Am Best Life Insurance Companies sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Life insurance is like a safety net, protecting your loved ones when you’re gone. But with so many companies out there, choosing the right one can feel like navigating a jungle of jargon. This guide breaks down the essentials, helping you find the perfect coverage for your unique situation.

Think of it like picking a team for your financial future. You want a company with a solid track record, a winning strategy, and a commitment to customer satisfaction. We’ll explore the different types of policies, dive into the nitty-gritty details of company ratings, and show you how to compare quotes like a pro. By the time you’re done, you’ll be equipped to make a confident decision and secure your family’s future.

Understanding Life Insurance

Life insurance is a financial safety net for your loved ones. It provides a lump sum payment to your beneficiaries upon your death, helping them cover expenses like funeral costs, outstanding debts, and living expenses.

Types of Life Insurance Policies

Life insurance policies come in various flavors, each with its unique features and benefits. Understanding these differences is crucial for choosing the right policy that aligns with your needs and financial goals.

- Term Life Insurance: This type of insurance provides coverage for a specific period, typically 10, 20, or 30 years. It’s generally the most affordable option, making it ideal for covering short-term needs like a mortgage or young children’s education. However, it doesn’t build cash value, meaning you won’t receive any payout if you outlive the policy term.

- Whole Life Insurance: This policy provides lifetime coverage, meaning it remains active as long as you pay your premiums. It also builds cash value, which you can borrow against or withdraw later. While more expensive than term life, it offers long-term financial security and can be a valuable investment tool.

- Universal Life Insurance: This policy offers flexible premiums and death benefits, allowing you to adjust your coverage and premiums based on your changing needs. It also accumulates cash value, but the interest rate earned on the cash value is variable, meaning it can fluctuate over time.

- Variable Life Insurance: This policy allows you to invest your premiums in sub-accounts, similar to mutual funds. The death benefit and cash value are tied to the performance of your chosen investments, meaning they can fluctuate based on market conditions. This policy can offer higher returns but also carries higher risk.

Key Factors to Consider

Choosing the right life insurance policy involves weighing several key factors:

- Your Needs and Goals: What are you trying to achieve with life insurance? Are you looking to cover a mortgage, provide for your family’s income, or leave a legacy? Understanding your specific needs will help you narrow down the options.

- Your Budget: Life insurance premiums can vary widely depending on factors like your age, health, and the type of policy you choose. Determine how much you can comfortably afford to pay each month.

- Your Health: Your health status plays a significant role in determining your premium rates. Individuals with pre-existing conditions may face higher premiums.

- Your Lifestyle: Your lifestyle choices, such as smoking or engaging in risky activities, can also impact your premium rates.

- Your Beneficiaries: Who will receive the death benefit? Ensure you clearly define your beneficiaries and their roles in managing the funds.

Comparison of Life Insurance Types

| Type | Pros | Cons |

|---|---|---|

| Term Life | Affordable, simple, covers short-term needs | No cash value, limited coverage period |

| Whole Life | Lifetime coverage, cash value accumulation, investment potential | Higher premiums, limited flexibility |

| Universal Life | Flexible premiums and death benefits, cash value accumulation | Variable interest rates, potential for higher premiums |

| Variable Life | Potential for higher returns, investment control | Higher risk, complex structure |

Factors to Consider When Choosing a Company

Choosing the right life insurance company is a crucial decision, as it involves safeguarding your loved ones’ financial well-being in the event of your passing. While the cost of premiums is a significant factor, it’s equally important to consider the long-term stability and reputation of the insurance company.

Financial Stability and Ratings

The financial strength of a life insurance company is paramount. A company with a solid financial track record is more likely to be able to pay out claims when needed. You can assess a company’s financial health by examining its ratings from independent agencies like A.M. Best, Moody’s, Standard & Poor’s, and Fitch. These agencies assign ratings based on a company’s financial performance, risk management practices, and overall stability. Look for companies with high ratings, such as A+ or A, which indicate strong financial strength and a lower risk of default.

Key Factors to Evaluate

Beyond financial stability, consider these key factors when selecting a life insurance company:

- Policy Features and Benefits: Different companies offer varying policy features and benefits, so compare them carefully. Consider factors such as coverage amounts, premiums, riders, and death benefit payout options.

- Customer Service and Reputation: A reputable company should provide excellent customer service, with responsive agents, clear communication, and efficient claim processing. Research customer reviews and ratings from independent sources to gauge the company’s track record.

- Financial Transparency: A transparent company will provide clear and understandable information about its policies, premiums, and financial performance. Look for companies that offer online resources, such as policy summaries, FAQs, and financial statements.

- Product Availability: Ensure the company offers the type of life insurance policy you need, whether it’s term life, whole life, universal life, or other options.

- Accessibility and Convenience: Consider the company’s accessibility, including its website, contact information, and availability of agents in your area.

Top Life Insurance Companies Based on Customer Satisfaction

The following table Artikels some of the top life insurance companies based on customer satisfaction ratings, as per independent surveys:

| Company | Customer Satisfaction Rating |

|---|---|

| State Farm | 4.5/5 |

| USAA | 4.6/5 |

| Northwestern Mutual | 4.4/5 |

| MassMutual | 4.3/5 |

| New York Life | 4.2/5 |

Key Features and Benefits

Life insurance offers a safety net for your loved ones in case of your untimely demise. It’s not just about financial security; it’s about peace of mind, knowing your family will be taken care of. Understanding the key features and benefits of life insurance is crucial to making an informed decision.

Death Benefit

The death benefit is the core of life insurance. It’s the lump sum payout your beneficiaries receive upon your death. This money can cover various expenses, such as funeral costs, outstanding debts, mortgage payments, and living expenses for your family.

For example, a $500,000 life insurance policy would provide your beneficiaries with $500,000 upon your death. This amount can be used to cover a wide range of needs, ensuring your family’s financial stability.

Cash Value

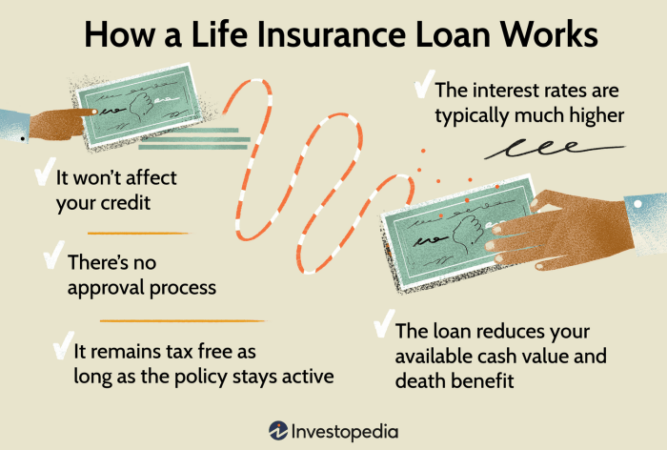

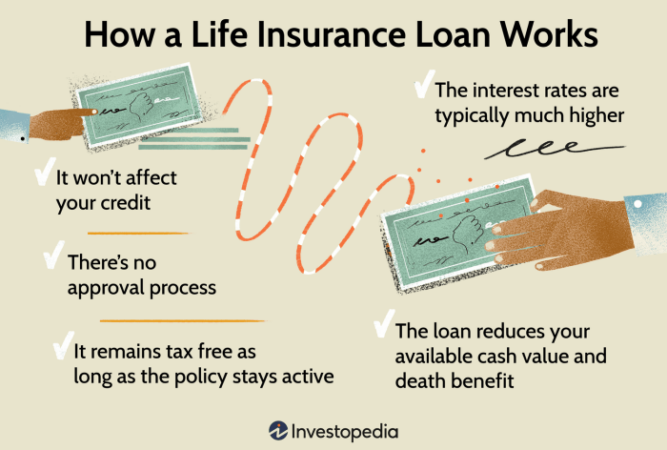

Some life insurance policies, like permanent life insurance, build cash value over time. This cash value can be borrowed against or withdrawn, providing you with access to funds during your lifetime.

Imagine you need to pay for your child’s college education or a major home repair. With a cash value policy, you can access these funds without jeopardizing the death benefit.

Riders

Riders are optional additions to your life insurance policy that provide extra coverage or benefits. Common riders include:

- Accidental Death Benefit: Pays a larger death benefit if the insured dies due to an accident.

- Waiver of Premium: Waives premium payments if the insured becomes disabled.

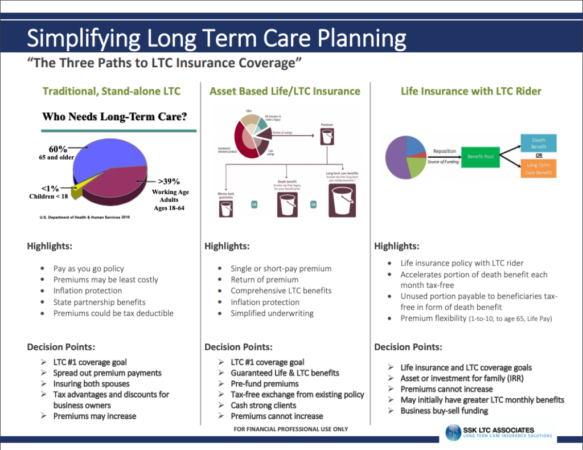

- Living Benefits: Allows you to access a portion of the death benefit while you’re still alive, for long-term care expenses or critical illnesses.

Policy Terms and Conditions

It’s essential to thoroughly understand the terms and conditions of your life insurance policy. This includes:

- Premium Payment Schedule: Understanding how much you’ll pay and when will help you budget accordingly.

- Grace Period: This period allows you to pay your premium late without the policy lapsing.

- Exclusions: Knowing what events are not covered by the policy is crucial. For example, some policies may exclude death due to suicide or risky activities.

Premium Rates and Coverage Options

Life insurance premiums vary based on several factors, including:

- Age: Younger individuals generally pay lower premiums than older individuals.

- Health: People with good health typically receive lower premiums than those with pre-existing conditions.

- Lifestyle: Engaging in risky activities, such as smoking or extreme sports, can increase premiums.

- Policy Type: Permanent life insurance generally has higher premiums than term life insurance.

- Coverage Amount: The higher the death benefit, the higher the premium.

Claims Process and Customer Support

The claims process is a crucial aspect of life insurance. You want to ensure the company has a clear and straightforward process, along with responsive customer support.

- Documentation Requirements: Understanding the documents required for a claim, such as death certificate and beneficiary information, is essential.

- Timeframe for Processing: Know how long it takes for the insurance company to process and approve claims.

- Customer Service Availability: Having access to knowledgeable and helpful customer service representatives can make the claims process less stressful.

Getting Quotes and Comparing Options

You’ve got the lowdown on life insurance, and you’re ready to dive in. But before you sign on the dotted line, you gotta get those quotes and compare ’em like it’s a fashion show for your financial future.

Getting quotes is like going on a first date with different life insurance companies. You wanna see who’s got the best deal and who’s gonna treat you right.

Obtaining Accurate Life Insurance Quotes

To get those quotes, you’ll need to give some basic info, like your age, health, and the amount of coverage you want. You can do this online, over the phone, or by meeting with an insurance agent.

- Be Honest: When you’re filling out the application, be upfront about your health history. This helps ensure you get the right coverage and price. Don’t try to be a slickster and hide any pre-existing conditions. You might think you’re being clever, but you could end up with a policy that’s not really right for you.

- Don’t Just Go With the First Quote: Just like you wouldn’t buy the first car you see, don’t settle for the first life insurance quote you get. Shop around and compare prices from multiple companies. You’ll be surprised how much the prices can vary.

- Consider Different Types of Coverage: There are different types of life insurance, like term life and whole life. Each type has its own features and benefits. Make sure you’re comparing quotes for the same type of coverage.

Comparing Quotes From Multiple Companies, Am best life insurance companies

Once you have a few quotes, it’s time to compare them. Look at the premium, the death benefit, and the coverage period. Make sure you’re comparing apples to apples. If you’re looking for a term life policy, don’t compare it to a whole life policy.

| Company | Premium | Death Benefit | Coverage Period | Other Features |

|---|---|---|---|---|

| Company A | $50/month | $500,000 | 20 years | Accidental death benefit |

| Company B | $45/month | $400,000 | 20 years | Guaranteed insurability option |

| Company C | $55/month | $600,000 | 20 years | Waiver of premium |

Applying for a Life Insurance Policy

Once you’ve chosen a company, you’ll need to apply for a policy. This usually involves filling out an application, providing medical records, and undergoing a medical exam. The application process can take a few weeks, so don’t wait until the last minute to start it.

Final Wrap-Up: Am Best Life Insurance Companies

Choosing the right life insurance company is a big decision, but it doesn’t have to be overwhelming. By understanding the different types of policies, researching company ratings, and comparing quotes, you can find the coverage that fits your needs and budget. Remember, it’s not just about getting the best deal; it’s about finding a company you can trust to be there for your family when you need them most.

FAQ Compilation

What are AM Best ratings, and why are they important?

AM Best is a leading credit rating agency specializing in the insurance industry. They assess the financial strength and stability of insurance companies, providing valuable insights for consumers. A high AM Best rating indicates a company is financially sound and likely to fulfill its obligations to policyholders.

How often should I review my life insurance policy?

It’s a good idea to review your life insurance policy every 2-3 years, or whenever there’s a significant life event, such as marriage, birth of a child, or a major change in income. This ensures your coverage remains adequate and aligns with your evolving needs.

Can I change my life insurance policy later on?

Yes, you can usually make changes to your life insurance policy, such as increasing or decreasing coverage, adding or removing riders, or changing the beneficiary. However, these changes may be subject to certain conditions and fees, so it’s best to consult with your insurance agent.

What is a life insurance rider?

A life insurance rider is an additional benefit that can be added to your policy, providing extra coverage or protection. Common riders include accidental death benefit, disability income benefit, and long-term care coverage.