A list of life insurance companies can seem overwhelming, but it’s a crucial step in securing your family’s financial future. Think of it like choosing the perfect superhero for your team – you want someone reliable, strong, and ready to protect you when you need them most. Life insurance isn’t just about death; it’s about ensuring your loved ones are taken care of when you’re gone. From term life to whole life, there’s a policy out there for everyone, and this guide will help you navigate the options and find the perfect fit.

Life insurance can provide peace of mind knowing your family will be financially secure if something unexpected happens. It can cover everything from funeral expenses to mortgage payments, ensuring your loved ones aren’t burdened with debt and can focus on healing and moving forward. But with so many companies offering different policies, it’s important to do your research and choose the one that best suits your needs and budget.

Life Insurance: Your Safety Net

Life insurance is a financial safety net that helps your loved ones cope with the financial burden of your absence. It provides a lump-sum payment to your beneficiaries, which can be used to cover expenses like funeral costs, outstanding debts, mortgage payments, and even college tuition for your children.

Types of Life Insurance

Life insurance policies are categorized into various types, each offering unique features and benefits to suit different needs and financial situations. Understanding the different types of life insurance is crucial to selecting the policy that best aligns with your financial goals and risk tolerance.

- Term Life Insurance: Term life insurance is a straightforward and affordable option that provides coverage for a specific period, typically ranging from 10 to 30 years. If you die within the term, your beneficiaries receive the death benefit. However, if you outlive the term, the policy expires, and you don’t receive any cash value. Term life insurance is ideal for temporary needs like covering a mortgage or providing income replacement for a specific period.

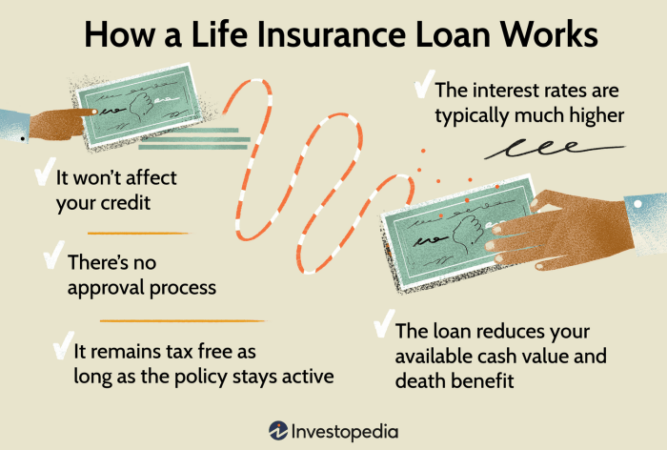

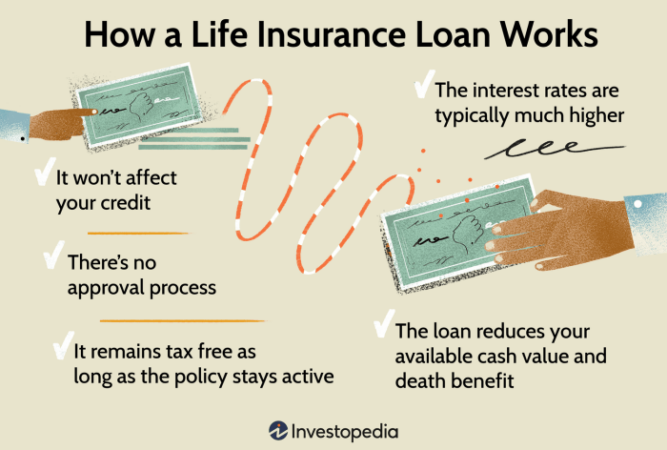

- Whole Life Insurance: Whole life insurance offers lifelong coverage, meaning it remains in effect as long as you pay the premiums. It also builds cash value, which grows over time and can be accessed through loans or withdrawals. Whole life insurance is a more expensive option than term life insurance, but it provides permanent coverage and a savings component.

- Universal Life Insurance: Universal life insurance combines death benefit coverage with a flexible savings component. You have more control over your premiums and death benefit, and you can adjust your coverage as your needs change. However, universal life insurance can be more complex and requires careful planning.

- Variable Life Insurance: Variable life insurance allows you to invest your premiums in sub-accounts that track the performance of various investment options, such as stocks or bonds. The death benefit and cash value fluctuate based on the investment performance. This type of insurance offers potential for higher returns but also carries greater risk.

- Indexed Universal Life Insurance: Indexed universal life insurance links your cash value growth to the performance of a specific market index, such as the S&P 500. It offers potential for higher returns than traditional universal life insurance but also carries some market risk.

Key Considerations for Choosing a Life Insurance Company

Choosing the right life insurance company is a big decision, and it’s important to do your research to make sure you’re getting the best possible coverage for your needs. There are many factors to consider, such as the financial stability of the company, the types of policies offered, and the customer service experience.

Financial Stability and Ratings

Financial stability is crucial when choosing a life insurance company. You want to make sure the company will be around to pay out your death benefit when the time comes. You can check the financial strength of a company by looking at its ratings from independent agencies such as A.M. Best, Moody’s, and Standard & Poor’s. These agencies assess a company’s financial health based on factors such as its capital reserves, investment performance, and claims-paying ability. A higher rating indicates a more financially stable company. For example, an A.M. Best rating of A+ or better is considered excellent, while a rating of B or lower may indicate financial instability.

Top Life Insurance Companies

Choosing the right life insurance company is a big decision, like choosing the right pizza toppings – you want to make sure you’re getting the best value for your money. And just like you wouldn’t trust your pizza to just any place, you shouldn’t trust your life insurance to just any company.

Top Life Insurance Companies

Here’s a list of some of the top life insurance companies in the US, based on factors like financial strength, customer satisfaction, and coverage options.

| Company | Location | Key Features |

|---|---|---|

| Northwestern Mutual | Milwaukee, WI | Strong financial ratings, wide range of products, excellent customer service. |

| New York Life | New York, NY | Long history, strong financial stability, diverse product offerings. |

| Prudential Financial | Newark, NJ | Large company with a variety of products, including life insurance, annuities, and retirement plans. |

| MassMutual | Springfield, MA | Known for its financial strength and customer service, offers a range of life insurance options. |

| State Farm | Bloomington, IL | Offers life insurance as part of a broader suite of insurance products, known for its accessibility and customer service. |

Factors to Consider When Comparing Life Insurance Companies

Choosing the right life insurance company is crucial for ensuring your loved ones are financially protected in the event of your passing. With so many options available, comparing different companies and their offerings is essential to find the best fit for your individual needs and budget.

Coverage Amount

The coverage amount, also known as the death benefit, is the sum of money your beneficiaries will receive upon your death. Determining the appropriate coverage amount is vital. Consider your family’s financial obligations, including mortgage payments, outstanding debts, and future educational expenses.

Premium Costs

Premiums are the regular payments you make to maintain your life insurance policy. Premium costs vary based on factors such as your age, health, coverage amount, and the type of policy you choose. It’s essential to compare premium costs from different companies to find the most affordable option without compromising coverage.

Policy Terms

Policy terms encompass the conditions and provisions of your life insurance contract. Key aspects to consider include the policy’s duration, grace period for premium payments, and any limitations or exclusions.

Riders and Add-ons

Riders are optional features that can be added to your life insurance policy to enhance its coverage. Common riders include:

- Accidental death benefit: Provides additional coverage if your death results from an accident.

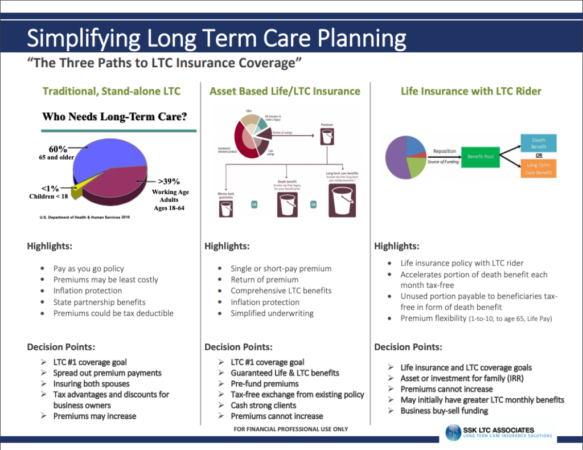

- Living benefits: Allow you to access a portion of your death benefit while you’re still alive, for situations like critical illness or long-term care.

- Waiver of premium: Waives premium payments if you become disabled.

Customer Service and Claims Processing

Customer service and claims processing procedures are crucial factors to consider. Look for companies with a reputation for responsiveness, efficiency, and transparency.

- Customer service: Research the company’s customer service ratings and reviews, and consider factors like availability of support channels (phone, email, online chat) and response times.

- Claims processing: Understand the company’s claims process, including the required documentation, timelines, and procedures for handling disputes.

Obtaining a Life Insurance Quote: A List Of Life Insurance Companies

Getting a life insurance quote is the first step in securing your financial future. It’s like trying on different shoes to find the perfect fit for your needs and budget.

Obtaining Quotes from Different Companies

Obtaining quotes from multiple companies allows you to compare prices, coverage options, and features. This empowers you to make an informed decision.

- Online Quote Request Forms: Most life insurance companies have user-friendly online forms where you can enter your information and receive a preliminary quote within minutes. Think of it like ordering a pizza online – quick and convenient.

- Phone Calls: Calling a life insurance company directly allows you to speak with an agent who can answer your questions and guide you through the quote process. It’s like having a personal shopper helping you find the right fit.

- Working with a Broker: An independent insurance broker can help you compare quotes from multiple companies, saving you time and effort. Imagine having a travel agent book your flights and hotels – they handle the details for you.

Comparing Quotes Effectively

Once you have quotes from several companies, it’s crucial to compare them side-by-side to determine the best value for your needs. It’s like comparing apples to apples, ensuring you’re getting the most for your money.

- Death Benefit: This is the amount of money your beneficiaries will receive upon your death. It’s like the prize money in a game show – the higher the payout, the better.

- Premium: This is the monthly or annual cost of your life insurance policy. It’s like the subscription fee for a streaming service – you want to find the best value for your entertainment dollar.

- Coverage Options: Different companies offer various coverage options, such as term life insurance, whole life insurance, and universal life insurance. Each option has its own features and benefits. It’s like choosing the right car – you want the one that best suits your lifestyle and budget.

- Riders: These are additional benefits that can be added to your policy, such as accidental death coverage or long-term care benefits. It’s like adding extra toppings to your pizza – you can customize your policy to meet your specific needs.

- Financial Stability of the Company: It’s important to choose a company with a strong financial history and a solid reputation. It’s like choosing a reliable bank – you want to ensure your money is in good hands.

Understanding the Terms and Conditions of Each Quote

Each life insurance quote comes with specific terms and conditions. It’s like reading the fine print before signing a contract – you want to understand what you’re agreeing to.

- Waiting Period: This is the time you must wait after purchasing the policy before it becomes fully effective. It’s like a grace period before a new membership takes effect.

- Exclusions: These are specific events or conditions that are not covered by the policy. It’s like the terms of service for a website – you want to know what’s not included.

- Renewal Options: Some policies offer renewal options, while others do not. It’s like renewing a magazine subscription – you want to know if you have the option to continue coverage.

Conclusion

So, you’re ready to level up your financial game and get that life insurance policy? Awesome! You’ve learned a ton about the different types of life insurance, how to choose the right company, and the key factors to consider when making your decision.

It’s like picking out the perfect pair of sneakers for your life—you want something that fits, supports you, and is gonna be there for you through thick and thin.

Choosing the Right Life Insurance Company, A list of life insurance companies

It’s important to remember that not all life insurance companies are created equal. You’ve got to find one that’s legit, trustworthy, and has your back. It’s like picking a teammate—you want someone reliable, strong, and ready to win. Think of it like this: you’re putting your trust in them to protect your loved ones in case something happens.

Choosing the right life insurance company is like picking the right team to support you—you want a reliable and trustworthy partner that has your back.

So, what are the key ingredients for finding the right life insurance company?

- Financial Stability: Make sure they’re not about to go bankrupt! You want a company that’s been around for a while and has a solid track record. It’s like checking out a restaurant—you want to see if they’re packed, right? That means they’re good!

- Customer Service: You want a company that’s there for you when you need them. That means responsive customer service and easy-to-understand policies. It’s like having a good friend—they’re always there to listen and help you out.

- Reputation: Do your homework and check out the company’s reputation. Look at reviews, talk to people who have used them, and see what the experts say. It’s like checking out a movie before you watch it—you want to make sure it’s good, right?

Last Recap

Choosing a life insurance company is a big decision, but it doesn’t have to be a stressful one. By understanding the different types of policies, comparing companies, and considering your unique needs, you can find the right coverage to protect your family. Remember, it’s about finding the right superhero to stand by your side, ensuring your loved ones are safe and secure, no matter what the future holds.

Questions and Answers

What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specific period, like 10, 20, or 30 years. It’s generally more affordable than whole life insurance, but it doesn’t build cash value. Whole life insurance provides lifetime coverage and builds cash value that you can borrow against. It’s a more expensive option, but it can be a good investment if you want a long-term policy with savings features.

How much life insurance do I need?

The amount of life insurance you need depends on your individual circumstances, including your income, debts, dependents, and financial goals. A good rule of thumb is to have enough coverage to replace your income for 10-15 years, cover outstanding debts, and provide for your family’s living expenses. You can use online calculators or consult with a financial advisor to determine the right amount for you.

What are some factors to consider when choosing a life insurance company?

When choosing a life insurance company, it’s important to consider factors like financial stability, ratings, coverage options, premiums, customer service, and claims processing procedures. Look for companies with a strong financial track record, good ratings from independent agencies, and a history of fair and efficient claims handling.