Am Best company insurance ratings are a crucial factor in determining the financial strength and reliability of insurance companies. These ratings, assigned by the independent rating agency A.M. Best, provide consumers with valuable insights into an insurer’s ability to pay claims and remain solvent. Understanding these ratings can help you make informed decisions about your insurance coverage, ensuring you choose a company that aligns with your needs and provides peace of mind.

Am Best ratings are based on a comprehensive evaluation of an insurance company’s financial performance, operating performance, and business profile. The agency assesses factors like the company’s reserves, capital adequacy, and claims-paying ability. Ratings range from A++ (Superior) to D (Weak) and provide a clear indication of an insurer’s overall financial health. Higher ratings generally signify a more stable and trustworthy company, while lower ratings may suggest potential risks.

Understanding Insurance Ratings

Insurance company ratings are like the Michelin stars of the financial world. They tell you how good a company is at keeping its promises and how likely it is to be around when you need it. These ratings can be a real game-changer when choosing an insurance company.

Factors Contributing to Insurance Ratings

Insurance ratings are not just a popularity contest. They are based on a bunch of factors that paint a picture of a company’s financial health and ability to meet its obligations. Think of it like a report card for insurance companies.

- Financial Strength: This is like the company’s bank account. How much money does it have on hand? How much debt does it have? How well does it manage its investments? A strong financial position means the company is less likely to go belly up and leave you hanging.

- Claims-Paying Ability: This is the big one – how good is the company at paying out claims when you need them? A high claims-paying ability means the company has a good track record of fulfilling its promises to policyholders.

- Operational Efficiency: This is about how well the company runs its day-to-day operations. Do they have a smooth claims process? Are they good at managing costs? A well-run company is more likely to be financially stable and able to serve its customers effectively.

- Management Quality: This is about the people running the show. Do they have experience in the insurance industry? Do they have a good track record of making sound business decisions? Strong leadership can make a big difference in the long run.

Rating Agencies and Their Methodologies

Different rating agencies use different methods to evaluate insurance companies, but they all aim to provide consumers with a clear and objective assessment of a company’s financial strength and ability to pay claims.

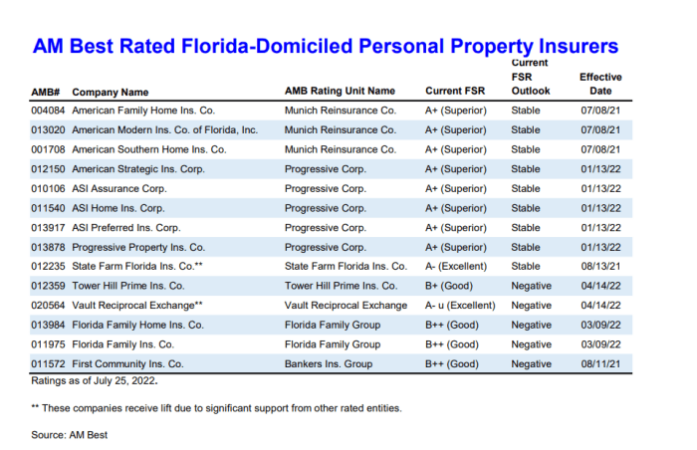

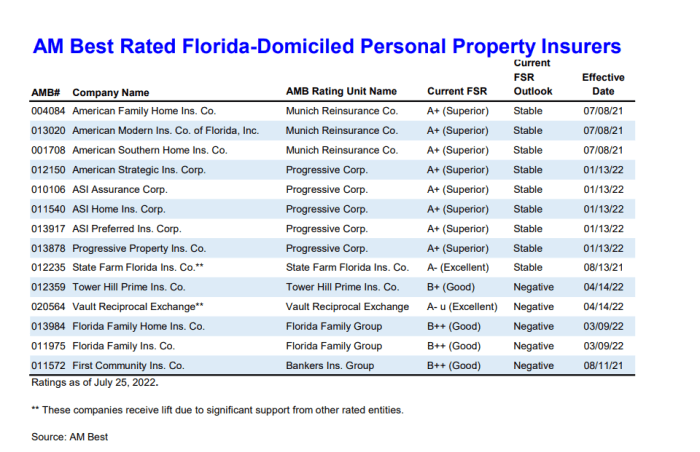

- AM Best: AM Best is one of the oldest and most respected rating agencies. They use a complex system of financial ratios and other metrics to assess a company’s overall financial strength. AM Best ratings are often used by insurance regulators and financial institutions to evaluate the financial health of insurance companies.

- Standard & Poor’s (S&P): S&P is another well-known rating agency. Their methodology focuses on a company’s financial strength, operational efficiency, and management quality. S&P ratings are widely used by investors and other financial professionals.

- Moody’s: Moody’s is a global rating agency that evaluates a wide range of financial instruments, including insurance companies. Their methodology focuses on a company’s financial strength, operational efficiency, and risk management practices. Moody’s ratings are often used by investors and financial institutions.

Top-Rated Insurance Companies

You’re ready to get insured, but with so many options, it can be tough to know where to start. Don’t worry, we’re here to break down the top-rated insurance companies, so you can pick the best fit for your needs. Think of it like choosing your favorite superhero team – you want the best protection, right?

We’ll dive into the top contenders in key insurance categories: auto, home, health, and life. We’ll use ratings from reputable agencies like AM Best, J.D. Power, and Moody’s, giving you the inside scoop on each company’s strengths and weaknesses.

Auto Insurance

Choosing the right auto insurance is crucial for protecting yourself financially in case of an accident. Here’s a breakdown of some of the top-rated companies, based on their financial stability, customer service, and claims handling:

- USAA: This military-focused insurer consistently ranks high for customer satisfaction and claims handling. They offer competitive rates, especially for active and retired military personnel. USAA is known for its exceptional customer service, with dedicated representatives who understand the unique needs of military families.

- Geico: Geico is a popular choice for its affordable rates and easy online tools. They’ve got a fun, quirky persona, but don’t let that fool you – they’re serious about providing quality coverage. Geico’s online quoting and claims process is a breeze, making it a favorite among tech-savvy drivers.

- State Farm: State Farm is a household name for a reason. They offer a wide range of insurance products, including auto, home, and life. They’re known for their strong financial stability and reliable claims handling. State Farm’s extensive network of agents provides personalized service, making them a good choice for those who prefer face-to-face interactions.

- Progressive: Progressive is a leader in innovation, offering features like personalized pricing based on your driving habits through their “Name Your Price” tool. They also offer a wide range of coverage options, including ride-sharing insurance. Progressive’s strong customer service and claims handling make them a popular choice for drivers who want flexibility and control.

Home Insurance

Protecting your biggest investment – your home – is a top priority. Here are some top-rated home insurance companies known for their coverage, customer service, and claims handling:

- Amica: Amica is a mutual insurance company, which means its policyholders are also its owners. This translates to a focus on customer satisfaction and competitive rates. Amica is known for its strong financial stability and excellent claims handling, making it a reliable choice for homeowners.

- USAA: Similar to auto insurance, USAA shines in home insurance, providing exceptional coverage and service for military families. They offer a range of features, including coverage for specific military-related risks, and their claims process is known for its efficiency.

- State Farm: State Farm’s comprehensive home insurance policies offer a variety of coverage options, including earthquake and flood insurance. They also have a strong network of agents who can provide personalized guidance and support throughout the claims process.

- Liberty Mutual: Liberty Mutual offers a variety of home insurance policies, including coverage for unique risks like identity theft and water damage. They’re known for their innovative features, such as their “Hope” program, which provides financial assistance to families affected by natural disasters.

Health Insurance

Navigating the world of health insurance can be overwhelming, but it’s crucial for protecting yourself from unexpected medical expenses. Here are some top-rated health insurance companies known for their comprehensive plans, customer service, and network access:

- Kaiser Permanente: Kaiser Permanente is a large integrated healthcare system that offers both health insurance and medical care. They’re known for their focus on preventative care and their wide network of doctors and hospitals. Kaiser Permanente’s integrated model allows for seamless coordination of care, making it a popular choice for those seeking comprehensive coverage.

- Blue Cross Blue Shield: Blue Cross Blue Shield is a network of independent insurance companies that offer a variety of health insurance plans. They’re known for their extensive network of providers, which makes it easier to find a doctor or hospital in your area. Blue Cross Blue Shield also offers a range of plans to fit different needs and budgets.

- UnitedHealthcare: UnitedHealthcare is the largest health insurer in the United States, offering a wide variety of plans through both individual and employer markets. They’re known for their innovative programs, such as their “Optum” division, which provides personalized health coaching and support. UnitedHealthcare’s extensive network and diverse plan options make them a popular choice for individuals and families.

- Cigna: Cigna is a global health service company that offers a variety of health insurance plans, including individual, family, and employer-sponsored plans. They’re known for their focus on customer service and their commitment to providing quality care. Cigna’s international network of providers makes them a good choice for those who travel frequently.

Life Insurance

Life insurance is a vital part of financial planning, ensuring your loved ones are protected in the event of your passing. Here are some top-rated life insurance companies known for their affordable rates, comprehensive coverage, and excellent customer service:

- Northwestern Mutual: Northwestern Mutual is a mutual insurance company with a long history of financial stability. They offer a variety of life insurance products, including term life, whole life, and universal life. Northwestern Mutual is known for its personalized service and its strong financial performance, making it a trusted choice for those seeking long-term financial security.

- New York Life: New York Life is another mutual insurance company with a long history of financial strength. They offer a variety of life insurance products, including term life, whole life, and universal life. New York Life is known for its competitive rates and its excellent customer service, making it a popular choice for individuals and families.

- MassMutual: MassMutual is a mutual insurance company with a focus on providing financial security to its policyholders. They offer a variety of life insurance products, including term life, whole life, and universal life. MassMutual is known for its strong financial performance and its commitment to customer satisfaction, making it a reliable choice for those seeking long-term financial protection.

- Prudential: Prudential is a global financial services company that offers a variety of life insurance products, including term life, whole life, and universal life. They’re known for their innovative products, such as their “Accelerated Death Benefit” option, which allows policyholders to access a portion of their death benefit if they are diagnosed with a terminal illness. Prudential’s wide range of products and services make them a good choice for those seeking flexible and customizable life insurance coverage.

Factors Influencing Ratings

Insurance company ratings are like the Michelin stars of the financial world. They tell you which companies are the cream of the crop, the ones you can trust to be there for you when you need them most. But what exactly goes into making these ratings? It’s not just about how much money they have, it’s about a whole lot more. Let’s dive into the factors that influence insurance company ratings.

Financial Stability, Am best company insurance ratings

Financial stability is like the foundation of a house. It’s the bedrock on which everything else is built. Insurance companies need to be financially sound to be able to pay out claims, especially during times of disaster or unexpected events. Insurance rating agencies like A.M. Best, Moody’s, and Standard & Poor’s closely examine a company’s financial strength. They look at things like:

- Capital and Surplus: This represents the company’s ability to cover claims and unexpected losses. It’s like having a big emergency fund for rainy days.

- Investment Portfolio: How well the company invests its money is crucial. They need to make smart investments that generate returns and ensure they have enough money to pay claims. Think of it like a wise investor who knows how to grow their money.

- Profitability: A company needs to be profitable to stay in business and continue to provide insurance. They need to generate enough revenue to cover their expenses and make a profit.

- Debt Levels: Too much debt can be a burden and impact a company’s financial stability. They need to manage their debt levels carefully.

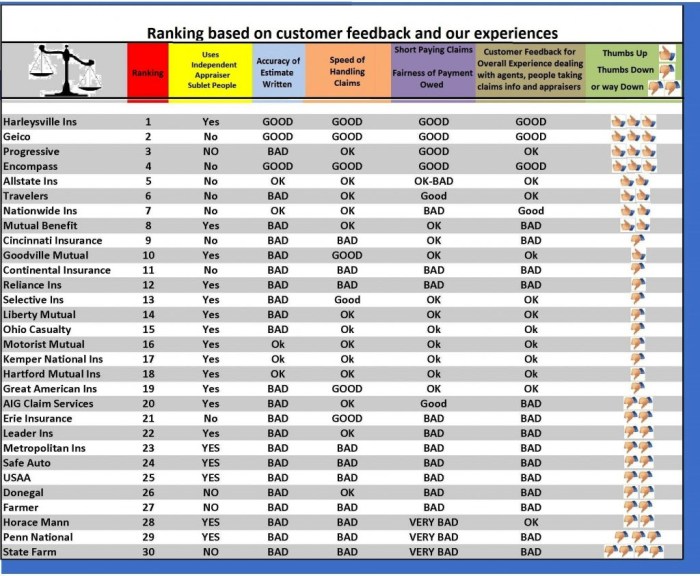

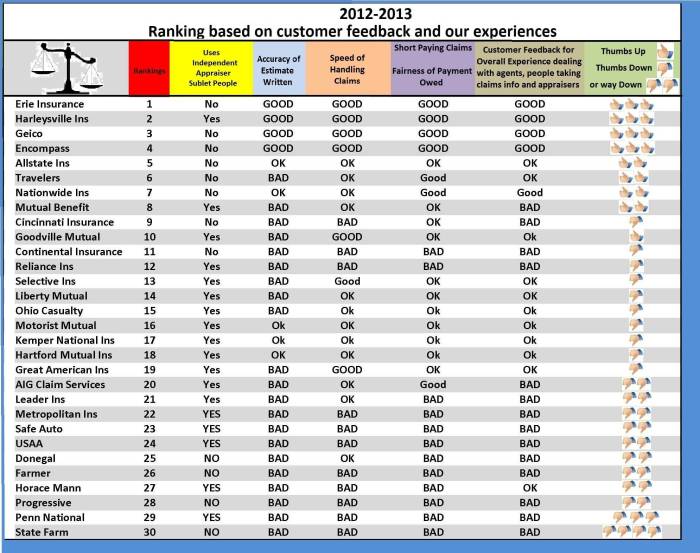

Claims Handling

Claims handling is the heart of the insurance business. It’s how a company shows its commitment to its customers when they need it most. Rating agencies look at how efficiently and fairly an insurance company handles claims. They want to see that companies:

- Process claims quickly: No one wants to wait weeks or months for their claim to be processed.

- Provide excellent customer service: Customers should feel supported and understood throughout the claims process.

- Settle claims fairly: Insurance companies need to be fair and reasonable in their settlements.

- Have a transparent claims process: Customers should be able to understand how their claim is being processed.

Customer Service

Customer service is the face of an insurance company. It’s how a company interacts with its customers, from the initial sales process to claims handling and beyond. Rating agencies look at how well a company treats its customers and how satisfied they are with the overall experience. They consider factors such as:

- Accessibility: Customers should be able to easily contact the company and get the help they need.

- Responsiveness: Companies should respond to customer inquiries promptly and professionally.

- Friendliness and helpfulness: Customer service representatives should be knowledgeable and helpful.

- Overall satisfaction: Customers should be happy with their overall experience with the company.

Innovation

Innovation is the key to staying ahead of the curve in the insurance industry. Rating agencies look at how companies are using technology and new ideas to improve their products and services. They want to see that companies are:

- Developing new products and services: Companies should be constantly looking for ways to meet the evolving needs of their customers.

- Adopting new technologies: Technology can help insurance companies streamline their processes and improve customer service.

- Investing in research and development: Companies need to invest in research and development to stay at the forefront of the industry.

Regulatory Changes and Market Trends

The insurance industry is constantly changing. Rating agencies need to stay up-to-date on the latest regulatory changes and market trends to ensure that their ratings are accurate and reflect the current landscape. For example, the rise of climate change and its impact on natural disasters has made it more important than ever for insurance companies to be financially stable and able to handle catastrophic claims.

“The insurance industry is constantly evolving, and companies that can adapt to these changes are more likely to receive higher ratings.”

Comparing Insurance Ratings

So, you’ve got the lowdown on insurance ratings and how they work, but how do you actually use this knowledge to compare different companies? Think of it like comparing your favorite pizza places – you want the best value, the tastiest toppings, and the fastest delivery. Insurance ratings are your guide to finding the best deals and the most reliable coverage.

Comparing Ratings Within Categories

Let’s say you’re looking for car insurance. You’ve got two companies on your radar: Company A, with a top-notch A+ rating, and Company B, with a solid A rating. What’s the difference, and does it matter?

Well, Company A’s higher rating might mean they’ve got a track record of prompt claim payments, excellent customer service, and financial stability. Company B, while still a good choice, might have a slightly lower rating due to a few hiccups in claims processing or maybe a slightly smaller financial cushion. But that doesn’t necessarily mean they’re bad!

Here’s how to break down the comparison:

- Financial Strength: A company with a high rating in this area has a strong financial foundation, meaning they’re less likely to go belly up and leave you hanging when you need to file a claim.

- Claims Handling: This rating reflects how well a company handles claims, including how quickly they pay them out and how easy it is to work with their claims adjusters.

- Customer Service: A high rating here indicates a company that’s responsive to customer needs and provides helpful, friendly service.

It’s essential to consider these factors when comparing ratings. Don’t just focus on the overall score; dig deeper to see what’s behind those numbers.

High vs. Low Ratings: Benefits and Drawbacks

Choosing a company with a high rating generally means you’re opting for a more established and financially sound insurer. This can be a great choice if you’re looking for peace of mind, knowing that your insurer is likely to be there for you when you need them.

However, higher ratings can sometimes come with higher premiums. If you’re on a tight budget, you might find that a company with a lower rating offers more competitive pricing. But remember, a lower rating doesn’t automatically mean a bad company. It could simply mean they’re newer, have a slightly smaller financial reserve, or have experienced a few bumps in the road with claims handling.

Here’s a breakdown of potential benefits and drawbacks:

| Rating | Benefits | Drawbacks |

|---|---|---|

| High | Strong financial stability, reliable claims handling, excellent customer service | Potentially higher premiums |

| Low | Potentially lower premiums, newer company with a fresh approach | Potential for less reliable claims handling, weaker financial stability |

Using Ratings to Make Informed Decisions

Insurance ratings can be a powerful tool for making informed decisions about your coverage. Here’s how to use them effectively:

- Compare apples to apples: When comparing ratings, make sure you’re looking at companies in the same category. For example, don’t compare a car insurance company’s rating to a home insurance company’s rating.

- Look beyond the overall score: Don’t just focus on the letter grade. Dive into the individual ratings for financial strength, claims handling, and customer service.

- Consider your individual needs: A high rating might be important to you if you’re looking for a company with a long track record of reliability. But if you’re on a tight budget, a lower rating might be more appealing.

- Read reviews: Insurance ratings are a great starting point, but they’re not the only factor to consider. Read reviews from other customers to get a sense of their experiences with different companies.

Remember, insurance ratings are just one piece of the puzzle. Use them as a guide, but don’t let them be your sole decision-maker. Do your research, compare quotes, and choose the company that best meets your individual needs and budget.

Beyond Ratings

Okay, so you’ve got your AM Best ratings, you’ve seen which companies are rockin’ it. But hold up, ratings are just one piece of the puzzle, like the first verse of a killer song. There’s more to consider before you choose your insurance crew.

Policy Coverage

Think of your insurance policy like your superhero suit: It’s got to protect you from all the bad stuff, right? But every suit has different powers, and that’s where policy coverage comes in. You need to know exactly what your policy covers, what’s excluded, and how much it’ll pay out. It’s like knowing your superhero’s limits.

Customer Reviews

Now, ratings tell you about the company’s financial strength, but what about their customer service? You wouldn’t want to be stuck with a company that’s got a reputation for being a real drag, right? Check out customer reviews online to get the inside scoop. See what other folks have to say about their claims process, communication, and overall experience.

Price

Let’s be real, price matters. You’re not going to drop a ton of cash on insurance just because a company has a fancy rating. But remember, the cheapest option isn’t always the best. Compare prices from different companies, but make sure you’re comparing apples to apples. Get quotes for the same coverage so you’re not comparing a basic plan to a super-powered one.

Closure

Navigating the world of insurance can be overwhelming, but understanding Am Best company insurance ratings is a powerful tool for making informed decisions. By considering these ratings alongside other factors like policy coverage, customer reviews, and price, you can choose an insurance company that offers both financial security and personalized protection. Remember, a high rating isn’t the only factor to consider, but it’s a crucial starting point in your search for the right insurance provider.

General Inquiries: Am Best Company Insurance Ratings

What are the different Am Best rating categories?

Am Best ratings range from A++ (Superior) to D (Weak), with various levels in between. These categories reflect the insurer’s financial stability and ability to meet its obligations.

How often are Am Best ratings updated?

Am Best ratings are typically updated on a regular basis, often annually or more frequently if significant changes occur in an insurer’s financial performance or business profile.

Are Am Best ratings the only factor to consider when choosing an insurance company?

While Am Best ratings are a valuable indicator of financial strength, they are not the sole factor to consider. You should also assess policy coverage, customer reviews, price, and other relevant factors to make a comprehensive decision.

Where can I find Am Best ratings for specific insurance companies?

You can access Am Best ratings on their official website or through various insurance comparison websites that include this information.