Do You Need Car Insurance in Florida? This question is crucial for anyone living in the Sunshine State, as Florida has strict laws regarding car insurance. Failing to comply with these requirements can result in significant legal penalties, including fines, license suspension, and even jail time.

This guide delves into the specifics of Florida’s car insurance laws, exploring the types of coverage required, the factors influencing insurance costs, and tips for finding the best policy for your individual needs. We’ll also cover the process of obtaining quotes, understanding your policy, and maximizing savings through discounts.

Florida’s Legal Requirements

In Florida, driving without car insurance is illegal and can result in serious consequences. The state has strict laws in place to ensure that all drivers have adequate financial protection in case of an accident.

Minimum Coverage Requirements

Florida requires all drivers to carry a minimum amount of car insurance, known as “financial responsibility.” This minimum coverage includes:

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for the insured driver and passengers in the event of an accident, regardless of who is at fault. The minimum PIP coverage required in Florida is $10,000 per person.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property if the insured driver is at fault in an accident. The minimum PDL coverage required in Florida is $10,000 per accident.

- Bodily Injury Liability (BIL): This coverage pays for medical expenses and other damages to other people injured in an accident if the insured driver is at fault. The minimum BIL coverage required in Florida is $10,000 per person and $20,000 per accident.

Penalties for Driving Without Insurance

Driving without the required minimum insurance coverage in Florida can lead to several penalties, including:

- Fines: Drivers caught driving without insurance can face fines ranging from $150 to $500, depending on the severity of the offense.

- License Suspension: The Florida Department of Motor Vehicles (DMV) can suspend the driver’s license for up to three years if they are caught driving without insurance.

- Vehicle Impoundment: The vehicle may be impounded until proof of insurance is provided.

- Jail Time: In some cases, driving without insurance can lead to jail time, especially if the driver is involved in an accident that results in injury or death.

Important Considerations

It’s important to note that the minimum coverage requirements are just that – minimums. They may not be sufficient to cover all expenses in the event of a serious accident. Consider purchasing additional coverage, such as:

- Collision Coverage: This coverage pays for repairs or replacement of the insured vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of the insured vehicle if it is damaged by events other than an accident, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if the insured driver is involved in an accident with a driver who is uninsured or underinsured.

Types of Car Insurance in Florida

In Florida, you have several car insurance options to choose from, each offering different levels of coverage and protection. Understanding the different types of car insurance available is crucial to making an informed decision that meets your specific needs and budget.

Liability Coverage

Liability insurance is the most basic type of car insurance required in Florida. It protects you financially if you cause an accident that results in injuries or property damage to others.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver or passengers in the other vehicle if you are at fault in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or any other property damaged in an accident that you caused.

The minimum liability coverage required in Florida is $10,000 for property damage liability and $10,000 per person/$20,000 per accident for bodily injury liability. However, it is highly recommended to consider higher limits, as these minimum requirements may not be enough to cover all potential costs in the event of a serious accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- This coverage is optional, but it is often recommended for newer vehicles or those with significant loan balances.

- Collision coverage helps protect you from financial hardship if your vehicle is totaled or significantly damaged in an accident.

You will need to pay a deductible, which is the amount you pay out of pocket before your insurance company covers the remaining costs.

Comprehensive Coverage, Do you need car insurance in florida

Comprehensive coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters.

- This coverage is also optional, but it can be beneficial for newer vehicles or those with significant loan balances.

- Comprehensive coverage helps protect you from financial hardship if your vehicle is damaged by events outside your control.

Similar to collision coverage, you will need to pay a deductible before your insurance company covers the remaining costs.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses.

- This coverage is optional, but it is highly recommended, as it can help you recover compensation for medical expenses, lost wages, and other damages.

- UM coverage protects you from drivers who have no insurance, while UIM coverage protects you from drivers who have insurance but not enough to cover your losses.

UM/UIM coverage is important because it provides financial protection in situations where the other driver’s insurance is insufficient or nonexistent.

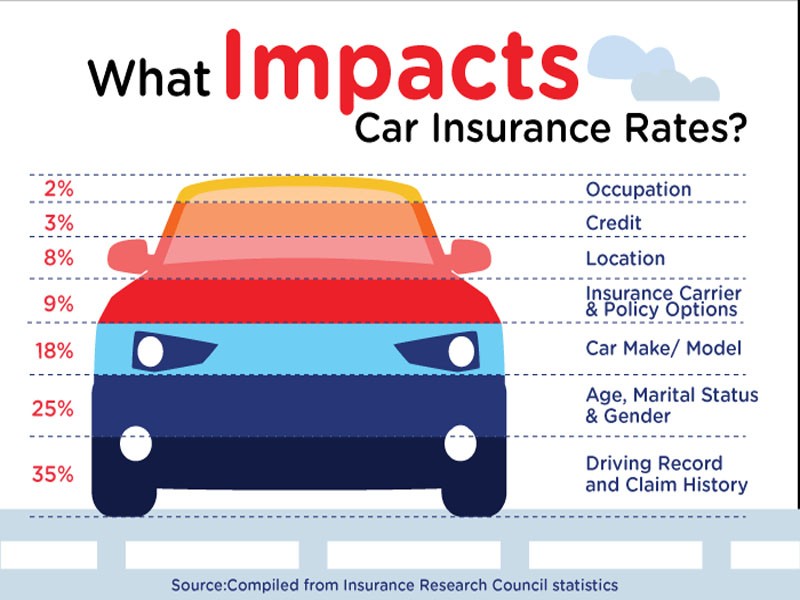

Factors Affecting Insurance Costs

Car insurance premiums in Florida are influenced by a variety of factors, reflecting the individual risk associated with each driver and vehicle. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

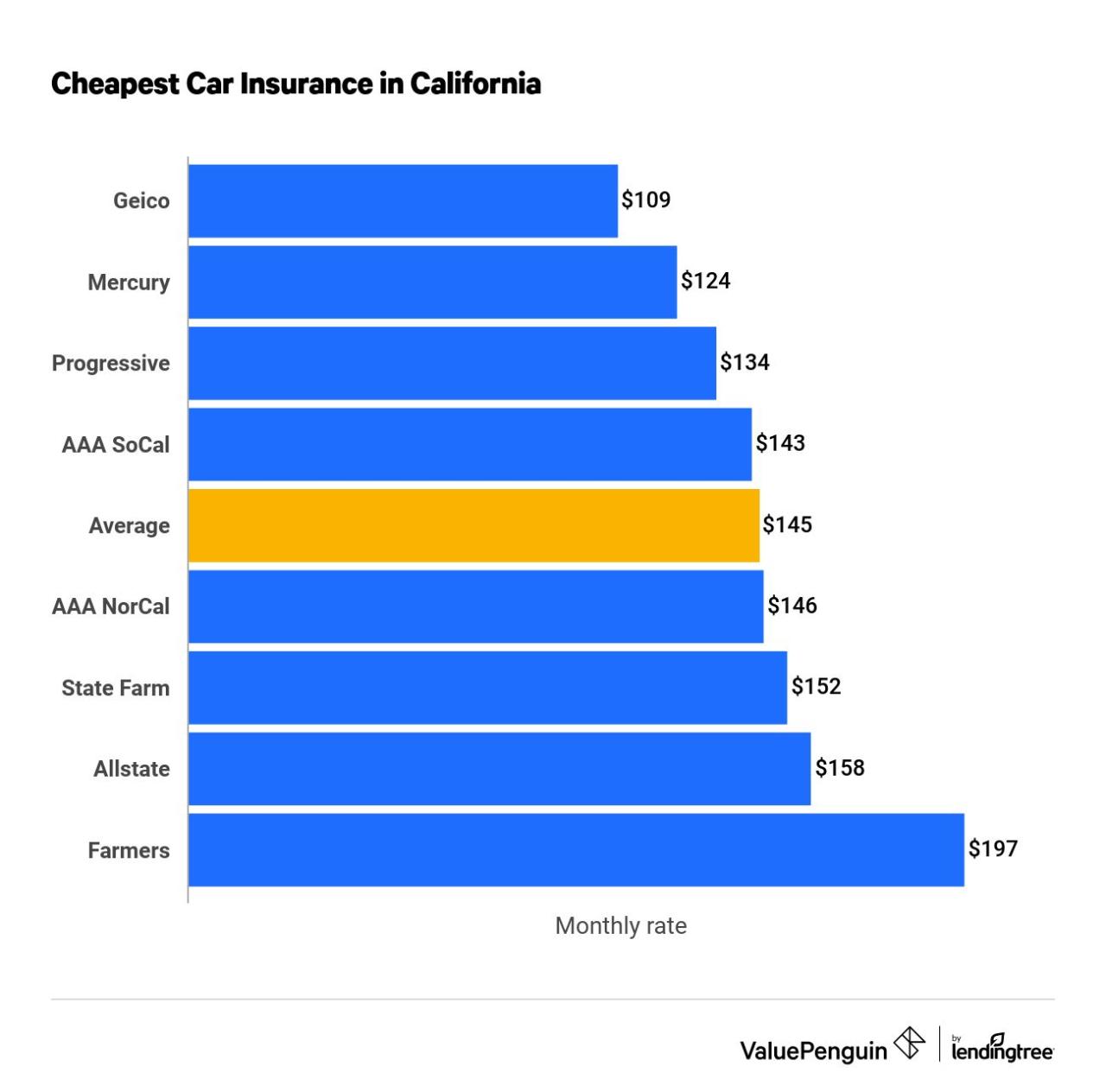

Factors Impacting Insurance Premiums

Several factors play a crucial role in determining your car insurance premiums in Florida. These factors are grouped below to illustrate their impact on insurance costs.

| Factor | Impact on Premiums | Examples | Explanation |

|---|---|---|---|

| Age | Younger drivers typically pay higher premiums due to their higher risk of accidents. As drivers age and gain more experience, their premiums tend to decrease. | A 18-year-old driver might pay significantly more than a 35-year-old driver with a similar driving history. | Younger drivers have less driving experience and are statistically more likely to be involved in accidents. Insurance companies account for this increased risk by charging higher premiums. |

| Driving History | Drivers with a clean driving record, without accidents or traffic violations, generally receive lower premiums. Conversely, those with a history of accidents or violations will face higher premiums. | A driver with multiple speeding tickets or a DUI conviction will likely pay higher premiums than a driver with a clean record. | Insurance companies use driving history as a strong indicator of future risk. Drivers with a history of accidents or violations are considered higher risk and therefore pay more. |

| Vehicle Type | The type of vehicle you drive significantly impacts your insurance premiums. High-performance vehicles, luxury cars, and vehicles with advanced safety features often come with higher premiums. | A sports car like a Porsche 911 will likely have a higher premium than a Toyota Camry. | High-performance vehicles are generally more expensive to repair and replace, and they are often associated with higher speeds and riskier driving behavior. Luxury cars and vehicles with advanced safety features may also have higher repair costs. |

| Location | Your location, specifically the zip code where your vehicle is registered, plays a role in determining your premiums. Areas with higher crime rates, traffic congestion, or a higher number of accidents tend to have higher insurance rates. | A driver living in a densely populated urban area might pay higher premiums than a driver living in a rural area. | Insurance companies consider the risk of accidents and theft in different locations. Areas with higher crime rates or traffic congestion present a greater risk, leading to higher premiums. |

Getting Quotes and Choosing a Provider

In Florida, obtaining car insurance quotes and selecting a provider is a crucial step in ensuring you have adequate coverage at a competitive price. The process involves gathering information, comparing quotes from multiple companies, and carefully evaluating each provider’s reputation and services.

Comparing Quotes from Multiple Companies

It is highly recommended to obtain quotes from several car insurance companies in Florida. This allows you to compare prices, coverage options, and discounts offered by different providers.

- By comparing quotes, you can identify the most affordable options while ensuring you have the coverage you need.

- You can use online comparison tools or contact insurance companies directly to request quotes.

- When comparing quotes, be sure to consider the deductibles, coverage limits, and any additional features or discounts offered.

Choosing a Reputable and Reliable Provider

Once you have gathered quotes from multiple companies, it is essential to select a provider that meets your needs and offers reliable service.

- Look for a company with a strong financial rating, as this indicates its ability to pay claims.

- Check the company’s customer satisfaction ratings and reviews to gauge its reputation for providing excellent customer service.

- Consider the provider’s claims process, including its speed and efficiency in handling claims.

- Evaluate the company’s availability of 24/7 customer support, online resources, and mobile apps for convenient access to your policy information and services.

Understanding Your Policy

Once you’ve selected a car insurance policy in Florida, it’s crucial to understand its details. Your policy is a legally binding contract outlining your coverage, responsibilities, and the terms of your agreement with the insurance company. Understanding your policy ensures you know what you’re covered for, how much you’ll pay, and how to file a claim if needed.

Key Components of a Car Insurance Policy

A typical car insurance policy in Florida includes several key components, each with its own specific terms and conditions. These components define the scope of your coverage and determine how much you’ll pay in premiums and deductibles.

- Coverage Limits: These limits represent the maximum amount your insurance company will pay for covered losses. Coverage limits are typically stated in dollar amounts per incident or per year. For example, your policy might have a $100,000 limit for bodily injury liability per person, $300,000 per accident, and $50,000 for property damage liability per accident.

- Deductibles: This is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible generally leads to lower premiums, while a lower deductible means higher premiums. For example, if you have a $500 deductible for collision coverage, you’ll pay the first $500 of repair costs for an accident, and your insurance will cover the rest.

- Exclusions: These are specific situations or events that are not covered by your insurance policy. Common exclusions include damage caused by wear and tear, intentional acts, and driving under the influence of alcohol or drugs.

Understanding and Interpreting Your Policy

Your car insurance policy is a legal document that can be complex and difficult to understand. However, it’s essential to read and understand your policy carefully to ensure you’re aware of your rights and responsibilities.

- Read the Policy Thoroughly: Take the time to read your entire policy document, including all the fine print. This will help you understand the specifics of your coverage and any limitations or exclusions.

- Ask Questions: If you have any questions or concerns about your policy, don’t hesitate to contact your insurance agent or company representative. They can explain any unclear terms or answer your questions in detail.

- Keep a Copy of Your Policy: Make sure you have a readily accessible copy of your policy document. This will help you reference it when needed and ensure you have all the necessary information in case of an accident or claim.

Filing a Claim

If you’re involved in an accident or experience a covered loss, it’s important to file a claim with your insurance company promptly. The claims process can be complex, but understanding the steps involved can help you navigate it effectively.

- Report the Accident: Immediately contact your insurance company to report the accident. Provide all the necessary details, including the date, time, location, and involved parties.

- Gather Information: Collect as much information as possible about the accident, including the names and contact details of all involved parties, witness statements, and photos of the damage.

- Follow Instructions: Your insurance company will provide instructions on how to proceed with your claim. Follow these instructions carefully and provide all the required documentation.

- Be Patient: The claims process can take some time, especially if there are complex issues or disputes involved. Be patient and stay in communication with your insurance company throughout the process.

Resources and Additional Information

Navigating the complexities of car insurance in Florida can be challenging, but access to reliable information can make the process much smoother. Several resources provide valuable insights, guidance, and support to help you make informed decisions.

Official Resources for Car Insurance Information

This section Artikels official resources that provide accurate and up-to-date information about car insurance in Florida.

| Resource | Website | Phone Number | Description |

|---|---|---|---|

| Florida Department of Financial Services | https://www.myfloridacfo.com/ | (877) 999-5330 | The Florida Department of Financial Services oversees the state’s insurance industry, including car insurance. It offers consumer resources, information on insurance regulations, and assistance with complaints. |

| Florida Office of Insurance Regulation | https://www.floir.com/ | (850) 413-3000 | The Florida Office of Insurance Regulation is responsible for regulating the insurance industry in the state. It provides information about insurance policies, rates, and consumer rights. |

Additional Resources for Car Insurance Information

This section Artikels additional resources that can be helpful for understanding car insurance in Florida.

| Resource | Website | Description |

|---|---|---|

| Insurance Information Institute (III) | https://www.iii.org/ | The III is a non-profit organization that provides information and resources on various insurance topics, including car insurance. It offers educational materials, statistics, and consumer guides. |

| National Association of Insurance Commissioners (NAIC) | https://www.naic.org/ | The NAIC is an association of insurance commissioners from all 50 states, the District of Columbia, and five U.S. territories. It provides information about insurance regulations and consumer protection. |

Epilogue

Navigating the world of car insurance in Florida can seem daunting, but understanding the legal requirements, exploring available coverage options, and taking advantage of discounts can make the process more manageable. Remember, having adequate car insurance is not only a legal obligation but also a vital step in protecting yourself financially in the event of an accident. By following the tips and insights provided in this guide, you can confidently choose a policy that meets your needs and provides the necessary financial protection.

FAQ Corner: Do You Need Car Insurance In Florida

What are the minimum car insurance coverage requirements in Florida?

Florida requires a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.

Can I drive without car insurance in Florida?

No, driving without car insurance in Florida is illegal and carries significant penalties. You risk fines, license suspension, and even jail time.

How do I get a car insurance quote in Florida?

You can obtain car insurance quotes online, by phone, or by visiting an insurance agent. Be sure to compare quotes from multiple companies to find the best rates.