Navigating the world of insurance can feel like a maze, but the Am Best Insurance Company Ratings Scale can be your trusty map. This system, used by experts, helps you decipher the fine print and choose a company that’s not just financially sound, but also has your back when you need it most.

Think of it like a movie review – you wouldn’t watch a film without checking out its rating, right? The same goes for insurance. Am Best, along with other rating agencies, analyze companies based on their financial strength, claims handling, and customer service. These ratings are like a sneak peek into the company’s reputation, giving you the lowdown on how they’ve performed in the past.

Understanding Insurance Company Ratings

Imagine you’re about to buy a new car, but you want to make sure you’re getting a reliable ride. You’d probably check out reviews and ratings, right? Well, it’s the same with insurance companies. These ratings are like a “carfax” for insurers, giving you the lowdown on their financial strength and ability to pay claims.

Rating Agencies and Their Methodologies

Insurance company ratings are assigned by independent agencies that evaluate insurers based on their financial stability, operating performance, and claims-paying ability. These agencies act as a third-party watchdog, ensuring that insurers are financially sound and can fulfill their obligations to policyholders.

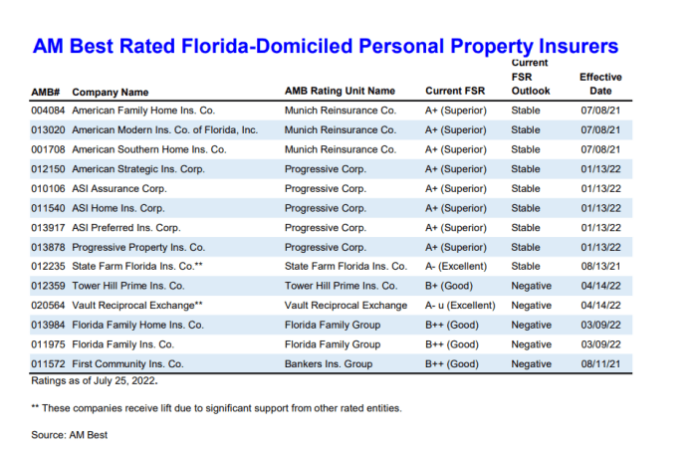

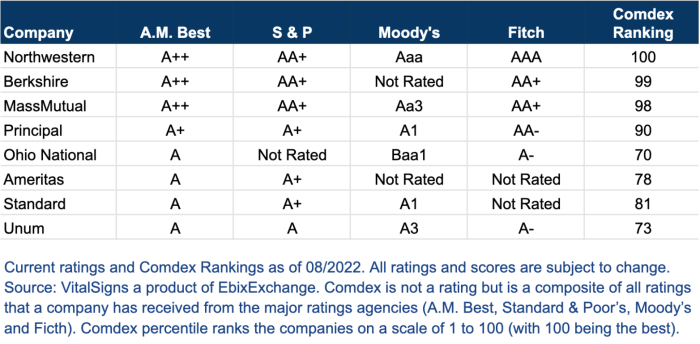

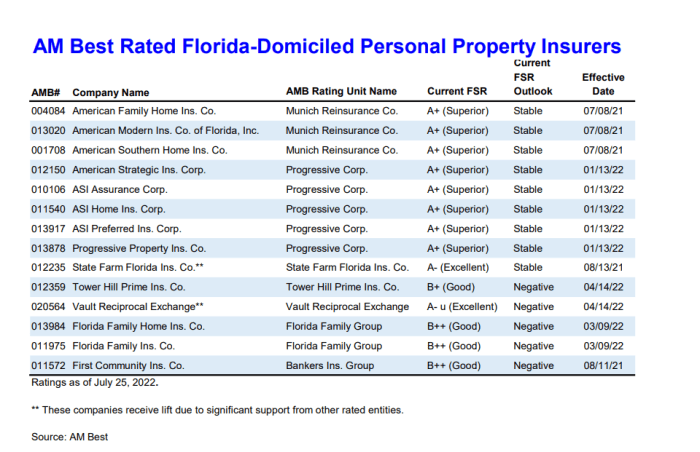

Here are some of the major rating agencies and their methodologies:

- AM Best: This agency, established in 1899, is a global credit rating agency specializing in the insurance industry. Their ratings are based on a comprehensive analysis of an insurer’s balance sheet, operating performance, business profile, and management quality.

- Standard & Poor’s (S&P): A well-known credit rating agency, S&P evaluates insurers based on their financial strength, operating performance, and management quality. Their ratings consider factors such as capital adequacy, risk management practices, and claims-paying ability.

- Moody’s: Another prominent credit rating agency, Moody’s assesses insurers based on their financial strength, operating performance, and risk management practices. They also consider factors such as the insurer’s market position, regulatory environment, and economic conditions.

- Fitch Ratings: This agency provides ratings for insurers based on their financial strength, operating performance, and risk management practices. They consider factors such as the insurer’s capital adequacy, profitability, and claims-paying ability.

Common Rating Scales and Interpretations

Rating agencies use different rating scales, but they generally reflect the insurer’s financial strength and ability to pay claims. Here are some common rating scales and their interpretations:

- AM Best:

- A++ (Superior): Insurers with this rating are considered financially very strong and have a very high ability to meet their financial obligations.

- A+ (Superior): Insurers with this rating are considered financially strong and have a high ability to meet their financial obligations.

- A (Excellent): Insurers with this rating are considered financially strong and have a strong ability to meet their financial obligations.

- A- (Excellent): Insurers with this rating are considered financially strong and have a good ability to meet their financial obligations.

- B++ (Good): Insurers with this rating are considered financially sound and have a good ability to meet their financial obligations.

- B+ (Good): Insurers with this rating are considered financially sound and have a fair ability to meet their financial obligations.

- B (Fair): Insurers with this rating are considered financially sound and have a fair ability to meet their financial obligations.

- B- (Fair): Insurers with this rating are considered financially sound and have a limited ability to meet their financial obligations.

- C++ (Marginal): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- C+ (Marginal): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- C (Weak): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- C- (Weak): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- D (Poor): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- E (Under Regulatory Supervision): Insurers with this rating are considered financially weak and are under regulatory supervision.

- Standard & Poor’s (S&P):

- AAA (Strongest): Insurers with this rating are considered financially very strong and have a very high ability to meet their financial obligations.

- AA+ (Very Strong): Insurers with this rating are considered financially very strong and have a very high ability to meet their financial obligations.

- AA (Very Strong): Insurers with this rating are considered financially very strong and have a high ability to meet their financial obligations.

- AA- (Strong): Insurers with this rating are considered financially strong and have a high ability to meet their financial obligations.

- A+ (Strong): Insurers with this rating are considered financially strong and have a strong ability to meet their financial obligations.

- A (Strong): Insurers with this rating are considered financially strong and have a strong ability to meet their financial obligations.

- A- (Strong): Insurers with this rating are considered financially strong and have a good ability to meet their financial obligations.

- BBB+ (Good): Insurers with this rating are considered financially sound and have a good ability to meet their financial obligations.

- BBB (Good): Insurers with this rating are considered financially sound and have a fair ability to meet their financial obligations.

- BBB- (Good): Insurers with this rating are considered financially sound and have a fair ability to meet their financial obligations.

- BB+ (Speculative): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- BB (Speculative): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- BB- (Speculative): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- B+ (Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- B (Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- B- (Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- CCC+ (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- CCC (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- CCC- (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- CC (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- C (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- D (Default): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- Moody’s:

- Aaa (Exceptional): Insurers with this rating are considered financially very strong and have a very high ability to meet their financial obligations.

- Aa1 (High Quality): Insurers with this rating are considered financially very strong and have a very high ability to meet their financial obligations.

- Aa2 (High Quality): Insurers with this rating are considered financially very strong and have a high ability to meet their financial obligations.

- Aa3 (High Quality): Insurers with this rating are considered financially strong and have a high ability to meet their financial obligations.

- A1 (Upper Medium Grade): Insurers with this rating are considered financially strong and have a strong ability to meet their financial obligations.

- A2 (Upper Medium Grade): Insurers with this rating are considered financially strong and have a strong ability to meet their financial obligations.

- A3 (Upper Medium Grade): Insurers with this rating are considered financially strong and have a good ability to meet their financial obligations.

- Baa1 (Medium Grade): Insurers with this rating are considered financially sound and have a good ability to meet their financial obligations.

- Baa2 (Medium Grade): Insurers with this rating are considered financially sound and have a fair ability to meet their financial obligations.

- Baa3 (Medium Grade): Insurers with this rating are considered financially sound and have a fair ability to meet their financial obligations.

- Ba1 (Speculative): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- Ba2 (Speculative): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- Ba3 (Speculative): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- B1 (Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- B2 (Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- B3 (Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- Caa1 (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- Caa2 (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- Caa3 (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- Ca (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- C (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- D (Default): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- Fitch Ratings:

- AAA (Exceptional): Insurers with this rating are considered financially very strong and have a very high ability to meet their financial obligations.

- AA+ (Very Strong): Insurers with this rating are considered financially very strong and have a very high ability to meet their financial obligations.

- AA (Very Strong): Insurers with this rating are considered financially very strong and have a high ability to meet their financial obligations.

- AA- (Strong): Insurers with this rating are considered financially strong and have a high ability to meet their financial obligations.

- A+ (Strong): Insurers with this rating are considered financially strong and have a strong ability to meet their financial obligations.

- A (Strong): Insurers with this rating are considered financially strong and have a strong ability to meet their financial obligations.

- A- (Strong): Insurers with this rating are considered financially strong and have a good ability to meet their financial obligations.

- BBB+ (Good): Insurers with this rating are considered financially sound and have a good ability to meet their financial obligations.

- BBB (Good): Insurers with this rating are considered financially sound and have a fair ability to meet their financial obligations.

- BBB- (Good): Insurers with this rating are considered financially sound and have a fair ability to meet their financial obligations.

- BB+ (Speculative): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- BB (Speculative): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- BB- (Speculative): Insurers with this rating are considered financially weak and have a limited ability to meet their financial obligations.

- B+ (Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- B (Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- B- (Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- CCC+ (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- CCC (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- CCC- (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- CC (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- C (Very Highly Speculative): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

- D (Default): Insurers with this rating are considered financially weak and have a very limited ability to meet their financial obligations.

It’s important to note that ratings are just one piece of the puzzle when choosing an insurance company. You should also consider factors such as price, coverage, customer service, and claims handling experience.

Key Factors Influencing Ratings: Am Best Insurance Company Ratings Scale

Think of insurance company ratings like a report card for your financial security. Rating agencies, like the good folks at AM Best, take a deep dive into the books of these companies to see how they’re doing. They look at a bunch of stuff, like how much money they’ve got, how well they handle claims, and how they treat their customers. This helps you, the consumer, know who to trust when it comes to your insurance needs.

Financial Stability

Financial stability is like the foundation of an insurance company. Rating agencies want to see if the company has enough money to pay out claims, even if there’s a major disaster. They check things like:

* Reserves: Insurance companies keep a pile of money called reserves, just in case they need to pay out a bunch of claims at once. Think of it like a rainy day fund for the company.

* Capitalization: This is how much money the company has invested in itself. A well-capitalized company has more resources to weather storms, like a big economic downturn.

* Investment Performance: How well the company invests its money matters too. If they’re making smart investments, they’ll have more money to pay out claims.

Claims Handling

Claims handling is the heart of the insurance business. It’s how the company deals with you when you need to file a claim. Rating agencies look at:

* Speed and Accuracy: How quickly and accurately does the company process claims? Nobody wants to wait forever for their insurance payout.

* Fairness: Are the claims handled fairly? The company should be willing to pay out what’s owed, without trying to pull a fast one on you.

* Customer Satisfaction: Are customers happy with how their claims are handled? This is a big indicator of how well the company is doing.

Customer Service

You want an insurance company that’s there for you, right? That’s why rating agencies also look at customer service. They consider:

* Accessibility: How easy is it to get in touch with the company? Do they have a friendly and helpful customer service team?

* Responsiveness: How quickly does the company respond to your questions and concerns? No one wants to feel like they’re being ignored.

* Transparency: Does the company clearly explain its policies and procedures? You should know what you’re getting into before you sign on the dotted line.

Innovation

Insurance companies are always looking for ways to improve their products and services. Rating agencies take note of companies that are:

* Developing New Products: Are they coming up with new insurance products that meet the needs of today’s consumers?

* Using Technology: Are they using technology to make insurance easier to buy, manage, and claim?

* Improving Efficiency: Are they finding ways to do things faster and more efficiently?

Interpreting and Using Ratings

So, you’ve got the lowdown on insurance company ratings and what makes them tick. Now, let’s get down to the nitty-gritty: how to actually use these ratings to make the best choice for your insurance needs.

Understanding Ratings in Action

Think of these ratings like a report card for insurance companies. Each rating agency grades companies on different aspects like financial strength, customer satisfaction, and claims handling. These ratings help you see how a company performs in key areas, giving you a clearer picture of their overall performance.

Comparing Ratings, Am best insurance company ratings scale

Let’s dive into a real-world example to see how this works. Check out this table comparing the ratings of major insurance companies across different categories:

| Company | Financial Strength | Claims Satisfaction | Customer Service | Innovation |

|—|—|—|—|—|

| Company A | A+ | 4.5/5 | 4/5 | 3.5/5 |

| Company B | A | 4/5 | 3.5/5 | 4/5 |

| Company C | B+ | 3.5/5 | 4/5 | 3/5 |

| Company D | A- | 4/5 | 3/5 | 2.5/5 |

As you can see, each company has its strengths and weaknesses. Company A, for example, has a strong financial rating, high customer satisfaction, and decent customer service, but its innovation rating is a bit lower. Company B, on the other hand, excels in innovation but has a slightly lower financial rating.

Using Ratings for Decision-Making

Now, here’s the real deal: how do you use this information to choose the right insurance company?

- Prioritize your needs: What’s most important to you? A financially stable company? Excellent customer service? A company that’s always innovating?

- Compare apples to apples: Don’t just look at the overall rating. Dive deeper into the individual categories to see how each company performs in areas that matter most to you.

- Read reviews: Don’t rely solely on ratings. Check out customer reviews and online forums to get a more comprehensive picture of what it’s like to be insured by a particular company.

- Get quotes: Once you’ve narrowed down your choices, get quotes from a few different companies to compare prices and coverage.

Beyond Ratings

Insurance company ratings provide a valuable starting point for evaluating potential insurers, but they’re not the whole story. To make a well-informed decision, it’s crucial to delve deeper and consider other factors that contribute to an insurer’s overall trustworthiness and reputation.

Customer Reviews and Feedback

Customer reviews and feedback offer a direct window into an insurance company’s performance from the perspective of those who have actually used their services. Websites like Yelp, Trustpilot, and the Better Business Bureau (BBB) are excellent resources for gathering insights into customer experiences. By reading reviews, you can get a sense of how responsive and helpful the insurer is, how well they handle claims, and the overall satisfaction levels of their policyholders.

Industry Awards and Recognition

Awards and recognition from industry organizations can be a strong indicator of an insurance company’s commitment to excellence. Look for awards related to customer satisfaction, financial stability, or innovation. These accolades demonstrate that an insurer has been recognized for its performance by respected third-party organizations.

Regulatory Actions and Complaints

It’s essential to be aware of any regulatory actions or complaints filed against an insurance company. State insurance departments and the National Association of Insurance Commissioners (NAIC) maintain records of complaints and disciplinary actions taken against insurers. By reviewing these records, you can assess whether the company has a history of questionable practices or has been subject to significant regulatory scrutiny.

Final Conclusion

Ultimately, the Am Best Insurance Company Ratings Scale is a powerful tool that empowers you to make informed decisions about your insurance. It’s like having a trusted advisor in your pocket, guiding you towards a company that’s not just financially secure, but also dedicated to providing exceptional service. So, before you sign on the dotted line, take a moment to check out those ratings and make sure you’re choosing a company that’s got your best interests at heart.

FAQ Explained

What is the highest Am Best rating?

The highest rating is A++ (Superior).

What does a “C” rating mean?

A “C” rating signifies that the company is in a weak financial position and may be at risk of defaulting on its obligations.

Do all rating agencies use the same scale?

No, different rating agencies have their own methodologies and scales. While Am Best is widely recognized, others include Moody’s and Standard & Poor’s.

Can a company’s rating change?

Yes, ratings are reviewed regularly and can change based on a company’s financial performance, regulatory actions, and other factors.