Low cost car insurance in florida – Navigating the complex world of car insurance in Florida can feel like driving through a hurricane. With high population density, frequent accidents, and a significant number of uninsured motorists, finding affordable car insurance in Florida requires a strategic approach. Understanding the unique factors that influence car insurance costs and exploring various coverage options are crucial steps in securing the right protection at a price that fits your budget.

This guide will delve into the intricacies of Florida’s car insurance market, providing insights into finding affordable coverage and navigating the complexities of insurance policies. From understanding the Florida No-Fault Law to exploring various discounts and comparing quotes from different providers, this comprehensive resource empowers you to make informed decisions and secure the best car insurance value for your needs.

Understanding Florida’s Car Insurance Market

Florida’s car insurance market is unique and complex, driven by a combination of factors that contribute to higher insurance costs compared to other states.

Factors Influencing Car Insurance Costs in Florida

Several factors contribute to the high cost of car insurance in Florida. These factors include:

- High Population Density: Florida’s large population and high concentration of vehicles on the roads increase the likelihood of accidents, leading to higher claims and insurance costs.

- Frequent Accidents: Florida has a higher-than-average number of car accidents, contributing to higher insurance premiums. This is partly due to the state’s warm weather, which encourages driving year-round, and its large tourist population.

- Prevalence of Uninsured Motorists: Florida has a significant number of uninsured drivers, which poses a risk to insured drivers involved in accidents. To mitigate this risk, insurance companies often increase premiums for all drivers.

Finding Affordable Car Insurance Options

Finding affordable car insurance in Florida can feel like a daunting task, but it’s achievable with the right knowledge and strategies. By understanding the factors that influence your rates and utilizing available discounts, you can significantly lower your premiums.

Factors Affecting Car Insurance Rates

Insurance companies use a complex algorithm to calculate your rates, considering several key factors:

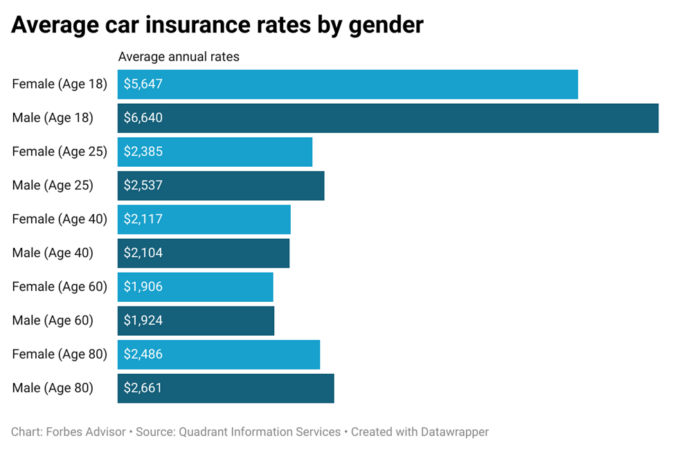

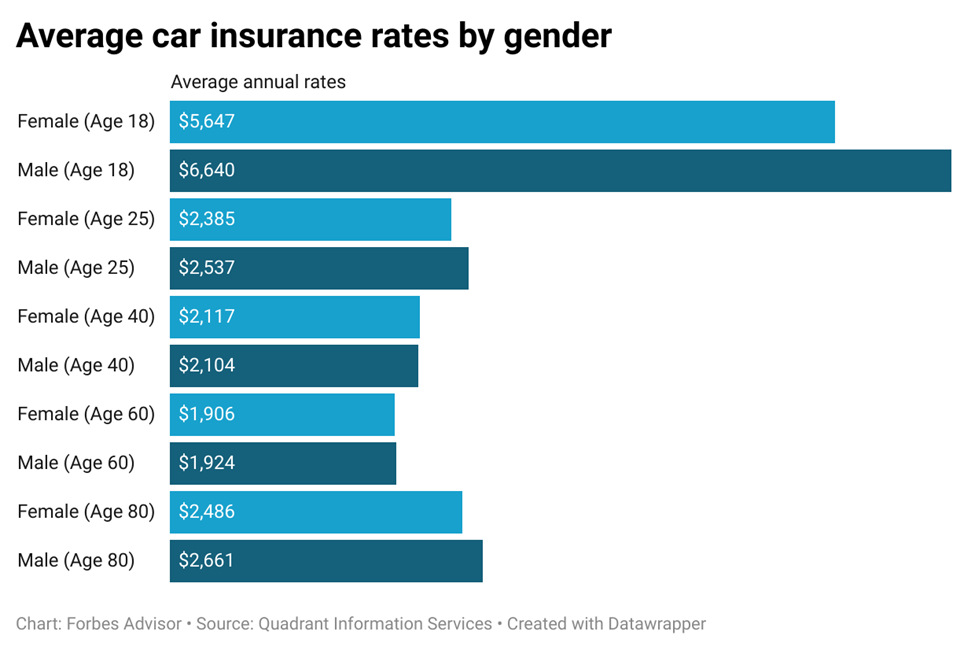

- Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. As you age and gain more driving experience, your rates typically decrease.

- Driving History: Your driving record is a major factor. Accidents, speeding tickets, and DUI convictions can significantly increase your rates. Maintaining a clean driving record is crucial for affordable insurance.

- Vehicle Type: The make, model, and year of your vehicle influence your rates. Expensive, high-performance cars are often associated with higher repair costs, resulting in higher premiums.

- Location: Your zip code plays a role in determining your rates. Areas with higher crime rates or more frequent accidents tend to have higher insurance premiums.

- Credit Score: In many states, including Florida, insurance companies use your credit score as a proxy for risk assessment. A good credit score can lead to lower insurance premiums.

Strategies for Lowering Premiums, Low cost car insurance in florida

Here are some proven strategies to reduce your car insurance costs in Florida:

- Maintain a Good Driving Record: This is the single most important factor in determining your rates. Avoid accidents, traffic violations, and DUI convictions.

- Increase Deductibles: A deductible is the amount you pay out-of-pocket before your insurance kicks in. Increasing your deductible can significantly lower your premium, as you’re taking on more financial responsibility.

- Bundle Insurance Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in substantial discounts.

- Shop Around for Quotes: Compare quotes from multiple insurance companies to find the best rates for your needs. Online comparison tools can streamline this process.

- Consider a Usage-Based Insurance Program: Some insurers offer programs that track your driving habits using a telematics device. If you drive safely and less frequently, you may qualify for discounts.

Types of Discounts

Insurance companies offer various discounts to encourage safe driving and loyalty. Here are some common types:

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record, typically for a certain number of years without accidents or violations.

- Good Student Discount: Students with good grades often receive discounts, reflecting their responsible nature.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can make your car less appealing to thieves and earn you a discount.

- Loyalty Discount: Some insurers reward long-term customers with discounts for their continued business.

Comparing Insurance Quotes and Choosing a Provider

Once you have a good understanding of your insurance needs and the Florida market, it’s time to start gathering quotes and comparing different providers. This is the most crucial step in securing affordable car insurance.

Comparing Insurance Quotes from Different Providers

To ensure you’re getting the best possible rate, it’s essential to compare quotes from multiple insurance companies. This involves using online comparison tools and contacting insurance agents directly.

- Online Comparison Tools: Websites like Insurance.com, The Zebra, and Policygenius allow you to enter your information once and receive quotes from several companies simultaneously. These tools are convenient and can save you time, but they may not always provide the most accurate or comprehensive quotes.

- Contacting Insurance Agents Directly: While online tools are useful, it’s important to contact insurance agents directly. This allows you to discuss your specific needs and ask questions about different policy options. Agents can also help you find discounts and promotions that might not be available through online tools.

Analyzing Insurance Policy Details

After gathering quotes, carefully review each policy’s details to understand the coverage, limitations, and costs involved. Key terms to focus on include:

- Coverage Limits: These limits determine the maximum amount the insurance company will pay for covered losses, such as bodily injury liability, property damage liability, and collision coverage. Higher limits provide greater financial protection but also result in higher premiums.

- Deductibles: The deductible is the amount you pay out-of-pocket before the insurance company starts covering the cost of repairs or medical expenses. Higher deductibles generally lead to lower premiums, but you’ll have to pay more in the event of a claim.

- Exclusions: Exclusions are specific events or situations that are not covered by the policy. Understanding these exclusions is crucial to avoid unexpected costs in the event of an accident.

Table Comparing Major Car Insurance Companies in Florida

| Insurance Company | Features | Pricing | Customer Service Rating |

|—|—|—|—|

| State Farm | Wide coverage options, discounts, mobile app | Competitive rates, varies by location | 4.2 stars |

| Geico | Easy online quote process, competitive rates, good customer service | Competitive rates, varies by location | 4.3 stars |

| Progressive | Customizable coverage options, discounts, Drive Safe & Save program | Competitive rates, varies by location | 3.9 stars |

| Allstate | Comprehensive coverage options, discounts, Drive Safe & Save program | Competitive rates, varies by location | 3.7 stars |

| USAA | Military-focused coverage, discounts, excellent customer service | Competitive rates for military members | 4.7 stars |

Saving Money on Car Insurance in Florida

Navigating the complex world of car insurance in Florida can be daunting, especially when seeking affordable options. While finding low-cost car insurance is essential, understanding the factors that influence your premiums and implementing strategies to reduce them can significantly impact your budget. This section explores practical ways to save money on car insurance in Florida, focusing on utilizing available resources, adopting preventive measures, and understanding the impact of credit scores.

Financial Assistance and Programs

Florida offers various resources and programs designed to help low-income residents afford car insurance. These initiatives aim to bridge the gap between financial limitations and the need for essential coverage. Understanding these options can be a crucial step towards securing affordable car insurance.

- Florida Department of Financial Services: The Florida Department of Financial Services provides information and resources for consumers, including guidance on finding affordable car insurance. Their website features a “Find an Insurance Agent” tool, allowing users to locate licensed agents in their area.

- Florida Insurance Guaranty Association (FIGA): FIGA is a non-profit organization that protects policyholders in the event of an insurance company’s insolvency. While not directly offering financial assistance, FIGA provides information on consumer rights and insurance options.

- Community Action Agencies: These agencies often provide financial assistance and counseling to low-income individuals, potentially including help with car insurance premiums.

- Local Non-Profit Organizations: Many local non-profit organizations offer financial assistance programs to low-income residents, sometimes including assistance with car insurance.

Preventive Measures for Lower Premiums

Adopting responsible driving habits and preventative measures can significantly impact your car insurance premiums. By demonstrating a commitment to safe driving, you can often secure lower rates from insurance providers. This section explores key strategies for reducing your car insurance costs.

- Maintain a Safe Driving Record: A clean driving record is crucial for securing lower car insurance rates. Avoid traffic violations like speeding tickets, reckless driving, and DUI offenses. These infractions can significantly increase your premiums.

- Practice Defensive Driving: Learning defensive driving techniques can equip you with the skills to anticipate potential hazards and react accordingly. This can reduce the likelihood of accidents, which can lower your insurance premiums.

- Consider a Driving Course: Completing a defensive driving course can demonstrate your commitment to safe driving practices. Some insurance companies offer discounts for completing such courses.

- Avoid Accidents: Accidents are a major factor influencing car insurance premiums. Practicing safe driving habits and avoiding accidents can help maintain lower rates.

Impact of Credit Scores on Car Insurance

In Florida, insurance companies can use your credit score as a factor in determining your car insurance premiums. While this practice may seem counterintuitive, it reflects the industry’s belief that individuals with better credit scores are more likely to be responsible drivers. Understanding the link between credit scores and car insurance rates can empower you to take steps to improve your credit score and potentially qualify for lower premiums.

- Credit Score as a Risk Indicator: Insurance companies view credit scores as an indicator of financial responsibility. Individuals with higher credit scores are perceived as less risky, leading to lower insurance premiums.

- Strategies for Credit Improvement: Improving your credit score can potentially lead to lower car insurance rates. Strategies for improving credit scores include paying bills on time, reducing debt, and avoiding unnecessary credit inquiries.

- Credit Score Monitoring: Regularly monitoring your credit score can help identify any errors or potential issues that might be affecting your rating. This allows you to take timely action to address any inaccuracies or concerns.

Ending Remarks

In the end, finding low-cost car insurance in Florida involves a combination of careful planning, proactive measures, and informed decision-making. By understanding the factors that influence insurance rates, comparing quotes from multiple providers, and exploring available discounts, you can secure the coverage you need while staying within your budget. Remember, protecting yourself and your finances on the road starts with understanding the intricacies of Florida’s car insurance market and making smart choices.

Top FAQs: Low Cost Car Insurance In Florida

How can I find the cheapest car insurance in Florida?

The cheapest car insurance in Florida depends on individual factors. To find the most affordable option, compare quotes from multiple providers, explore discounts, and consider adjusting coverage levels and deductibles.

What are the minimum car insurance requirements in Florida?

Florida requires drivers to carry at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). However, it’s advisable to consider higher coverage limits for greater financial protection.

How does my credit score affect my car insurance rates in Florida?

In Florida, insurance companies can use your credit score to determine your insurance rates. A higher credit score generally translates to lower premiums. Improving your credit score can potentially lead to savings on your car insurance.