Am Best insurance companies are a hot topic, especially when you’re trying to find the best coverage for your life, health, car, or home. It’s like navigating a jungle of policies and premiums, and you want to make sure you’re not getting ripped off, right? So, how do you find the best insurance company for you? It’s all about understanding the different types of insurance, the factors that affect your premiums, and the criteria that make a company truly “best.” This guide will break it all down, so you can feel confident in your insurance choices.

We’ll explore the different types of insurance, from life and health to auto and home, and explain the key factors that influence your premiums. You’ll learn about financial stability, customer service, claims processing, and coverage options, and how to choose the company that best meets your needs. We’ll also compare and contrast different rating agencies and their methodologies, so you can make informed decisions.

Understanding the Insurance Landscape

Insurance is a fundamental aspect of modern life, offering financial protection against unexpected events and risks. Understanding the different types of insurance available and the factors that influence premiums is crucial for making informed decisions about your coverage.

Types of Insurance

Insurance policies are designed to provide financial security in various situations. Some common types of insurance include:

- Life Insurance: This policy provides a death benefit to beneficiaries upon the insured’s death. It helps cover funeral expenses, outstanding debts, and financial support for surviving family members.

- Health Insurance: This policy covers medical expenses, such as doctor’s visits, hospital stays, and prescription drugs. It can be purchased individually or through an employer.

- Auto Insurance: This policy provides coverage for damages to your vehicle and liability protection if you cause an accident. It is typically required by law in most states.

- Homeowners Insurance: This policy protects your home and belongings from damage caused by fire, theft, natural disasters, and other perils. It also provides liability coverage in case someone is injured on your property.

- Renters Insurance: This policy covers your personal belongings in a rental property and provides liability protection. It’s essential for renters to protect their assets.

- Disability Insurance: This policy provides income replacement if you are unable to work due to an illness or injury.

Factors Influencing Insurance Premiums

Insurance premiums are calculated based on various factors that assess the risk associated with insuring you. These factors can include:

- Age: Generally, younger individuals pay lower premiums for life and health insurance, while older individuals pay higher premiums. This is because younger individuals have a longer life expectancy.

- Health: Your health history and current health status play a significant role in determining your health insurance premiums. Individuals with pre-existing conditions or poor health typically pay higher premiums.

- Location: Insurance premiums can vary based on your location. Factors such as crime rates, natural disaster risks, and cost of living can influence premiums.

- Driving Record: Your driving history, including accidents, traffic violations, and driving experience, affects your auto insurance premiums. A clean driving record typically leads to lower premiums.

- Credit Score: In some states, your credit score can be used to determine your insurance premiums. A higher credit score generally indicates a lower risk, leading to lower premiums.

The Insurance Industry in the United States

The insurance industry in the United States is vast and complex. It is regulated at both the state and federal levels. The industry is dominated by a few large insurance companies, but there are also many smaller, regional companies.

The insurance industry plays a vital role in the US economy, providing financial protection to individuals and businesses.

Defining “Best” Insurance Companies

So, you’re ready to dive into the world of insurance, but with so many companies out there, how do you even begin to choose the “best” one? It’s like trying to pick the perfect pizza topping – everyone has their own preferences! Choosing the right insurance company is a big deal, and it’s not just about finding the cheapest option. You want to make sure you’re getting the best coverage, the best customer service, and the best overall value for your money.

Criteria for Evaluating Insurance Companies

To determine the “best” insurance company, you need to consider a variety of factors. Think of it like judging a reality TV show – you’re looking for the perfect blend of qualities! Here are some of the key criteria to keep in mind:

- Financial Stability: This is like the foundation of your insurance – you want to make sure your company can actually pay out when you need them to. Look for companies with strong financial ratings from independent agencies like AM Best, Moody’s, and Standard & Poor’s. Think of it like checking the “likes” on a social media post – the more, the better!

- Customer Service: You don’t want to be stuck in a frustrating phone loop when you need to file a claim. Look for companies with a reputation for excellent customer service, with quick response times and helpful representatives. Imagine it like a five-star review on Yelp – you want to be sure you’re getting the best experience!

- Claims Processing: How smoothly and efficiently a company handles claims is crucial. You want to make sure they’re fair and transparent, and that you’re not stuck in a long and complicated process. Think of it like a smooth airport check-in – you want a hassle-free experience!

- Coverage Options: Different companies offer different types of coverage and policy options. You need to find a company that offers the right level of coverage for your specific needs and budget. It’s like customizing your own pizza – you want to make sure you’re getting the toppings you want!

- Price: While it’s important to consider the price, don’t solely focus on the cheapest option. Remember, you’re getting what you pay for. Look for a company that offers a balance of affordability and comprehensive coverage. It’s like finding a bargain on a quality product – you want to make sure you’re getting the best value for your money!

Importance of Individual Needs and Preferences

It’s important to remember that what works for one person might not work for another. Choosing the “best” insurance company is very personal, like picking your favorite flavor of ice cream. Consider your individual needs and preferences when making your decision. For example:

- Age and Health: If you’re younger and healthy, you might not need as much coverage as someone who is older and has pre-existing health conditions. It’s like choosing a fitness class – you want to find one that’s right for your current level!

- Lifestyle: If you’re a high-risk driver, you might need to look for a company that specializes in insuring drivers with less-than-perfect records. It’s like choosing a car – you want to make sure it’s the right fit for your lifestyle!

- Budget: Your budget will play a big role in your decision. It’s like shopping for clothes – you want to find something that looks good and fits your budget!

Rating Agencies and Their Methodologies

There are a number of independent rating agencies that evaluate insurance companies based on their financial strength, claims-paying ability, and other factors. These ratings can be helpful in narrowing down your choices. Think of them like the judges on a reality TV show – they’re giving you an objective opinion!

- AM Best: This agency uses a complex methodology to evaluate companies’ financial strength, operating performance, and business profile. Their ratings are based on a scale from A++ (Superior) to D (Weak). They also provide a “Financial Size Category” to help you understand the size and scope of the company.

- Moody’s: This agency uses a similar methodology to AM Best, but their ratings are based on a scale from Aaa (Highest Quality) to C (Lowest Quality). They also provide a “Rating Outlook” to indicate whether the rating is expected to improve, decline, or remain stable.

- Standard & Poor’s: This agency uses a slightly different methodology, but their ratings are also based on a scale from AAA (Highest Quality) to D (Lowest Quality). They also provide a “CreditWatch” status to indicate whether the rating is under review for possible upgrade or downgrade.

Top-Rated Insurance Companies

Finding the right insurance company can be a real headache, especially with all the different options out there. But don’t worry, we’ve got your back! We’ve scoured the market to bring you the top-rated insurance companies across different categories, so you can find the perfect fit for your needs.

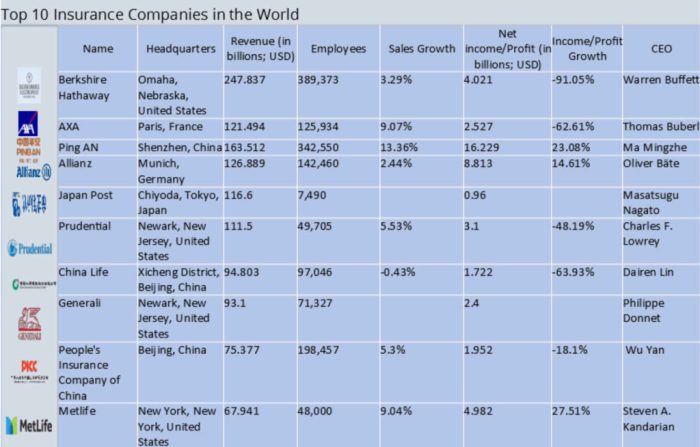

Top-Rated Insurance Companies

Choosing the best insurance company isn’t just about picking the cheapest option. You want a company that’s financially sound, has a great reputation for customer service, and offers policies that actually meet your needs. We’ve compiled a list of top-rated insurance companies based on financial strength, customer satisfaction, and coverage features.

| Category | Company | Financial Strength Rating | Customer Satisfaction Rating | Key Coverage Features |

|---|---|---|---|---|

| Life Insurance | Northwestern Mutual | A++ (AM Best) | 4.5/5 (J.D. Power) | Term life, whole life, universal life, variable life |

| Health Insurance | UnitedHealthcare | A+ (AM Best) | 3.5/5 (J.D. Power) | Individual and family health plans, Medicare Advantage, Medicaid |

| Auto Insurance | USAA | A++ (AM Best) | 4.5/5 (J.D. Power) | Comprehensive and collision coverage, liability coverage, uninsured/underinsured motorist coverage |

| Home Insurance | State Farm | A++ (AM Best) | 4/5 (J.D. Power) | Dwelling coverage, personal property coverage, liability coverage |

Examples of Specific Insurance Policies

These top-rated insurance companies offer a wide range of policies to fit different needs and budgets. Let’s look at some examples:

- Northwestern Mutual’s “Whole Life” policy: This policy provides lifetime coverage and builds cash value, which can be borrowed against or withdrawn. It’s a great option for those seeking long-term financial security and a potential investment vehicle.

- UnitedHealthcare’s “Medicare Advantage” plans: These plans offer additional benefits beyond traditional Medicare, such as prescription drug coverage, vision care, and dental care. They can be a good choice for seniors looking for comprehensive coverage and lower out-of-pocket costs.

- USAA’s “Military Spouse Coverage”: This policy offers additional coverage for military spouses, including protection for their belongings while their partner is deployed. It’s a unique benefit for those who serve in the armed forces.

- State Farm’s “Homeowners Plus” policy: This policy includes additional coverage for things like identity theft, water damage, and earthquake protection. It’s a good option for homeowners who want extra peace of mind.

Key Coverage Features to Consider

When comparing insurance companies, it’s important to consider the key coverage features offered by each policy. Here are some important factors to keep in mind:

- Deductibles: This is the amount you’ll pay out of pocket before your insurance kicks in. A higher deductible typically means lower premiums.

- Coverage Limits: This is the maximum amount your insurance company will pay for a covered claim.

- Exclusions: These are specific events or circumstances that are not covered by your policy.

- Discounts: Many insurance companies offer discounts for things like good driving records, safety features in your home, or bundling multiple policies.

Choosing the Right Insurance Company: Am Best Insurance Companies

Finding the right insurance company is like finding the perfect pair of jeans – you want something that fits your needs, your budget, and your style. And just like with jeans, you’ll need to try on a few different options before you find the perfect fit. So, buckle up, because we’re about to dive into the world of insurance shopping!

Comparing Quotes from Multiple Insurance Companies, Am best insurance companies

It’s crucial to compare quotes from several insurance companies to ensure you get the best deal. Think of it like price-checking groceries at different stores – you’d be surprised at the price differences! Here’s how to get the most out of your insurance shopping spree:

- Use online comparison tools: Websites like Insurance.com and Policygenius allow you to compare quotes from multiple insurers in one place. It’s like having a personal shopper for your insurance needs.

- Contact insurers directly: Don’t be afraid to call insurance companies directly to get personalized quotes. You can often negotiate better rates by speaking with a representative.

- Consider your needs: When comparing quotes, make sure you’re comparing apples to apples. Consider factors like coverage limits, deductibles, and discounts to ensure you’re getting the right level of protection for your needs.

Negotiating Insurance Premiums

You wouldn’t accept the first price tag at a car dealership, right? The same goes for insurance premiums. Don’t be afraid to negotiate! Here are some tips for getting the best possible deal:

- Shop around: The more quotes you get, the better your negotiating position. It’s like having a secret weapon – knowledge is power!

- Bundle your policies: Many insurance companies offer discounts for bundling multiple policies, like car and homeowners insurance. It’s like a two-for-one deal, but for insurance!

- Ask about discounts: Insurers offer a variety of discounts, such as good driver discounts, safety feature discounts, and loyalty discounts. Don’t be shy – ask about all the discounts you qualify for!

- Consider raising your deductible: Raising your deductible can lower your premium. It’s like taking a small risk to save some money. Just make sure you can afford the higher deductible if you need to file a claim.

Filing an Insurance Claim

So, you’ve got your insurance policy, and you’re feeling good. But what happens if you need to file a claim? Don’t panic! Here’s a breakdown of the process:

- Contact your insurer: As soon as possible after an accident or incident, contact your insurer to report the claim. They’ll guide you through the next steps.

- Provide necessary information: Your insurer will need information about the incident, such as the date, time, and location. They may also ask for photos or a police report.

- Cooperate with your insurer: Be honest and upfront with your insurer. The more information you provide, the smoother the claim process will be.

- Review your claim: Once your claim is processed, carefully review the settlement offer to make sure it’s fair. If you have any questions, don’t hesitate to contact your insurer.

Factors Influencing Claim Payouts

While everyone hopes to never need to file a claim, it’s important to understand the factors that can affect how much you receive if you do. Think of it like a game of insurance poker – knowing the rules can give you an edge:

- Policy coverage: The amount of coverage you have will determine how much your insurer will pay. It’s like having a set of chips – the more you have, the bigger your potential payout.

- Deductible: You’ll need to pay your deductible before your insurer covers the rest of the claim. It’s like a buy-in for the game – the higher your deductible, the lower your premium.

- Claim details: The details of your claim, such as the cause of the incident and the extent of the damage, will influence the payout. It’s like playing your cards right – the stronger your hand, the better your chances of winning.

- Policy terms and conditions: Your policy will Artikel the specific terms and conditions that govern claim payouts. It’s like the rules of the game – make sure you understand them before you play.

Emerging Trends in the Insurance Industry

The insurance industry is undergoing a significant transformation driven by technological advancements, evolving consumer preferences, and a changing global landscape. These trends are shaping the way insurance is bought, sold, and delivered, creating a more dynamic and customer-centric environment.

The Impact of Technology on the Insurance Industry

Technology is revolutionizing the insurance industry, creating new opportunities for efficiency, personalization, and innovation.

- Telematics: Telematics, the use of technology to collect and analyze data from vehicles, is transforming auto insurance. Devices installed in cars, such as GPS trackers and sensors, gather information about driving behavior, such as speed, braking, and mileage. This data allows insurers to offer personalized premiums based on actual driving habits, rewarding safe drivers with lower rates. For example, companies like Progressive and Liberty Mutual offer discounts to policyholders who use telematics devices to track their driving behavior.

- Artificial Intelligence (AI): AI is playing an increasingly important role in insurance, automating tasks, improving risk assessment, and enhancing customer service. AI-powered chatbots can answer customer inquiries 24/7, while machine learning algorithms can analyze vast amounts of data to identify patterns and predict risks. AI can also personalize insurance plans by analyzing individual customer data, such as health records, driving history, and lifestyle choices. For example, companies like Lemonade and Metromile use AI to streamline claims processing and provide personalized insurance solutions.

The Rise of Personalized Insurance Plans

Consumers are increasingly demanding personalized insurance plans that cater to their unique needs and preferences. The traditional one-size-fits-all approach to insurance is no longer sufficient, as customers want customized coverage options and flexible payment plans.

- Micro-insurance: Micro-insurance offers small, affordable insurance policies tailored to specific needs, such as mobile phone insurance or travel insurance. These policies are designed to meet the needs of individuals with limited resources or specific coverage requirements. For example, companies like BIMA and MicroEnsure provide micro-insurance products in developing countries, offering affordable protection against risks such as illness, accidents, and natural disasters.

- On-demand Insurance: On-demand insurance allows customers to purchase coverage only when they need it, eliminating the need for traditional annual policies. This flexible approach is particularly attractive to individuals who only require insurance for specific periods, such as during travel or when using a rental car. For example, companies like Trov and Lemonade offer on-demand insurance for items like electronics, jewelry, and bicycles.

The Future of Insurance: Innovation and Disruption

The insurance industry is expected to continue evolving, with new technologies and business models emerging to meet changing customer needs.

- Blockchain Technology: Blockchain technology has the potential to revolutionize the insurance industry by creating a secure and transparent system for managing data and transactions. Blockchain can streamline claims processing, reduce fraud, and enhance data security. For example, companies like Lemonade and Etherisc are exploring the use of blockchain to create decentralized insurance platforms.

- Internet of Things (IoT): The Internet of Things (IoT) is connecting everyday devices to the internet, creating a wealth of data that can be used to improve insurance products and services. IoT devices, such as smart home appliances and wearable fitness trackers, can provide valuable insights into individual behavior and risk factors, enabling insurers to offer personalized and preventative solutions. For example, companies like Zurich and Allianz are developing IoT-based insurance products that offer discounts for healthy lifestyles and proactive risk management.

Last Recap

In the end, choosing the right insurance company is a personal decision. It’s about finding the best balance of price, coverage, and customer service. By understanding the insurance landscape, the criteria for “best” companies, and the tips for choosing the right fit, you can navigate the insurance world with confidence and peace of mind. So, do your research, compare quotes, and find the insurance company that’s the perfect match for you.

FAQ Resource

What does “Am Best” mean?

Am Best is a credit rating agency that specializes in the insurance industry. They evaluate the financial strength and creditworthiness of insurance companies.

How often should I review my insurance policies?

It’s a good idea to review your insurance policies at least once a year, or whenever there’s a major life change, like getting married, having a child, or buying a new home.

What are some common insurance scams?

Be wary of unsolicited calls or emails offering insurance deals, and never give out your personal information to someone you don’t trust.