- Florida’s Minimum Car Insurance Requirements

- Understanding Florida’s No-Fault System

- Factors Influencing Minimum Car Insurance Costs

- Finding Affordable Minimum Car Insurance

- Understanding Additional Coverage Options: Florida Minimum Car Insurance

- The Impact of Florida’s Insurance Laws

- Outcome Summary

- Query Resolution

Florida minimum car insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of car insurance can be daunting, especially in a state like Florida, known for its unique insurance laws. This guide dives deep into the intricacies of Florida’s minimum car insurance requirements, unraveling the complexities of the no-fault system, and revealing the factors that influence your premiums.

From understanding the legal requirements and potential consequences of driving without adequate coverage to exploring strategies for finding affordable options, this comprehensive exploration equips you with the knowledge you need to make informed decisions about your car insurance in Florida.

Florida’s Minimum Car Insurance Requirements

Florida is a “no-fault” insurance state, meaning that drivers are generally required to carry personal injury protection (PIP) coverage to pay for their own medical expenses following an accident, regardless of who is at fault. However, Florida also has minimum liability insurance requirements that drivers must meet to legally operate a vehicle. These requirements are designed to protect other drivers and passengers in case of an accident.

Minimum Coverage Requirements

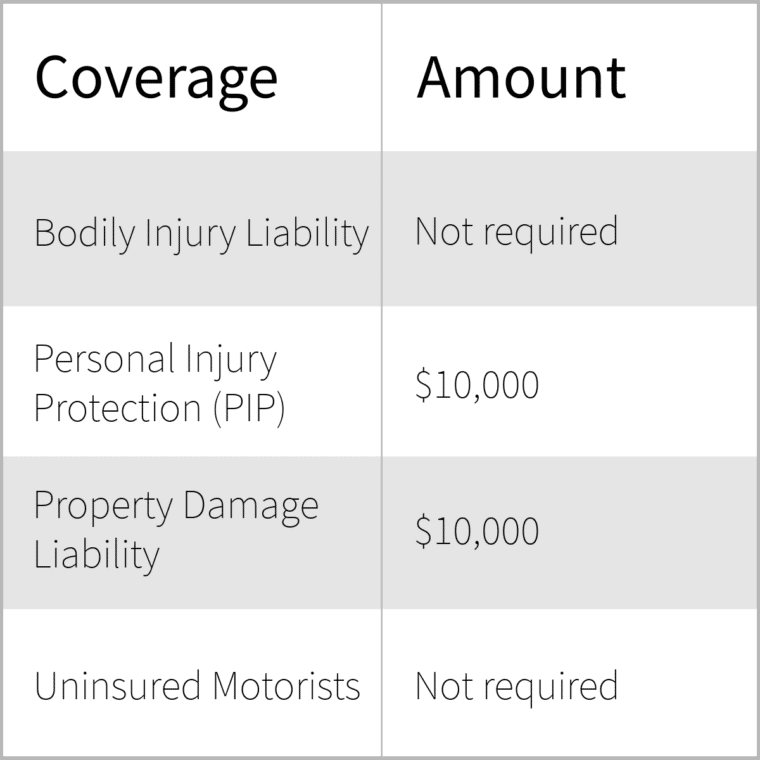

Florida law mandates that all drivers carry the following minimum insurance coverage:

- Personal Injury Protection (PIP): $10,000 per person

- Property Damage Liability: $10,000 per accident

- Bodily Injury Liability: $10,000 per person/$20,000 per accident

PIP coverage pays for medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of fault. Property damage liability covers damage to another person’s vehicle or property, while bodily injury liability covers injuries to other people.

Consequences of Driving Without Minimum Insurance

Driving without the required minimum car insurance in Florida can result in serious consequences, including:

- Fines and Penalties: Drivers caught driving without insurance face significant fines and penalties, which can vary depending on the severity of the offense. These fines can range from hundreds to thousands of dollars.

- License Suspension: The Florida Department of Motor Vehicles (DMV) can suspend a driver’s license if they are caught driving without insurance. This suspension can last for a specified period, depending on the circumstances.

- Vehicle Impoundment: In some cases, the vehicle itself may be impounded until proof of insurance is provided. This can lead to additional fees and inconvenience for the driver.

- Financial Responsibility: If you are involved in an accident without insurance, you are personally responsible for all damages and injuries, even if you were not at fault. This can result in significant financial hardship, including lawsuits, medical bills, and property damage costs.

It is crucial to remember that these are just the minimum requirements. It is highly recommended that drivers consider carrying higher limits of liability insurance to provide greater protection in case of an accident.

Understanding Florida’s No-Fault System

Florida’s no-fault insurance system is a unique approach to handling car accidents, aiming to streamline the claims process and reduce litigation. This system, implemented in 1971, shifts the focus from assigning fault to providing prompt medical treatment and compensation for economic losses.

The Concept of No-Fault Insurance

The no-fault system, also known as “personal injury protection” (PIP), requires drivers to seek compensation for their injuries and damages from their own insurance company, regardless of who caused the accident. This eliminates the need to prove fault in most cases, simplifying the claims process and potentially reducing court delays and expenses.

Factors Influencing Minimum Car Insurance Costs

In Florida, minimum car insurance premiums are influenced by a variety of factors, each contributing to the overall cost of coverage. Understanding these factors is crucial for policyholders to make informed decisions and potentially reduce their insurance expenses.

Age

Age plays a significant role in determining car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to their lack of experience and higher risk-taking behavior. Insurance companies, therefore, charge higher premiums for younger drivers to compensate for this increased risk. As drivers age and gain experience, their premiums typically decrease.

Driving History

A driver’s driving history is another crucial factor affecting insurance costs. Drivers with a clean record, free of accidents, traffic violations, or DUI convictions, are considered low-risk and receive lower premiums. Conversely, drivers with a history of accidents, speeding tickets, or other violations are deemed higher risk and face higher premiums.

Vehicle Type

The type of vehicle you drive also influences your insurance costs. Higher-performance vehicles, luxury cars, and sports cars are often associated with higher repair costs and a greater risk of accidents. Consequently, insurance companies charge higher premiums for these types of vehicles. Conversely, smaller, less expensive cars typically have lower insurance premiums.

Location

The location where you live can significantly impact your insurance costs. Areas with high crime rates, traffic congestion, and a higher frequency of accidents tend to have higher insurance premiums. Insurance companies assess the risk of driving in different locations and adjust premiums accordingly.

Finding Affordable Minimum Car Insurance

Navigating the world of car insurance in Florida can feel overwhelming, especially when trying to find the most affordable minimum coverage. However, by understanding the options available and employing smart strategies, you can secure a policy that meets your needs without breaking the bank.

Comparing Quotes from Different Insurers

One of the most effective ways to find affordable minimum car insurance is to compare quotes from multiple insurers. This process allows you to evaluate different coverage options and pricing structures, ultimately helping you find the best deal.

- Use Online Comparison Tools: Many websites and apps allow you to enter your information once and receive quotes from various insurers simultaneously. This streamlined approach saves you time and effort.

- Contact Insurers Directly: Don’t rely solely on online tools. Contact insurers directly to discuss your specific needs and request personalized quotes. This approach allows you to ask questions and gain a deeper understanding of their policies.

- Consider Different Insurer Types: Explore quotes from both large national insurers and smaller regional companies. Regional insurers may offer more competitive rates, particularly for drivers with good driving records.

Negotiating Lower Premiums, Florida minimum car insurance

Once you’ve gathered quotes, you can explore ways to negotiate lower premiums. While some factors, such as your driving history, are beyond your control, there are strategies you can use to potentially reduce your costs.

- Bundle Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts. Ask insurers about their bundling options and explore the potential savings.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in the event of an accident, but it can lead to lower premiums. Carefully consider your financial situation and risk tolerance when deciding on a deductible amount.

- Shop Around Regularly: Insurance rates can fluctuate over time, so it’s essential to shop around regularly, even if you’re happy with your current insurer. Comparing quotes every six months or annually can ensure you’re getting the best possible price.

- Ask About Discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your car, and membership in certain organizations. Inquire about available discounts and see if you qualify.

- Maintain a Good Driving Record: This is perhaps the most important factor in determining your insurance premiums. Avoid traffic violations and accidents to maintain a clean driving record and secure lower rates.

Understanding Additional Coverage Options: Florida Minimum Car Insurance

While Florida’s minimum car insurance requirements are designed to provide basic financial protection in case of an accident, they may not be enough to cover all potential costs. Consider additional coverage options to enhance your protection and peace of mind.

Benefits and Drawbacks of Optional Coverage

Optional coverage can provide valuable protection beyond the minimum requirements. However, it’s crucial to weigh the potential benefits against the additional costs.

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault.

- Benefit: Provides financial protection to repair or replace your vehicle.

- Drawback: Higher premiums, especially for newer or more expensive vehicles.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events like theft, vandalism, or natural disasters.

- Benefit: Provides financial protection for repairs or replacement, even if the damage isn’t caused by an accident.

- Drawback: Higher premiums, especially for vehicles with high replacement costs.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Protects you and your passengers if you’re injured in an accident caused by a driver without adequate insurance or no insurance at all.

- Benefit: Ensures financial protection for medical expenses, lost wages, and other damages even if the at-fault driver doesn’t have sufficient coverage.

- Drawback: Can increase premiums, but the potential benefits outweigh the cost in many cases.

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

- Benefit: Provides immediate financial assistance for medical treatment and other related expenses after an accident.

- Drawback: Premiums can be higher, but the coverage can be crucial in covering medical expenses.

Importance of Uninsured/Underinsured Motorist Coverage in Florida

Florida’s no-fault system means you are primarily responsible for covering your own medical expenses after an accident. However, if you’re injured by an uninsured or underinsured driver, you may face significant financial burdens. UM/UIM coverage provides crucial protection in such situations.

UM/UIM coverage is essential in Florida due to the high number of uninsured drivers. It ensures you can recover damages even if the at-fault driver doesn’t have adequate insurance.

Available Coverage Options and Their Costs

The cost of additional coverage varies depending on factors such as your driving history, vehicle type, and location. However, here’s a general overview of common coverage options and their potential costs:

- Collision Coverage: Costs vary based on the vehicle’s value, but it can be significantly higher for newer or more expensive vehicles.

- Comprehensive Coverage: Similar to collision coverage, costs depend on the vehicle’s value and can be higher for luxury or high-performance vehicles.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Premiums vary depending on coverage limits and other factors, but it’s generally considered a worthwhile investment in Florida.

- Personal Injury Protection (PIP): The cost of PIP varies depending on the coverage limits and other factors. It’s typically a mandatory coverage in Florida.

The Impact of Florida’s Insurance Laws

Florida’s car insurance laws have evolved significantly over the years, driven by a complex interplay of factors, including economic conditions, accident statistics, and political considerations. The state’s unique “no-fault” system, while intended to streamline claims processing, has led to various challenges and controversies. This section delves into the historical evolution of Florida’s car insurance laws, analyzes the current state of insurance regulations, and identifies potential areas for improvement or reform.

Historical Evolution of Florida’s Car Insurance Laws

Florida’s car insurance landscape has undergone substantial changes since the early 20th century. The state’s initial foray into regulating car insurance was in the 1930s, primarily focusing on establishing minimum coverage requirements. This early legislation was relatively simple, primarily aimed at ensuring basic financial protection for accident victims.

The 1970s marked a pivotal period for Florida’s car insurance laws. The state adopted a “no-fault” system, aiming to reduce litigation and expedite claims processing. This system mandated that drivers carry Personal Injury Protection (PIP) coverage, which would cover their medical expenses and lost wages, regardless of fault. However, the no-fault system, while intended to simplify claims processing, created its own set of challenges.

The no-fault system, combined with rising healthcare costs and a surge in fraudulent claims, led to a dramatic increase in insurance premiums. This prompted a series of reforms in the 1980s and 1990s, including the introduction of caps on PIP benefits and stricter regulations on medical providers. These reforms aimed to control costs and prevent abuse within the system.

Current State of Insurance Regulations and Their Impact on Consumers

Florida’s current car insurance regulations are a complex mix of requirements, limitations, and exceptions. The state’s no-fault system remains in place, with drivers required to carry a minimum of $10,000 in PIP coverage. This coverage is intended to cover medical expenses and lost wages for the insured driver and passengers, regardless of who caused the accident.

However, the no-fault system has been criticized for its high costs and limitations. The state’s regulations have been accused of driving up premiums and restricting access to necessary medical treatment. Furthermore, the system’s emphasis on PIP coverage has led to concerns about limited coverage for other types of damages, such as pain and suffering.

Potential Areas for Improvement or Reform in Florida’s Insurance System

While Florida’s car insurance laws have evolved significantly, there are areas where improvements or reforms could benefit both consumers and the insurance industry.

- Reforming the No-Fault System: One of the most frequently discussed areas for reform is the state’s no-fault system. Critics argue that the system’s complexity and limitations have led to higher premiums and reduced consumer choice. Potential reforms could include simplifying the system, expanding coverage options, and reducing the influence of medical providers.

- Addressing Premium Costs: The high cost of car insurance in Florida remains a major concern for many consumers. Reforms aimed at reducing premiums could include increasing competition among insurance companies, exploring alternative coverage models, and addressing factors contributing to high healthcare costs.

- Improving Transparency and Consumer Protection: Increased transparency in the insurance market is crucial to empowering consumers. Reforms could include requiring insurers to disclose pricing data, simplifying policy language, and strengthening consumer protection measures.

Outcome Summary

As you navigate the Florida car insurance landscape, remember that understanding your options and choosing the right coverage is crucial for safeguarding yourself and your loved ones. By arming yourself with knowledge about minimum requirements, the no-fault system, and available coverage options, you can confidently navigate the complexities of Florida’s insurance world and secure the protection you need.

Query Resolution

What happens if I get into an accident and don’t have the minimum car insurance required in Florida?

Driving without the required minimum car insurance in Florida can result in serious consequences, including fines, license suspension, and even jail time. Additionally, you could be held personally liable for any damages or injuries caused in an accident.

Can I choose to have more coverage than the minimum requirements in Florida?

Yes, you can choose to purchase additional coverage beyond the minimum requirements in Florida. This can provide greater financial protection in the event of an accident, especially if you are involved in a collision with an uninsured or underinsured motorist.

How often should I review my car insurance policy in Florida?

It’s a good idea to review your car insurance policy at least annually, or whenever there are significant life changes, such as a change in your driving history, the addition of a new driver to your household, or the purchase of a new vehicle.