- Understanding Florida’s Car Insurance Landscape

- Key Factors to Consider When Choosing a Car Insurance Company

- Top Car Insurance Companies in Florida: Best Car Insurance Companies Florida

- Tips for Saving Money on Car Insurance in Florida

- Filing a Car Insurance Claim in Florida

- Last Point

- Questions Often Asked

Best car insurance companies florida – Finding the best car insurance companies in Florida can feel like navigating a maze of confusing policies and prices. Florida’s unique driving landscape, with its high population density and frequent accidents, makes finding affordable and comprehensive coverage a challenge. But don’t worry, we’re here to help you decipher the complexities and find the best fit for your needs.

This guide will walk you through the essential factors to consider when choosing a car insurance company in Florida, including coverage options, pricing, customer service, financial stability, and online tools. We’ll also highlight top-rated companies, offer tips for saving money on your premiums, and explain the process of filing a claim.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance market is unique and complex, influenced by several factors that contribute to higher premiums compared to other states. Understanding these factors is crucial for Florida residents seeking affordable and comprehensive car insurance.

Factors Influencing Car Insurance Costs in Florida

Several factors contribute to Florida’s high car insurance costs.

- High Population Density: Florida’s dense population leads to increased traffic congestion and a higher likelihood of accidents, increasing insurance claims and costs.

- Frequent Accidents: Florida has a higher-than-average rate of car accidents, contributing to higher insurance premiums to cover claims.

- Prevalence of Lawsuits: Florida is known for its “tort” system, where individuals can sue for damages resulting from car accidents. This system can lead to higher insurance costs as companies need to cover potential lawsuits.

- High Cost of Living: Florida’s high cost of living, including healthcare and vehicle repairs, translates into higher insurance premiums to cover these expenses.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, requiring all drivers to carry Personal Injury Protection (PIP) coverage. This system aims to expedite the claims process and reduce lawsuits. However, it also impacts coverage options and costs.

- PIP Coverage: PIP coverage provides benefits for medical expenses and lost wages following an accident, regardless of fault. Drivers can choose different levels of PIP coverage, impacting their premiums.

- Limited Tort Option: Florida offers a “limited tort” option for drivers, which restricts their ability to sue for pain and suffering unless they meet certain thresholds. Choosing this option can result in lower premiums.

- Impact on Coverage Options: The no-fault system can influence the availability and cost of other coverage options, such as collision and comprehensive coverage.

The Role of the Florida Office of Insurance Regulation (OIR)

The Florida Office of Insurance Regulation (OIR) plays a crucial role in regulating car insurance companies and ensuring consumer protection.

- Rate Regulation: The OIR reviews and approves car insurance rate increases to ensure they are justified and reasonable.

- Consumer Protection: The OIR investigates consumer complaints against insurance companies and enforces compliance with state regulations.

- Market Oversight: The OIR monitors the car insurance market to identify any potential problems or unfair practices.

Key Factors to Consider When Choosing a Car Insurance Company

Choosing the right car insurance company in Florida is crucial, as it can significantly impact your financial well-being in the event of an accident. This decision involves weighing various factors, including coverage options, pricing, customer service, and financial stability. By understanding these key considerations, you can make an informed choice that aligns with your specific needs and budget.

Coverage Options

Understanding the different types of car insurance coverage available is essential for making an informed decision. In Florida, the primary types of coverage include:

- Liability Coverage: This coverage is mandatory in Florida and protects you financially if you cause an accident that results in injuries or property damage to others. It includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault. It helps cover damages caused by collisions with other vehicles, objects, or even single-car accidents.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It is optional in Florida but highly recommended for safeguarding your vehicle’s value.

- Personal Injury Protection (PIP): Florida requires all drivers to carry PIP coverage, which covers medical expenses and lost wages for you and your passengers in the event of an accident, regardless of fault.

Pricing

Pricing is a significant factor in choosing a car insurance company, as it directly affects your monthly expenses.

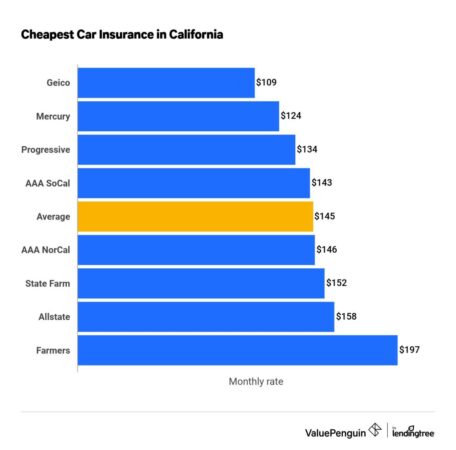

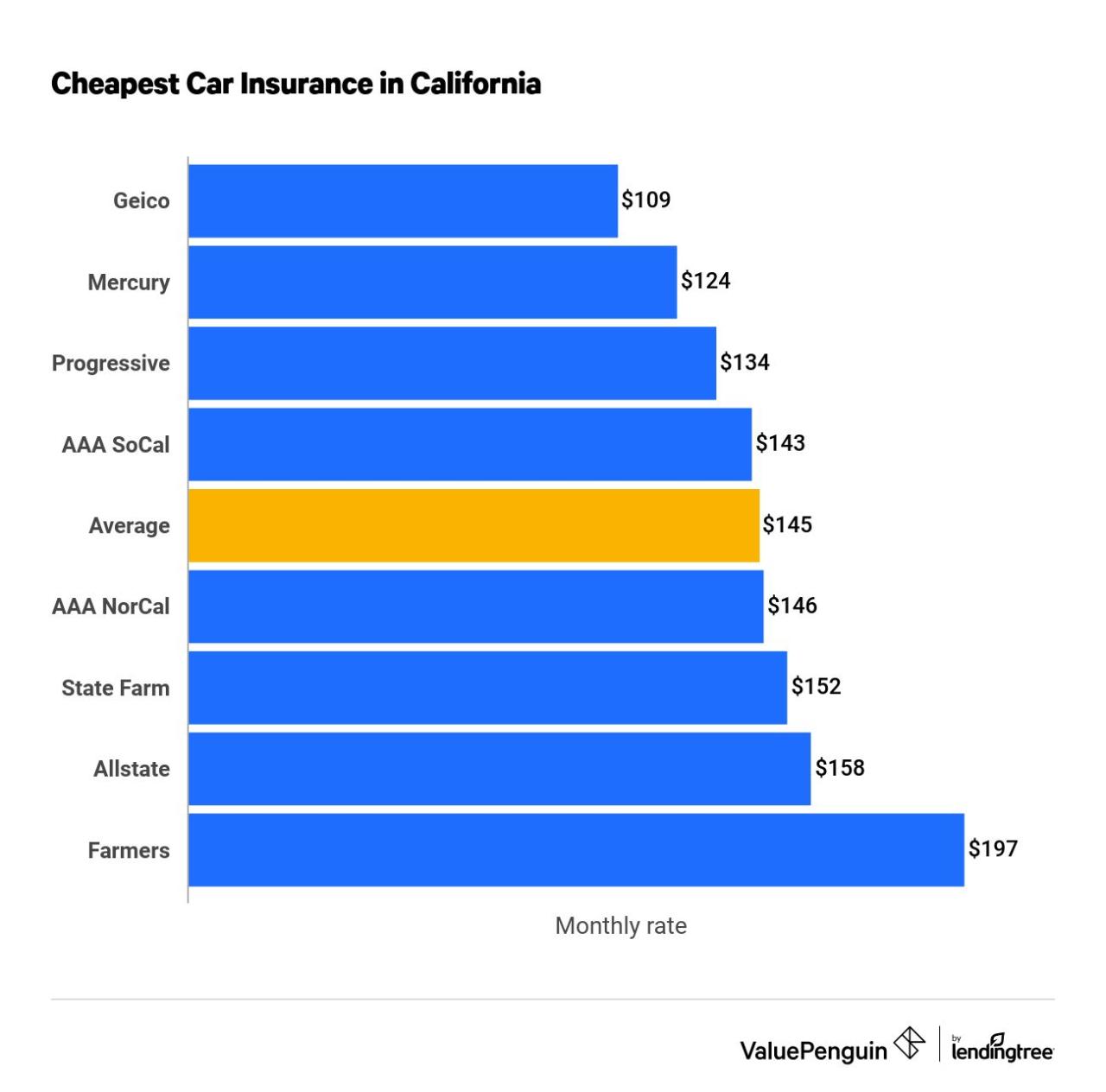

- Premiums: The amount you pay for your car insurance policy is called the premium. Factors influencing premium costs include your driving history, vehicle type, location, age, and coverage levels.

- Deductibles: This is the amount you agree to pay out-of-pocket in the event of a claim before your insurance coverage kicks in. A higher deductible typically translates to lower premiums, while a lower deductible results in higher premiums.

- Coverage Limits: Coverage limits define the maximum amount your insurance company will pay for a covered claim. Higher limits generally result in higher premiums but offer greater financial protection.

Customer Service

A reliable car insurance company should provide excellent customer service, especially when you need it most.

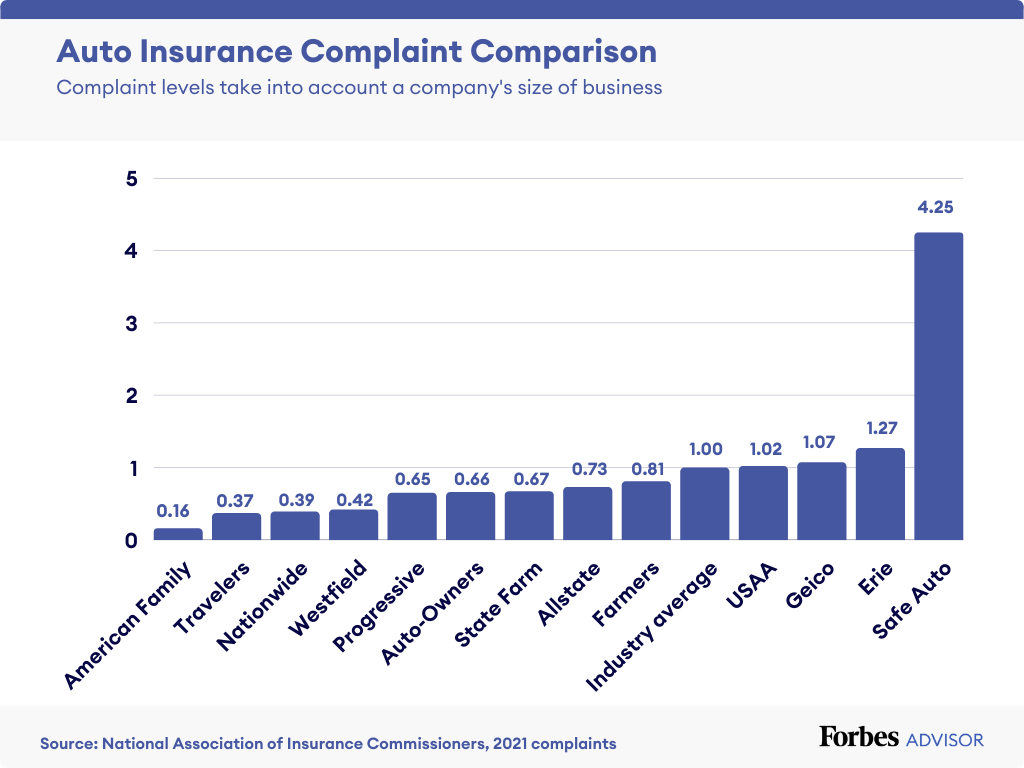

- Responsiveness: A reputable company should be responsive to your inquiries, claims, and requests.

- Accessibility: Having multiple ways to contact the insurance company, such as phone, email, or online chat, enhances convenience and accessibility.

- Claims Processing: The efficiency and transparency of the claims process are crucial. A company that handles claims promptly and fairly is highly desirable.

Financial Stability

Financial stability is a critical aspect of choosing a car insurance company, as it ensures that they can fulfill their obligations in the event of a significant claim.

- Financial Ratings: Reputable financial rating agencies, such as A.M. Best and Standard & Poor’s, provide ratings that assess the financial health of insurance companies. Look for companies with strong financial ratings, indicating their ability to meet their commitments.

- Claims Paying History: A company’s claims paying history reflects its commitment to settling claims fairly and promptly. Research their track record to gauge their reliability in fulfilling their obligations.

Online Tools

In today’s digital age, car insurance companies are increasingly offering online tools to enhance customer convenience and efficiency.

- Online Quotes: The ability to obtain quotes online allows you to compare different insurance options without having to contact each company individually.

- Policy Management: Online platforms enable you to manage your policy, including making payments, updating contact information, and accessing policy documents.

- Claims Filing: The ability to file claims online simplifies the process and provides a convenient way to report accidents.

Top Car Insurance Companies in Florida: Best Car Insurance Companies Florida

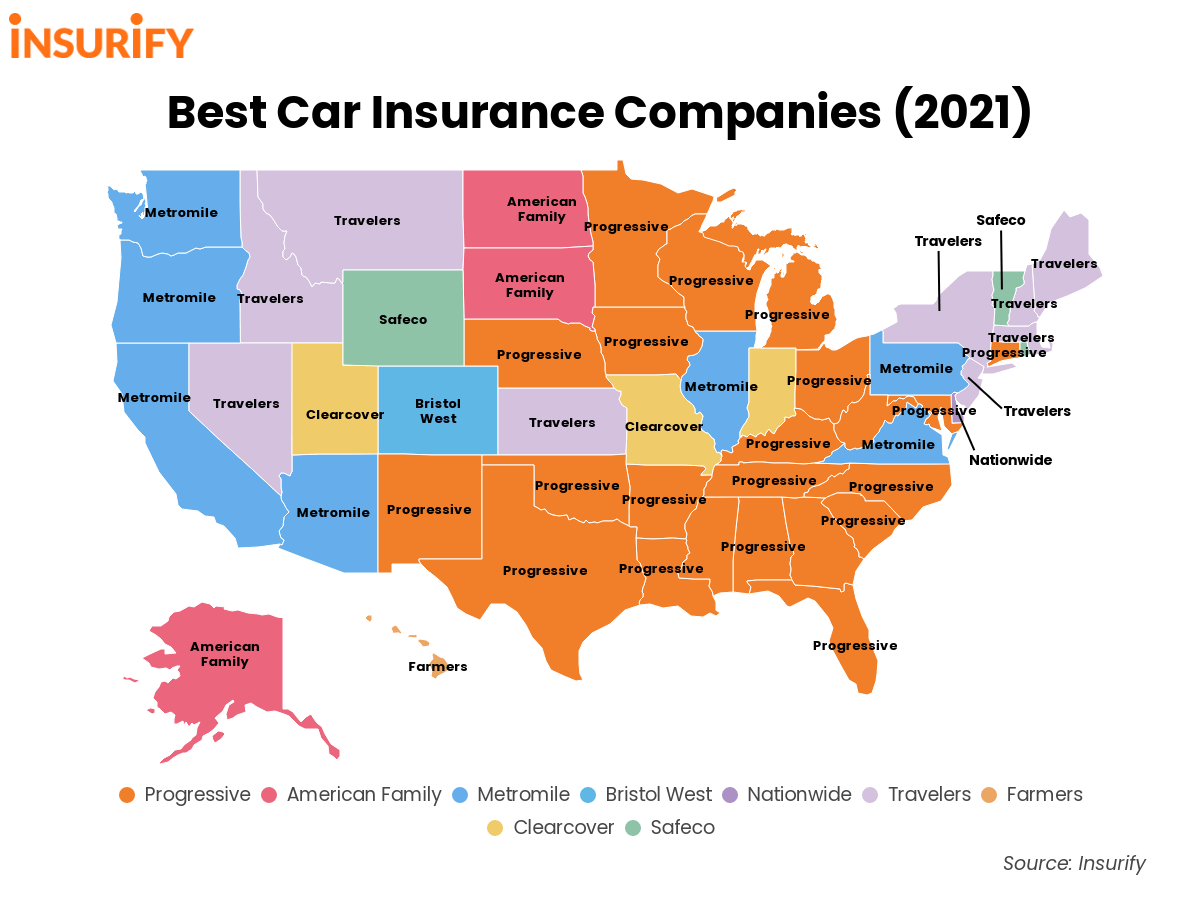

Finding the best car insurance company in Florida requires careful consideration. With numerous options available, it’s crucial to evaluate each company’s strengths and weaknesses to determine the best fit for your specific needs and budget.

Top Car Insurance Companies in Florida, Best car insurance companies florida

This section provides a comprehensive overview of some of the top car insurance companies in Florida, highlighting their key features, pricing, customer satisfaction ratings, and unique offerings.

| Company | Key Features | Pricing | Customer Satisfaction | Unique Offerings |

|---|---|---|---|---|

| State Farm | Wide range of coverage options, strong financial stability, extensive agent network, discounts for good driving records, and bundling options. | Competitive rates, varying based on individual factors. | High customer satisfaction ratings, consistently ranked among the top providers. | Drive Safe & Save program rewards safe driving with discounts, and offers various telematics programs for personalized insurance. |

| Geico | Known for its affordable rates, online convenience, and 24/7 customer service. | Generally lower premiums compared to other major providers. | Positive customer reviews, recognized for its user-friendly online platform. | Offers discounts for good drivers, military personnel, and homeowners, and provides various online tools for managing policies. |

| Progressive | Offers a variety of coverage options, including unique features like Name Your Price tool and Snapshot telematics program. | Rates vary significantly based on individual factors, but often competitive. | Mixed customer reviews, known for its innovative features but sometimes criticized for customer service. | Name Your Price tool allows customers to set their desired premium and receive quotes accordingly. |

| USAA | Exclusively available to military personnel and their families, known for its exceptional customer service and financial stability. | Generally offers competitive rates, particularly for military members. | Consistently receives high customer satisfaction ratings, lauded for its commitment to service. | Provides various discounts for military members, including deployments, and offers a dedicated network of agents. |

Tips for Saving Money on Car Insurance in Florida

Car insurance is a significant expense for most Floridians, but there are ways to reduce your premiums and save money. By implementing smart strategies and understanding the factors that influence your rates, you can lower your insurance costs without compromising your coverage.

Improving Driving Habits

Improving your driving habits can significantly impact your car insurance premiums. Insurance companies reward safe drivers with lower rates, recognizing that good driving habits reduce the risk of accidents.

- Avoid Distracted Driving: Distracted driving is a major cause of accidents. Put your phone away, avoid eating or drinking while driving, and focus on the road ahead.

- Maintain a Safe Speed: Speeding increases your risk of accidents and can lead to higher insurance premiums. Stick to the speed limit and avoid aggressive driving.

- Avoid Driving Under the Influence: Driving under the influence of alcohol or drugs is illegal and extremely dangerous. Always have a designated driver or use a ride-sharing service if you plan to consume alcohol.

Bundling Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings. Many insurance companies offer discounts for bundling multiple policies.

- Homeowners and Renters Insurance: Combining your car insurance with homeowners or renters insurance can often result in a significant discount.

- Other Policies: Some insurance companies offer discounts for bundling other policies, such as life insurance or health insurance.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your monthly premiums.

- Higher Deductible, Lower Premium: A higher deductible means you pay more out of pocket in the event of an accident, but it also lowers your monthly premiums.

- Evaluate Your Risk Tolerance: Consider your financial situation and risk tolerance when deciding on a deductible.

Exploring Discounts

Insurance companies offer a variety of discounts to reduce your premiums. Take advantage of these discounts to lower your costs.

- Good Driver Discounts: If you have a clean driving record, you may qualify for a good driver discount.

- Safe Driver Discounts: Some insurance companies offer safe driver discounts based on factors like your driving history and vehicle safety features.

- Multi-Car Discounts: If you insure multiple vehicles with the same insurance company, you may qualify for a multi-car discount.

- Other Discounts: Other discounts may be available based on your occupation, education, or other factors.

Comparing Quotes from Multiple Insurance Companies

Getting quotes from multiple insurance companies is crucial for finding the best rates.

- Online Comparison Tools: Use online comparison tools to get quotes from various insurers simultaneously.

- Contact Insurance Agents: Speak with insurance agents to discuss your specific needs and get personalized quotes.

- Negotiate: Once you have quotes from multiple companies, don’t hesitate to negotiate for a better rate.

Filing a Car Insurance Claim in Florida

Navigating the car insurance claims process in Florida can be daunting, especially after an accident. However, understanding the steps involved and your rights as a policyholder can make the process smoother. This section Artikels the crucial steps in filing a car insurance claim in Florida, providing a clear guide for residents to follow.

Reporting the Accident

After an accident, it’s crucial to report the incident to your insurance company as soon as possible. The Florida Department of Highway Safety and Motor Vehicles (DHSMV) requires you to file an accident report if the incident results in:

- Injury or death

- Property damage exceeding $500

- Hit-and-run

You can file the report online, by mail, or in person at a DHSMV office. Your insurance company may have its own reporting procedures as well.

Providing Documentation

Your insurance company will require documentation to process your claim. This typically includes:

- Police report (if available)

- Photos of the damage to your vehicle

- Medical records (if applicable)

- Details of the other driver’s insurance information

The more information you provide, the faster your claim will be processed.

Understanding the Claims Process

Once you’ve reported the accident and provided the necessary documentation, your insurance company will begin investigating the claim. This may involve:

- Assessing the damage to your vehicle

- Reviewing medical records (if applicable)

- Contacting the other driver’s insurance company

You will be notified of the outcome of the investigation and the next steps in the claims process.

The Role of the Florida Department of Highway Safety and Motor Vehicles (DHSMV)

The DHSMV plays a crucial role in accident reporting and claim resolution in Florida. The department:

- Maintains a database of accident reports, which can be used by insurance companies to investigate claims

- Provides resources and information to drivers about their rights and responsibilities

- Investigates serious accidents and enforces traffic laws

The DHSMV’s website provides valuable information about accident reporting, claims, and other driver-related matters.

Last Point

Ultimately, finding the best car insurance company in Florida requires careful consideration of your individual needs and preferences. By understanding the key factors, comparing quotes, and taking advantage of available discounts, you can secure the right coverage at a price that fits your budget. Remember, your insurance policy is your safety net in the event of an accident, so choose wisely and drive confidently.

Questions Often Asked

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry a minimum amount of Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. This includes $10,000 in PIP coverage and $10,000 in PDL coverage.

What are some common car insurance discounts available in Florida?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for anti-theft devices.

How can I file a car insurance claim in Florida?

To file a claim, you’ll need to contact your insurance company and report the accident. You’ll then need to provide documentation, such as a police report and photos of the damage. Your insurance company will guide you through the claims process.