.

- Multi-Car Discount: Insurance companies often offer discounts when you insure multiple vehicles with them.

- Anti-theft Device Discount: Installing anti-theft devices in your car can lower your premiums, as it reduces the risk of theft.

- Loyalty Discount: Some insurance companies offer discounts to long-term customers who have been with them for a certain period.

Utilizing Comparison Websites and Online Tools

Online comparison websites and tools can help you find the best car insurance rates in Florida. These platforms allow you to compare quotes from multiple insurance companies simultaneously, making it easier to find the most affordable option.

“Using comparison websites is an effective way to save money on car insurance, as you can quickly and easily compare rates from different providers.”

When using comparison websites, ensure you provide accurate information to receive accurate quotes. Also, consider the company’s financial stability, customer service, and claims handling process before making a decision.

Closing Summary: Car Insurance Quote Florida

Obtaining car insurance quotes in Florida is a straightforward process. You can compare quotes online, by phone, or in person. By taking the time to research and compare different providers, you can find the best coverage at the most competitive price. Remember to consider factors like financial stability, customer service, claim handling processes, and available discounts when choosing your insurer.

FAQ Corner

How often should I review my car insurance rates?

It’s recommended to review your car insurance rates at least annually, as your driving history, vehicle, and other factors can change over time.

What are the benefits of bundling car and home insurance?

Bundling car and home insurance can lead to significant discounts, as insurers often offer incentives for multiple policies.

What are the penalties for driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time.