Am Best A++ life insurance companies are the crème de la crème of the financial world, offering peace of mind and security for your loved ones. But with so many options out there, how do you pick the right one? Think of it like choosing your favorite superhero – you want someone reliable, trustworthy, and ready to step up when you need them most. These A++ rated companies have proven their financial stability and commitment to customer satisfaction, so you can rest assured knowing your family is protected.

This guide will break down the key factors to consider when choosing a life insurance company, from types of policies and features to financial stability and reputation. We’ll also explore the different types of life insurance available and how to find the best fit for your individual needs and budget.

Understanding “Best” Life Insurance Companies

Finding the “best” life insurance company isn’t just about picking the one with the flashiest commercials or the lowest initial quote. It’s about finding the right fit for your unique needs and circumstances.

Factors Determining the “Best” Life Insurance Companies, Am best a++ life insurance companies

When determining the “best” life insurance companies, several key factors are considered. These factors help to paint a comprehensive picture of a company’s reliability, customer-centricity, and overall value proposition.

- Financial Stability: A financially stable life insurance company is crucial. It ensures that your policy will be honored even in the event of unexpected circumstances. Look for companies with high ratings from reputable financial institutions like AM Best, Moody’s, and Standard & Poor’s. A strong financial rating indicates a company’s ability to meet its obligations to policyholders.

- Customer Service: Excellent customer service is essential, especially when dealing with sensitive matters like life insurance. Consider companies with a proven track record of responsiveness, clarity, and helpfulness. You can find this information through online reviews, customer testimonials, and independent rating agencies.

- Policy Features: Life insurance policies can vary significantly in their features and benefits. Consider factors such as:

- Coverage: Choose a policy that provides the appropriate level of coverage for your needs.

- Riders: Riders are optional additions to your policy that can enhance coverage or provide additional benefits.

- Flexibility: Consider whether you need a policy that can be adjusted over time as your circumstances change.

- Pricing: The cost of life insurance is an important consideration. Compare quotes from multiple companies and ensure you understand the factors influencing the price, such as age, health, coverage amount, and policy type.

Importance of Individual Needs and Circumstances

Life insurance is a highly personalized product. What’s “best” for one person may not be the best for another. It’s crucial to consider your individual needs and circumstances when choosing a policy. Factors to consider include:

- Financial Obligations: Evaluate your financial obligations, such as mortgage payments, outstanding debts, and future expenses for your family.

- Income: Your income level will influence the amount of coverage you need.

- Health: Your health status can impact the cost and availability of certain policies.

- Age: The younger you are, the lower your premiums will generally be.

Types of Life Insurance

Life insurance is a crucial financial tool that can help protect your loved ones from the financial burden of your death. There are many different types of life insurance policies, each with its own unique features and benefits. Choosing the right type of life insurance depends on your individual needs, financial situation, and goals.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is the most affordable type of life insurance and is ideal for individuals who need temporary coverage, such as during a period of high debt or when raising young children.

- Benefits: Term life insurance is typically the most affordable option, offering a high death benefit for a lower premium. It is a good choice for temporary coverage needs, such as covering a mortgage or supporting dependents while they are young.

- Drawbacks: Term life insurance does not build cash value and has no investment component. It only provides coverage for a specific period, after which the policy expires and you may need to renew it.

- Suitability: Term life insurance is suitable for individuals with temporary coverage needs, such as covering a mortgage, replacing lost income, or supporting dependents during their formative years. It is also a good option for those on a tight budget, as it offers the most value for your premium dollar.

Real-Life Scenario: A young couple with a mortgage and two young children may choose term life insurance to provide financial protection for their family if one of them passes away. The policy would ensure that the surviving spouse can continue to pay the mortgage and support their children until they are financially independent. This type of insurance is often used to cover specific financial obligations, such as paying off a mortgage or replacing lost income, during a limited period.

Whole Life Insurance

Whole life insurance is a permanent type of life insurance that provides coverage for your entire lifetime. It combines a death benefit with a savings component, known as cash value.

- Benefits: Whole life insurance provides lifelong coverage, offering a guaranteed death benefit. It also accumulates cash value, which you can borrow against or withdraw from, allowing for potential investment growth and financial flexibility.

- Drawbacks: Whole life insurance is typically more expensive than term life insurance due to its cash value component. The cash value growth may be limited and can be impacted by market fluctuations.

- Suitability: Whole life insurance is suitable for individuals who need permanent coverage, such as covering estate taxes or providing a legacy for their heirs. It is also a good option for those seeking a long-term investment opportunity, as it offers potential for cash value growth.

Real-Life Scenario: A successful entrepreneur with a large estate may choose whole life insurance to provide a substantial death benefit for their heirs and ensure that their estate taxes are covered. The cash value component can also be used to supplement retirement income or fund other financial goals.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that combines a death benefit with a savings component. It offers more control over your premium payments and cash value growth compared to whole life insurance.

- Benefits: Universal life insurance provides flexibility in premium payments and cash value growth. It offers a death benefit that can be adjusted based on your needs.

- Drawbacks: Universal life insurance can be more complex than other types of life insurance and may have higher fees. It requires careful planning and management to ensure that your policy meets your needs and goals.

- Suitability: Universal life insurance is suitable for individuals who need flexibility in their coverage and premium payments. It is also a good option for those who want more control over their cash value growth.

Real-Life Scenario: An individual with a fluctuating income may choose universal life insurance to adjust their premium payments based on their financial situation. They can also choose to allocate their cash value growth to different investment options, allowing for greater control over their financial future.

Key Features to Consider

Choosing the right life insurance policy is like picking the perfect outfit for a big event – you want it to fit your needs, look good, and offer the right protection. Just like a stylish outfit has key elements, a life insurance policy has key features that determine its value and suitability. Let’s break down these features to help you find the policy that’s a perfect fit for you.

Death Benefit

The death benefit is the core of any life insurance policy. It’s the amount of money your beneficiaries will receive upon your death. Think of it as the financial safety net you leave behind for your loved ones to cover expenses, debts, or simply to provide for their future. The amount of the death benefit is a critical factor in determining the cost of your premiums. A higher death benefit generally means higher premiums, but it also offers greater financial protection for your beneficiaries.

Premiums

Premiums are the regular payments you make to keep your life insurance policy active. These payments are like monthly rent for your financial protection. The premium amount is determined by several factors, including your age, health, lifestyle, and the type of life insurance you choose. The premium can be paid monthly, annually, or even in a lump sum. The frequency of payment can impact the overall cost of your policy, so consider your budget and financial situation when making this decision.

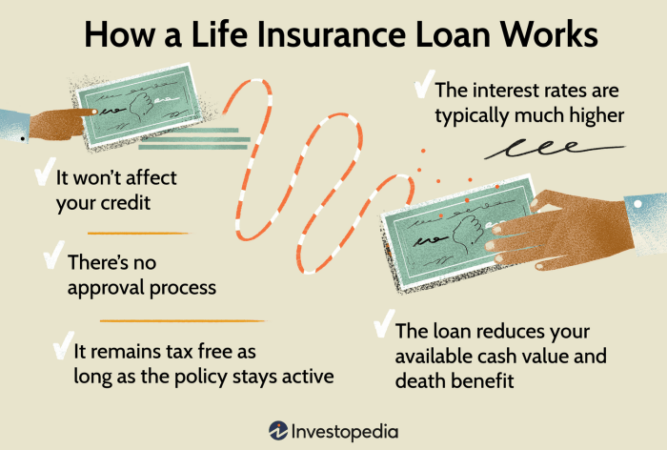

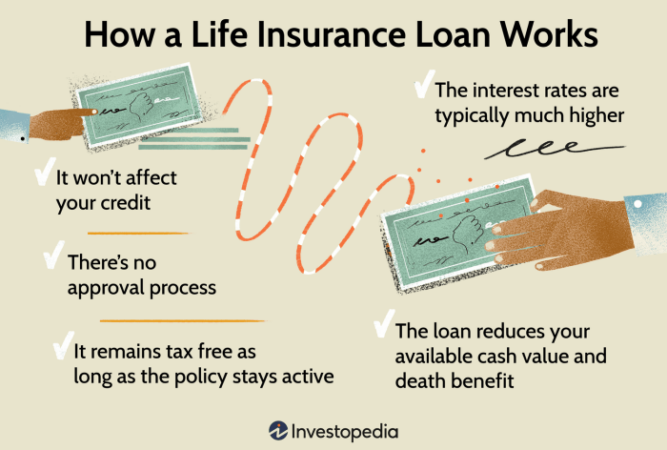

Cash Value

Not all life insurance policies offer cash value, but for those that do, it’s a valuable feature. Cash value is the accumulated savings portion of your policy that you can access while you’re still alive. It’s like a savings account that grows over time, allowing you to withdraw money for emergencies, investments, or other financial needs. However, withdrawing cash value can impact the death benefit and may incur penalties, so it’s essential to understand the terms and conditions before making any withdrawals.

Riders

Riders are optional additions to your life insurance policy that provide extra coverage or benefits. Think of them as accessories that enhance your policy’s functionality. Common riders include:

- Accidental Death Benefit: Pays an additional sum if your death is due to an accident.

- Waiver of Premium: Waives premium payments if you become disabled.

- Living Benefits: Allows you to access a portion of your death benefit while you’re still alive for certain medical expenses or long-term care.

Riders can increase the cost of your policy, but they can also provide valuable peace of mind and financial protection. Carefully consider your individual needs and budget when deciding whether to add riders to your policy.

Exclusions

Exclusions are specific events or circumstances that are not covered by your life insurance policy. These are like the “fine print” that Artikels the limitations of your coverage. Common exclusions include:

- Suicide: Most policies exclude suicide for a certain period after the policy is issued.

- War or Military Service: Some policies may exclude death due to war or military service in certain situations.

- Dangerous Activities: Policies may exclude death resulting from dangerous activities like skydiving or scuba diving.

Understanding the exclusions of your policy is crucial to ensure you have adequate coverage for the situations that matter most. Review the policy documents carefully and ask your insurance agent to clarify any uncertainties.

Comparing Key Features

Here’s a table comparing the key features of several leading life insurance companies. This can help you get a better understanding of the differences in coverage and pricing.

| Company | Death Benefit | Premiums | Cash Value | Riders | Exclusions |

|---|---|---|---|---|---|

| Company A | $500,000 | $100/month | Yes | Accidental Death, Waiver of Premium | Suicide (first two years), War |

| Company B | $250,000 | $50/month | No | Accidental Death | Suicide (first year), War, Dangerous Activities |

| Company C | $1,000,000 | $200/month | Yes | Accidental Death, Waiver of Premium, Living Benefits | Suicide (first year), War |

It’s important to remember that this table is just a general comparison and does not reflect the specific features of every policy offered by these companies. Always review the policy documents and consult with an insurance agent to determine the best policy for your individual needs.

Choosing the Right Company

Picking the right life insurance company is like choosing the right pair of shoes: You want something that fits your needs, is comfortable, and will last the long haul. But with so many companies out there, how do you know where to start? We’ll break down the steps to help you find the perfect fit.

Steps to Choosing the Right Company

- Define your needs: Before you start shopping around, consider your life insurance goals. Are you looking for coverage for your family, to pay off debt, or to cover final expenses? What type of policy is best for you? The more specific you are, the easier it will be to find the right company.

- Get quotes from multiple companies: Don’t settle for the first quote you get. Shop around and compare prices, coverage options, and customer service. You can use online comparison tools or contact companies directly.

- Check the company’s financial strength: Look for a company with a strong financial rating, meaning they are financially stable and have a good track record of paying claims. You can find this information from rating agencies like AM Best, Standard & Poor’s, and Moody’s.

- Read reviews: See what other customers have to say about the company’s reputation for customer service, claim processing, and overall satisfaction. Websites like Trustpilot and Yelp can provide valuable insights.

- Compare policy features: Once you’ve narrowed down your choices, compare the features of each policy. Look at things like the death benefit, premiums, policy terms, and riders. Make sure the policy meets your specific needs and budget.

Getting Quotes and Comparing Policy Options

Once you’ve determined your life insurance needs, it’s time to get quotes from different companies. There are several ways to do this:

- Online comparison tools: Websites like Policygenius, NerdWallet, and Insurify allow you to compare quotes from multiple companies in one place. This can save you time and effort.

- Contact companies directly: You can also contact companies directly to get quotes. Be prepared to provide some basic information, such as your age, health, and desired coverage amount.

- Work with an insurance agent: An independent insurance agent can help you compare quotes from multiple companies and find the best policy for your needs. They can also guide you through the application and underwriting process.

Navigating the Application and Underwriting Process

Once you’ve chosen a company, you’ll need to complete an application. The application process will involve providing personal information, health history, and financial details. You may also need to undergo a medical exam, depending on the policy you choose.

- Be honest and accurate: It’s important to be honest and accurate on your application. Any misrepresentations or omissions could lead to your policy being denied or voided later on.

- Gather necessary documents: Have all the necessary documents ready, such as your driver’s license, Social Security number, and medical records. This will help to streamline the application process.

- Follow up with the company: After submitting your application, follow up with the company to check on the status. This will help to ensure that your application is being processed in a timely manner.

Financial Stability and Reputation

You wouldn’t buy a used car without checking the engine, right? The same goes for life insurance. You need to be sure the company you choose is financially sound and has a good reputation. Otherwise, you could be left with a worthless policy if the company goes belly up.

Choosing a financially stable and reputable life insurance company is crucial. It ensures that your beneficiaries will receive the death benefit when the time comes. A company with a strong financial foundation is less likely to go bankrupt, leaving you with a useless policy and no financial protection.

Evaluating Financial Strength

Evaluating a company’s financial strength is essential. You can assess this by looking at their financial ratings from independent organizations like AM Best and Moody’s. These agencies analyze a company’s financial health, including its assets, liabilities, and operating performance.

AM Best and Moody’s ratings provide a valuable snapshot of a company’s financial stability, giving you confidence in your choice.

A high rating from these organizations signifies a strong financial position, indicating that the company is well-equipped to fulfill its financial obligations to policyholders. Conversely, a low rating might suggest a company is struggling financially and may not be able to meet its commitments in the future.

Examples of Reputable Life Insurance Companies

Many life insurance companies have a long history of strong financial performance and positive customer reviews. Here are a few examples:

- Northwestern Mutual: Known for its financial strength and long-term stability, Northwestern Mutual consistently receives high ratings from AM Best and Moody’s. It’s also been recognized for its exceptional customer service.

- New York Life: Another company with a solid track record, New York Life has a long history of financial stability and positive customer reviews. It’s also known for its diverse range of life insurance products.

- Prudential Financial: Prudential Financial is a large, well-established life insurance company with a strong financial foundation. It offers a wide range of products and services, including life insurance, annuities, and retirement planning.

Final Summary

Finding the right life insurance company can be a bit like finding a needle in a haystack, but with a little research and a solid understanding of your needs, you can find the perfect fit. Remember, choosing a company with an A++ rating from AM Best is a great starting point, but it’s crucial to do your due diligence and compare policies, features, and prices. Don’t be afraid to ask questions and seek guidance from a qualified financial advisor. After all, your family’s future is worth it.

Quick FAQs: Am Best A++ Life Insurance Companies

What does an A++ rating from AM Best mean?

An A++ rating from AM Best means the company has exceptional financial strength and is considered very likely to meet its financial obligations to policyholders. It’s like a gold star for financial stability!

How often should I review my life insurance policy?

It’s a good idea to review your life insurance policy at least every few years, especially if you experience major life changes like getting married, having children, or changing your career.

Can I get life insurance if I have pre-existing health conditions?

Yes, you can usually get life insurance even with pre-existing conditions, but it might cost more or require a medical exam. It’s best to speak with an insurance agent to find out your options.