Florida car insurance rates are a complex subject, influenced by a variety of factors, from your driving history to the type of vehicle you own. The state’s unique no-fault insurance system plays a significant role in determining costs, while other factors like your age, gender, and credit score also come into play. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

This guide will delve into the key aspects of Florida car insurance, exploring how rates are calculated, offering strategies for saving money, and providing insights into the state’s insurance regulations. Whether you’re a new driver, a seasoned motorist, or simply looking for ways to optimize your coverage, this comprehensive overview will equip you with the knowledge you need to navigate the intricacies of Florida’s car insurance landscape.

Factors Influencing Florida Car Insurance Rates

Florida’s car insurance market is unique due to its no-fault insurance system and other factors that can significantly impact premiums. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning that drivers are required to file claims with their own insurance companies, regardless of who is at fault in an accident. This system aims to streamline the claims process and reduce litigation. However, it can also lead to higher insurance rates due to the increased number of claims filed.

Driving History, Florida car insurance rates

Your driving history is a major factor in determining your car insurance premiums. Insurance companies consider your past driving record, including accidents, traffic violations, and driving convictions.

- Accidents: Accidents, even those where you were not at fault, can significantly increase your insurance premiums. Insurance companies view accidents as indicators of higher risk.

- Traffic Violations: Traffic violations, such as speeding tickets, running red lights, and DUI convictions, can also lead to higher premiums. Insurance companies see these violations as signs of risky driving behavior.

- Driving Convictions: Driving convictions, such as driving under the influence (DUI) or reckless driving, can have the most significant impact on your insurance rates. These convictions are considered serious offenses and can result in significant premium increases or even policy cancellation.

Vehicle Type and Value

The type and value of your vehicle are also crucial factors in determining your car insurance premiums.

- Vehicle Type: Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and greater risk of theft.

- Vehicle Value: The value of your car is directly related to your insurance premiums. More expensive cars, even if they are not high-performance, will typically have higher insurance premiums due to the higher cost of replacement or repair in the event of an accident.

Age, Gender, and Credit Score

- Age: Younger drivers, particularly those under the age of 25, are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for younger drivers due to this increased risk.

- Gender: Historically, men have been statistically more likely to be involved in accidents than women. As a result, men may face higher insurance premiums than women. However, this trend is changing, and insurance companies are increasingly focusing on individual driving history rather than gender alone.

- Credit Score: Your credit score can also impact your car insurance premiums. Insurance companies often use credit scores as a proxy for risk, assuming that individuals with lower credit scores are more likely to file claims. However, this practice is controversial, and some states have banned the use of credit scores in insurance pricing.

Coverage Levels

The level of coverage you choose will also influence your insurance premiums.

- Liability Coverage: Liability coverage protects you financially if you are at fault in an accident that causes injury or damage to others. Higher liability limits provide greater protection but also result in higher premiums.

- Comprehensive Coverage: Comprehensive coverage protects you against damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters. This coverage is optional but can be essential depending on your individual needs and the value of your vehicle.

- Collision Coverage: Collision coverage protects you against damage to your vehicle in the event of an accident, regardless of who is at fault. This coverage is also optional but is often required if you have a car loan or lease.

Strategies for Saving on Florida Car Insurance

Saving money on car insurance in Florida is achievable with the right strategies. By understanding the factors that influence your rates and implementing effective cost-saving techniques, you can significantly reduce your premiums without compromising coverage.

Defensive Driving Courses

Taking a defensive driving course can significantly reduce your car insurance premiums in Florida. These courses teach safe driving techniques and traffic laws, which can help you avoid accidents and reduce your risk profile. By demonstrating your commitment to safe driving, insurance companies often offer discounts for completing these courses.

Bundling Insurance Policies

Bundling your car insurance with other policies, such as home or renters insurance, can lead to substantial savings. Insurance companies often offer discounts for bundling multiple policies, as they benefit from having a broader customer base. By consolidating your insurance needs with a single provider, you can streamline your payments and potentially lower your overall premiums.

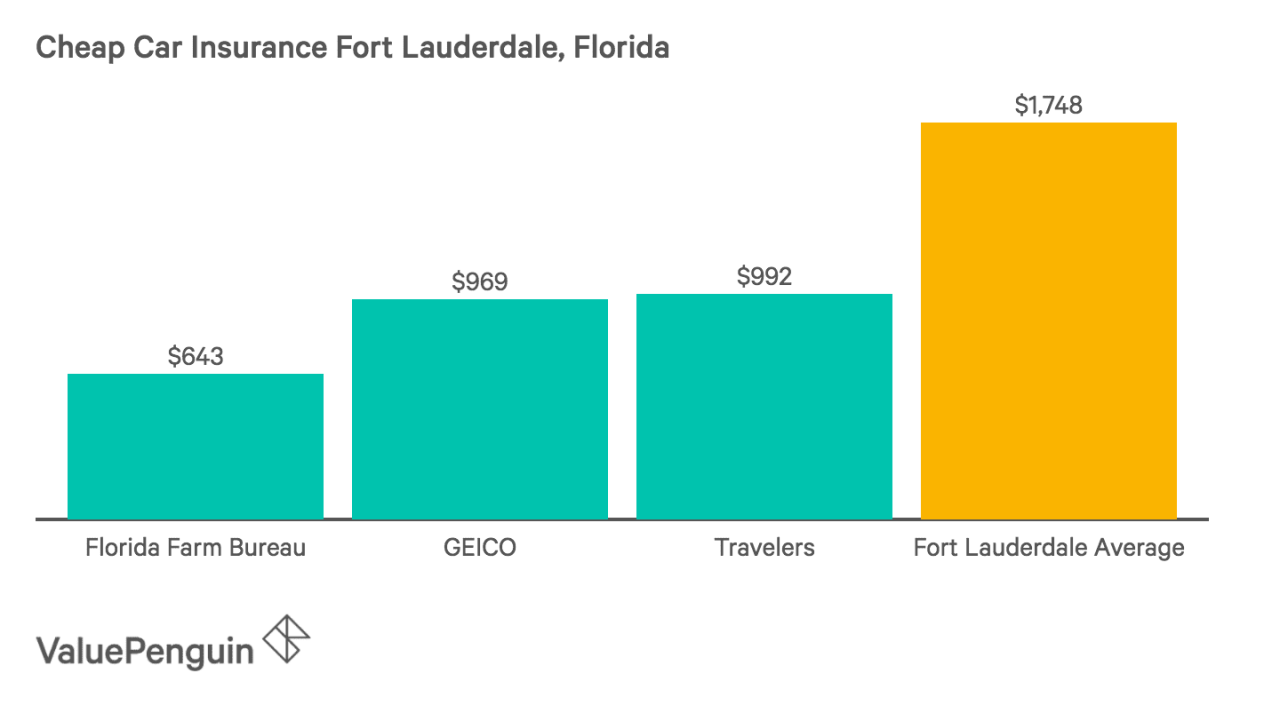

Comparing Quotes and Using Independent Agents

Comparison websites and independent agents can be invaluable resources for finding affordable car insurance. Comparison websites allow you to input your information and receive quotes from multiple insurance companies simultaneously, enabling you to easily compare prices and coverage options. Independent agents can provide personalized guidance and negotiate rates on your behalf, leveraging their expertise and relationships with various insurance companies.

Negotiating Rates

Negotiating your car insurance rates with insurance companies is a worthwhile endeavor. By understanding your policy details, your driving history, and the market rates, you can effectively advocate for lower premiums. Here are some tips for successful negotiation:

* Review your policy: Analyze your coverage and identify any unnecessary add-ons that you can eliminate to reduce your premium.

* Shop around: Get quotes from multiple insurance companies to understand the market rates and identify potential savings.

* Highlight your positive factors: Emphasize your clean driving record, safety features in your car, and any other factors that demonstrate your low risk profile.

* Be polite and persistent: Maintain a respectful and assertive tone during your negotiation.

* Consider bundling: Inquire about discounts for bundling your car insurance with other policies.

* Ask for a lower rate: Don’t be afraid to ask for a lower premium, especially if you have a history of good driving and have made changes to reduce your risk.

By implementing these strategies, you can effectively lower your car insurance premiums in Florida while ensuring adequate coverage. Remember to shop around, compare quotes, and negotiate with insurance companies to find the best possible rates.

Understanding Florida’s Insurance Regulations

Navigating the complex world of car insurance in Florida requires understanding the state’s specific regulations. These regulations dictate the minimum coverage requirements, the process for filing claims, and the role of the state’s regulatory body in protecting consumers.

Mandatory Car Insurance Coverage

Florida law mandates that all drivers carry a minimum amount of liability insurance to protect themselves and others in the event of an accident. This coverage, known as Financial Responsibility, is designed to ensure that individuals who cause accidents have the financial means to compensate those who are injured or whose property is damaged.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries caused by an insured driver to others. Florida requires a minimum of $10,000 per person and $20,000 per accident.

- Property Damage Liability: This coverage pays for repairs or replacement costs for damage to another person’s property caused by an insured driver. Florida requires a minimum of $10,000 per accident.

- Personal Injury Protection (PIP): This coverage, often referred to as “no-fault” insurance, pays for medical expenses and lost wages for the insured driver and passengers regardless of fault in an accident. Florida requires a minimum of $10,000 in PIP coverage.

- Uninsured Motorist Coverage (UM): This coverage protects drivers and passengers from financial losses caused by uninsured or hit-and-run drivers. It is optional but highly recommended. Florida requires a minimum of $10,000 per person and $20,000 per accident for UM coverage.

Filing Claims and Resolving Disputes

When an accident occurs, the insured driver is responsible for promptly notifying their insurance company. The insurer will then investigate the claim, assess the damages, and determine the extent of coverage.

- Initial Claim Filing: Contact your insurance company as soon as possible after an accident, providing details about the incident, injuries, and damages. Your insurer will guide you through the claim filing process.

- Claim Investigation: The insurance company will investigate the claim, gathering information from the insured, witnesses, and police reports. They will assess the extent of damages and determine liability.

- Claim Settlement: If the claim is approved, the insurance company will issue a settlement payment to the insured or the other party involved in the accident. The settlement amount will be based on the policy coverage and the assessed damages.

- Disputes and Appeals: If the insured disagrees with the insurer’s decision regarding a claim, they can appeal the decision. The appeal process typically involves filing a formal complaint with the insurance company and, if necessary, pursuing arbitration or litigation.

Role of the Florida Office of Insurance Regulation

The Florida Office of Insurance Regulation (OIR) is responsible for overseeing the state’s insurance industry, ensuring fair and competitive practices, and protecting consumers’ rights. The OIR investigates consumer complaints, enforces insurance laws, and approves insurance rates.

- Consumer Complaint Resolution: The OIR provides a platform for consumers to file complaints against insurance companies for unfair or deceptive practices. The OIR investigates these complaints and takes appropriate action to resolve them.

- Rate Regulation: The OIR reviews and approves insurance rates to ensure they are fair and reasonable. The OIR also monitors the financial stability of insurance companies to protect policyholders from potential insolvency.

- Insurance Market Oversight: The OIR monitors the insurance market to identify and address any issues that may impact consumers. The OIR works to ensure a competitive and stable insurance market in Florida.

Ultimate Conclusion: Florida Car Insurance Rates

Navigating Florida’s car insurance market can seem daunting, but by understanding the factors that influence rates, comparing quotes from different insurers, and utilizing available discounts, you can secure affordable and comprehensive coverage. Remember, your insurance policy is a crucial investment in your financial well-being, so it’s essential to choose wisely and stay informed about your options.

Top FAQs

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.

How can I find the best car insurance rates in Florida?

Compare quotes from multiple insurance companies using online comparison websites or independent insurance agents. Consider factors like coverage levels, discounts, and customer service when making your decision.

What are some common discounts available on Florida car insurance?

Common discounts include good driver discounts, safe driver courses, multi-car discounts, and bundling with other insurance policies.

What should I do if I have a car accident in Florida?

Contact your insurance company as soon as possible to report the accident and file a claim. Follow the instructions provided by your insurer and cooperate with any investigations.