- Understanding Florida’s Car Insurance Landscape

- Identifying Factors Affecting Low-Cost Car Insurance

- Exploring Low-Cost Car Insurance Options: Low Cost Car Insurance Florida

- Strategies for Lowering Car Insurance Costs

- Additional Considerations for Low-Cost Car Insurance

- Final Conclusion

- Query Resolution

Low cost car insurance Florida is a sought-after commodity for many drivers, especially those seeking to balance financial responsibility with adequate coverage. Navigating the complex landscape of Florida car insurance can be daunting, but with the right information and strategies, you can find affordable options that meet your specific needs.

Understanding the unique factors that influence car insurance costs in Florida is crucial. From mandatory coverage requirements to the role of the Florida Department of Financial Services, various aspects contribute to the overall cost of insurance.

Understanding Florida’s Car Insurance Landscape

Florida presents a unique landscape for car insurance, with several factors influencing costs and coverage requirements. Understanding these nuances is crucial for drivers seeking affordable and comprehensive insurance.

Factors Influencing Car Insurance Costs in Florida, Low cost car insurance florida

Florida’s car insurance rates are influenced by various factors, including the state’s high population density, frequent accidents, and the presence of a large number of uninsured drivers. These factors contribute to a higher risk environment, leading to higher premiums.

- High Population Density: Florida’s dense population leads to more vehicles on the road, increasing the likelihood of accidents and driving up insurance costs.

- Frequent Accidents: Florida has a high rate of car accidents, primarily due to its large number of tourists and seasonal residents, contributing to higher insurance premiums.

- High Number of Uninsured Drivers: Florida has a significant number of uninsured drivers, making it more expensive for insured drivers to cover the costs of accidents involving uninsured motorists.

- High Cost of Healthcare: Florida’s high healthcare costs, particularly for accident-related injuries, impact insurance premiums as insurers need to cover these expenses.

- Florida’s No-Fault System: Florida operates under a no-fault insurance system, where drivers are primarily responsible for their own injuries and damages after an accident. This system can lead to higher premiums as insurers need to cover the costs of medical expenses regardless of fault.

- Fraudulent Claims: Florida has a history of insurance fraud, which increases costs for all policyholders as insurers must account for these fraudulent claims.

Required Car Insurance Coverage in Florida

Florida mandates specific types of car insurance coverage to ensure financial protection for drivers and their victims. These requirements are designed to address potential financial losses arising from accidents.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault.

- Property Damage Liability (PDL): This coverage protects the insured driver against financial losses arising from damage to another person’s property, such as a vehicle, in an accident.

- Bodily Injury Liability (BIL): This coverage provides financial protection to the insured driver against claims for injuries caused to others in an accident.

Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the state’s car insurance market. It ensures that insurers operate fairly and transparently, protecting consumers from unfair practices and ensuring adequate coverage.

- Consumer Protection: The DFS investigates complaints against insurers, enforces insurance regulations, and provides educational resources to consumers.

- Market Oversight: The DFS monitors insurance rates, ensuring they are reasonable and fair, and preventing insurers from engaging in discriminatory pricing practices.

- Financial Stability: The DFS oversees the financial stability of insurance companies, ensuring they have adequate reserves to cover claims and maintain solvency.

Identifying Factors Affecting Low-Cost Car Insurance

Securing affordable car insurance in Florida requires a thorough understanding of the factors that influence premiums. Various aspects contribute to the final cost, and by being aware of these factors, individuals can make informed decisions to potentially lower their insurance expenses.

Driving History

Your driving history plays a pivotal role in determining your insurance premiums. A clean driving record with no accidents or traffic violations is highly desirable and often results in lower rates. However, a history of accidents, speeding tickets, or DUI convictions can significantly increase your premiums.

- Accidents: Each accident on your record can lead to a substantial increase in your insurance rates. The severity of the accident, such as property damage or injuries, also affects the premium increase.

- Traffic Violations: Even minor violations, such as speeding tickets or running a red light, can impact your insurance costs. Multiple violations can lead to higher premiums and may even result in your insurance being canceled.

- DUI Convictions: Driving under the influence (DUI) is a serious offense that carries significant penalties, including hefty insurance premium increases. Insurers view DUI convictions as a high risk and often impose substantial surcharges.

Age

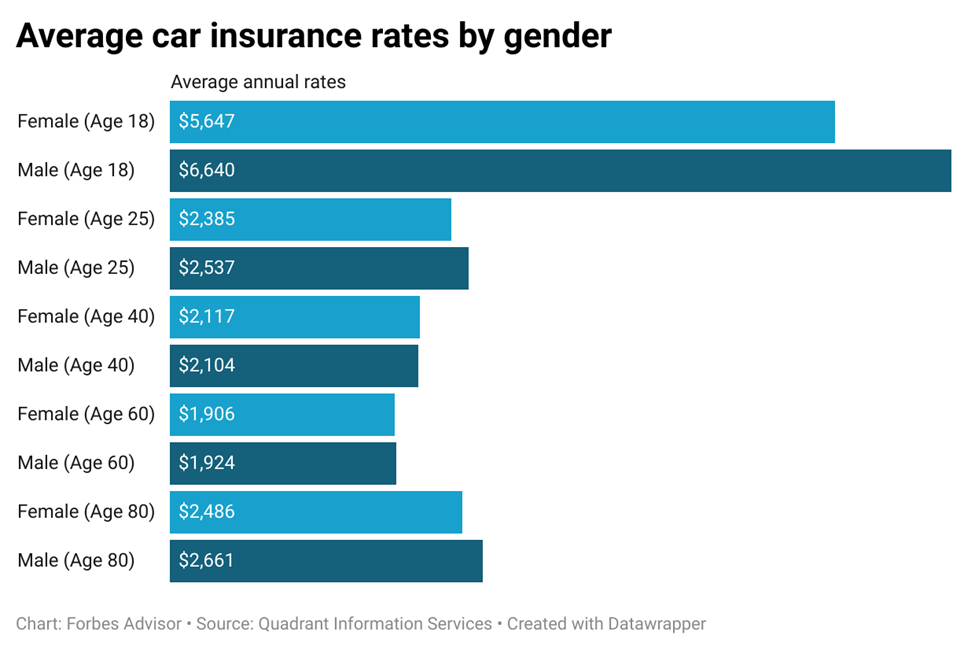

Age is a key factor in determining car insurance premiums, as it correlates with driving experience and risk. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As drivers gain experience and age, their insurance premiums tend to decrease.

- Young Drivers: Due to their limited driving experience, young drivers are considered higher risk and face higher insurance premiums. Insurers may offer discounts for completing driver’s education courses or maintaining good grades.

- Mature Drivers: Older drivers, generally over 65, may benefit from lower insurance rates due to their extensive driving experience and statistically lower risk of accidents.

Credit Score

While it may seem counterintuitive, your credit score can influence your car insurance premiums. Insurers use credit scores as a proxy for financial responsibility, believing that individuals with good credit are more likely to be responsible drivers.

- Impact of Credit Score: A higher credit score typically translates to lower insurance premiums, while a lower credit score can result in higher rates. This practice is controversial, as some argue that it unfairly penalizes individuals with poor credit history who may be responsible drivers.

- Credit-Based Insurance Scores: Insurers use credit-based insurance scores (CBIS) to assess risk. These scores consider factors such as payment history, credit utilization, and length of credit history.

Vehicle Type

The type of vehicle you drive also plays a role in determining your insurance premiums. Certain vehicle characteristics, such as safety features, engine size, and theft risk, can impact your rates.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for discounts. These features reduce the risk of accidents and injuries, leading to lower premiums.

- Engine Size: Vehicles with larger engines tend to be more expensive to repair and insure. Insurers may charge higher premiums for vehicles with high-performance engines.

- Theft Risk: Certain car models are more prone to theft than others. Insurers may charge higher premiums for vehicles with a higher theft risk.

Exploring Low-Cost Car Insurance Options: Low Cost Car Insurance Florida

Finding affordable car insurance in Florida can be challenging, but with careful research and strategic choices, you can secure a policy that fits your budget. This section will guide you through various options, enabling you to make informed decisions.

Reputable Car Insurance Companies in Florida

Choosing the right insurance company is crucial for securing a competitive rate. Several reputable companies operate in Florida, offering competitive rates and reliable coverage.

- State Farm: Known for its extensive network of agents, strong financial stability, and customer-friendly policies.

- Geico: Renowned for its affordable rates, convenient online tools, and 24/7 customer service.

- Progressive: Offers a wide range of coverage options, personalized discounts, and innovative features like its Name Your Price tool.

- USAA: Exclusively for military members and their families, USAA consistently receives high ratings for customer satisfaction and financial strength.

- Florida Peninsula Insurance Company: Specializes in providing coverage for Florida residents, known for its competitive rates and personalized service.

Understanding Different Car Insurance Policies

Florida requires drivers to carry specific types of car insurance, but understanding the various options available can help you choose a policy that meets your needs and budget.

- Liability Insurance: This is the most basic type of car insurance, legally required in Florida. It covers damages to other vehicles or property and medical expenses for injuries caused by an accident, but does not cover your own vehicle.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault.

- Comprehensive Coverage: This protects your vehicle against damages from non-accident events, such as theft, vandalism, natural disasters, and falling objects.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you’re involved in an accident with a driver who is uninsured or underinsured.

Comparing Low-Cost Car Insurance Options

| Company | Liability Coverage | Collision Coverage | Comprehensive Coverage | PIP Coverage | Average Monthly Premium (Estimated) |

|---|---|---|---|---|---|

| State Farm | $10,000/$20,000 | $1,000 deductible | $500 deductible | $10,000 | $80-$120 |

| Geico | $10,000/$20,000 | $1,000 deductible | $500 deductible | $10,000 | $75-$110 |

| Progressive | $10,000/$20,000 | $1,000 deductible | $500 deductible | $10,000 | $85-$125 |

| USAA | $10,000/$20,000 | $1,000 deductible | $500 deductible | $10,000 | $70-$100 |

| Florida Peninsula | $10,000/$20,000 | $1,000 deductible | $500 deductible | $10,000 | $75-$115 |

Note: These are estimated monthly premiums and can vary based on individual factors such as driving history, vehicle type, age, location, and coverage options.

Strategies for Lowering Car Insurance Costs

In Florida, car insurance is mandatory, but that doesn’t mean you have to pay an arm and a leg for it. There are various strategies you can implement to lower your premiums and save money. By understanding the factors influencing your insurance costs and making informed decisions, you can significantly reduce your monthly expenses.

Improving Driving Habits

Your driving record plays a crucial role in determining your car insurance rates. Maintaining a clean driving record is essential for securing lower premiums.

- Avoid Traffic Violations: Every speeding ticket, reckless driving citation, or DUI conviction can result in higher insurance rates.

- Maintain a Safe Driving Record: By practicing safe driving habits, you can minimize the risk of accidents and maintain a clean driving record. This includes following traffic rules, being aware of your surroundings, and avoiding distractions while driving.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically means lower premiums.

- Evaluate Your Risk Tolerance: Before increasing your deductible, consider your financial situation and risk tolerance. If you can afford to pay a higher deductible in case of an accident, it can lead to significant savings on your insurance premiums.

- Compare Premiums: Contact your insurance company or use online tools to compare premiums with different deductible levels. This will help you determine the optimal deductible amount for your specific needs and budget.

Bundling Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Explore Bundling Options: Contact your current insurance company or shop around for different providers to compare bundling discounts.

- Evaluate Your Needs: Make sure the bundled policies meet your requirements and provide sufficient coverage.

Comparing Quotes

Obtaining quotes from multiple insurance companies is crucial for finding the best rates.

- Online Quote Tools: Many insurance companies offer online quote tools that allow you to quickly and easily compare rates. These tools are convenient and save you time.

- Independent Insurance Agents: Independent agents can provide quotes from multiple insurance companies, giving you a wider range of options. They can also offer personalized advice and guidance.

Negotiating Car Insurance Rates

Don’t be afraid to negotiate with your insurance company.

- Shop Around: Get quotes from multiple insurance companies to leverage competition and use them as leverage during negotiations.

- Highlight Your Good Driving Record: Emphasize your clean driving history and any safety features in your vehicle.

- Consider Loyalty Discounts: Ask about any loyalty discounts for long-term customers.

Additional Considerations for Low-Cost Car Insurance

Choosing the cheapest car insurance option might seem appealing, but it’s crucial to understand the full picture. While saving money is essential, sacrificing crucial coverage can lead to significant financial burdens in the event of an accident. This section delves into vital considerations that go beyond the initial price tag, ensuring you make an informed decision that protects your financial well-being.

Understanding Coverage Limits and Exclusions

Insurance policies are complex legal documents with specific terms and conditions that define what is covered and what is excluded. It’s essential to understand the coverage limits and exclusions in your policy to avoid surprises during a claim.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to others. It typically has limits on the amount it will pay for bodily injury and property damage. Make sure these limits are adequate to cover potential liabilities. For instance, a low liability limit might not cover all the costs if you are involved in a serious accident causing significant injuries.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. However, it often comes with a deductible, which is the amount you pay out-of-pocket before the insurance kicks in. Choosing a high deductible can lower your premium but will require you to pay more upfront in case of an accident.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. Similar to collision coverage, it typically has a deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance. It’s crucial to have this coverage as it can cover your medical expenses and vehicle damage in such situations.

Navigating the Claims Process

Understanding the claims process is crucial to ensure you receive the compensation you deserve.

- Report the Accident: Immediately contact your insurance company to report the accident. Provide all the necessary details, including the date, time, location, and any injuries involved.

- Gather Evidence: Collect evidence at the accident scene, including photographs, witness statements, and police reports. This documentation will help support your claim.

- Cooperate with Your Insurer: Be responsive to your insurance company’s requests for information and cooperate fully throughout the claims process. Provide all the necessary documentation and follow their instructions carefully.

- Negotiate Settlement: Your insurance company will assess your claim and offer a settlement. If you disagree with the offer, you can negotiate a higher amount or seek legal advice.

Potential Risks of Low-Cost Insurance

While low-cost insurance options can save money upfront, they often come with trade-offs.

- Limited Coverage: Lower premiums often mean reduced coverage. This could leave you financially vulnerable in case of a significant accident or unexpected event. For example, a policy with low liability limits might not cover all the costs of an accident, leaving you responsible for the difference.

- Higher Deductibles: Lower premiums are often associated with higher deductibles. This means you’ll pay more out-of-pocket before your insurance kicks in, which can be a financial burden in case of an accident.

- Limited Customer Service: Some low-cost insurance companies may offer limited customer service, making it challenging to resolve issues or get assistance when you need it.

- Financial Instability: Some low-cost insurers may have financial instability, which could impact their ability to pay claims in the future.

Final Conclusion

Finding low cost car insurance Florida requires a balanced approach. While seeking the most affordable options, it’s essential to prioritize coverage that protects you and your finances. By understanding your needs, exploring various options, and implementing cost-saving strategies, you can secure affordable car insurance that provides peace of mind on the road.

Query Resolution

What are the minimum car insurance requirements in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BI) per person.

How can I get a free car insurance quote?

Most insurance companies offer free online quotes. You can also contact an insurance agent or broker to receive personalized quotes.

What is the best way to compare car insurance quotes?

Use online comparison tools or contact multiple insurance companies directly to compare quotes. Make sure you are comparing similar coverage levels and deductibles.

Can I get car insurance discounts in Florida?

Yes, Florida offers various car insurance discounts, including discounts for good driving records, safety features, and bundling insurance policies.

What are some tips for lowering my car insurance costs?

Consider increasing your deductible, improving your driving record, taking a defensive driving course, and bundling your insurance policies.