- State Farm Car Insurance in Florida

- Florida’s Unique Car Insurance Landscape

- State Farm’s Car Insurance Offerings in Florida

- Factors Influencing Car Insurance Rates in Florida

- Customer Experience with State Farm in Florida

- Comparing State Farm to Other Car Insurance Providers in Florida

- State Farm’s Commitment to Customer Satisfaction in Florida

- Concluding Remarks: State Farm Car Insurance Florida

- Helpful Answers

State Farm car insurance Florida is a popular choice for drivers seeking reliable coverage and competitive rates. As one of the largest insurance providers in the U.S., State Farm has a strong presence in Florida’s diverse car insurance market. The Sunshine State’s unique insurance landscape, including its no-fault system and emphasis on Personal Injury Protection (PIP), presents both challenges and opportunities for drivers. This guide delves into the intricacies of State Farm’s car insurance offerings in Florida, examining factors that influence rates, customer experiences, and comparisons with other major providers.

Navigating the complexities of car insurance in Florida can be daunting. This guide aims to simplify the process by providing clear explanations of State Farm’s coverage options, rate calculations, and customer service. We’ll also explore ways to save money on your premiums and make informed decisions about your car insurance needs.

State Farm Car Insurance in Florida

State Farm is one of the largest and most well-known insurance providers in the United States, offering a wide range of insurance products, including car insurance. In Florida, State Farm holds a significant presence in the car insurance market, serving a large number of policyholders.

The state of Florida has a high concentration of vehicles and a substantial number of car accidents, making car insurance a crucial necessity for residents. State Farm’s strong presence in the state reflects its commitment to providing reliable and comprehensive car insurance coverage to Floridians.

State Farm’s Market Share in Florida

State Farm’s market share in Florida’s car insurance market is substantial, reflecting its popularity and customer base in the state. According to the Florida Office of Insurance Regulation, State Farm was the second-largest auto insurer in Florida in 2022, holding a market share of approximately 14%. This indicates that State Farm insures a significant portion of vehicles in Florida.

- State Farm’s large market share in Florida is a testament to its reputation for providing competitive rates, comprehensive coverage options, and excellent customer service. The company’s strong brand recognition and extensive network of agents contribute to its success in the state.

- The high volume of State Farm policyholders in Florida underscores the company’s ability to cater to the diverse insurance needs of the state’s residents, from individual drivers to families and businesses.

Florida’s Unique Car Insurance Landscape

Florida’s car insurance market is unlike any other in the nation. It’s a complex landscape shaped by a unique blend of factors, including high accident rates, a no-fault insurance system, and a significant presence of uninsured motorists. These elements combine to create a market where premiums are often higher than in other states, and navigating the system can be challenging for both drivers and insurers.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, which means that after an accident, drivers are primarily responsible for covering their own medical expenses, regardless of who was at fault. This system aims to streamline the claims process and reduce litigation, but it has also contributed to higher insurance premiums in Florida.

Under Florida’s no-fault system, drivers are required to carry Personal Injury Protection (PIP) coverage, which pays for medical expenses, lost wages, and other related costs following an accident.

- This system is designed to simplify the claims process and reduce litigation by eliminating the need to determine fault in many cases.

- However, Florida’s no-fault system has been criticized for its impact on insurance premiums. The state’s high accident rates and the prevalence of fraud in the PIP system have driven up costs for insurers, who pass these costs on to consumers in the form of higher premiums.

State Farm’s Car Insurance Offerings in Florida

State Farm, a leading insurance provider in the US, offers a comprehensive range of car insurance options tailored to the specific needs of Florida drivers. Understanding these options and their intricacies is crucial for choosing the right coverage that balances protection and affordability.

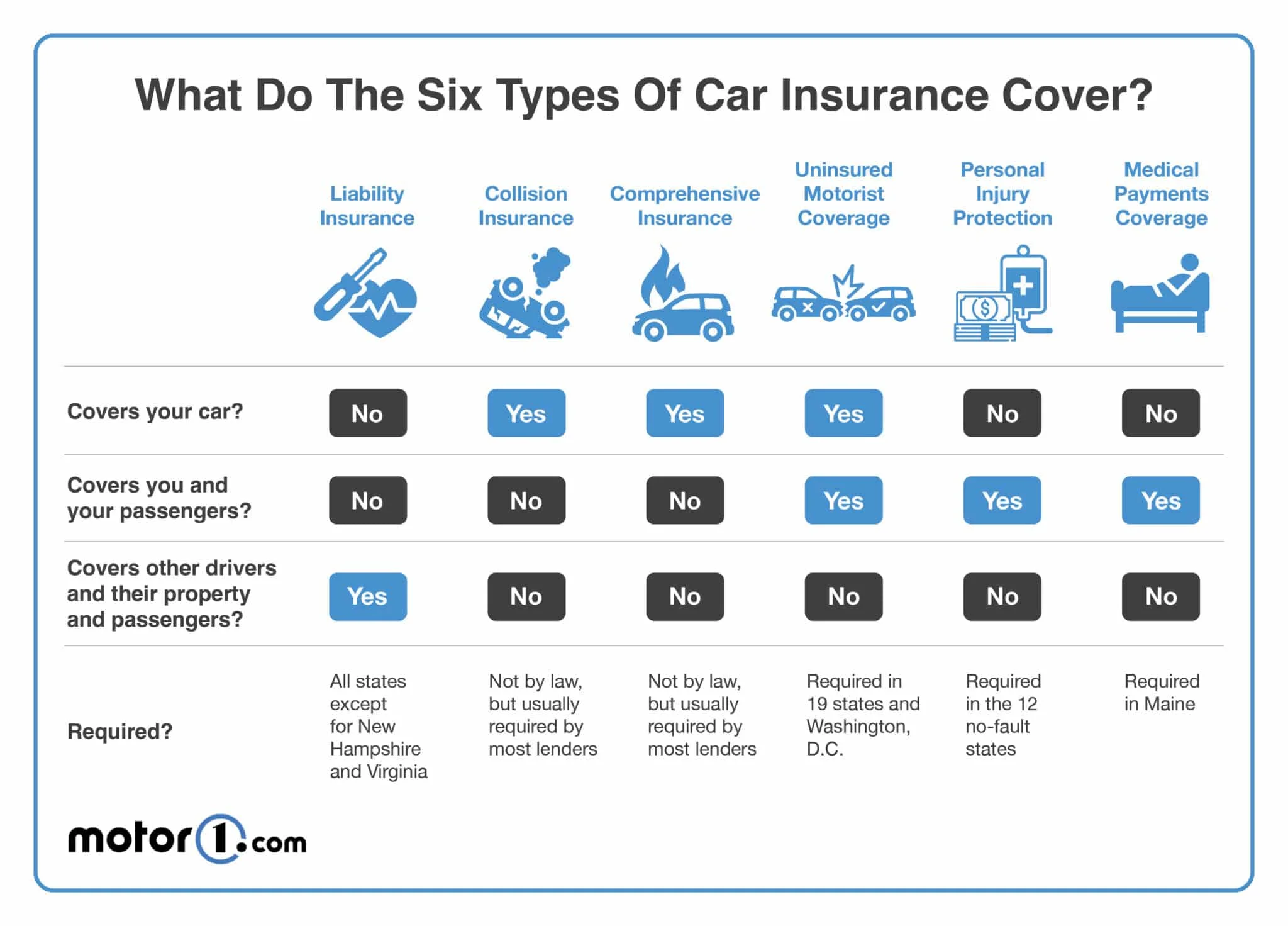

Types of Car Insurance Coverage

State Farm provides various car insurance coverages, each addressing specific risks and offering distinct benefits. These coverages are designed to protect you financially in case of an accident or other unforeseen events.

- Liability Coverage: This coverage is legally required in Florida and protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries. It covers medical expenses, property damage, and legal defense costs up to the policy limits.

- Personal Injury Protection (PIP): PIP is also mandatory in Florida and covers your medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident. It provides a predetermined amount of coverage, usually $10,000.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s optional, but it’s typically recommended if you have a financed or leased vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by non-collision events, such as theft, vandalism, fire, hail, and natural disasters. It’s optional, but it’s essential if your vehicle is relatively new or has a high value.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you financially if you’re involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage up to the policy limits.

- Rental Car Coverage: This coverage provides you with a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage offers assistance with various roadside emergencies, such as flat tires, jump starts, and towing.

Benefits and Limitations of Each Coverage Type, State farm car insurance florida

Each type of car insurance coverage offers specific benefits and limitations. Understanding these nuances helps you make informed decisions about your coverage needs.

- Liability Coverage: While legally required, liability coverage alone might not be sufficient in case of a serious accident. It doesn’t cover your own vehicle’s damage or your medical expenses.

- PIP Coverage: PIP coverage provides essential medical and wage loss benefits, but it has a limited coverage amount, which might not be enough to cover significant expenses.

- Collision Coverage: This coverage offers valuable protection for your vehicle in case of an accident, but it doesn’t cover non-collision damages.

- Comprehensive Coverage: Comprehensive coverage safeguards your vehicle against a wide range of non-collision events, but it has a deductible, which you’ll need to pay before the insurance kicks in.

- UM/UIM Coverage: This coverage is crucial in Florida, where a significant number of drivers are uninsured or underinsured. It provides financial protection when you’re involved in an accident with a driver who lacks sufficient insurance.

- Rental Car Coverage: This coverage is helpful if you need a rental car while your vehicle is being repaired, but it might not cover all rental car expenses, such as fuel or tolls.

- Roadside Assistance: Roadside assistance is a valuable add-on that provides peace of mind in case of emergencies, but it typically has limitations on the number of services you can use each year.

Comparison with Other Major Providers

State Farm’s car insurance offerings are competitive with other major providers in Florida, such as Geico, Progressive, and Allstate. While the specific coverages and their details may vary slightly between providers, State Farm’s offerings generally align with industry standards.

- Price: State Farm’s rates are generally competitive, with some fluctuations based on individual factors like driving history, vehicle type, and location.

- Coverage Options: State Farm offers a wide range of coverage options, similar to other major providers, allowing you to customize your policy based on your needs and budget.

- Customer Service: State Farm has a reputation for providing excellent customer service, with various channels available for assistance, including phone, online, and mobile app.

- Claims Handling: State Farm’s claims handling process is generally efficient and straightforward, with a focus on resolving claims promptly and fairly.

Factors Influencing Car Insurance Rates in Florida

Car insurance rates in Florida are influenced by various factors that insurance companies consider to assess the risk associated with insuring a particular driver. These factors help determine the premium you pay for coverage.

State Farm’s Car Insurance Rate Calculation

State Farm, like other insurance companies, uses a complex formula to calculate car insurance premiums. This formula considers several factors, including:

- Driving history: This includes your past driving record, such as accidents, traffic violations, and driving experience. Drivers with a clean driving record generally pay lower premiums.

- Vehicle type: The type of vehicle you drive significantly impacts your insurance rates. For example, sports cars and luxury vehicles are often considered higher risk and may attract higher premiums due to their performance and repair costs.

- Location: Your location, including the city and zip code, influences your insurance rates. Areas with higher rates of accidents and theft tend to have higher premiums.

- Coverage levels: The amount of coverage you choose, such as liability limits, collision coverage, and comprehensive coverage, affects your premium. Higher coverage levels generally result in higher premiums.

- Credit score: In some states, including Florida, insurance companies may consider your credit score when determining your insurance rates. A higher credit score can indicate financial responsibility and may lead to lower premiums.

- Age and gender: Younger drivers, particularly those under 25, often pay higher premiums due to their higher risk of accidents. Gender can also play a role in insurance rates, with some insurance companies charging slightly higher premiums for young male drivers.

- Marital status: In some cases, married individuals may pay lower premiums than single individuals, as they are often considered to be more responsible drivers.

- Other factors: Other factors that may influence your insurance rates include your driving habits, such as mileage and driving time, and the presence of safety features in your vehicle.

Driving History

Your driving history plays a significant role in determining your car insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, accidents and traffic violations can lead to higher premiums, as they indicate a higher risk of future accidents.

For example, a driver with a DUI conviction may face a significant increase in their insurance premiums due to the increased risk of future accidents associated with impaired driving.

Vehicle Type

The type of vehicle you drive also affects your car insurance rates. Sports cars and luxury vehicles are often considered higher risk due to their performance and higher repair costs.

For example, a driver with a high-performance sports car may pay higher premiums than a driver with a standard sedan, even if they have similar driving records.

Location

Your location, including the city and zip code, can significantly impact your insurance rates. Areas with higher rates of accidents and theft tend to have higher premiums. This is because insurance companies have to pay out more claims in these areas, which increases their overall costs.

For example, a driver living in a densely populated urban area may pay higher premiums than a driver living in a rural area with lower traffic density and fewer accidents.

Customer Experience with State Farm in Florida

Customer experience with State Farm in Florida is a critical factor for potential policyholders. To understand how State Farm performs in Florida, it’s essential to explore customer reviews, assess the company’s customer service reputation, and understand the ease of filing claims and receiving compensation.

Customer Reviews and Testimonials

Customer reviews provide valuable insights into State Farm’s car insurance services in Florida. While individual experiences can vary, analyzing online reviews can offer a general understanding of customer satisfaction.

- Positive Reviews: Many customers praise State Farm for its competitive rates, responsive customer service, and smooth claims processing. Some highlight the availability of agents and the ease of managing policies online.

- Negative Reviews: Some customers express frustration with claim denials, long wait times for claims processing, and difficulty reaching customer service representatives. Others may find the rates to be higher than expected or experience challenges with policy changes.

State Farm’s Customer Service Reputation in Florida

State Farm is generally recognized for its strong customer service reputation. The company has a large network of agents throughout Florida, offering personalized service and local expertise.

- Agent Accessibility: State Farm’s agent network provides convenient access to in-person assistance, allowing customers to discuss their needs and concerns directly.

- Online and Mobile Services: State Farm offers online and mobile platforms for managing policies, paying premiums, and accessing account information, enhancing customer convenience.

- 24/7 Customer Support: State Farm provides 24/7 customer support via phone and online channels, allowing customers to access assistance whenever needed.

Ease of Filing Claims and Receiving Compensation

Filing a claim with State Farm in Florida is generally considered a straightforward process.

- Online and Mobile Claims Filing: State Farm allows customers to file claims online or through their mobile app, simplifying the process and providing immediate access to claim information.

- Dedicated Claims Teams: State Farm has dedicated claims teams that handle claims efficiently and provide support throughout the process.

- Transparent Communication: State Farm strives to communicate clearly with customers throughout the claims process, providing updates on claim status and explaining the steps involved.

Comparing State Farm to Other Car Insurance Providers in Florida

Choosing the right car insurance provider in Florida can be a daunting task, given the diverse range of options available. State Farm, a prominent national insurer, holds a significant presence in the state. However, it’s crucial to compare State Farm’s offerings with other reputable providers to determine the best fit for your individual needs and budget.

Comparing State Farm to Other Providers in Florida

To facilitate a comprehensive comparison, we’ll examine State Farm’s car insurance rates and coverage options alongside those of its key competitors in Florida. We’ll also delve into the strengths and weaknesses of State Farm compared to other providers. This information is presented in a table format for clarity and ease of comparison.

| Provider | Coverage Options | Rates | Strengths and Weaknesses |

|---|---|---|---|

| State Farm |

|

State Farm’s rates vary based on factors like driving history, vehicle type, location, and coverage options. They generally offer competitive rates, often falling within the average range for Florida. |

|

| Geico |

|

Geico is known for its competitive rates, often ranking among the most affordable options in Florida. Their rates are particularly attractive for drivers with good driving records. |

|

| Progressive |

|

Progressive offers a wide range of coverage options and is known for its personalized pricing based on individual risk factors. Their rates can be competitive, especially for drivers with less-than-perfect driving records. |

|

| USAA |

|

USAA specializes in serving military members and their families. They often offer competitive rates and excellent customer service, particularly for this target audience. |

|

State Farm’s Commitment to Customer Satisfaction in Florida

State Farm is known for its dedication to providing excellent customer service, and this commitment extends to its operations in Florida. The company strives to ensure a positive experience for its policyholders, offering various resources and initiatives to meet their needs.

State Farm’s Customer Service Channels

State Farm offers a variety of channels for customers to connect with them, making it easy to get assistance or address concerns.

- Phone Support: State Farm provides 24/7 phone support, allowing customers to reach a representative at any time.

- Online Services: The State Farm website and mobile app provide a convenient platform for managing policies, making payments, filing claims, and accessing other services.

- Local Agents: State Farm has a vast network of local agents across Florida, offering personalized support and guidance.

State Farm’s Customer Reviews and Feedback

Customer feedback plays a crucial role in State Farm’s commitment to continuous improvement. The company actively seeks feedback from its policyholders through various channels, including online reviews, surveys, and direct interactions.

- Online Review Platforms: State Farm’s customer reviews on platforms like Google, Yelp, and Trustpilot provide insights into customer satisfaction levels and areas for improvement.

- Customer Satisfaction Surveys: State Farm regularly conducts customer satisfaction surveys to gauge customer sentiment and identify areas for enhancement.

State Farm’s Initiatives to Enhance Customer Experience

State Farm continuously invests in initiatives to enhance the customer experience in Florida. These initiatives include:

- Digital Transformation: State Farm is committed to leveraging technology to streamline processes and provide a seamless digital experience for its customers.

- Personalized Service: State Farm agents are trained to understand individual customer needs and provide tailored solutions.

- Claim Handling: State Farm prioritizes efficient and transparent claim handling processes, ensuring a smooth experience for customers.

Concluding Remarks: State Farm Car Insurance Florida

Ultimately, choosing the right car insurance policy is a personal decision based on individual needs and circumstances. By understanding State Farm’s offerings in Florida, you can compare options, evaluate rates, and make an informed choice that provides the coverage you need at a price that fits your budget. Remember to explore available discounts, bundle policies, and shop around to ensure you’re getting the best value for your insurance dollar.

Helpful Answers

What types of discounts are available through State Farm in Florida?

State Farm offers a variety of discounts in Florida, including good driver discounts, safe driver discounts, multi-policy discounts, and discounts for safety features on your vehicle.

How can I file a claim with State Farm in Florida?

You can file a claim with State Farm in Florida online, by phone, or through a local State Farm agent. State Farm has a reputation for providing prompt and efficient claims processing.

What are the penalties for driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time. It’s essential to maintain valid car insurance coverage at all times.