A rated life insurance companies – A-rated life insurance companies are the VIPs of the insurance world, offering peace of mind and financial stability like no other. They’re the ones with the solid reputation, the financial muscle, and the commitment to protecting your loved ones. So, buckle up and let’s dive into the world of A-rated life insurance, where your future is secure and your worries fade away.

Think of it like this: When you’re picking a life insurance policy, you want to make sure you’re going with a company that’s got your back, right? An A rating means they’ve got the financial strength and track record to pay out your claims when you need them most. It’s like having a trusted friend who’s always got your best interests at heart.

Understanding A-Rated Life Insurance Companies

Choosing the right life insurance policy is a big decision, and you want to make sure you’re working with a company you can trust. One way to gauge the financial strength and stability of a life insurance company is by looking at its rating. A-rated life insurance companies are considered to be financially sound and reliable, making them a good choice for policyholders.

Meaning of an A Rating

An A rating, often referred to as “A-rated,” signifies that a life insurance company has been assessed as having a strong financial standing by independent rating agencies. These agencies, such as AM Best, Moody’s, and Standard & Poor’s, evaluate various factors to determine a company’s financial strength.

Significance of an A Rating for Policyholders

An A rating is significant for policyholders because it indicates a high likelihood that the insurance company will be able to fulfill its financial obligations to its policyholders. This means that you can have greater confidence that your beneficiaries will receive the death benefit when the time comes.

Key Factors Contributing to an A Rating

Several key factors contribute to an A rating for insurance companies:

* Strong Capitalization: A-rated companies typically have a substantial amount of capital, which acts as a financial cushion to absorb unexpected losses.

* Sound Investment Practices: They invest their assets wisely, ensuring a healthy return on investment and a stable financial base.

* Effective Risk Management: A-rated companies have robust risk management practices to minimize potential losses and maintain financial stability.

* Strong Management Team: A-rated companies are led by experienced and skilled management teams with a proven track record.

* Positive Operating Performance: They demonstrate consistent profitability and strong financial performance.

Benefits of Choosing A-Rated Life Insurance Companies

Choosing a life insurance company with a strong financial rating is like choosing a sturdy foundation for your financial future. It means you’re picking a company that’s been proven to be reliable, trustworthy, and capable of fulfilling its promises, even during tough times. An A-rating is a signal that a company has met rigorous financial standards, offering you peace of mind and confidence that your loved ones will be taken care of.

Financial Stability and Security

An A-rated life insurance company is like a rock-solid fortress for your financial security. They’ve earned this rating through years of sound financial management, demonstrating their ability to withstand market fluctuations and economic storms. This means they’re less likely to face financial difficulties, ensuring that they’ll be there to pay out your death benefit when the time comes.

- Stronger Capital Reserves: A-rated companies maintain significant capital reserves, which act as a safety net to absorb unexpected losses and ensure they can fulfill their obligations to policyholders.

- Lower Risk of Insolvency: A-rating signifies a lower risk of insolvency, meaning the company is unlikely to go bankrupt. This protects you from the heartbreak of losing your life insurance policy and the financial security it provides.

- Stable Investment Practices: These companies invest prudently, minimizing risk and ensuring the long-term sustainability of their operations. This translates into greater stability for your policy and the assurance that your death benefit will be available when needed.

Policyholder Confidence and Peace of Mind

Imagine knowing that your loved ones are protected by a company that’s been vetted and recognized for its financial strength. That’s the peace of mind that comes with choosing an A-rated life insurance company. It’s like having a guardian angel watching over your family’s financial well-being.

- Trustworthy Reputation: A-ratings are a testament to a company’s trustworthiness and commitment to its policyholders. This reputation inspires confidence and reassures you that your family’s financial future is in good hands.

- Reduced Worry and Stress: Knowing your life insurance policy is backed by a financially stable company reduces the stress and worry associated with life’s uncertainties. You can focus on living your life knowing your loved ones are protected.

- Increased Security for Your Family: An A-rating provides a sense of security for your family, knowing that their financial future is anchored by a reliable and financially sound institution.

Key Considerations for Choosing A-Rated Companies: A Rated Life Insurance Companies

Choosing an A-rated life insurance company is a big decision, and it’s important to consider all your options. While an A-rating is a good indicator of financial stability, it’s not the only factor to consider. You’ll want to ensure you’re getting the best coverage at a price that fits your budget.

Comparing Different A-Rated Companies

A-rated companies offer a range of policies, each with its own unique features and benefits. You’ll want to compare and contrast different A-rated companies based on their specific offerings to find the best fit for your needs.

Factors to Consider

- Premiums: Compare premiums from different companies for similar coverage amounts. Consider factors like your age, health, and lifestyle when comparing premiums.

- Coverage: Look at the types of coverage offered by each company. Some companies may offer additional benefits, such as accidental death coverage or critical illness coverage. Make sure you understand the terms and conditions of each policy.

- Customer Service: Check out customer reviews and ratings to get a sense of the company’s customer service. You want to choose a company that is responsive and helpful.

- Financial Stability: While A-rated companies are generally considered financially stable, it’s still important to check their financial ratings and track record. You can find this information on websites like A.M. Best and Standard & Poor’s.

Illustrative Table of A-Rated Companies

The following table illustrates some key aspects of A-rated companies:

| Company | Premium (Monthly) | Coverage (Death Benefit) | Customer Service Rating |

|---|---|---|---|

| Company A | $50 | $500,000 | 4.5 Stars |

| Company B | $60 | $600,000 | 4 Stars |

| Company C | $45 | $400,000 | 4.8 Stars |

Note: The above table is for illustrative purposes only and should not be considered a definitive guide. Premiums and coverage amounts will vary depending on individual circumstances. It is essential to contact the insurance companies directly for personalized quotes and information.

Understanding the Impact of Ratings on Policyholders

It’s important to understand that life insurance ratings aren’t just some abstract numbers. They have a real impact on you, the policyholder, both now and in the future. So, let’s break down how these ratings affect your policy and your wallet.

The Implications of Rating Changes on Existing Policies and Future Premiums

Think of it like this: A-rated life insurance companies are like the A-list celebrities of the insurance world. They’re reliable, dependable, and have a track record of success. But just like celebrities, they can have their ups and downs. If a company’s rating drops, it could affect your existing policy in a few ways.

First, your policy might become less valuable. A lower rating might make it harder to sell your policy on the secondary market or to borrow against it. Second, your premiums could increase. If the company’s financial stability weakens, they might need to charge higher premiums to cover their costs.

Now, let’s talk about the flip side. If a company’s rating improves, it’s good news for you. It means they’re becoming even more financially secure, and that could translate into lower premiums or better policy benefits.

The Role of Regulatory Oversight in Maintaining the Integrity of Insurance Ratings

It’s not like the Wild West out there, where insurance companies can just do whatever they want. State insurance regulators play a big role in ensuring that ratings are accurate and reflect the true financial health of companies. These regulators conduct regular audits, review financial statements, and enforce rules to ensure that companies are meeting their obligations to policyholders.

Think of them as the insurance industry’s referees, making sure everyone plays by the rules and keeps things fair.

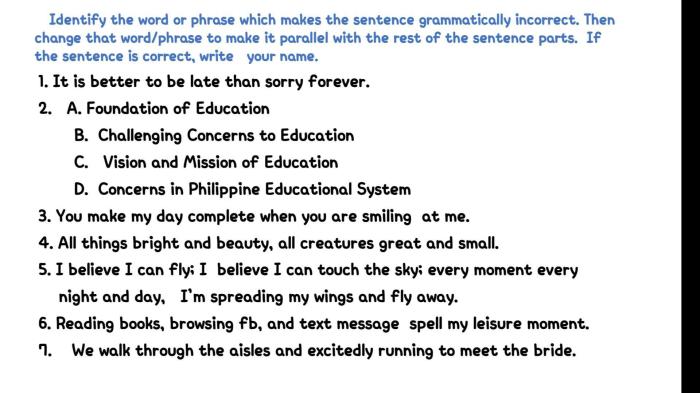

Potential Impact of Different Rating Levels on Policyholders, A rated life insurance companies

Here’s a table summarizing the potential impact of different rating levels on policyholders:

| Rating Level | Potential Impact on Policyholders |

|---|---|

| A++ | Highest financial strength, lowest risk of policyholder losses, potential for lower premiums. |

| A+ | Strong financial strength, low risk of policyholder losses, generally stable premiums. |

| A | Good financial strength, moderate risk of policyholder losses, premiums may fluctuate slightly. |

| B++ | Financial strength is adequate, higher risk of policyholder losses, premiums may be higher than A-rated companies. |

| B+ | Financial strength is below average, higher risk of policyholder losses, premiums may be significantly higher. |

| B | Financial strength is weak, high risk of policyholder losses, premiums may be very high and subject to significant fluctuations. |

Remember, this is just a general overview. It’s always best to consult with a qualified financial advisor to understand the specific implications of ratings for your individual situation.

Last Word

Choosing an A-rated life insurance company is a smart move that ensures your financial future and gives you the peace of mind to focus on what matters most. By understanding the benefits, considering your options, and researching thoroughly, you can find the perfect policy that fits your needs and provides a safety net for your loved ones. Remember, it’s not just about the policy, it’s about the company behind it, and with an A rating, you know you’re in good hands.

FAQ Guide

What does an A rating actually mean?

An A rating signifies that a life insurance company has a strong financial standing and is considered reliable in paying out claims. It’s a sign of their financial stability and commitment to their policyholders.

How often are insurance ratings updated?

Insurance ratings are regularly reviewed and updated by independent rating agencies. The frequency of updates varies depending on the agency, but they generally happen on a quarterly or annual basis.

Can a company’s rating change over time?

Yes, a company’s rating can change over time based on factors like financial performance, claims experience, and regulatory compliance. It’s important to stay informed about any changes to a company’s rating.

Are there any other types of ratings besides A?

Yes, there are various rating levels, ranging from A to lower levels like B, C, and even D. Each rating reflects a different level of financial strength and reliability.