- Understanding Florida’s Unique Insurance Landscape: Best Car Insurance Companies In Florida

- Key Factors to Consider When Choosing a Car Insurance Company

- Top Car Insurance Companies in Florida

- Types of Car Insurance Coverage in Florida

- Tips for Getting the Best Car Insurance Rates in Florida

- Understanding Florida’s Insurance Laws and Regulations

- Summary

- Clarifying Questions

Best car insurance companies in Florida: Navigating the Sunshine State’s unique insurance landscape can be tricky. Florida’s no-fault system and high accident rates mean higher premiums than many other states. But with careful research and planning, you can find affordable coverage that meets your needs.

This guide will help you understand the key factors to consider when choosing a car insurance company in Florida, explore the top-rated providers, and learn how to get the best rates possible. Whether you’re a new driver or a seasoned veteran, this information will empower you to make informed decisions about your car insurance.

Understanding Florida’s Unique Insurance Landscape: Best Car Insurance Companies In Florida

Florida’s car insurance market stands apart from other states due to a unique combination of factors. These factors significantly influence the cost of car insurance and the overall insurance experience for drivers.

The Impact of Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, which means drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of who caused it. This system is designed to streamline the claims process and reduce litigation, but it also impacts car insurance costs. In Florida, drivers are required to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages up to a certain limit. While PIP coverage can help reduce out-of-pocket expenses, it also contributes to higher premiums. The no-fault system encourages drivers to seek medical attention even for minor injuries, which can lead to higher healthcare costs and ultimately drive up insurance premiums.

Average Car Insurance Premiums in Florida

Florida’s average car insurance premiums are significantly higher than the national average. According to the National Association of Insurance Commissioners (NAIC), the average annual premium for car insurance in Florida in 2022 was $2,850, compared to the national average of $1,771. This disparity is primarily attributed to several factors, including:

- High number of accidents: Florida has a high number of car accidents, which increases the risk for insurers and leads to higher premiums. The state’s large population, tourist influx, and extensive road network contribute to this issue.

- High healthcare costs: Florida has a high cost of living, including healthcare, which impacts the cost of PIP coverage. Insurance companies must factor in these costs when setting premiums.

- Frequent lawsuits: While Florida’s no-fault system is intended to reduce litigation, it doesn’t always prevent lawsuits. This increases insurance costs, as insurers must allocate funds to cover potential legal expenses.

- High fraud rates: Florida has a history of insurance fraud, particularly in the auto insurance sector. Insurers must factor in the cost of fraud prevention and detection, which contributes to higher premiums.

Key Factors to Consider When Choosing a Car Insurance Company

Choosing the right car insurance company in Florida is crucial for safeguarding your financial well-being in the event of an accident. Navigating the complex world of insurance can be daunting, especially in a state known for its high accident rates. Therefore, understanding the key factors that influence your decision is essential.

Understanding Your Needs and Priorities

Before diving into the specifics of insurance companies, it’s vital to assess your individual needs and priorities. This involves considering your driving history, the type of car you own, your budget, and the level of coverage you require. For instance, if you have a high-value car or a history of accidents, you’ll likely need comprehensive coverage and higher liability limits. Understanding your specific needs will help you narrow down your options and find the best fit.

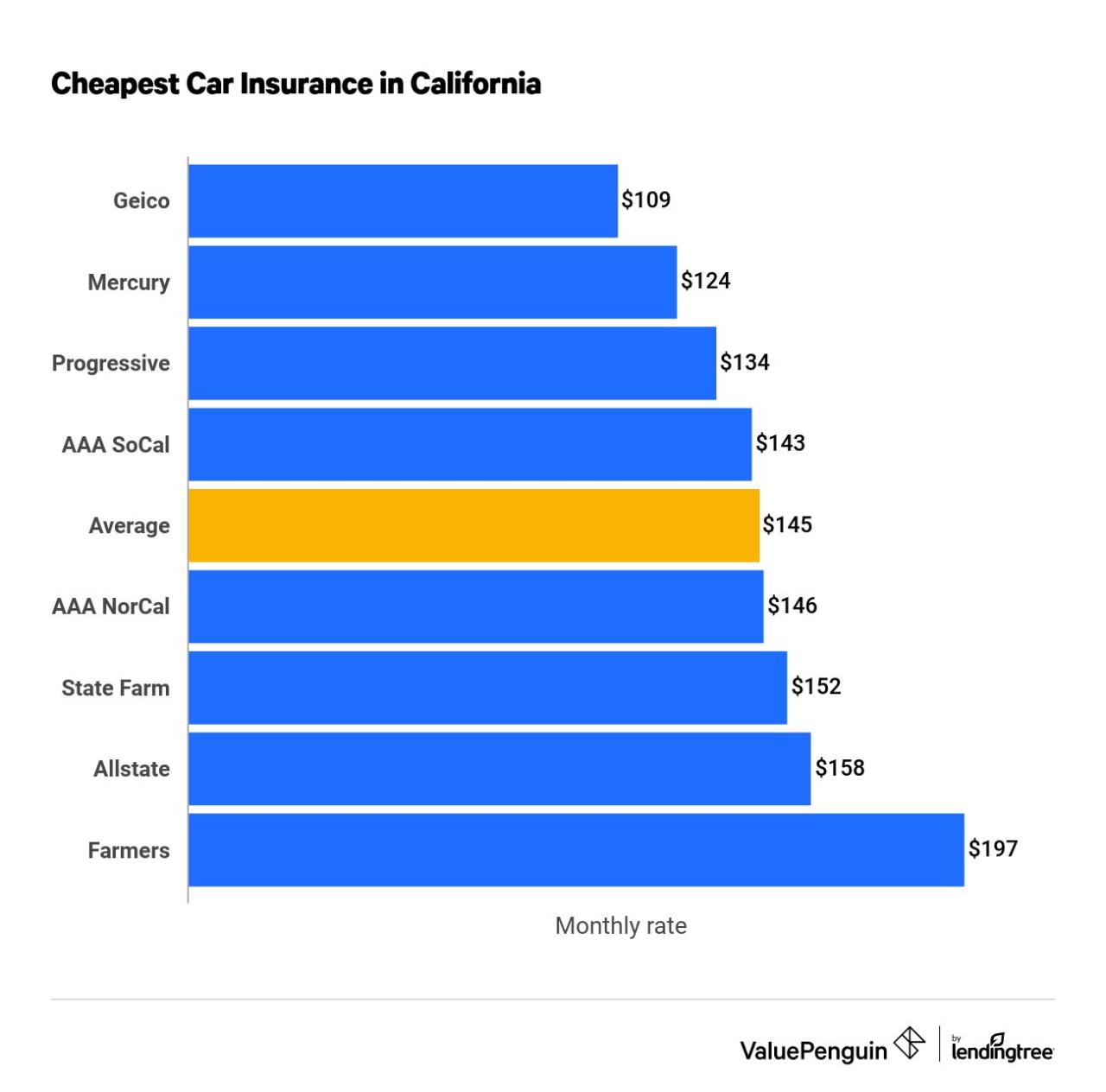

Cost and Affordability, Best car insurance companies in florida

Car insurance premiums in Florida are notoriously high due to factors such as a large number of uninsured drivers and a high volume of accidents. Finding an affordable policy is a top priority for most drivers. While price should be a significant factor, it’s essential to strike a balance between cost and the level of coverage you need. Comparing quotes from multiple insurers is crucial to ensure you’re getting the best deal. Consider factors like deductibles and coverage limits, as they can significantly impact your premiums.

Coverage Options and Limits

Florida law requires drivers to carry a minimum level of liability coverage. However, opting for higher limits and additional coverages like comprehensive and collision can provide greater financial protection in case of an accident. Consider the potential risks associated with your driving habits, the value of your car, and your financial situation when determining the necessary coverage limits.

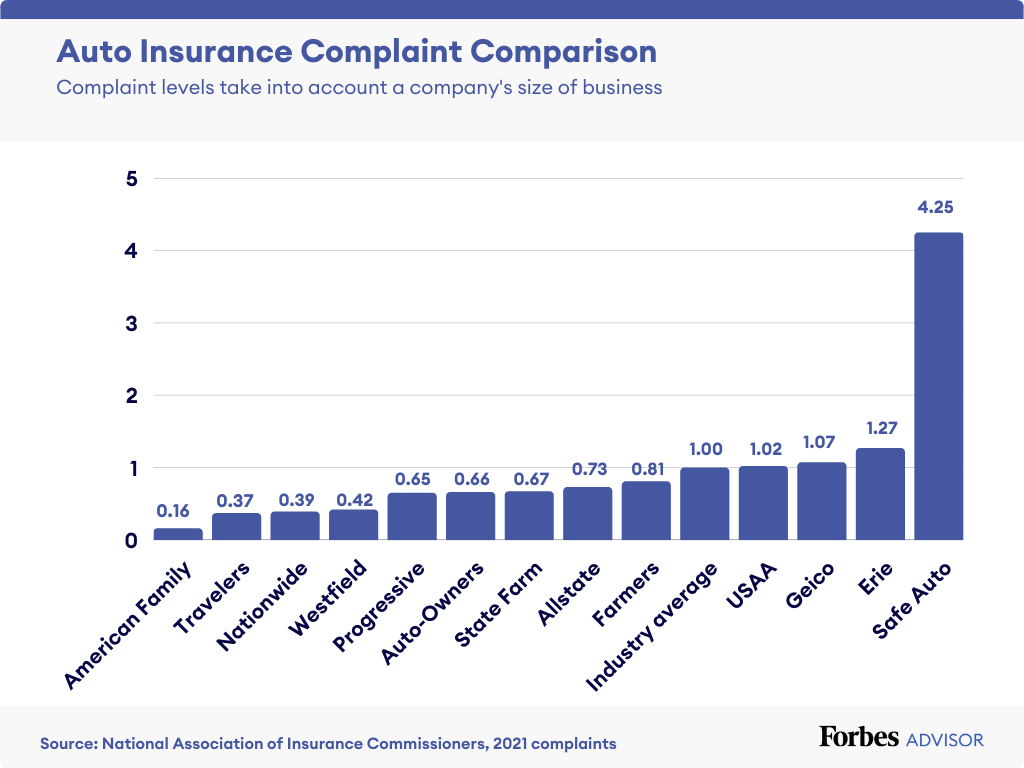

Customer Service and Claims Handling

The experience of dealing with an insurance company goes beyond just the initial quote. You’ll likely interact with them in case of an accident, so it’s essential to choose a company with a reputation for excellent customer service and efficient claims handling. Research the company’s track record for handling claims, customer reviews, and complaint ratios. Look for insurers that offer 24/7 customer support, online claim filing options, and transparent communication throughout the process.

Financial Stability and Reputation

Choosing a financially stable insurance company is crucial to ensure that they can pay out your claims if needed. Research the company’s financial ratings from organizations like AM Best and Standard & Poor’s. Look for companies with strong financial standing and a positive reputation for reliability and fair practices.

Top Car Insurance Companies in Florida

Choosing the right car insurance company in Florida is crucial, given the state’s unique insurance landscape and the high risk of accidents. This section will delve into the top 10 car insurance companies in Florida, based on customer satisfaction ratings and financial stability.

Top Car Insurance Companies in Florida

This list of the top 10 car insurance companies in Florida provides a comprehensive overview of their strengths, weaknesses, and key features. It’s important to note that the best company for you will depend on your individual needs and preferences.

| Company Name | Key Features | Customer Reviews | Pricing |

|---|---|---|---|

| State Farm | Wide coverage options, strong financial stability, excellent customer service | 4.5/5 stars on Google Reviews | Competitive rates, discounts for good drivers and bundling |

| Geico | Affordable rates, easy online quoting and management, 24/7 customer service | 4.2/5 stars on Google Reviews | Lower rates compared to some competitors, but fewer coverage options |

| Progressive | Innovative features like Name Your Price tool, strong financial stability, various discounts | 4.1/5 stars on Google Reviews | Competitive rates, but customer service can be inconsistent |

| USAA | Excellent customer service, strong financial stability, exclusive discounts for military members | 4.8/5 stars on Google Reviews | Highly competitive rates, but only available to military members and their families |

| Allstate | Wide range of coverage options, strong financial stability, mobile app for easy management | 3.9/5 stars on Google Reviews | Rates can be higher than some competitors, but good customer service |

| Farmers | Strong financial stability, competitive rates, variety of discounts | 3.8/5 stars on Google Reviews | Affordable rates, but customer service can be inconsistent |

| Nationwide | Excellent customer service, strong financial stability, wide range of discounts | 4.0/5 stars on Google Reviews | Competitive rates, but coverage options can be limited |

| Liberty Mutual | Innovative features like Drive Safe & Save program, strong financial stability, good customer service | 3.7/5 stars on Google Reviews | Rates can be higher than some competitors, but good customer service |

| AAA | Excellent customer service, strong financial stability, roadside assistance included | 4.2/5 stars on Google Reviews | Rates can be higher than some competitors, but good customer service and benefits |

| Florida Peninsula | Specializes in Florida insurance, competitive rates, good customer service | 4.1/5 stars on Google Reviews | Lower rates compared to some competitors, but limited coverage options |

Types of Car Insurance Coverage in Florida

Florida law requires drivers to carry a minimum level of car insurance coverage, known as the “Financial Responsibility Law.” This law ensures that drivers have adequate financial protection in case of accidents, protecting both themselves and others. However, these minimum requirements might not be sufficient to cover all potential expenses. Therefore, understanding the different types of car insurance coverage available in Florida is crucial for making informed decisions about your car insurance policy.

Liability Coverage

Liability coverage is a crucial component of car insurance, providing financial protection if you are at fault in an accident. It covers the costs of injuries and damages to other people and their property.

- Bodily Injury Liability Coverage: This coverage pays for medical expenses, lost wages, and pain and suffering to the other driver and passengers if you are at fault in an accident. It is usually expressed as a per-person limit and a per-accident limit, for example, 25/50, meaning $25,000 per person and $50,000 per accident.

- Property Damage Liability Coverage: This coverage pays for repairs or replacement of the other driver’s vehicle and any other damaged property if you are at fault in an accident. It is typically expressed as a single limit, for example, $10,000, meaning $10,000 for all property damage caused in an accident.

The cost of liability coverage varies depending on factors such as your driving history, age, location, and the type of vehicle you drive. It is generally advisable to carry higher liability limits than the state minimum requirements to protect yourself from significant financial losses in case of a serious accident.

Personal Injury Protection (PIP)

Florida’s PIP coverage, often referred to as “no-fault” insurance, covers your medical expenses and lost wages regardless of who is at fault in an accident. It is mandatory in Florida, with a minimum coverage limit of $10,000.

- Medical Expenses: PIP covers medical bills, including hospital stays, doctor visits, surgeries, and rehabilitation services. It is limited to 80% of the medical expenses, with the remaining 20% paid by your health insurance or out-of-pocket.

- Lost Wages: PIP coverage can help compensate for lost income if you are unable to work due to injuries sustained in an accident. It is usually limited to a certain percentage of your weekly wages, and there are limits on the total amount of lost wages covered.

While PIP is mandatory, you can opt for higher coverage limits beyond the minimum requirement. The cost of PIP coverage can vary based on factors like your age, driving history, and the coverage limits you choose.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional in Florida.

- Repairs: If your vehicle is damaged in an accident, collision coverage will pay for repairs up to the actual cash value (ACV) of your vehicle. ACV is the market value of your vehicle before the accident, taking into account factors like age, mileage, and condition.

- Replacement: If the cost of repairs exceeds the ACV of your vehicle, collision coverage will pay for a replacement vehicle. The amount paid will be based on the ACV of your vehicle, not the cost of a brand-new vehicle.

The cost of collision coverage depends on factors like the value of your vehicle, your driving history, and the deductible you choose. A deductible is the amount you pay out-of-pocket before your insurance company starts covering the costs of repairs. Higher deductibles generally result in lower premiums.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement of your vehicle if it is damaged by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. This coverage is also optional in Florida.

- Repairs: Comprehensive coverage will pay for repairs up to the ACV of your vehicle, taking into account factors like age, mileage, and condition.

- Replacement: If the cost of repairs exceeds the ACV of your vehicle, comprehensive coverage will pay for a replacement vehicle. The amount paid will be based on the ACV of your vehicle, not the cost of a brand-new vehicle.

The cost of comprehensive coverage depends on factors like the value of your vehicle, your driving history, and the deductible you choose. Higher deductibles generally result in lower premiums.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage provides financial protection if you are injured in an accident caused by a driver who does not have insurance or has insufficient insurance. This coverage is optional in Florida, but it is highly recommended.

- Uninsured Motorist Coverage: This coverage pays for your medical expenses, lost wages, and pain and suffering if you are injured by a driver who does not have insurance.

- Underinsured Motorist Coverage: This coverage pays for the difference between the other driver’s liability coverage and your actual damages if you are injured by a driver who has insurance but does not have enough coverage to cover your losses.

The cost of UM/UIM coverage depends on factors like your driving history and the coverage limits you choose. Higher coverage limits generally result in higher premiums.

Other Coverage Options

In addition to the basic coverage types, you may also consider other coverage options to customize your car insurance policy. These options can provide additional protection for your vehicle and yourself.

- Rental Car Coverage: This coverage pays for the cost of a rental car if your vehicle is damaged in an accident or is being repaired.

- Roadside Assistance: This coverage provides assistance with services such as towing, flat tire changes, jump starts, and lockout assistance.

- Gap Insurance: This coverage helps pay the difference between the actual cash value of your vehicle and the amount you owe on your loan if your vehicle is totaled.

The availability and cost of these optional coverage options vary depending on the insurance company and your individual needs.

Tips for Getting the Best Car Insurance Rates in Florida

Finding affordable car insurance in Florida can be a challenge, given the state’s high accident rates and insurance regulations. However, by implementing smart strategies, you can significantly lower your premiums and secure the best possible rates.

Impact of Driving History on Insurance Rates

Your driving history is a major factor influencing your car insurance premiums. Insurance companies assess your risk based on your past driving behavior, and a clean record translates into lower rates.

- Avoid Accidents and Traffic Violations: Every accident and traffic violation, even minor ones, can significantly increase your premiums. Driving safely and obeying traffic laws is essential to maintain a good driving record.

- Complete Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices and may qualify you for discounts, further lowering your premiums.

- Maintain a Clean Driving Record: A spotless driving record with no accidents or violations is the most significant factor in obtaining lower insurance rates.

Impact of Credit Score on Insurance Rates

In Florida, insurance companies are permitted to consider your credit score when calculating your premiums. A good credit score can lead to lower rates, while a poor credit score can result in higher premiums.

- Improve Your Credit Score: By paying bills on time, managing debt effectively, and avoiding excessive credit inquiries, you can improve your credit score and potentially qualify for lower insurance rates.

- Dispute Errors on Your Credit Report: Review your credit report for any errors or inaccuracies and dispute them with the credit bureaus. Correcting errors can lead to a higher credit score and potentially lower insurance premiums.

Impact of Vehicle Safety Features on Insurance Rates

Modern vehicles often come equipped with advanced safety features that can reduce the risk of accidents and injuries. Insurance companies recognize this and often offer discounts for vehicles with safety features.

- Anti-theft Devices: Installing anti-theft devices like alarms, immobilizers, or GPS tracking systems can significantly lower your insurance premiums.

- Advanced Safety Features: Vehicles with advanced safety features like lane departure warning, automatic emergency braking, adaptive cruise control, and blind spot monitoring can qualify you for discounts.

Strategies for Negotiating Insurance Rates

While insurance companies have their own pricing models, there are still opportunities to negotiate lower rates.

- Shop Around and Compare Quotes: Obtain quotes from multiple insurance companies to compare prices and coverage options. Don’t settle for the first quote you receive; take the time to explore different options.

- Bundle Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Negotiate with Your Existing Insurer: Contact your current insurer to discuss your policy and explore potential discounts or rate reductions. Be prepared to explain why you believe your premiums are too high and be willing to switch providers if you’re not satisfied.

Exploring Discounts

Insurance companies offer various discounts to reduce premiums.

- Good Student Discounts: Maintaining good grades in school can qualify you for discounts.

- Safe Driver Discounts: Drivers with a clean driving record, no accidents, and no traffic violations often qualify for discounts.

- Multi-Car Discounts: Insuring multiple vehicles with the same company can result in significant savings.

- Loyalty Discounts: Many insurers offer discounts to long-term customers who have maintained their policies for a significant period.

- Pay-in-Full Discounts: Paying your premium in full upfront may qualify you for a discount.

Understanding Florida’s Insurance Laws and Regulations

Florida has a unique and complex insurance landscape, shaped by a combination of state laws, regulations, and court decisions. Understanding these regulations is crucial for drivers in the state, as they directly impact the cost and availability of car insurance.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a pivotal role in regulating the insurance industry in the state. It oversees all aspects of insurance, including car insurance, and is responsible for:

- Licensing and monitoring insurance companies.

- Enforcing insurance laws and regulations.

- Protecting consumers from unfair or deceptive practices.

- Investigating and resolving consumer complaints.

- Educating the public about insurance issues.

Key Insurance Regulations and Laws

Florida has a number of specific laws and regulations that impact car insurance, including:

- No-Fault Insurance: Florida is a no-fault insurance state, meaning that drivers are required to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages regardless of who is at fault in an accident. The minimum PIP coverage required is $10,000.

- Minimum Liability Coverage: Florida also requires drivers to carry liability coverage, which protects them from financial responsibility if they cause an accident that results in injuries or property damage to others. The minimum liability coverage required is $10,000 per person and $20,000 per accident for bodily injury and $10,000 for property damage.

- Uninsured Motorist Coverage: This coverage protects drivers from financial losses if they are involved in an accident with an uninsured or underinsured motorist. It is not mandatory in Florida, but it is highly recommended.

- Florida’s “PIP Threshold”: Florida’s “PIP threshold” law requires drivers to prove that their injuries meet a certain threshold of severity before they can sue for pain and suffering. This threshold can be difficult to meet, and it has led to a significant increase in lawsuits against insurance companies.

- Florida’s “Insurance Fraud Detection Unit”: The DFS has a dedicated unit that investigates and prosecutes insurance fraud. This unit works to protect consumers from scams and ensure that insurance companies are operating fairly.

Consumer Protection Rights

Florida law provides consumers with a number of important protections in the insurance industry, including:

- The right to receive a clear and concise explanation of their insurance policy.

- The right to file a complaint with the DFS if they believe they have been treated unfairly by an insurance company.

- The right to appeal a decision by an insurance company.

Filing Complaints

Consumers can file complaints with the DFS online, by mail, or by phone. The DFS will investigate the complaint and take appropriate action if necessary.

Summary

Finding the best car insurance company in Florida requires careful consideration of your individual needs and priorities. By understanding the state’s unique insurance landscape, comparing quotes from multiple providers, and taking advantage of available discounts, you can secure the best possible coverage at a competitive price. Remember, your car insurance is a vital part of your financial security, so don’t settle for anything less than the best.

Clarifying Questions

What is the average car insurance premium in Florida?

The average annual car insurance premium in Florida is around $2,500, but this can vary significantly based on factors like your driving history, age, and the type of car you drive.

What is Florida’s no-fault insurance system?

Florida’s no-fault system requires drivers to file claims with their own insurance company, regardless of who is at fault in an accident. This can help to expedite the claims process and reduce litigation, but it can also lead to higher premiums.

What are some common discounts available for car insurance in Florida?

Many car insurance companies offer discounts for good driving records, safe driving courses, multi-car policies, and vehicle safety features.