Aggregate stocks, also known as market indices, represent the collective performance of a large group of companies. They provide a snapshot of the overall health of the stock market, giving investors a way to track and invest in the broader economy. From the Dow Jones Industrial Average to the S&P 500, these indices are like the stock market’s A-list, showcasing the top performers and giving us a glimpse into the market’s pulse.

These indices are more than just numbers; they are a powerful tool for investors of all levels. They offer a way to diversify your portfolio, track market trends, and even implement specific investment strategies. Whether you’re a seasoned pro or just starting your investing journey, understanding aggregate stocks is key to navigating the world of finance.

What are Aggregate Stocks?

Think of aggregate stocks as a giant basket filled with a whole bunch of different stocks. It’s like having a super-sized portfolio that gives you a broad overview of how the stock market is doing.

Instead of picking individual stocks, aggregate stocks group together a large number of companies, representing various industries and sectors. This helps investors get a more comprehensive picture of the market’s performance.

Examples of Aggregate Stock Indexes

Aggregate stocks are often represented by stock indexes, which are like a scorecard for the overall market. Here are some popular examples:

- S&P 500: This index tracks the performance of 500 of the largest publicly traded companies in the United States. It’s considered a good indicator of the overall health of the US stock market.

- Dow Jones Industrial Average (DJIA): This index tracks 30 large, publicly owned companies in various industries. It’s one of the oldest and most widely followed stock indexes in the world.

- Nasdaq Composite: This index tracks the performance of over 3,000 companies listed on the Nasdaq Stock Market, focusing on technology and growth-oriented companies.

Types of Aggregate Stock Indices: Aggregate Stocks

Aggregate stock indices, also known as market indices, are benchmarks that track the performance of a group of stocks. They are used to gauge the overall health of the stock market and as a basis for investment strategies. Different types of aggregate stock indices use different methodologies to calculate their values, leading to variations in their performance and suitability for different investment objectives.

Market-Cap Weighted Indices

Market-cap weighted indices are the most common type of aggregate stock index. These indices are calculated by weighting each stock’s price by its market capitalization, which is the total value of all outstanding shares. This means that larger companies with higher market caps have a greater influence on the index’s value.

For example, the S&P 500, one of the most widely followed market indices, is a market-cap weighted index that tracks the performance of 500 large-cap U.S. companies. The largest companies in the S&P 500, such as Apple and Microsoft, have a greater impact on the index’s value than smaller companies.

The formula for calculating a market-cap weighted index is:

Index Value = (Sum of (Stock Price x Number of Outstanding Shares)) / (Divisor)

- Advantages: Market-cap weighted indices are considered to be representative of the overall market because they give more weight to larger companies, which are typically more stable and have a greater impact on the economy.

- Disadvantages: Market-cap weighted indices can be biased towards large companies, which may not always reflect the performance of smaller companies or emerging sectors. They can also be susceptible to volatility, especially during periods of market downturns.

Equal-Weighted Indices

Equal-weighted indices are calculated by giving each stock in the index an equal weight, regardless of its market capitalization. This means that smaller companies have the same influence on the index’s value as larger companies.

For example, the NYSE Equal-Weighted Index is an equal-weighted index that tracks the performance of all stocks listed on the New York Stock Exchange. Each stock in the index receives an equal weight, regardless of its market capitalization.

The formula for calculating an equal-weighted index is:

Index Value = (Sum of Stock Prices) / (Number of Stocks in the Index)

- Advantages: Equal-weighted indices provide a more balanced representation of the market by giving equal weight to all companies, regardless of their size. They can also outperform market-cap weighted indices during periods of market growth or when smaller companies are outperforming larger companies.

- Disadvantages: Equal-weighted indices can be more volatile than market-cap weighted indices because they are more sensitive to the performance of smaller companies, which tend to be more volatile.

Sector-Specific Indices

Sector-specific indices track the performance of companies within a specific industry or sector. These indices can be used to gauge the health of a particular sector and as a basis for investment strategies.

For example, the S&P 500 Energy Index tracks the performance of companies in the energy sector. The index includes companies involved in oil and gas exploration and production, refining, and distribution.

The formula for calculating a sector-specific index can vary depending on the methodology used, but typically involves weighting each stock’s price by its market capitalization within the sector.

- Advantages: Sector-specific indices provide investors with a way to focus their investments on specific sectors that they believe have growth potential. They can also be used to hedge against market risk by investing in sectors that are less correlated with the overall market.

- Disadvantages: Sector-specific indices can be more volatile than broader market indices because they are more concentrated in a single industry or sector. They can also be affected by factors specific to that sector, such as changes in regulations or consumer demand.

Using Aggregate Stocks in Investment Strategies

Aggregate stock indices provide a valuable tool for investors seeking to gain exposure to the broader market or specific sectors. They offer a convenient and cost-effective way to track market performance and implement various investment strategies.

Passive Investing

Passive investing involves tracking a specific market index, aiming to replicate its performance. Investors using this strategy typically invest in index funds or exchange-traded funds (ETFs) that track aggregate stock indices.

Passive investing aims to match the returns of a specific market index, minimizing active management and trading costs.

- Index Funds: Mutual funds designed to mirror the composition and performance of a specific index, such as the S&P 500 or the Nasdaq 100.

- Exchange-Traded Funds (ETFs): Similar to index funds, ETFs are traded on stock exchanges, offering flexibility and lower costs compared to actively managed funds.

Index Tracking

Index tracking involves investing in a portfolio that closely matches the composition of a particular aggregate stock index. Investors aim to achieve returns similar to the index by holding a diversified basket of stocks that mirror its weighting.

Index tracking seeks to mimic the performance of a specific index by replicating its asset allocation and weighting.

- Diversification: Index tracking offers broad diversification, spreading investment risk across a wide range of companies and sectors.

- Cost-Effectiveness: Tracking an index generally involves lower management fees compared to actively managed funds.

Sector Rotation

Sector rotation involves adjusting a portfolio’s asset allocation based on economic cycles and industry trends. Investors may utilize aggregate stock indices to identify and capitalize on sectors expected to perform well during specific economic phases.

Sector rotation involves strategically shifting investments between different sectors based on anticipated economic trends and industry performance.

- Economic Cycles: During economic expansions, sectors like technology and consumer discretionary often outperform. During contractions, sectors like utilities and healthcare tend to be more resilient.

- Industry Trends: Emerging industries or sectors experiencing rapid growth may offer attractive investment opportunities. However, sector rotation requires careful analysis and timing.

Factors Influencing Aggregate Stock Performance

The performance of aggregate stocks, representing the overall health of the stock market, is influenced by a complex interplay of economic, political, and social factors. Understanding these factors is crucial for investors seeking to navigate the market effectively.

Interest Rates

Interest rates play a significant role in determining the cost of borrowing money. When interest rates rise, companies face higher costs for borrowing, potentially leading to reduced investment and slower economic growth. This can negatively impact corporate earnings and, in turn, stock prices. Conversely, lower interest rates encourage borrowing and investment, potentially boosting economic growth and stock market performance.

Higher interest rates make borrowing more expensive, potentially slowing economic growth and reducing corporate earnings.

Lower interest rates encourage borrowing and investment, potentially boosting economic growth and stock market performance.

Inflation

Inflation, a persistent increase in the general price level of goods and services, can erode the purchasing power of investors. When inflation rises, companies may face pressure to raise prices, potentially impacting consumer demand and profit margins. High inflation can also lead to higher interest rates, further impacting stock market performance. However, moderate inflation is often considered healthy for the economy, as it can encourage investment and growth.

High inflation can erode purchasing power, impact consumer demand, and lead to higher interest rates.

Moderate inflation can encourage investment and growth.

Economic Growth

Economic growth, measured by the increase in a country’s gross domestic product (GDP), is a key driver of stock market performance. When the economy is growing, businesses tend to perform well, leading to higher profits and stock prices. Conversely, a slowing economy can negatively impact corporate earnings and stock prices.

Strong economic growth is often associated with positive stock market performance.

A slowing economy can negatively impact corporate earnings and stock prices.

Geopolitical Events

Geopolitical events, such as wars, trade disputes, and political instability, can significantly impact stock market movements. These events can create uncertainty and volatility in the market, leading to fluctuations in stock prices. For example, the 2008 financial crisis, triggered by the collapse of the US housing market, led to a sharp decline in global stock markets.

Geopolitical events can create uncertainty and volatility in the market, leading to fluctuations in stock prices.

Historical Performance of Aggregate Stocks

The historical performance of aggregate stocks provides valuable insights into their long-term trends and potential for future returns. Analyzing past data helps investors understand the risks and rewards associated with investing in these broad market indices.

Performance of Major Aggregate Stock Indices

The table below showcases the historical performance of some major aggregate stock indices, providing a snapshot of their returns over various periods.

| Index | 1-Year Return | 5-Year Return | 10-Year Return |

|---|---|---|---|

| S&P 500 | -19.4% | 11.2% | 12.8% |

| Nasdaq Composite | -33.0% | 13.7% | 14.9% |

| Dow Jones Industrial Average | -17.8% | 9.7% | 11.6% |

| Russell 2000 | -21.3% | 8.4% | 10.2% |

These figures are based on historical data and do not guarantee future performance. It’s important to note that past performance is not indicative of future results.

Long-Term Trends and Periods of High and Low Returns

Aggregate stocks have historically delivered positive returns over the long term, showcasing their potential for wealth creation. However, their performance has varied significantly over different periods, influenced by economic conditions, market sentiment, and other factors.

- Periods of High Returns: The post-World War II era, the 1980s, and the late 1990s witnessed robust growth in the stock market, fueled by economic expansion, technological advancements, and favorable government policies. During these periods, aggregate stocks delivered impressive returns, exceeding the returns of other asset classes.

- Periods of Low Returns: Conversely, periods of economic recession, financial crises, and geopolitical uncertainty have led to significant market corrections and lower returns for aggregate stocks. The 2008 financial crisis, for example, resulted in a steep decline in stock prices, highlighting the potential for substantial losses during periods of market turmoil.

Factors Influencing Performance Patterns

Several factors contribute to the performance patterns observed in aggregate stocks. Understanding these factors is crucial for investors seeking to make informed decisions about their investment strategies.

- Economic Growth: A robust economy typically leads to increased corporate earnings and higher stock valuations, boosting aggregate stock performance. Conversely, economic downturns can negatively impact corporate profits and stock prices.

- Interest Rates: Lower interest rates tend to stimulate borrowing and investment, leading to higher stock prices. Conversely, higher interest rates can make borrowing more expensive and reduce investment, potentially impacting stock valuations.

- Inflation: Moderate inflation is generally considered healthy for the economy. However, high inflation can erode corporate profits and purchasing power, potentially impacting stock prices. Central banks often raise interest rates to combat high inflation, which can further impact stock market performance.

- Market Sentiment: Investor sentiment and confidence play a significant role in driving stock prices. Positive sentiment can lead to increased demand for stocks, pushing prices higher. Conversely, negative sentiment can lead to selling pressure and lower prices.

- Technological Advancements: Technological innovations can create new industries, boost productivity, and drive economic growth, leading to higher stock valuations. The rise of the internet and e-commerce, for example, significantly impacted the stock market in the late 1990s and early 2000s.

- Government Policies: Government policies, such as tax laws, regulations, and monetary policy, can significantly impact the stock market. Favorable policies can encourage investment and economic growth, while unfavorable policies can stifle growth and negatively impact stock valuations.

Aggregate Stocks vs. Individual Stocks

Choosing between investing in aggregate stocks, like broad market indices, and individual stocks can feel like picking between a comforting, familiar meal and a daring, exotic dish. Both have their own appeal and can lead to delicious results, but understanding the nuances of each approach is key to making the right choice for your palate.

Investing in Aggregate Stocks

Investing in aggregate stocks is like ordering a sampler platter at a restaurant: you get a taste of everything. It provides broad exposure to a diverse range of companies across various sectors and industries. This diversification can help mitigate risk and reduce the impact of any single company’s performance on your overall portfolio.

Investing in Individual Stocks

Investing in individual stocks is like ordering a specific dish: you’re making a conscious choice to invest in a particular company based on its unique characteristics and potential for growth. This approach allows you to potentially achieve higher returns but also carries a higher risk of losing money.

Pros and Cons of Investing in Aggregate Stocks

-

Pros:

- Diversification: Aggregate stocks offer broad exposure to the market, reducing the risk of any single company’s performance significantly impacting your portfolio.

- Lower Costs: Investing in aggregate stocks through index funds or ETFs often comes with lower expense ratios than actively managed mutual funds or individual stocks.

- Convenience: Investing in aggregate stocks is relatively easy, requiring less research and monitoring compared to individual stocks.

-

Cons:

- Limited Upside Potential: While diversification reduces risk, it also limits the potential for outsized returns compared to investing in individual stocks.

- Lack of Control: You don’t have the same level of control over your investments when investing in aggregate stocks, as you’re essentially relying on the performance of the entire market.

- Limited Flexibility: You can’t choose specific companies within an aggregate stock index, which might not align with your individual investment goals.

Pros and Cons of Investing in Individual Stocks, Aggregate stocks

-

Pros:

- Potential for Higher Returns: Investing in individual stocks allows you to choose companies with high growth potential, potentially leading to higher returns.

- Control and Flexibility: You have the power to select specific companies that align with your investment goals and risk tolerance.

- Potential for Active Management: You can actively research and monitor individual stocks, making adjustments to your portfolio based on changing market conditions.

-

Cons:

- Higher Risk: Investing in individual stocks carries a higher risk of losing money, as the performance of a single company can be highly volatile.

- Higher Costs: Investing in individual stocks often involves higher trading fees and commissions than investing in aggregate stocks.

- Time Commitment: Researching, monitoring, and managing individual stocks requires a significant time commitment.

Scenarios Where Each Strategy Might Be More Suitable

-

Aggregate Stocks:

- For Long-Term Investors: Aggregate stocks are a great option for investors seeking long-term growth and diversification, especially those who prefer a hands-off approach.

- For Beginners: Investing in aggregate stocks can be a good starting point for beginners who are not comfortable with the intricacies of individual stock selection.

- For Risk-Averse Investors: Diversification through aggregate stocks can help mitigate risk and provide peace of mind.

-

Individual Stocks:

- For Experienced Investors: Experienced investors with a deep understanding of the market and a higher risk tolerance might prefer to invest in individual stocks to potentially achieve higher returns.

- For Investors with Specific Investment Goals: Individual stocks allow you to tailor your portfolio to specific investment goals, such as investing in a particular industry or sector.

- For Investors with Time and Resources: Investing in individual stocks requires significant time and resources for research, monitoring, and management.

Epilogue

Investing in aggregate stocks offers a unique blend of diversification and potential for growth. By understanding the different types of indices, their performance drivers, and associated risks, investors can make informed decisions that align with their goals and risk tolerance. So, whether you’re seeking a passive approach to investing or aiming to actively manage your portfolio, aggregate stocks offer a versatile and powerful tool for navigating the exciting and ever-evolving world of the stock market.

Questions and Answers

What are the benefits of investing in aggregate stocks?

Investing in aggregate stocks offers diversification, which helps reduce risk by spreading investments across a wide range of companies. It also provides a convenient way to track market performance and implement passive investing strategies.

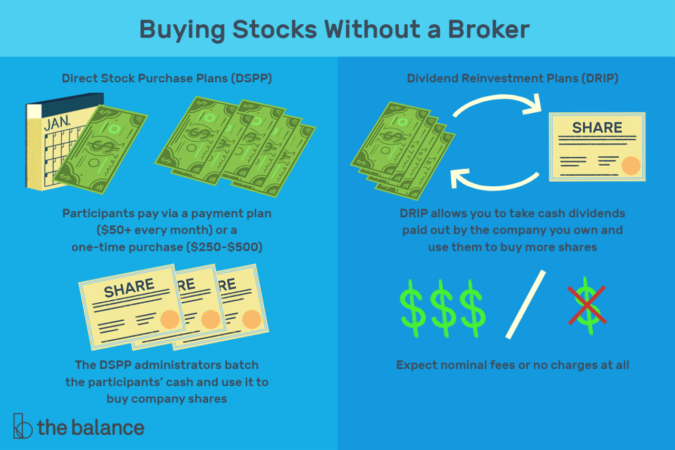

How can I invest in aggregate stocks?

You can invest in aggregate stocks through index funds, exchange-traded funds (ETFs), or mutual funds that track specific indices. These funds allow you to gain exposure to a basket of stocks representing the entire market or a particular sector.

Are aggregate stocks always a good investment?

While aggregate stocks offer diversification and potential for growth, they are not without risks. Market volatility, economic downturns, and inflation can impact their performance. It’s essential to understand these risks and choose investments that align with your risk tolerance.