- Understanding the Affordable Care Act in Florida

- Navigating Florida’s Health Insurance Marketplace

- Financial Assistance and Eligibility

- Key Considerations for Floridians

- Impact on Different Populations

- Future of Affordable Care in Florida: Affordable Care Act Insurance Florida

- Final Wrap-Up

- Essential FAQs

Affordable care act insurance florida – Affordable Care Act insurance in Florida, also known as Obamacare, has significantly impacted healthcare access and affordability for residents. The Affordable Care Act (ACA) has brought about major changes to the health insurance landscape in Florida, with both positive and negative implications for individuals and families. This comprehensive guide will delve into the intricacies of the ACA in Florida, exploring its key provisions, the Florida Health Insurance Marketplace, financial assistance programs, and the unique challenges faced by Floridians in accessing affordable healthcare.

From understanding eligibility requirements and navigating the Marketplace to exploring the impact of the ACA on different populations, this guide aims to provide a clear and concise overview of the ACA’s role in shaping healthcare in the Sunshine State.

Understanding the Affordable Care Act in Florida

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted health insurance coverage and affordability in Florida. This landmark legislation aimed to expand health insurance access and affordability for millions of Americans, including Floridians.

Key Provisions of the ACA in Florida, Affordable care act insurance florida

The ACA introduced several key provisions that have shaped health insurance in Florida, including:

- Individual Mandate: This provision required most Americans to have health insurance or face a penalty. The individual mandate was repealed in 2017, but Florida continues to offer subsidies for individuals and families who purchase insurance through the Health Insurance Marketplace.

- Medicaid Expansion: The ACA allowed states to expand Medicaid eligibility to cover more low-income individuals. However, Florida declined to expand Medicaid, leaving a significant gap in coverage for many residents.

- Health Insurance Marketplace: The ACA created the Health Insurance Marketplace, a platform where individuals and families can compare and purchase health insurance plans from private insurers. Floridians can access the Marketplace through the federal website, Healthcare.gov.

- Essential Health Benefits: The ACA requires all health insurance plans to cover a set of essential health benefits, including preventive care, hospitalization, prescription drugs, and mental health services. This ensures that Floridians have access to a comprehensive set of benefits, regardless of their chosen plan.

- Premium Tax Credits: The ACA provides premium tax credits to help individuals and families afford health insurance. These credits are available to those who purchase plans through the Marketplace and meet certain income requirements. In Florida, these credits have helped many residents access affordable coverage.

Navigating Florida’s Health Insurance Marketplace

The Florida Health Insurance Marketplace, also known as the HealthCare.gov website, is a platform where Floridians can explore and enroll in health insurance plans that meet their individual needs and budgets. Navigating this marketplace requires understanding the enrollment process, the different types of plans available, and the resources available to guide you through the process.

Enrollment Process

The enrollment process for health insurance through the Florida Health Insurance Marketplace is straightforward and can be completed online, over the phone, or with the assistance of a certified enrollment assister.

- Create an Account: You will need to create an account on the HealthCare.gov website or through the Marketplace’s mobile app. This account will store your personal information and allow you to access your plan details and manage your coverage.

- Provide Information: Once you have created an account, you will be asked to provide personal information, including your income, household size, and any dependents you may have. This information will help determine your eligibility for financial assistance and the types of plans you qualify for.

- Compare Plans: The Marketplace will then present you with a list of plans that meet your eligibility criteria. You can compare plans based on factors such as monthly premiums, deductibles, copayments, and coverage details.

- Select a Plan: After reviewing the available plans, you can select the one that best meets your needs and budget. You can also make changes to your plan during the open enrollment period or if you experience a qualifying life event, such as a job loss or marriage.

- Enroll: Once you have selected a plan, you can enroll and confirm your choice. Your coverage will typically begin on the first day of the month following your enrollment.

Types of Health Insurance Plans

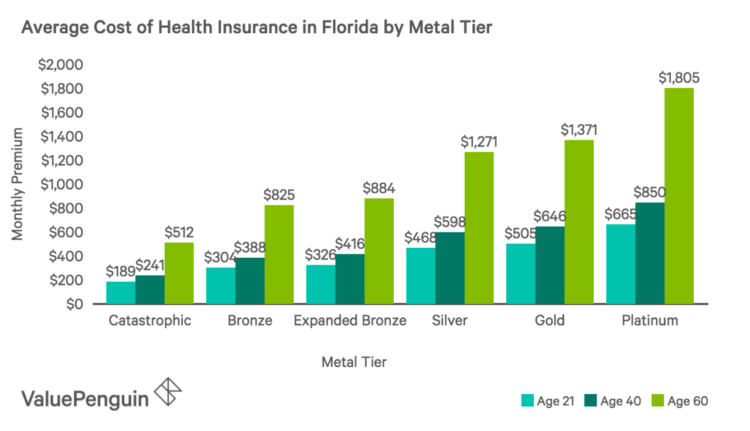

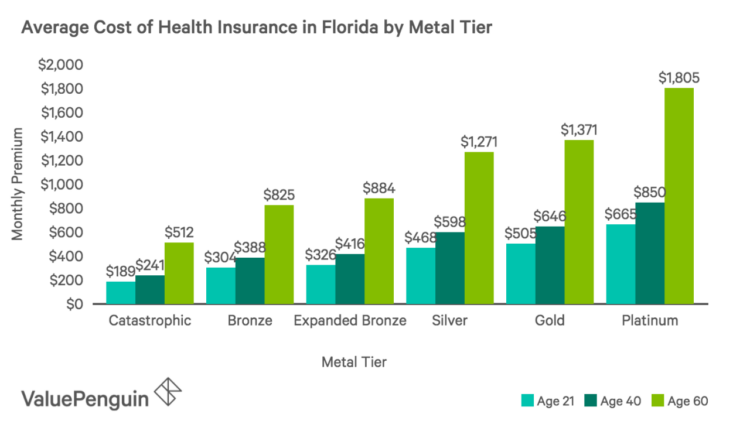

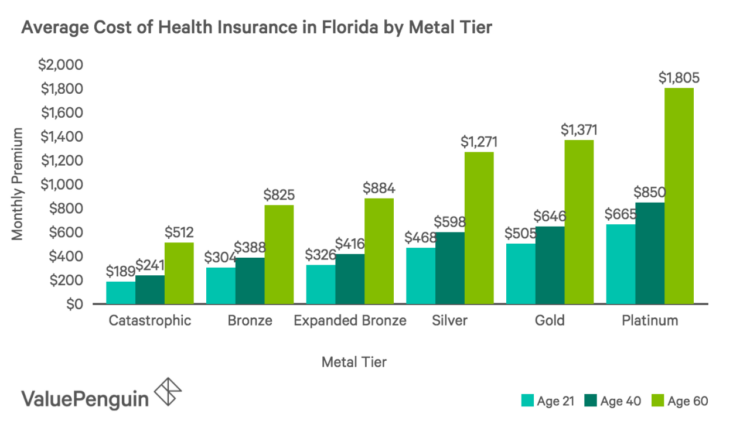

The Florida Health Insurance Marketplace offers a variety of health insurance plans, each with its own coverage and cost structure. The main types of plans available include:

- Bronze: Bronze plans have the lowest monthly premiums but have higher deductibles and copayments. This means you will pay less each month but will likely pay more out-of-pocket for healthcare services.

- Silver: Silver plans offer a balance between premiums and out-of-pocket costs. They have lower deductibles and copayments than bronze plans but higher premiums.

- Gold: Gold plans have higher premiums than silver plans but offer lower deductibles and copayments, resulting in lower out-of-pocket costs for healthcare services.

- Platinum: Platinum plans have the highest premiums but the lowest deductibles and copayments, providing the most comprehensive coverage and the lowest out-of-pocket expenses.

- Catastrophic: Catastrophic plans are available to individuals under 30 or those with a hardship exemption. They have very low monthly premiums but cover only essential health benefits and have very high deductibles.

Resources and Tools

The Florida Health Insurance Marketplace provides various resources and tools to help Floridians navigate the enrollment process and choose the right plan:

- Plan Comparison Tool: The Marketplace offers a comprehensive plan comparison tool that allows you to compare different plans based on your specific needs and budget.

- Enrollment Assistance: Certified enrollment assisters are available to provide personalized guidance and support throughout the enrollment process. They can answer questions, explain coverage options, and help you find the right plan.

- Financial Assistance: The Marketplace offers financial assistance in the form of tax credits to help eligible individuals and families afford their health insurance premiums. The amount of financial assistance you receive depends on your income and household size.

- Open Enrollment Period: The open enrollment period for health insurance through the Marketplace runs from November 1st to January 15th each year. During this period, you can enroll in a new plan or make changes to your existing coverage.

Financial Assistance and Eligibility

The Affordable Care Act (ACA) offers financial assistance to help Floridians afford health insurance. These programs, available through the Health Insurance Marketplace, aim to make coverage accessible to a broader population.

Tax Credits and Subsidies

The ACA provides tax credits and subsidies to lower the cost of health insurance premiums. These financial assistance programs are based on income and family size.

- Premium Tax Credits: These credits reduce the monthly cost of health insurance premiums. The amount of the tax credit is calculated based on household income and the cost of the chosen health plan. The tax credit is applied directly to the premium, reducing the amount the individual or family pays each month.

- Cost-Sharing Reductions: These subsidies reduce out-of-pocket costs, such as deductibles, copayments, and coinsurance. These reductions are available to individuals and families with incomes below a certain threshold.

Income Eligibility Requirements

To qualify for financial assistance, individuals and families must meet specific income eligibility requirements. These requirements vary depending on family size and the state of residence.

- Modified Adjusted Gross Income (MAGI): The ACA uses MAGI to determine eligibility for financial assistance. MAGI is a measure of income used for tax purposes and includes various income sources, such as wages, salaries, interest, dividends, and capital gains.

- Income Thresholds: The income thresholds for eligibility vary depending on family size. For example, in 2023, a single individual with a MAGI of up to $51,040 qualifies for premium tax credits. For a family of four, the MAGI threshold is $133,500.

Impact on Affordability

The financial assistance programs under the ACA have significantly improved affordability for Floridians seeking health insurance.

- Reduced Premiums: Tax credits have reduced the cost of health insurance premiums for millions of Americans, including Floridians. This has made health insurance more accessible to individuals and families who previously could not afford it.

- Lower Out-of-Pocket Costs: Cost-sharing reductions have reduced the out-of-pocket costs associated with healthcare services, making healthcare more affordable for low- and moderate-income individuals and families.

- Increased Coverage: The combination of tax credits and subsidies has resulted in a significant increase in the number of Floridians with health insurance. This has led to improved health outcomes and reduced financial burdens for many individuals and families.

Key Considerations for Floridians

Florida faces unique challenges when it comes to healthcare affordability and access. The state has a large and diverse population, with a significant portion of residents being elderly or living in rural areas. These factors can influence the cost and availability of healthcare services, making it crucial for Floridians to understand the nuances of the Affordable Care Act and how it applies to their specific needs.

Demographics and Healthcare Needs in Florida

Florida’s population is characterized by a high concentration of seniors, with a large number of individuals over 65 years of age. This demographic trend contributes to a higher demand for healthcare services, particularly those related to chronic conditions and long-term care. Additionally, Florida has a significant Hispanic population, which often faces language barriers and cultural differences that can hinder access to healthcare.

Geographic Location and Healthcare Access

Florida’s vast geographic area presents challenges for healthcare access, particularly in rural communities. Limited availability of healthcare providers and facilities, as well as transportation barriers, can make it difficult for individuals in these areas to receive timely and affordable care.

State-Specific Programs and Initiatives

Florida has implemented several programs and initiatives to support affordable healthcare for its residents. These include:

- Florida Healthy Kids Corporation: This program provides health insurance to children from low-income families.

- Florida KidCare: A comprehensive health insurance program for children and families with limited incomes.

- Florida Medicaid: A federal-state partnership that provides health insurance to low-income individuals and families.

“These state-specific programs play a vital role in ensuring that Floridians have access to affordable healthcare, particularly for vulnerable populations.”

Factors Influencing Healthcare Affordability

Several factors can influence the affordability of healthcare in Florida, including:

- Cost of Living: Florida’s high cost of living, particularly in urban areas, can impact healthcare affordability, as individuals may have less disposable income to spend on healthcare expenses.

- Healthcare Provider Availability: Limited availability of healthcare providers in certain areas can lead to higher prices due to lower competition.

- Insurance Premiums and Out-of-Pocket Costs: Florida’s insurance market can be competitive, with varying premium rates and out-of-pocket costs, making it important for individuals to compare plans carefully.

“Understanding these factors and exploring available resources is crucial for Floridians to make informed decisions about their healthcare options.”

Impact on Different Populations

The Affordable Care Act (ACA) has had a significant impact on healthcare access and affordability for various populations in Florida. This section explores the specific effects on seniors, low-income individuals, and families, highlighting the challenges they face and potential solutions.

Seniors

Seniors in Florida have benefited from the ACA’s expansion of Medicaid eligibility and the creation of health insurance marketplaces. The ACA’s provisions have helped seniors access affordable healthcare, including preventive services, prescription drugs, and coverage for pre-existing conditions.

- Expanded Medicaid Eligibility: The ACA’s expansion of Medicaid eligibility has provided health insurance coverage to millions of low-income individuals, including many seniors. This expansion has significantly reduced the number of uninsured seniors in Florida, improving access to essential healthcare services.

- Medicare Prescription Drug Coverage: The ACA’s Medicare Prescription Drug Improvement and Modernization Act (MMA) expanded Medicare Part D coverage, providing seniors with more affordable access to prescription drugs. The MMA also created a program to help low-income seniors afford prescription drugs.

- Preventive Services: The ACA mandates that Medicare cover preventive services, such as annual wellness visits and screenings for diseases like cancer and heart disease. These preventive services can help seniors identify health problems early and receive timely treatment, leading to better health outcomes and lower healthcare costs.

Low-Income Individuals

The ACA’s expansion of Medicaid and the creation of health insurance marketplaces have been particularly impactful for low-income individuals in Florida. These programs have significantly reduced the number of uninsured individuals in the state, improving access to affordable healthcare and reducing financial strain.

- Medicaid Expansion: The ACA’s expansion of Medicaid eligibility has provided health insurance coverage to millions of low-income individuals in Florida, including those who were previously ineligible. This expansion has significantly reduced the number of uninsured individuals in the state, improving access to essential healthcare services.

- Financial Assistance: The ACA provides financial assistance to low-income individuals to help them afford health insurance premiums and out-of-pocket costs. This assistance is available through the health insurance marketplaces, making coverage more affordable for many low-income individuals.

- Essential Health Benefits: The ACA mandates that all health insurance plans offered through the marketplaces must cover essential health benefits, including preventive services, prescription drugs, and mental health services. This ensures that low-income individuals have access to a comprehensive set of healthcare services.

Families

The ACA has had a significant impact on families in Florida, providing them with access to affordable healthcare and reducing the financial burden of healthcare costs.

- Dependent Coverage: The ACA allows children to stay on their parents’ health insurance plans until they turn 26, regardless of their marital status or whether they are a student. This provision has provided health insurance coverage to millions of young adults, reducing the number of uninsured individuals in the state.

- Preventive Services: The ACA mandates that all health insurance plans cover preventive services, such as vaccinations, screenings, and counseling. These preventive services can help families identify health problems early and receive timely treatment, leading to better health outcomes and lower healthcare costs.

- Financial Assistance: The ACA provides financial assistance to families to help them afford health insurance premiums and out-of-pocket costs. This assistance is available through the health insurance marketplaces, making coverage more affordable for many families.

Future of Affordable Care in Florida: Affordable Care Act Insurance Florida

The Affordable Care Act (ACA) has significantly impacted healthcare access and affordability in Florida, but its future remains uncertain. Ongoing legal challenges, political shifts, and evolving healthcare needs necessitate an examination of potential changes and their implications.

Potential Changes and Updates to the ACA

Florida’s healthcare landscape is subject to continuous evolution, influenced by both federal and state-level policy decisions. Several potential changes could impact the ACA’s implementation and its long-term effects on healthcare access and affordability in the state.

- Federal Legislation: The ACA has been subject to numerous attempts at repeal or modification since its inception. Future legislative changes, either at the federal or state level, could alter the ACA’s provisions and impact healthcare access and affordability in Florida. For example, changes to subsidies, eligibility requirements, or essential health benefits could affect the number of Floridians who qualify for coverage and the cost of premiums.

- State-Level Policies: Florida has the option to implement policies that expand or restrict access to healthcare. The state could choose to expand Medicaid eligibility, implement state-based marketplaces, or enact other measures that impact the ACA’s reach.

- Court Challenges: The ACA has faced legal challenges since its passage. Future court rulings could alter key provisions of the law, impacting healthcare access and affordability in Florida. For instance, a ruling striking down the individual mandate could lead to a decrease in the number of insured individuals, potentially affecting the stability of the insurance market.

Long-Term Implications of Changes

Potential changes to the ACA in Florida could have far-reaching consequences for healthcare access and affordability.

- Healthcare Affordability: Changes to subsidies or eligibility requirements could impact the affordability of healthcare for Floridians. Reductions in subsidies could lead to higher premiums, making coverage unaffordable for some individuals and families. Changes to eligibility requirements could exclude individuals from coverage, leaving them without access to essential healthcare services.

- Healthcare Access: Modifications to the ACA could impact the availability and accessibility of healthcare services in Florida. Changes to essential health benefits could limit the scope of coverage, potentially leading to a decline in the quality of care. Reductions in subsidies could lead to a decrease in enrollment in health insurance plans, potentially affecting the financial viability of healthcare providers.

Emerging Trends and Innovations in Healthcare

The healthcare landscape is constantly evolving, with emerging trends and innovations impacting the future of affordable care in Florida.

- Telehealth: Telehealth has gained significant momentum, offering remote access to healthcare services. This technology could expand access to care in rural areas and reduce healthcare costs by minimizing the need for in-person visits.

- Value-Based Care: Value-based care models focus on improving patient outcomes and reducing healthcare costs. These models incentivize healthcare providers to deliver high-quality care at a lower cost, potentially improving healthcare affordability and access in Florida.

- Artificial Intelligence (AI): AI applications in healthcare are becoming increasingly prevalent. AI can assist with tasks such as diagnosis, treatment planning, and drug discovery, potentially improving the efficiency and effectiveness of healthcare delivery.

Final Wrap-Up

The Affordable Care Act has undeniably brought about significant changes to healthcare in Florida, offering both opportunities and challenges. Understanding the ACA’s provisions, navigating the Marketplace, and accessing financial assistance are crucial steps for Floridians seeking affordable healthcare. While the future of the ACA remains uncertain, its impact on the state’s healthcare system is undeniable, and it continues to be a subject of ongoing debate and discussion.

Essential FAQs

What are the different types of plans available on the Florida Health Insurance Marketplace?

The Florida Health Insurance Marketplace offers a variety of plans, including Bronze, Silver, Gold, and Platinum, each with varying levels of coverage and costs.

How can I determine if I am eligible for financial assistance through the Marketplace?

Eligibility for financial assistance is based on your income level and household size. You can use the Marketplace’s online tools or contact a certified enrollment assister to determine your eligibility.

What are the key differences between the Affordable Care Act and Florida’s Medicaid program?

The Affordable Care Act expands Medicaid eligibility for certain low-income individuals and families, while Florida’s Medicaid program has its own eligibility requirements and benefits.