Best price car insurance Florida is a crucial consideration for any driver in the Sunshine State. Florida’s unique driving environment, with its high population density, frequent weather events, and a significant number of uninsured drivers, makes finding affordable and comprehensive coverage a challenge. This guide will help you navigate the complexities of Florida’s car insurance market and discover strategies for securing the best possible price for your needs.

Understanding Florida’s car insurance landscape is essential for making informed decisions. The state mandates specific types of coverage, including personal injury protection (PIP), property damage liability, and uninsured motorist coverage. These requirements are designed to protect drivers and passengers in the event of an accident, regardless of who is at fault. Additionally, Florida offers various discounts that can help reduce your premiums, such as good driver discounts, safe driving courses, and multi-policy discounts.

Understanding Florida Car Insurance

Florida’s unique environment and driving landscape create a distinct car insurance market. Several factors influence car insurance costs in the Sunshine State, including a high population density, frequent weather events, and a large number of uninsured drivers. Understanding these factors and the types of coverage required by law can help Florida residents navigate the car insurance landscape effectively.

Florida’s Unique Car Insurance Landscape

Florida’s car insurance market is shaped by several factors that contribute to higher premiums compared to other states.

- High Population Density: Florida’s large population leads to more vehicles on the road, increasing the likelihood of accidents. This higher risk translates to higher premiums for drivers.

- Frequent Weather Events: Florida is prone to hurricanes, severe thunderstorms, and other weather events that can cause significant damage to vehicles. Insurers factor in these risks when setting premiums.

- Large Number of Uninsured Drivers: Florida has a higher percentage of uninsured drivers than other states. This increases the risk for insured drivers who may be involved in accidents with uninsured motorists.

Required Car Insurance Coverage in Florida

Florida law mandates specific car insurance coverage for all drivers.

- Personal Injury Protection (PIP): PIP coverage covers medical expenses, lost wages, and other related costs for the policyholder and passengers in their vehicle, regardless of fault in an accident. It is mandatory in Florida and covers up to $10,000 per person.

- Property Damage Liability: This coverage protects the policyholder against financial responsibility for damages to another person’s property in an accident. Florida law requires a minimum of $10,000 in property damage liability coverage.

- Uninsured Motorist Coverage: This coverage protects policyholders in the event of an accident with an uninsured or underinsured driver. It covers medical expenses, lost wages, and other damages. Florida law requires a minimum of $10,000 in uninsured motorist coverage.

Common Car Insurance Discounts in Florida

Several discounts are available to Florida drivers to reduce their car insurance premiums.

- Good Driver Discount: This discount is offered to drivers with a clean driving record and no accidents or traffic violations.

- Safe Driving Course Discount: Completing a defensive driving course can qualify drivers for a discount on their premiums.

- Multi-Policy Discount: Insurers often offer discounts for bundling multiple insurance policies, such as car, home, and renters insurance.

Factors Affecting Car Insurance Prices: Best Price Car Insurance Florida

The cost of car insurance in Florida is influenced by a variety of factors, each playing a significant role in determining your premium. Understanding these factors can help you make informed decisions to potentially lower your insurance costs. This section delves into the key factors that influence car insurance premiums, providing insights into how they affect your overall cost.

Driving History

Your driving history is one of the most influential factors in determining your car insurance premium. Insurance companies consider your past driving record to assess your risk of future accidents. A clean driving record with no accidents or traffic violations will generally result in lower premiums, while a history of accidents or violations can significantly increase your costs.

- Accidents: Each accident, regardless of fault, can negatively impact your premium. The severity of the accident and the number of accidents you’ve been involved in will further influence the increase.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations can also lead to higher premiums. The severity of the violation and the number of violations you have will impact the increase.

- Driving Record Review: Insurance companies will review your driving record from the past 3-5 years, and sometimes even longer, to assess your risk.

Age

Age is another significant factor in car insurance pricing. Younger drivers, particularly those under 25, are generally considered higher risk due to their lack of experience and higher likelihood of accidents. As you age and gain more driving experience, your insurance premiums tend to decrease.

- Teen Drivers: Insurance companies often charge higher premiums for teenage drivers due to their inexperience and higher risk of accidents.

- Mature Drivers: Drivers over the age of 65 may also face higher premiums, as they are statistically more likely to be involved in accidents due to age-related factors.

- Experience Matters: The more experience you gain as a driver, the lower your insurance premiums are likely to be.

Vehicle Type

The type of vehicle you drive also plays a role in your insurance premium. Some vehicles are more expensive to repair or replace than others, and some are statistically more prone to accidents. This can influence the cost of your insurance.

- Luxury Vehicles: Luxury cars, SUVs, and high-performance vehicles are generally more expensive to repair and replace, leading to higher insurance premiums.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for lower insurance premiums.

- Vehicle Value: The value of your vehicle is a key factor in determining your insurance premium. Higher-value vehicles will generally have higher premiums.

Location

Your location in Florida can significantly impact your car insurance rates. Areas with higher crime rates, traffic congestion, and accident rates tend to have higher insurance premiums.

- Urban vs. Rural: Insurance premiums are generally higher in urban areas due to increased traffic congestion and higher risk of accidents.

- Statewide Variations: Insurance rates can vary significantly across different counties in Florida.

- Natural Disaster Risk: Areas prone to hurricanes, floods, or other natural disasters may face higher insurance premiums due to the increased risk of damage.

Credit Score

In Florida, your credit score can influence your car insurance rates. Insurance companies use your credit score as an indicator of your financial responsibility and risk assessment.

- Credit Score Impact: A higher credit score generally translates to lower car insurance premiums, while a lower credit score can result in higher premiums.

- Financial Responsibility: Insurance companies believe that individuals with good credit scores are more likely to be responsible drivers and pay their premiums on time.

- State Laws: Florida allows insurance companies to consider your credit score when determining your insurance rates.

Coverage Levels and Deductibles

The amount of coverage you choose and the deductible you select can significantly impact your car insurance premium.

- Coverage Levels: Higher coverage levels, such as comprehensive and collision coverage, provide more protection but come with higher premiums.

- Deductibles: A higher deductible means you pay more out-of-pocket in case of an accident, but your premium will be lower.

- Balancing Coverage and Cost: You need to find a balance between the level of coverage you need and the affordability of your premium.

Finding the Best Price

Finding the best price for car insurance in Florida involves a strategic approach that goes beyond simply comparing rates from a few providers. It’s about understanding your needs, exploring various options, and negotiating effectively to secure the most favorable terms.

Obtaining Multiple Car Insurance Quotes

To get the best price, you need to compare quotes from multiple car insurance companies. This allows you to see the range of rates available and identify the best deals. Here’s a step-by-step guide:

- Gather your information: Before you start, gather all the necessary information, such as your driver’s license number, vehicle identification number (VIN), and driving history. This will help you provide accurate information to each insurer.

- Use online comparison websites: Websites like Insurance.com, Policygenius, and The Zebra allow you to enter your information once and receive quotes from multiple insurers simultaneously. This is a convenient and time-saving method for comparing rates.

- Contact insurers directly: While online comparison websites are helpful, it’s also advisable to contact insurers directly. This allows you to discuss your specific needs and get personalized quotes.

- Request multiple quotes: When contacting insurers, be sure to request quotes from several different companies. This will give you a wider range of options to compare.

- Review the quotes carefully: Once you receive your quotes, review them carefully. Pay attention to the coverage limits, deductibles, and any additional fees or discounts offered.

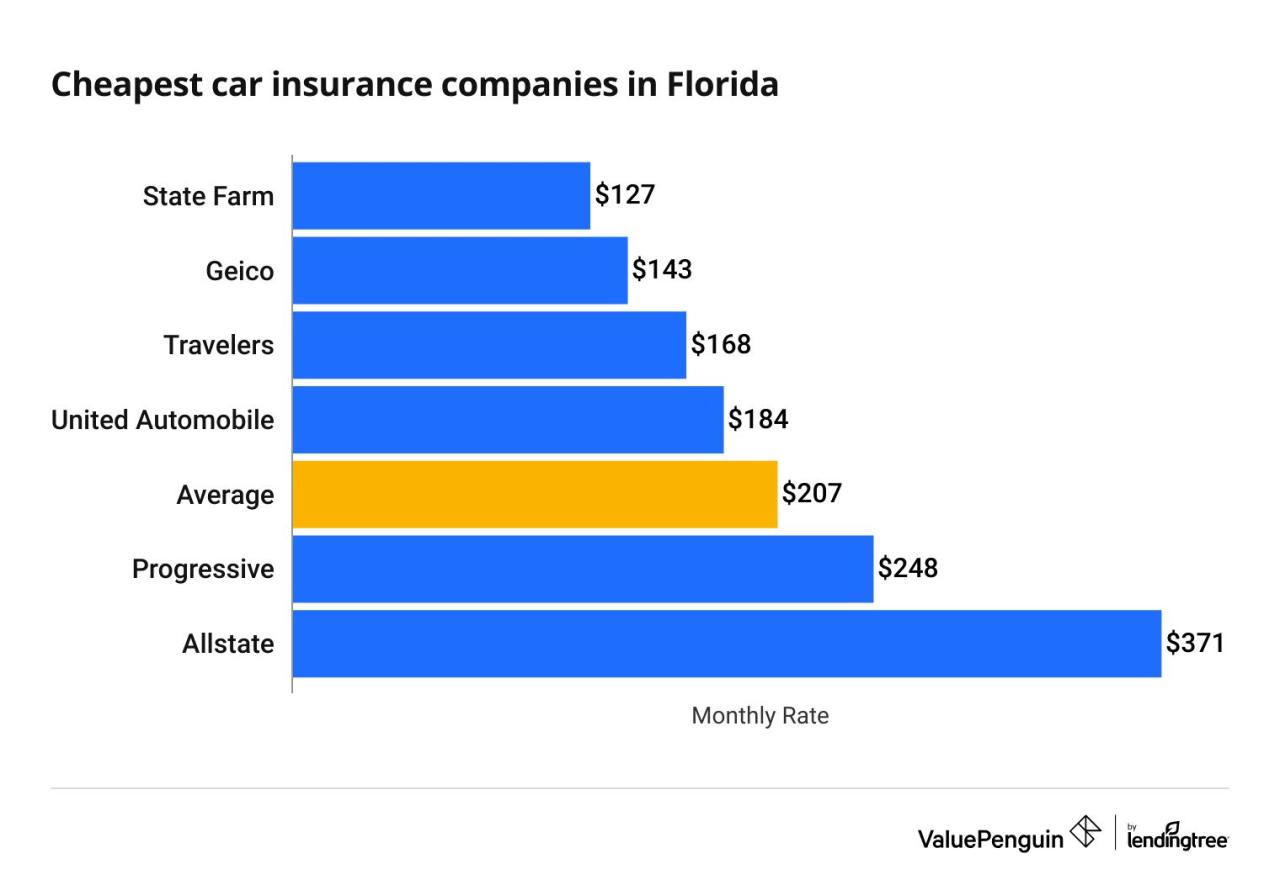

Top Car Insurance Companies in Florida

| Company | Customer Satisfaction | Financial Stability | Coverage Options |

|---|---|---|---|

| State Farm | High | Strong | Comprehensive |

| Geico | High | Strong | Comprehensive |

| Progressive | Moderate | Strong | Comprehensive |

| USAA | High | Strong | Comprehensive |

| Allstate | Moderate | Strong | Comprehensive |

Note: Customer satisfaction ratings are based on J.D. Power surveys, while financial stability is assessed by A.M. Best ratings. Coverage options may vary by insurer and state.

Negotiating Car Insurance Rates

While comparing quotes is essential, you can often negotiate your car insurance rates further. Here are some tips:

- Ask about discounts: Most insurers offer discounts for various factors, such as good driving records, safe driving courses, multiple policy bundling, and paying your premium in full. Be sure to inquire about these discounts and see if you qualify.

- Consider increasing your deductible: Increasing your deductible can lower your premium. However, it’s important to weigh this against your financial situation, as you’ll be responsible for paying a higher amount out of pocket in case of an accident.

- Shop around periodically: Don’t settle for the same insurer year after year. Shop around periodically to ensure you’re still getting the best rate.

- Be prepared to switch insurers: If you’re not satisfied with your current insurer, be prepared to switch. This can sometimes motivate your current insurer to offer you a better rate.

Avoiding Common Pitfalls

Navigating the world of Florida car insurance can be tricky, and many individuals make mistakes that end up costing them more than they should. Understanding these common pitfalls and taking preventative measures can save you a significant amount of money in the long run.

Choosing the Cheapest Policy Without Considering Coverage

While it’s tempting to go for the cheapest option, simply focusing on the premium without considering the coverage can lead to significant financial losses in case of an accident. A cheaper policy might have lower limits for liability, medical payments, or collision coverage, leaving you responsible for substantial out-of-pocket expenses.

- Evaluate your needs: Before comparing prices, assess your risk tolerance and potential financial exposure. Factors like the value of your car, your driving history, and your financial situation can influence your coverage needs.

- Compare coverage levels: Don’t just compare premiums; compare the coverage limits offered by different insurers. Ensure the policy covers your specific needs, such as comprehensive coverage for theft or damage from natural disasters, or higher liability limits for greater financial protection.

- Consider deductibles: A higher deductible generally means a lower premium, but you’ll have to pay more out of pocket in case of an accident. Choose a deductible you can comfortably afford, keeping in mind the potential financial impact of an accident.

Not Reading the Policy Terms and Conditions

It’s essential to understand the details of your policy before signing up. Skipping this step can lead to unpleasant surprises later on, such as discovering limitations on coverage or exclusions that you were unaware of.

- Review the policy document: Take the time to read through the entire policy document, paying attention to the fine print. Don’t hesitate to ask your insurance agent to clarify any terms or conditions you don’t understand.

- Understand exclusions: Be aware of specific situations or events that are not covered by your policy. For instance, certain policies might exclude coverage for specific types of accidents or damages.

- Check the coverage limits: Carefully review the coverage limits for different aspects of your policy, such as liability, medical payments, and collision coverage. Ensure they are adequate to cover your potential financial liabilities.

Driving Without Adequate Insurance

Driving without the required car insurance in Florida is illegal and can result in severe consequences, including fines, license suspension, and even jail time. It’s crucial to maintain the minimum required coverage and consider additional coverage for greater financial protection.

- Minimum coverage requirements: Florida law mandates a minimum level of car insurance coverage for all drivers, including:

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

- Property Damage Liability (PDL): Covers damages to other vehicles or property in an accident that you cause.

- Consequences of driving uninsured: Driving without adequate insurance can lead to:

- Fines: Up to $500 for the first offense, and up to $1,000 for subsequent offenses.

- License suspension: Your driver’s license can be suspended for up to three years.

- Jail time: You can be imprisoned for up to 90 days for driving without insurance.

- Financial burden: If you cause an accident without insurance, you’ll be responsible for all damages, including medical expenses and property repairs.

Additional Considerations

Beyond finding the best price, there are several other important factors to consider when purchasing car insurance in Florida. These include exploring resources for affordable options, understanding the claims process, and evaluating the benefits of bundling insurance policies.

Resources for Affordable Car Insurance, Best price car insurance florida

Finding affordable car insurance options in Florida can be challenging. However, several resources can help you navigate this process.

- Florida Office of Insurance Regulation (OIR): The OIR provides information on insurance companies, rates, and consumer rights. You can access their website for resources and contact information.

- Florida Department of Financial Services (DFS): The DFS offers consumer protection services, including information on insurance fraud and how to file complaints.

- Community Organizations: Some community organizations offer assistance with finding affordable car insurance. For example, the United Way of Florida may be able to provide referrals to local resources.

Filing a Car Insurance Claim

Understanding the car insurance claims process in Florida is crucial. This section Artikels the key steps involved in filing a claim and what to expect.

- Report the Accident: Immediately contact your insurance company to report the accident, providing details such as the date, time, location, and parties involved.

- File a Claim: Follow your insurance company’s instructions for filing a claim, which typically involves providing documentation such as a police report and photographs of the damage.

- Cooperate with Your Insurance Company: Provide all necessary information and documentation to your insurance company promptly. This includes attending any required inspections or assessments.

- Negotiate a Settlement: Once the claim is reviewed, your insurance company will provide a settlement offer. You have the right to negotiate this offer if you believe it is insufficient.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often result in significant cost savings. This is because insurance companies typically offer discounts for bundling multiple policies.

- Homeowners Insurance: Bundling your car insurance with homeowners insurance can save you money on both premiums.

- Renters Insurance: Similarly, bundling your car insurance with renters insurance can provide cost savings.

- Other Insurance Policies: In addition to homeowners and renters insurance, you may be able to bundle other policies, such as life insurance or health insurance, for additional discounts.

Epilogue

Navigating the world of car insurance in Florida can seem daunting, but with the right information and strategies, you can find the best price for your needs. By understanding the factors that influence premiums, comparing quotes from different providers, and taking advantage of available discounts, you can secure comprehensive coverage that fits your budget. Remember to review your policy regularly and make adjustments as your circumstances change to ensure you have the right level of protection.

FAQ Guide

What are the minimum car insurance requirements in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Uninsured Motorist Coverage (UM).

How can I get a free car insurance quote in Florida?

Most car insurance companies offer free online quotes. You can also contact an insurance agent or broker to get a quote over the phone or in person.

What factors affect car insurance rates in Florida?

Factors that affect car insurance rates in Florida include your driving history, age, vehicle type, location, credit score, coverage levels, and deductibles.

How can I lower my car insurance premiums in Florida?

You can lower your car insurance premiums by maintaining a good driving record, taking a defensive driving course, bundling your car insurance with other types of insurance, and choosing a higher deductible.

What happens if I drive without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time. You may also be responsible for all costs associated with any accidents you cause.